China Intelligent Door Market Research Report, 2023 released by ResearchInChina analyzes and studies the features, market status, OEMs’ layout, suppliers’ layout, and development trends of intelligent doors in China.

In addition to components of conventional doors, intelligent doors add other components like door control unit, driver and sensor to enable intelligent functions such as intelligent unlocking, automatic door opening/closing, environmental perception, hovering on the slope, and even interaction and combination with other components. As vehicle intelligence develops, the demand for intelligent doors is increasing.

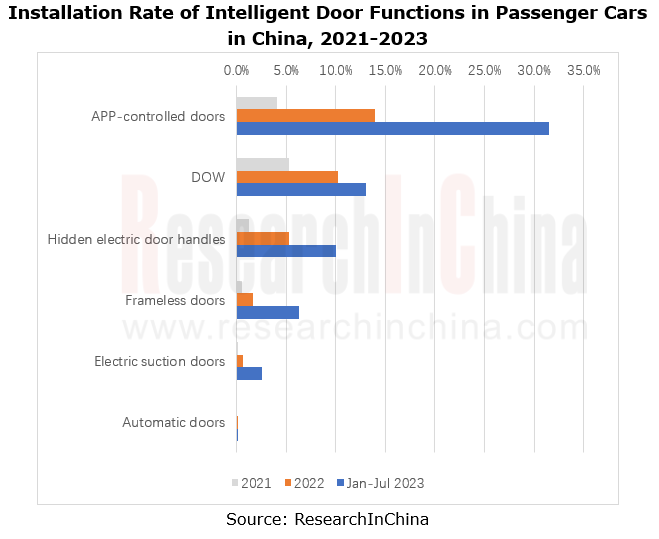

First, the installation rate of intelligent door functions has surged.

In terms of marketization degree, the intelligent door functions that have found wide application in vehicles include APP-controlled doors, door open warning (DOW), hidden electric door handles, frameless doors, electric suction doors, automatic door opening and closing, etc.

APP-controlled doors boast the highest installation rate, higher than 30% as of July 2023, followed by DOW with over 10%.

Hidden electric door handles and frameless doors make vehicles more stylish, with fast-growing installation rates.

Electric suction doors are largely mounted on mid-to-high-end models priced over RMB350,000, like Li L7/L8/L9 and NIO ET5. However, compared with 2022, they have begun to sink to models worth around RMB150,000, such as Leapmotor C11.

Still as a luxury configuration, automatic suction doors are available to fewer than 10 models valued at more than RMB300,000, including HiPhi Z, ZEEKR 001, Xpeng P7 and IM L7.

Second, doors are integrated with sensors to create intelligent entry modes.

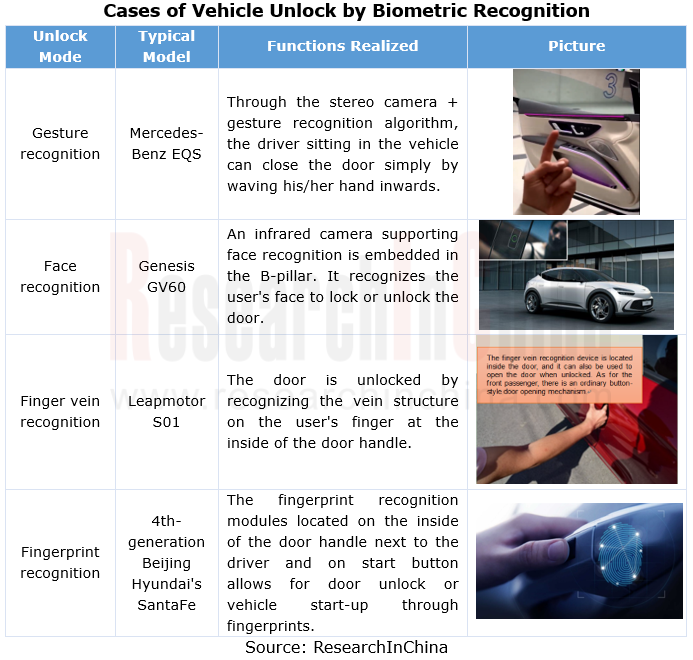

In terms of door opening mode, digital keys and PEPS leverage communication modules to unlock vehicles. This is the mainstream entry mode at present. However, as sensors mature and biometric technology develops, installing cameras, fingerprint sensors, etc. on door handles, B-pillars or windows for unconscious unlock is expected to become the next-generation intelligent entry mode. At this stage, biometric recognition modes which are available to models to open doors mainly include gesture recognition, face recognition, fingerprint recognition, and finger vein recognition.

Suppliers are working to deploy biometric recognition modes for door opening.

ArcSoft’s 3D ToF gesture interaction solution offers detection depth information and enables face recognition for anti-counterfeiting, guaranteeing IVI login or door unlock.

