Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024

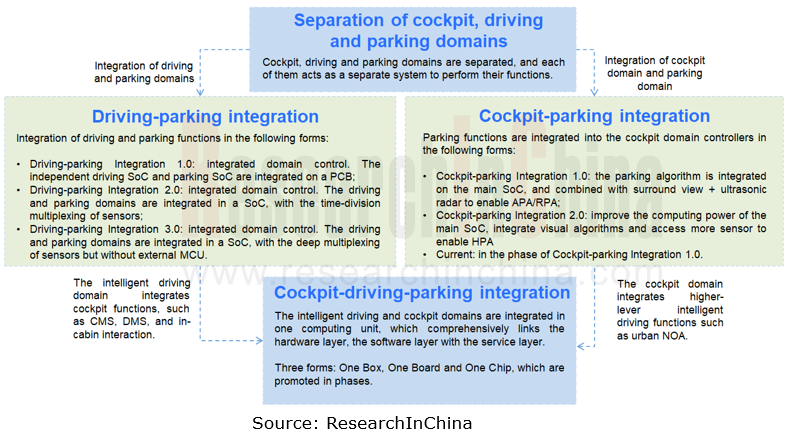

At present, EEA is developing from the distributed type to domain centralization and cross-domain fusion. The trend for internal and external integration of domain controllers, especially the integration of two core domains, intelligent driving domain and cockpit domain, becomes clearer. Against this background, three main integration forms come out: driving-parking integration, cockpit-parking integration and cockpit-driving integration.

Given this, ResearchInChina released the Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024, aiming to comprehensively comb through cockpit-driving-parking integration and summarize the development directions of the industry.

Driving-parking integration: Since wide adoption in 2023, driving-parking integration solutions have been mounted on nearly 70 vehicle models of more than 30 manufacturers. According to the statistics of ResearchInChina, from January to November 2023 driving-parking integration solutions were installed in over 1.4 million vehicles in China, a like-on-like surge of 38.0%. The figure is expected to hit more than 3 million in 2025.

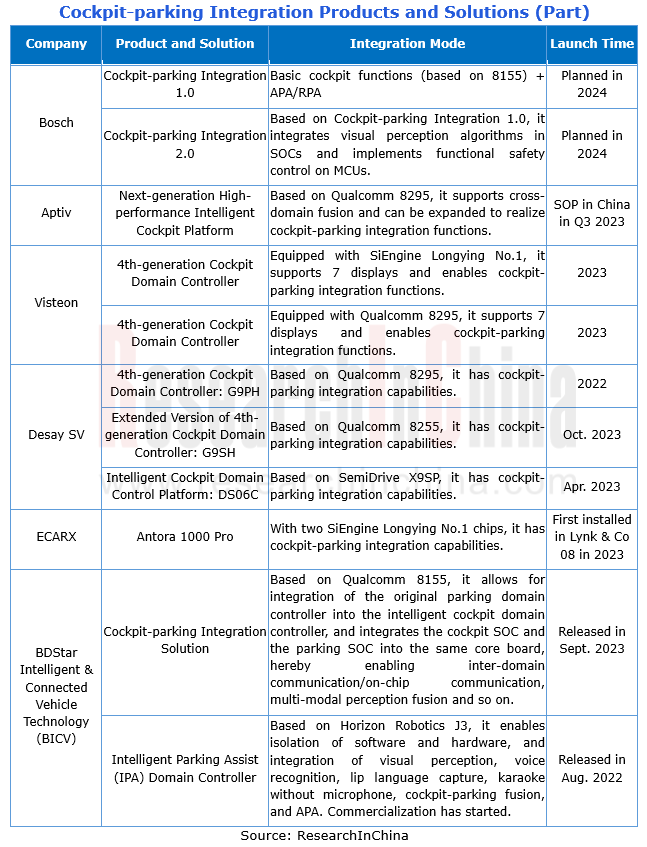

Cockpit-parking integration: In the stage of commercial exploration, high-compute chips such as Qualcomm 8155/8295, SiEngine Longying No.1 and SemiDrive X9SP have been the first to be used. On this basis, Bosch, Aptiv, Visteon, Desay SV, ECARX, Yuanfeng Technology and BICV, among others have launched cockpit-parking integration solutions, some of which have been designated by or mass-produced for OEMs for their models like Lynk & Co 08. During 2024-2025, cockpit-parking integration will find massive application in vehicles.

Cockpit-driving integration: The hardware foundation is basically in place. For example, NVIDIA Drive Thor and Qualcomm Snapdragon Ride Flex, with computing power up to 2000TOPS, enable the integration of intelligent driving and in-cabin algorithms on a single chip, and support isolation among multiple computing domains. Cockpit-driving integration has begun to be accelerated in the second half of 2023 and is expected to be mass-produced and applied in 2025.

1. Driving-parking integration highlights "cost performance" and the market is further segmented.

Driving-parking integration means the original independent driving and parking controllers are integrated into a domain controller, lowering costs while supporting more and higher-level intelligent driving functions.

In recent two years, the booming driving-parking integration has attracted OEMs, Tier1 suppliers, intelligent driving companies, algorithm companies, software companies and chip companies to make layout. Two main reasons stand out: first, driven by cost, integrating driving and parking ECUs on the same domain controller can reduce a lot of hardware costs; second, as the demand for intelligence increases, driving-parking integration allows for computing resource sharing and deep sensor multiplexing, and improves intelligent driving experiences for users via unified OTA updates.

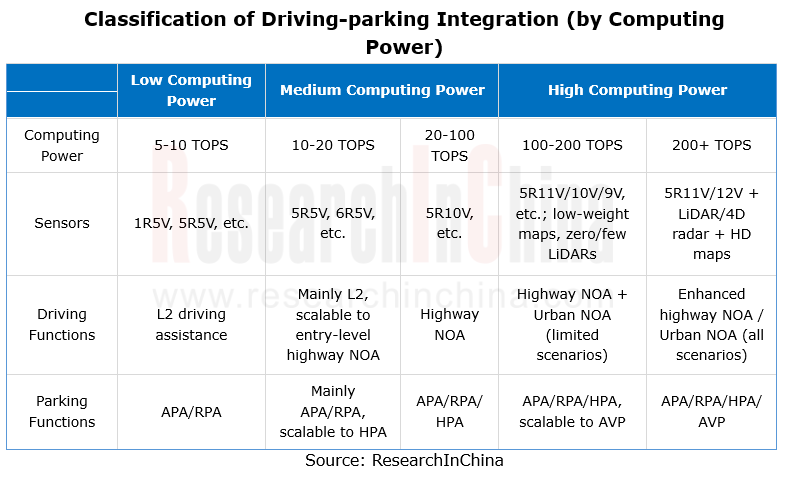

By computing power, driving-parking integration is roughly divided into three levels: low (5-10 TOPS), medium (10-100 TOPS), and high (100+ TOPS). In 2023, OEMs are in urgent need of cost reduction, so that Tier 1 suppliers of driving-parking integration have played the "ultimately cost-effective" card to facilitate market segmentation.