Cerence has introduced Cerence Exterior Vehicle Communication, a new suite of AI and voice-powered innovations that enables drivers to interact with their cars from the outside. The system accurately recognizes voiceprint and content by voice to complete tasks such as unlocking the door, opening the trunk and turning on the light.

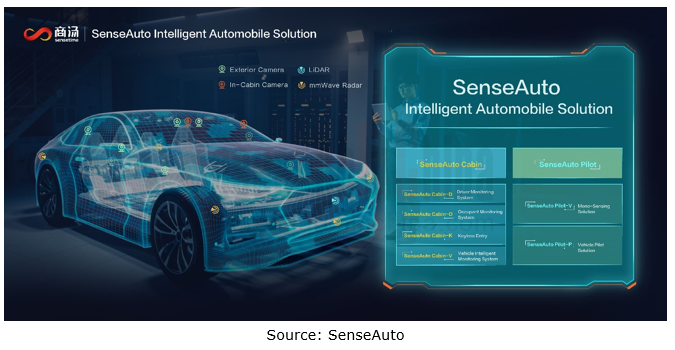

SenseTime’s SenseAuto Cabin-K is a complete “controller+module+trigger device+software” integrated solution based on high-precision face recognition, in-vivo detection and other recognition technologies. Combined with 3D modules and various human-computer interactions, it enables unconscious unlock by face. It meets payment-level security requirements, allowing cloud or local managers to intelligently manage vehicles.

Third, the trend for integrated door control is clear.

Amid the evolution of E/E architecture, body domain controllers present two major trends:

First, more functions are integrated on the basis of the original BCM. The decentralized function combination is transitioning to the integration of basic drives of all body electronics, key functions, lights, doors, windows, etc.

Second, the body domain is expected to be integrated with cockpit, domain and chassis domains in the cross-domain integration stage to accomplish a wider range of centralized control and functional linkage.

With domain controller architecture, OEMs can connect doors with cameras, radars, ambient lights, etc. to create intelligent entry and exit experience.

For example, HiPhi has developed the H-SOA (Hip Hi Service Oriented Architecture), consisting of six computing platforms to manage the vehicle: the infotainment domain computing platform (IDCM), the autonomous driving domain computing platform (ADCM), the power and chassis domain computing platform (VDCM), the body domain computing platform (BDCM), the central gateway (CGW) and the communication computing platform (V-Box). Based on the H-SOA, the intelligent door system built by HiPhi is equipped with 6 electric NT doors, 6 motors, 4 position sensors, 12 ultrasonic sensors, 6 anti-collision and anti-pinch sensors, a rainfall sensor, and a body control computing platform to support multiple automatic entry modes (such as face recognition, mobile phone ID and intelligent key) and light interaction, creating intelligent access experience in different scenarios.

From the perspective of suppliers, door control units are heading in the direction of hardware centralization and software virtualization.

For instance, the next-generation door system electronic control unit developed by Brose integrates all door functions from window regulators and automatic door opening/closing to collision detection. Users only need to make a simple gesture, and then the side door will open and close automatically. A radar sensor scans the surrounding environment in real time to prevent collisions. During driving, the in-car screen displays the data from the outside cameras in real time. Moreover the speaker control function can not only actively reduce noise, but also improve the sound quality of the vehicle entertainment system, thereby providing passengers with comfortable travel experience.

Brose will mass-produce its next-generation door system electronic control unit in 2025. A high-bandwidth wire harness is connected to the central controller, which can reduce more than 30 wire harnesses for corresponding doors, significantly saving space and cost, and solving problems about multi-sensor data processing and fusion, as well as low-latency and high-rate transmission of image data.

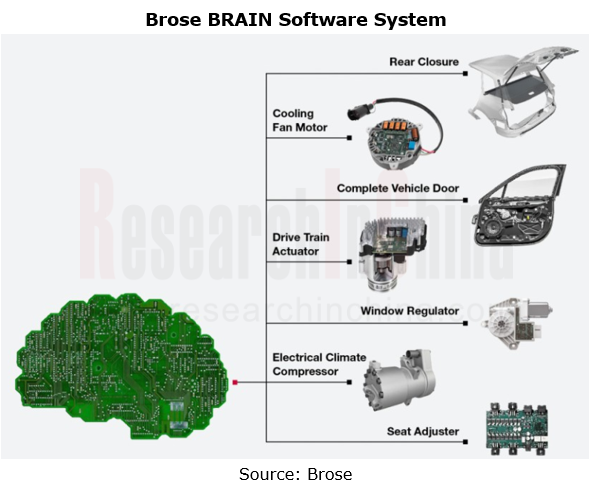

In terms of software, Brose’s BRAIN software system is a solution based on domain controllers. BRAIN integrates Brose’s PWM control, anti-pinch and other access systems and related control algorithms. Based on SOA-oriented modular development, this software system can be integrated into the electronic architectures of various models and major automakers' systems.