There are two main ways: first, they expand to low computing power (5-10TOPS) by squeezing chip computing power and working hard on algorithms; second, vendors who originally aimed at the high-end market above 200TOPS no longer “stack up” but strengthen algorithms and software technologies to balance the performance and cost of high-level driving-parking integration.

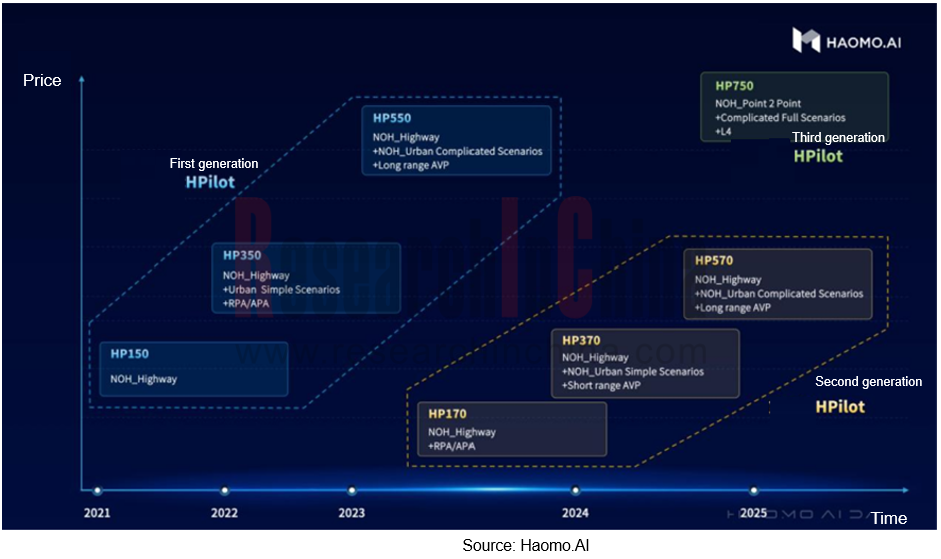

In October 2023, Haomo.AI released the 2nd-generation HPilot system, including three driving-parking integration solutions - HP170, HP370 and HP570, which cover high-, medium- and low-level scenarios and are scheduled to be mass-produced in 2024.

HP170: the RMB3,000 solution can meet the market demand for low-compute driving-parking integration solutions. The solution uses a non-map solution, features time-division multiplexing, and supports access to 5V2-5R sensors to enable urban NOA without maps.

HP370: the RMB5,000 solution is involved with medium computing power. Based on TDA4 VH (30 TOPS), it supports 9V3-5R (two optional front corner radars) to enable highway NOH, urban memory driving and HPA.

HP570: the RMB8,000 solution enables urban NOH in all scenarios without maps. With optional 72TOPS and 100TOPS chips, standard 11V1R12U, and an optional LiDAR, it realizes such functions as non-map urban NOH, all-scenario parking assist, all-scenario intelligent obstacle avoidance, and cross-floor teaching-free HPA.

Zhang Kai, the president of Haomo.AI, said that the three passenger car driving assistance products of the 2nd-generation HPilot drag down price but improve performance, making medium- and high-level intelligent driving cheaper and easier to use. Compared with the first-generation HP550 (based on Qualcomm Snapdragon Ride with the computing power of 360TOPS, it can be connected to LiDAR, etc. to achieve urban NOA), HP570 reduces costs by two-thirds without compromising on performance.

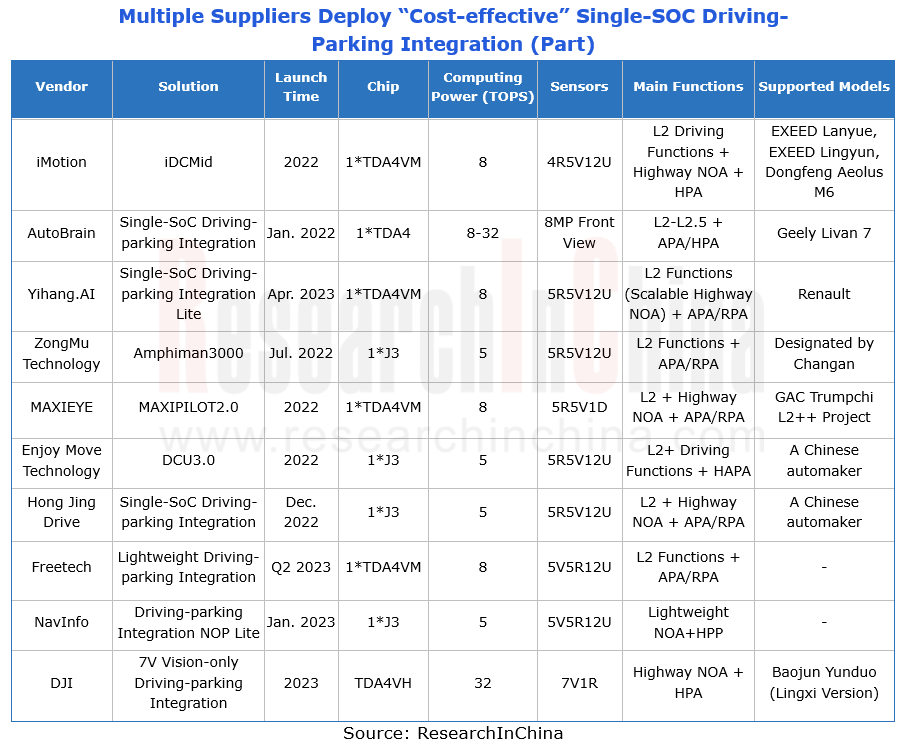

In addition, Tier 1 suppliers, such as Hong Jing Drive, iMotion, Freetech, and NavInfo, are sparing no effort to promote the "extremely cost-effective" products. Most of them make layout in the low-compute and low-to-mid-end markets to seize the dividend of large-scale application.

In February 2023, Freetech introduced a single-SOC low-compute driving-parking integration solution (based on TDA4M, 8TOPS, 5V5R configuration), with cost controlled within RMB3,000, including sensors, domain controllers, algorithms, etc.

By the end of 2023, Hong Jing Drive's driving-parking integration solution (time-division multiplexing) based on a single J3 chip from Horizon Robotics has been production-ready. With the computing power of 5TOPS, self-developed parking perception, and planning and control algorithms, it can be connected to 5R5V12U (supporting 8MP front view) to enable functions such as automatic lane change and large vehicle avoidance. The total cost of the solution amounts to RMB3,000.

2. Chip vendors make a quick response to the urgent need for "cost reduction and efficiency improvement”.

To meet OEMs’ need for "lower costs and higher efficiency", driving-parking integration chip vendors have begun to adjust their product lines and have developed a series of new products. Typical companies are NVIDIA, Horizon Robotics, Black Sesame Technologies and TI.

NVIDIA: To help OEMs reduce costs, NVIDIA developed Orin-N, its next-generation chip which was first mounted on DENZA N7, a model launched in September 2023.

Orin-N is a low-power version of Orin X, with fewer CPUs and GPUs. With computing power of 84TOPS, it supports highway NOA, AVP and other functions.

Despite a little lower computing power than Orin X, Orin N can compare with Orin-X in development tools and data links. In development, automakers can transplant algorithms to make Orin-N compatibile with Orin X and other versions of Orin.

The mass production and installation of Orin-N caters to automakers who intend to reduce costs and improve efficiency. It is expected to be used in more models in the future. At present, Desay SV is developing an Orin-N-based driving-parking integration product on IPU02.

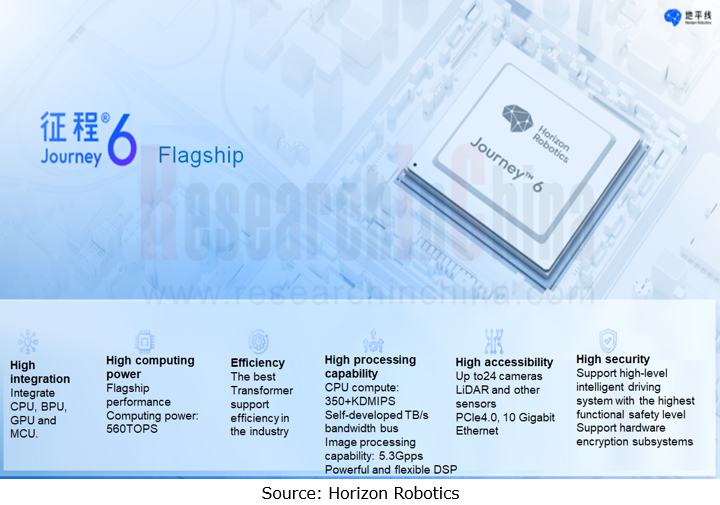

Horizon Robotics: J3, J5, J6 and other series of chips have been or will be launched one after another. Among them, J6 will be released in April 2024, supporting urban NOA in all scenarios. J6 series chips will cover low-, medium- and high-level intelligent driving.

The flagship version of J6 was first unveiled in November 2023, with computing power up to 560TOPS and the integration of CPU, BPU, GPU, and CU. It can not only be easier to deploy, but also improve the cost performance of the system. It supports full-stack computing tasks (such as perception, prediction, planning, control, and cockpit perception), 24 cameras with the maximum resolution of 18MP, and access to multiple types of sensors such as LiDAR and 4D radar.

J6's first partners include BYD, GAC, Bosch, Li Auto and Volkswagen Cariad.

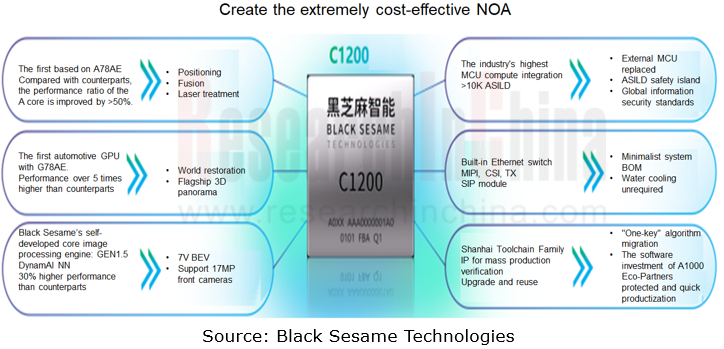

Black Sesame Technologies: it has launched Huashan Series chips for intelligent driving and Wudang Series chips for cross-domain computing.

Huashan Series contains three products: A1000L, A1000 and A1000 Pro, which are based on two self-developed IPs - NeuralIQ ISP (automotive image processor) and DynamAI NN (automotive low power consumption neural network accelerator). All of them have been mass-produced to satisfy L2-L3 intelligent driving.

Wudang Series C1200, launched in April 2023 and based on the 7nm process, uses the latest ARM A78AE+G78AE automotive CPU+GPU architecture. A single C1200 meets the requirements of cross-domain computing scenarios including CMS, driving-parking integration, vehicle computing, infotainment system, intelligent headlights, and in-cabin perception system.

In April 2023, Black Sesame Technologies indicated that based on A1000 Series, it had launched a cost-effective driving-parking integration intelligent driving domain controller solution supporting 10V (camera) NOA functions, with the BOM cost lower than RMB3,000.

3. Quite a few companies deploy cockpit-parking integration, and ECARX is a pioneer in application.

In 2023, while driving-parking integration became popular, cockpit-parking integration has been quietly emerging.

In addition to parking functions, cockpit-parking integration also integrates cockpit functions, and uses cockpit GPU resources to provide rendering capabilities for AVM and APA, so as to reduce costs and improve efficiency. Currently Bosch, Aptiv, Visteon, ECARX, Desay SV, Yuanfeng Technology, and BICV among others have launched cockpit-parking integration solutions.

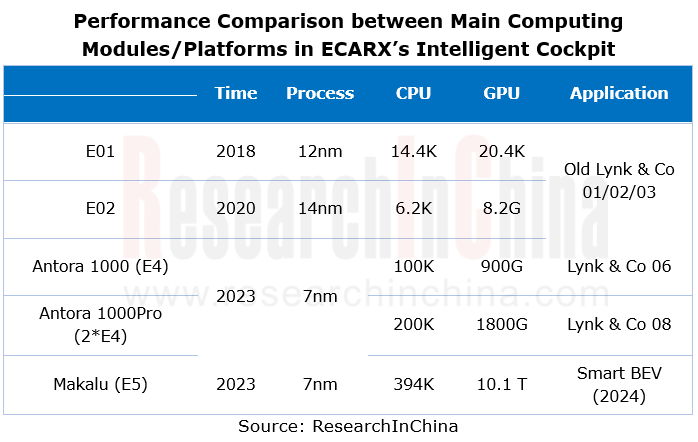

ECARX is strategically invested by Geely. In September, 2023, ECARX first installed Antora 1000 Pro computing platform on Lynk & Co 08. Launched in March 2023, this platform is ECARX’s first cockpit-parking integration computing platform. It integrates two Longying No.1 chips, with NPU compute up to 16TOPS. It can provide L2 driving assistance, automated parking assist (APA), remote parking assist (RPA) and other functions while supporting cockpit entertainment interaction.

Antora 1000 Pro, an equivalent of Qualcomm 8155, features 200K DMIPS CPU, 1800G FLOPS GPU, up to 16TOPS (INT8) NPU, and SE-LINK customized by SiEngine.

Established in 2018, SiEngine is a joint venture between ECARX and ARM China. Longying No.1 used in Antora 1000 Pro was developed by SiEngine independently and released in March 2023, as the first 7nm automotive chip in China. It has built in 8 CPU cores, 14 GPU cores, an 8TOPS (INT8) programmable NPU, an ASIL-D security island, and a high-performance encryption and decryption engine. It supports 7 4K/2K different independent screens and 12 2/3MP cameras.