BRAIN provides users with an easy-to-use graphical operation interface, that is, Composer. Besides more than 70 application scenarios defined by Brose, OEMs, third parties and even end users can customize and personalize the scenes through Composer. So far, the design of BRAIN has been initially completed, and the sample has been installed and demonstrated to the public. Related business negotiations are being held with quite a few Chinese and foreign OEMs.

Passenger Car Intelligent Chassis Controller and Chassis Domain Controller Research Report, 2024

Chassis controller research: More advanced chassis functions are available in cars, dozens of financing cases occur in one year, and chassis intelligence has a bright future. The report combs th...

New Energy Vehicle Thermal Management System Market Research Report, 2024

xEV thermal management research: develop towards multi-port valve + heat pump + liquid cooling integrated thermal management systems.

The thermal management system of new energy vehicles evolves fro...

New Energy Vehicle Electric Drive and Power Domain industry Report, 2024

OEMs lead the integrated development of "3 + 3 + X platform", and the self-production rate continues to increase

The electric drive system is developing around technical directions of high integratio...

Global and China Automotive Smart Glass Research Report, 2024

Research on automotive smart glass: How does glass intelligence evolve?

ResearchInChina has released the Automotive Smart Glass Research Report 2024. The report details the latest advances in d...

Passenger Car Brake-by-Wire and AEB Market Research Report, 2024

1. EHB penetration rate exceeded 40% in 2024H1 and is expected to overshoot 50% within the yearIn 2024H1, the installations of electro-hydraulic brake (EHB) approached 4 million units, a year-on-year ...

Autonomous Driving Data Closed Loop Research Report, 2024

Data closed loop research: as intelligent driving evolves from data-driven to cognition-driven, what changes are needed for data loop?

As software 2.0 and end-to-end technology are introduced into a...

Research Report on Intelligent Vehicle E/E Architectures (EEA) and Their Impact on Supply Chain in 2024

E/E Architecture (EEA) research: Advanced EEAs have become a cost-reducing tool and brought about deep reconstruction of the supply chain

The central/quasi-central + zonal architecture has become a w...

Automotive Digital Power Supply and Chip Industry Report, 2024

Research on automotive digital power supply: looking at the digital evolution of automotive power supply from the power supply side, power distribution side, and power consumption side

This report fo...

Automotive Software Business Models and Suppliers’ Layout Research Report, 2024

Software business model research: from "custom development" to "IP/platformization", software enters the cost reduction cycle

According to the vehicle software system architecture, this report classi...

Passenger Car Intelligent Steering Industry Research Report, 2024

Intelligent Steering Research: Steer-by-wire is expected to land on independent brand models in 2025

The Passenger Car Intelligent Steering Industry Research Report, 2024 released by ResearchInChina ...

China Passenger Car Mobile Phone Wireless Charging Research Report, 2024

China Passenger Car Mobile Phone Wireless Charging Research Report, 2024 highlights the following:Passenger car wireless charging (principle, standards, and Qi2.0 protocol);Passenger car mobile phone ...

Automotive Smart Exteriors Research Report, 2024

Research on automotive smart exteriors: in the trend towards electrification and intelligence, which exteriors will be replaced by intelligence?

The Automotive Smart Exteriors Research Report, 2024 ...

Automotive Fragrance and Air Conditioning System Research Report, 2024

Research on automotive fragrance/air purification: With surging installations, automotive olfactory interaction is being linked with more scenarios.

As users require higher quality of personalized, i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2024

Multi-Domain Computing Research: A Summary of Several Ideas and Product Strategies for Cross-Domain Integration

1. Several ideas and strategies for cross-domain integration of OEMs

With the increasi...

Analysis on Xiaomi Auto's Electrification, Connectivity, Intelligence and Sharing, 2024

Research on Xiaomi Auto: Xiaomi Auto's strengths and weaknesses

Since the release of SU7, Xiaomi delivered 7,058 units and 8,630 units in April and May, respectively, and more than 10,000 units in bo...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: make all-round attempts to transform and localize supply chain and teams.???

1. Foreign ADAS Tier 1 suppliers fall behind relatively in development of inte...

Research Report on Passenger Car Cockpit Entertainment--In-vehicle Game, 2024

1. In-vehicle entertainment screens are gaining momentum, and Chinese brands rule the roost.

In-vehicle entertainment screens refers to display screens used for entertainment activities such as viewi...

Body (Zone) Domain Controller and Chip Industry Research Report,2024

Research on body (zone) domain controller: an edge tool to reduce vehicle costs, and enable hardware integration + software SOA.

Integration is the most important means to lower vehicle costs. Funct...