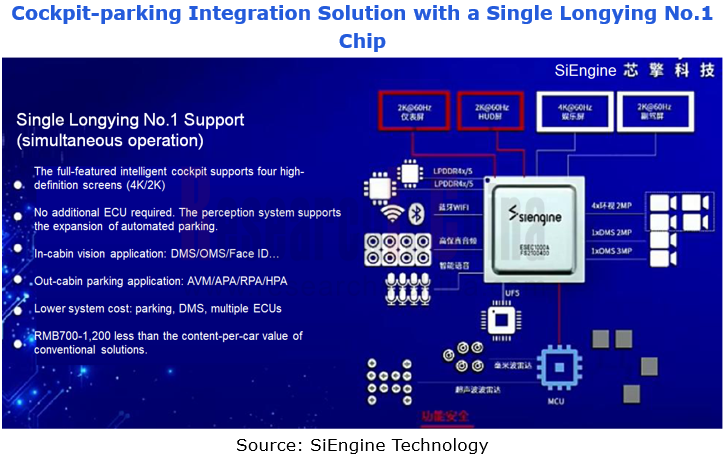

Based on a single Longying No.1 chip, SiEngine has developed a cockpit-parking integration solution to bolster a full-featured intelligent cockpit with four 4K/2K screens, without additional ECU and perception system for automated parking expansions such as RPA/HPA. Compared with conventional solutions, this solution can save RMB700-1,200.

4. Cockpit-driving integration takes the fast road, and is expected to go into mass production in 2025.

Cockpit-driving integration means the cockpit and intelligent driving domains are integrated into a high-performance computing unit to support both intelligent driving and intelligent cockpit functions simultaneously. It is considered the future development direction.

So far, NVIDIA, Qualcomm and Black Sesame Technologies among others have launched high-compute chips to support computing across intelligent driving and intelligent cockpit domains.

NVIDIA: with computing power up to 2000TOPS, a single Drive Thor chip fuses intelligent driving and in-cabin algorithms, and supports isolation among multiple computing domains. It is scheduled to be mass-produced for ZEEKR in 2025. At CES 2024, Li Auto indicated that it will use DRIVE Thor.

Qualcomm: With computing power up to 2000TOPS, a single Snapdragon Ride Flex (8775) SoC supports multi-domain fusion computing of cockpit and autonomous driving. At present, ThunderX, Megatronix and Autolink World are developing cockpit-driving integration products and solutions based on this platform.

Since the second half of 2023, the pace of development and application of cockpit-driving integration have quickened, and Baidu, ThunderX, Autolink World, Bosch and Aptiv have launched single-SoC cockpit-driving integration products or solutions. This will favor the rapid adoption of cockpit-driving integration, which is expected to be applied on a large scale after 2025.

In October 2023, Baidu launched Apollo Robo-Cabin, a cockpit-driving integration intelligent computing platform based on a Qualcomm cockpit chip (compatible with Qualcomm 8295, 8255 and 8775). With software and chip integrated, this platform also enables basic intelligent driving functions and cockpit capabilities, including AEB and LCC. The primary version of the solution has been first available in models like Geely Galaxy E8 and Jiyue 01. In addition, Baidu has cooperated with Hangsheng Electronics to build a new generation of cockpit-driving integration products scheduled to be launched in Q3 2024.

In November 2023, ThunderX unveiled RazorDCX Tarkine, a single-SoC cockpit-driving integration solution. Based on Qualcomm Snapdragon Ride Flex, it supports a through-type long 8K screen. Coupled with an all-scenario, immersive and full 3D interface, it enables 360° surround view, driver monitoring, gaming, audio and video entertainment, interconnection and other cockpit functions. It also supports automated parking, L2++ highway and urban intelligent driving functions.

In January 2024, Autolink World launched its latest cockpit-driving integration domain controller based on Qualcomm Snapdragon Ride Flex. A single SoC can realize L2+ intelligent driving functions such as highway NOA, HPA, and camera monitoring system (CMS). This product will be mounted on the next-generation models of Neta Auto.

In January 2024, Aptiv launched its first cockpit-driving-parking integration system based on a single SoC - Cross-domain Fusion Computing Platform. Based on a domestic chip and Wind River software, it covers three domains: intelligent cockpit, intelligent driving assistance and automated parking, and can simultaneously support multiple functions such as multi-screen interaction, online video, navigation and voice assistants, lane line and traffic light recognition, parking space and obstacle perception.

At the core of the new vehicle computer unveiled by Bosch in January 2024 – called the cockpit & ADAS integration platform – is a single SoC, which processes a variety of functions from the two domains of infotainment and driver assistance simultaneously. This includes, for example, automated parking and lane detection, paired with smart, personalized navigation and voice assistance.

1 Electronic/Electrical Architecture (EEA) and Cockpit-driving-parking Integration

1.1 Evolution Route of Automotive EEA

1.1.1 Evolution Trends of Automotive EEA in the Next Decade

1.1.2 Key Technologies for Building Next-generation EEA

1.1.3 OEMs’ New-generation EEA and Domain Integration Mode (1)

1.1.4 OEMs’ New-generation EEA and Domain Integration Mode (2)

1.2 EEA and Cockpit-driving-parking Integration

1.2.1 EEA Evolution Promotes Domain Controller Integration

1.2.2 Comparison between Driving-parking Integration, Cockpit-parking Integration and Cockpit-driving Integration

1.2.3 Iteration Process of Parking Functions in Domain Integration/Fusion

1.2.4 Iteration Process of Driving Functions in Domain Integration/Fusion

1.2.5 Iteration Process of Cockpit Functions in Domain Integration/Fusion

1.2.6 Prediction for Implementation Time of Driving-parking/Cockpit-parking/Cockpit-driving Integration

1.3 OEMs’ Cockpit-driving Integration Layout and Latest Dynamics

1.3.1 Geely

1.3.2 Changan

1.3.3 Neta Auto

1.3.4 Leapmotor

1.3.5 Jiyue Auto

1.3.6 IM Motors

2 Driving-parking Integration Modes and Trends

2.1 Introduction to Driving-parking Integration

2.1.1 Driving-parking Integration and Its Benefits

2.1.2 Four Forms of Driving-parking Integration

2.1.3 Major Players in Driving-parking Integration

2.1.4 Main Chips and Applications for Driving-parking Integration

2.1.5 Evolution of Driving-parking Integration Software Algorithms

2.2 Driving-parking Integration Solutions

2.2.1 Comparison between Single-chip and Multi-chip Driving-parking Integration Solutions

2.2.2 Two Technology Paths for Single-SOC Driving-parking Integration Solutions

2.2.3 Comparison between Lightweight and High-level Driving-parking Integration Solutions

2.2.4 List of Lightweight Driving-parking Integration Solutions (1)-(3)

2.2.5 List of High-level Driving-parking Integration Solutions (1)-(4)

2.3 Application of Driving-parking Integration in Vehicles

2.3.1 Installations and Installation Rate of Driving-parking Integration in China

2.3.2 Installations and Installation Rate of Driving-parking Integration of Independent/Joint-venture Automakers

2.3.3 Top 10 Brands/Models by Installations of Driving-parking Integration

2.3.4 Installations and Proportion of Driving-parking Integration by Computing Power

2.3.5 Installations and Proportion of Driving-parking Integration by Price

2.3.6 Top 10 Driving-parking Integration Suppliers

2.4 Development Trends of Driving-parking Integration

2.4.1 Is Single-SOC Driving-parking Integration An Inevitable Trend? (1)

2.4.2 Is Single-SOC Driving-parking Integration An Inevitable Trend? (2)

2.4.3 Is Single-SOC Driving-parking Integration An Inevitable Trend? (3)

2.4.4 Which Direction High-level Driving-parking Integration Is Heading in? (1)

2.4.5 Which Direction High-level Driving-parking Integration Is Heading in? (2)

2.4.6 What Chips Driving-parking Integration Requires?

2.4.7 How the Cooperation Models in the Driving-parking Integration Industry Chain Change?

2.4.8 Cooperation Model 1 in Driving-parking Integration Industry Chain

2.4.9 Cooperation Model 2 in Driving-parking Integration Industry Chain

2.4.10 Cooperation Model 3 in Driving-parking Integration Industry Chain

2.4.11 How Chip Vendors Help OEMs Implement Driving-parking Integration Solutions? (1)

2.4.12 How Chip Vendors Help OEMs Implement Driving-parking Integration Solutions? (2)

2.4.13 How to Transition from Driving-parking Integration to Cockpit-driving Integration?

3 Cockpit-parking Integration Modes and Trends

3.1 Introduction to Cockpit-parking Integration

3.1.1 Cockpit-parking Integration and Its Merits and Demerits

3.1.2 Drivers for Cockpit-parking Integration (1)

3.1.3 Drivers for Cockpit-parking Integration (2)

3.1.4 Drivers for Cockpit-parking Integration (3)

3.1.5 Drivers for Cockpit-parking Integration (4)

3.1.6 Cockpit-parking Integration VS Driving-parking Integration

3.1.7 Cockpit-parking Integration Modes

3.2 Exploration of Cockpit-parking Integration Trends

3.2.1 In What Models Is Cockpit-parking Integration Applied?

3.2.2 What Companies Deploy Cockpit-parking Integration? (1)

3.2.3 What Companies Deploy Cockpit-parking Integration? (2)

3.2.4 What Chips Cockpit-parking Integration Requires?

3.2.5 What Are Cockpit-parking Integration Chip Vendors?

3.2.6 Qualcomm Is Very Superior in Cockpit-parking Integration/ Cockpit-driving Integration (1)

3.2.7 Qualcomm Is Very Superior in Cockpit-parking Integration/ Cockpit-driving Integration (2)

3.2.8 Challenges in Cockpit-parking Integration

4 Cockpit-driving Integration Modes and Trends

4.1 Introduction to Cockpit-driving Integration

4.1.1 Cockpit-driving Integration and Its Merits and Demerits

4.1.2 Requirements of Cockpit-driving Integration and Advantages

4.1.3 Cockpit-driving Integration Technology System Architecture

4.2 Main Cockpit-driving Integration Modes

4.2.1 Three Modes to Implement Cockpit-driving Integration

4.2.2 Multi-chip Software and Hardware Cockpit-driving Integration Solutions

4.2.3 Single-chip Software and Hardware Cockpit-driving Integration Modes

4.2.4 Requirements of Cockpit-driving Integration for Chips

4.2.5 Main Cockpit-driving Integration Chips and Progress

4.3 Exploration of Cockpit-driving Integration Trends

4.3.1 Is Cockpit-driving Integration An Inevitable Trend?

4.3.2 How to Promote Cockpit-driving Integration?

4.3.3 What Is the Direction of Cockpit-driving Integration?

4.3.4 What Companies Deploy Cockpit-driving Integration? (1)

4.3.5 What Companies Deploy Cockpit-driving Integration? (2)

4.3.6 Exploration of Structure of Cockpit-driving Integration Companies

4.3.7 What Are OEMs’ Demands for Cockpit-driving Integration and Purchase Demands?

4.3.8 Challenges in Cockpit-driving Integration

4.3.9 Challenge 1

4.3.10 Challenge 2

4.3.11 Challenge 3

4.3.12 Challenge 4

5 Products and Solutions of Major Suppliers

5.1 Bosch

5.1.1 Introduction to Bosch XC

5.1.2 Cockpit-driving Integration Development Path

5.1.3 Cockpit-parking Integration Solutions

5.1.4 Cockpit-parking Integration Solution (1)

5.1.5 Cockpit-driving Integration Solution (2)

5.1.6 New Intelligent Driving and Cockpit Cross-domain Fusion Platform

5.2 Continental

5.2.1 Profile

5.2.2 Cross-domain Fusion Business Layout (1)

5.2.3 Cross-domain Fusion Business Layout (2)

5.2.4 Driving-parking Integration Solution of Continental Xinzhijia

5.2.5 Elektrobit HPC Software

5.3 Aptiv

5.3.1 Profile

5.3.2 SVA Hardware Platform

5.3.3 Wind River Software Platform

5.3.4 New-generation Intelligent Cockpit Platform and Iteration Trends (1)

5.3.5 New-generation Intelligent Cockpit Platform and Iteration Trends (2)

5.3.6 Driving-parking Integration Solution

5.3.7 Cockpit-driving-parking Integration System

5.3.8 Dynamics in Cooperation

5.4 ZF

5.4.1 Profile

5.4.2 Computing Platforms

5.4.3 ProAI Computing Platform (1)

5.4.4 ProAI Computing Platform (2)

5.5 Visteon

5.5.1 Profile

5.5.2 Cockpit Domain Controller

5.5.3 Cockpit-parking Integration Products and Solutions (1)

5.5.4 Cockpit-parking Integration Products and Solutions (2)

5.6 Desay SV

5.6.1 Profile

5.6.2 Cockpit-driving-parking Business Layout

5.6.3 Driving-parking Integration Products and Solutions (1)

5.6.4 Driving-parking Integration Products and Solutions (2)

5.6.5 Driving-parking Integration Products and Solutions (3)

5.6.6 Cockpit-parking Integration Products and Solutions (1)

5.6.7 Cockpit-parking Integration Products and Solutions (2)

5.6.8 Cockpit-parking Integration Products and Solutions (3)

5.6.9 Cockpit-parking Integration Products and Solutions (4)

5.6.10 Cockpit-driving integrated Products and Solutions (1)

5.6.11 Cockpit-driving integrated Products and Solutions (2)

5.7 ThunderX

5.7.1 Profile

5.7.2 Development History

5.7.3 Domain Controller Planning

5.7.4 Driving-parking Integration Solution

5.7.5 Cockpit-driving Integration Solution

5.7.6 Middleware Product Solution

5.7.7 Cooperation Model and Dynamics in Cooperation

5.8 Baidu Apollo

5.8.1 Profile

5.8.2 Intelligent Product Matrix

5.8.3 Iteration Process of Driving-parking Integration

5.8.4 Driving-parking Integration Solutions (1)

5.8.5 Driving-parking Integration Solutions (2)

5.8.6 Robo-Cabin Cabin-driving Integration Intelligent Computing Platform with Software-chip Integration

5.8.7 Cockpit-driving Integration Solution

5.8.8 Cooperation Model and Dynamics in Cooperation

5.9 ECARX

5.9.1 Profile

5.9.2 Subsidiary—JICA Intelligent Robot

5.9.3 Development History and Planning

5.9.4 Computing Platform Products

5.9.5 Driving-parking Integration Products

5.9.6 Cockpit-parking Integration Products

5.9.7 Cockpit-driving Integration Products

5.9.8 Cloudpeak Cross-domain Capability Base

5.9.9 Dynamics in Cooperation

5.10 Z-ONE

5.10.1 EEA Iteration

5.10.2 Full Stack 3.0

5.10.3 Intelligent Driving Computing Platform - ZPD

5.10.4 Cockpit-driving Integration Computing Platform - ZXD (1)

5.10.5 Cockpit-driving Integration Computing Platform - ZXD (2)

5.10.6 1st Generation Central Brain - ZXD1

5.10.7 Cockpit-driving Integration Digital Experience Products

5.11 Zongmu Technology

5.11.1 Profile

5.11.2 Layout of Cockpit-driving Integration Products and Solutions

5.11.3 Driving-parking Integration Products and Solutions

5.11.4 Driving-parking Integration Products and Solutions (1)

5.11.5 Driving-parking Integration Products and Solutions (2)

5.11.6 Driving-parking Integration Products and Solutions (3)

5.11.7 Driving-parking Integration Products and Solutions (4)

5.11.8 Driving-parking Integration Products and Solutions (5)

5.11.9 Cockpit-driving Integration Products and Solutions

5.11.10 Partners and Dynamics in Cooperation

5.12 Holomatic Technology

5.12.1 Profile

5.12.2 Iteration Process of Driving, Cockpit and Parking Products

5.12.3 Driving-parking Integration Products and Solutions

5.12.4 Models Applying Driving-parking Integration Solutions

5.12.5 Software and Hardware Integrated Domain Controller Products and Solutions

5.12.6 Cockpit-driving Integration Products and Solutions (1)

5.12.7 Cockpit-driving integrated Products and Solutions (2)

5.12.8 Partners and Dynamics

5.13 PATEO CONNECT+

5.13.1 Profile

5.13.2 Iteration Process of Intelligent Cockpits

5.13.3 Central Computing Platform (1)

5.13.4 Central Computing Platform (2)

5.13.5 Cockpit-driving Integration Solution

5.14 EnjoyMove Technology

5.14.1 Profile

5.14.2 Main Products

5.14.3 Driving-parking Integration Solution - DCU3.0

5.14.4 Driving-parking Integration Solution - XCG Cen1

5.14.5 Cockpit-parking Integration Solutions (1)

5.14.6 Cockpit-parking Integration Solutions (2)

5.14.7 Cockpit-parking Integration Solutions (3)

5.14.8 Cockpit-parking Integration Solutions (4)

5.14.9 Cockpit-parking Integration Solutions (5)

5.14.10 Cockpit-driving-parking Integration Solution

5.14.11 Dynamics

5.15 Yuanfeng Technology

5.15.1 Profile

5.15.2 Cockpit-driving-parking Integration Product Route

5.15.3 Cockpit-parking Integration 1.0

5.15.4 Cockpit-parking Integration 2.0

5.15.5 Cockpit-driving Integration and Application Scenarios

5.15.6 Cockpit-driving Integration Cooperation Model

5.15.7 Cockpit-driving Integration Solution Cooperative Customers

5.15.8 Major Customers and Partners

5.16 Foryou Corporation

5.16.1 Profile

5.16.2 Intelligence Layout

5.16.3 Driving-parking Integration Domain Controller

5.16.4 Cockpit-parking Integration Domain Controller

5.17 BICV

5.17.1 Profile

5.17.2 Driving-cockpit-parking Business Layout

5.17.3 Cockpit-parking Integration Products Based on Horizon Robotics’ Chips

5.17.4 Cockpit-parking Integration Products Based on Qualcomm’s Chips

5.18 NavInfo

5.18.1 Profile

5.18.2 Intelligent Driving Product Layout

5.18.3 Driving-parking Integration Solution (1)

5.18.4 Driving-parking Integration Solution (2)

5.18.5 Driving-parking Integration Solution (3)

5.18.6 Cockpit-driving Integration Layout

5.18.7 Chip Layout

5.19 Jingwei Hirain

5.19.1 Profile

5.19.2 Intelligent Driving Layout

5.19.3 Driving-parking Integration Products and Solutions (1)

5.19.4 Driving-parking Integration Products and Solutions (2)

5.19.5 Dynamics in Cooperation

5.20 Freetech

5.20.1 Profile

5.20.2 Core Intelligent Driving Capabilities (1)

5.20.3 Core Intelligent Driving Capabilities (2)

5.20.4 Intelligent Driving Solution Roadmap

5.20.5 Driving-parking Integration Domain Controller Products

5.20.6 L2 Driving-parking Integration Solution

5.20.7 L2+ Driving-parking Integration Solution

5.20.8 L2.5 Driving-parking Integration Solution

5.20.9 L2.9 Driving-parking Integration Solution

5.20.10 L3/L3+ Driving-parking Integration Solution

5.20.11 Intelligent Driving Partners

5.21 Haomo.ai

5.21.1 Profile

5.21.2 HPilot System Iteration Diagram

5.21.3 1st Generation HPilot System (1)

5.21.4 1st Generation HPilot System (2)

5.21.5 Driving-parking Integration Solution - HP350

5.21.6 Driving-parking Integration Solution - HP550 (1)

5.21.7 Driving-parking Integration Solution - HP550 (2)

5.21.8 2nd Generation HPilot System (1)

5.21.9 2nd Generation HPilot System (2)

5.21.10 Models Applying Intelligent Driving

5.21.11 Customers and Partners

5.22 Yihang.ai

5.22.1 Profile

5.22.2 Intelligent Business Model

5.22.3 Autonomous Driving Solutions

5.22.4 Driving-parking Integration Lite Version (Single SoC) (1)

5.22.5 Driving-parking Integration Lite Version (Single SoC) (2)

5.22.6 Driving-parking Integration Flagship Version (Dual SoC) (1)

5.22.7 Driving-parking Integration Flagship Version (Dual SoC) (2)

5.22.8 Driving-parking Integration Flagship Version (Dual SoC) (3)

5.22.9 All-scenario Full Self-Driving (FSD) Solutions

5.22.10 All-scenario Autonomous Driving Solutions

5.22.11 Partners and Dynamics

5.23 Hongjing Drive

5.23.1 Profile

5.23.2 Business Layout

5.23.3 Business Model

5.23.4 Core Autonomous Driving Technologies

5.23.5 Products and Solutions

5.23.6 Single-chip Driving-parking Integration Solution (1)

5.23.7 Single-chip Driving-parking Integration Solution (2)

5.23.8 High-level Driving-parking Integration Solution

5.23.9 Cockpit-parking Integration Layout

5.23.10 Main Partners

5.24 DJI Automotive

5.24.1 Profile of DJI Automotive (Zhuoyu Technology)

5.24.2 R&D and Production

5.24.3 Intelligent Driving Business Development Strategy (1)

5.24.4 Intelligent Driving Business Development Strategy (2)

5.24.5 All-scenario Intelligent Driving Solutions

5.24.6 Lingxi Intelligent Driving Technology Route

5.24.7 Lingxi Intelligent Driving System 2.0 (1)

5.24.8 Lingxi Intelligent Driving System 2.0 (2)

5.24.9 Lingxi Intelligent Driving System 2.0 (3)

5.24.10 Lingxi Intelligent Driving System 2.0 (4)

5.24.11 Lingxi Intelligent Driving System 2.0 (5)

5.24.12 Lingxi Intelligent Driving System 2.0 (6)

5.24.13 Lingxi Intelligent Driving System 2.0 (7)

5.24.14 Application Cases of Driving-parking Integration Solution (1)

5.24.15 Application Cases of Driving-parking Integration Solution (2)

5.24.16 Partners and Dynamics

5.25 Huawei

5.25.1 Automotive BU Business Layout (1)

5.25.2 Automotive BU Business Layout (2)

5.25.3 Automotive BU Business Layout (3)

5.25.4 Full-stack Solutions for Intelligent Vehicles

5.25.5 Computing and Communication Architecture (CCA)

5.25.6 CCA + VehicleStack (1)

5.25.7 CCA + VehicleStack (2)

5.25.8 MDC Series Computing Platform

5.25.9 MDC 610

5.25.10 MDC 810

5.25.11 ADS Solutions

5.25.12 Features and Functions of ADS 2.0 (1)

5.25.13 Features and Functions of ADS 2.0 (2)

5.25.14 Features and Functions of ADS 2.0 (3)

5.25.15 Features and Functions of ADS 2.0 (4)

5.25.16 Dynamics in Cooperation

5.26 iMotion

5.26.1 Profile

5.26.2 Development History

5.26.3 Revenue and Structure (1)

5.26.4 Revenue and Structure (2)

5.26.5 Product Roadmap

5.26.6 Intelligent Driving Product Solutions

5.26.7 Driving-parking Integration Domain Controllers (1)

5.26.8 Driving-parking Integration Domain Controllers (2)

5.26.9 Driving-parking Integration Domain Controller iDC Series Solutions (1)

5.26.10 Driving-parking Integration Domain Controller iDC Series Solutions (2)

5.26.11 Driving-parking Integration Domain Controller iDC Series Solutions (3)

5.26.12 Driving-parking Integration Domain Controller SuperVision Solution

5.26.13 Core Driving-parking Integration Technologies

5.26.14 Main Mass Production Projects

5.27 Neusoft Reach

5.27.1 Profile

5.27.2 SOA-based Series Products

5.27.3 Driving-parking Integration Domain Controllers

5.27.4 Driving-parking Integration Domain Controller - X-Box 4.0

5.27.5 Central Computing Unit - X-Center 2.0

5.27.6 FBB Architecture

5.27.7 openVOC Open Technology Framework (1)

5.27.8 openVOC Open Technology Framework (2)

5.27.9 openVOC Open Technology Framework (3)

5.27.10 openVOC Open Technology Framework (4)

5.27.11 openVOC Open Technology Framework (5)

5.27.12 Dynamics

5.28 MAXIEYE

5.28.1 Profile

5.28.2 MAXIPILOT 2.0

5.28.3 Driving-parking Integration Solution - MAXIPILOT 2.0 Pro

5.28.4 BEV Platform Architecture (1)

5.28.5 BEV Platform Architecture (2)

5.28.6 MAXI-DI Data Intelligent Architecture

5.28.7 Main Mass Production Projects

5.29 SenseTime

5.29.1 Profile

5.29.2 SenseAuto Driving-parking Integration Solutions

5.29.3 SenseAuto Lowly Configured Driving-parking Integration Solution

5.29.4 SenseAuto Medium Configured Driving-parking Integration Solution

5.29.5 SenseAuto Highly Configured Driving-parking Integration Solution

5.29.6 SenseAuto Intelligent Driving Capabilities (1)

5.29.7 SenseAuto Intelligent Driving Capabilities (2)

5.29.8 Automotive Partners

5.30 Motovis

5.30.1 Profile

5.30.2 Product Layout and Planning

5.30.3 Driving-parking Integration Solution

5.30.4 Driving-parking Integration Domain Controller - Magic Pilot 1.0

5.30.5 Driving-parking Integration Domain Controller - Magic Pilot 2.0

5.30.6 Core Driving-parking Integration Technologies

5.30.7 Core Strengths and Partners

5.31 MINIEYE

5.31.1 Profile

5.31.2 Driving-parking Integration Product Lineup

5.31.3 Driving-parking Integration Products Based on Journey Series

5.31.4 Driving-parking Integration Products Based on TI Series

5.31.5 Major Customers and Dynamics

5.32 AutoBrain

5.32.1 Profile

5.32.2 Single-SoC Driving-parking Integration Domain Controller Products

5.32.3 Main Advantages of Driving-parking Integration (1)

5.32.4 Main Advantages of Driving-parking Integration (2)

5.32.5 Dynamics in Cooperation

5.33 Nullmax

5.33.1 Profile

5.33.2 Main Products

5.33.3 MaxDrive Intelligent Driving Solution

5.33.4 Core Capabilities of Intelligent Driving (1)

5.33.5 Core Capabilities of Intelligent Driving (2)

5.33.6 Core Capabilities of Intelligent Driving (3)

5.33.7 Partners and Dynamics

5.34 Idriverplus

5.34.1 Profile

5.34.2 Intelligent Driving Solutions

5.34.3 High-compute Driving-parking Integration Solutions (1)

5.34.4 High-compute Driving-parking Integration Solutions (2)

5.34.5 High-compute Driving-parking Integration Solutions (3)

5.34.6 Core Technologies (1)

5.34.7 Core Technologies (2)

5.34.8 Core Technologies (3)

5.34.9 Core Technologies (4)

5.34.10 Dynamics in Cooperation

5.35 Technomous

5.35.1 Profile

5.35.2 Driving-parking Integration Domain Controller Product Lineup

5.35.3 Driving-parking Integration Domain Controller iECU 1.5

5.35.4 Driving-parking Integration Domain Controller iECU 3.1

5.35.5 Driving-parking Integration Domain Controller iECU 3.5

5.35.6 Driving-parking Integration Domain Controller Software Platform

5.35.7 Cooperation Models and Dynamics

5.36 Voyager Technology

5.36.1 Profile

5.36.2 Iteration of Intelligent Driving Solution VT-Pilot

5.36.3 Driving-parking Integration Product Route

5.36.4 Driving-parking Integration 2.0

5.36.5 Driving-parking/Cockpit-parking Domain Controllers

5.36.6 Cooperation Models and Partners

5.37 Baolong Automotive

5.37.1 Profile

5.37.2 Intelligent Driving Business and Model

5.37.3 Subsidiary Baolong Leadmove’s Driving-parking Integration Domain Control Solutions (1)

5.37.4 Subsidiary Baolong Leadmove’s Driving-parking Integration Domain Control Solutions (2)

5.37.5 Driving-parking Integration Solutions

5.37.6 Driving-parking Integration Solution - V-SEE 1.0

5.37.7 Driving-parking Integration Solution - V-SEE 2.0

5.37.8 Driving-parking Integration Solution - V-SEE 3.0

5.38 JOYNEXT

5.38.1 Profile

5.38.2 Domain Controller Product Planning

5.38.3 Autonomous Driving Domain Controllers

5.38.4 nDrive M Autonomous Driving Domain Controller

5.38.5 nDrive H Autonomous Driving Domain Controller

5.38.6 Central Computing Units and Solutions

5.38.7 Cockpit-driving Integration Layout

5.38.8 Dynamics

5.39 Pony.ai

5.39.1 Profile

5.39.2 Fangzai Intelligent Driving Domain Controller

5.39.3 Cangqiong Data Closed Loop Tool Chain

5.39.4 Pony Shitu Driving-parking Integration Solutions

5.39.5 Pony Shitu PonyClassic Driving-parking Integration Solution

5.39.6 Pony Shitu Core Technologies (1)

5.39.7 Pony Shitu Core Technologies (2)

5.40 QCraft

5.40.1 Profile

5.40.2 Driving-parking Integration Solutions

5.40.3 Driving-parking Integration Solution: Urban NOA Version

5.40.4 Core Intelligent Driving Technologies (1)

5.40.5 Core Intelligent Driving Technologies (2)

5.40.6 Partners and Dynamics

5.41 DeepRoute.ai

5.41.1 Profile

5.41.2 Business Layout

5.41.3 DeepRoute-Driver Solution

5.41.4 Driving-parking Integration Solutions

5.41.5 Driving-parking Integration Solution - D-PRO

5.41.6 Driving-parking Integration Product - D-AIR

5.41.7 Core Intelligent Driving Technologies

5.41.8 Dynamics

5.42 Autolink

5.42.1 Profile

5.42.2 Cockpit Domain Control Products

5.42.3 Cockpit-parking Integration Product Layout

5.42.4 Cockpit-driving Integration Products

5.43 Nobo Automotive Technology

5.43.1 Product Layout

5.43.2 Cockpit-parking Integration Products and Solutions

5.44 Megatronix

5.44.1 Profile

5.44.2 Cockpit-driving Integration Products

6 Products and Solutions of Major Chip Vendors

6.1 Main Products and Cockpit-driving-parking Solutions of Chip Companies

6.2 NVIDIA

6.2.1 Iteration of Autonomous Driving Chips

6.2.2 Driving-parking Integration Chips

6.2.3 Cockpit-driving Fusion Chips

6.2.4 Ecosystem Partners

6.3 Qualcomm

6.3.1 Automotive Solutions

6.3.2 Iteration of Cockpit Chips

6.3.3 Ride Chips and Product Portfolio

6.3.4 Cockpit-driving Fusion Chips

6.3.5 Cockpit-driving-parking Partners

6.4 TI

6.4.1 Profile

6.4.2 TDA4 Chip

6.4.3 Driving-parking Integration Chip - TDA4VM

6.4.4 Implementation Mode of Dual-TDA4 Driving-parking Integration Solution

6.4.5 Implementation Mode of Single-TDA4 Driving-parking Integration Solution

6.4.6 Advantages of TDA4 Series Chips

6.4.7 Dynamics in Driving-parking Integration Cooperation

6.5 Ambarella

6.5.1 Profile

6.5.2 Automotive Chip Layout

6.5.3 CV72AQ and Driving-parking Integration Solution (1)

6.5.3 CV72AQ and Driving-parking Integration Solution (2)

6.5.3 CV72AQ and Driving-parking Integration Solution (3)

6.5.3 CV72AQ and Driving-parking Integration Solution (4)

6.5.4 CV3-AD and Solutions

6.5.5 Partners and Mass Production Projects

6.6 Horizon Robotics

6.6.1 Chip Iteration

6.6.2 Mainstream Driving-parking Integration Domain Control Solutions Based on Journey 3 and Journey 5

6.6.3 Journey 3 and Driving-parking Integration Solution

6.6.4 Journey 5 and Driving-parking Integration Solution

6.6.5 Horizon Journey 6

6.6.6 Horizon Journey Series Partners

6.7 Black Sesame Technologies

6.7.1 Profile

6.7.2 Automotive Chips

6.7.3 A1000 Platform

6.7.4 A1000L Single-SoC Lightweight Driving-parking Integration Reference Solution

6.7.5 A1000 Single-SoC High-level Driving-parking Integration Reference Solution

6.7.6 Drive Sensing Driving-parking Integration Solution

6.7.7 A1000 Software Architecture System

6.7.8 C1200 Platform

6.7.9 Typical Automotive Applications Based on C1200

6.7.10 Chip Advantages

6.7.11 Tool Chain Development Kit and Application Support

6.7.12 Shanhai Artificial Intelligence Tool Platform

6.7.13 Cooperation Models and Ecosystem Partners

6.7.14 Dynamics in Cooperation

6.8 SemiDrive

6.8.1 Chip Layout

6.8.2 Cockpit Chip X9 Series and Application Scenarios

6.8.3 Cockpit-parking Integration Solution Based on X9

6.8.4 Intelligent Driving Chip V9 Series and Application Scenarios

6.8.5 Driving-parking Integration Solution Based on V9

6.8.6 Central Computing Architecture and Reference Design

6.8.7 Ecosystem Partners and Mass Production Projects

6.9 SiEngine

6.9.1 Profile

6.9.2 Chip Solutions

6.9.3 Longying No.1

6.9.4 Cockpit-parking Integration Solution

6.9.5 Cockpit-driving Integration Solution

6.9.6 Computing Power for Single-chip Cockpit-driving-parking Fusion Solution

6.9.7 Partners and Dynamics

6.10 Novauto

6.10.1 Profile

6.10.2 Intelligent Driving Computing Chip - Jingzhe R1

6.10.3 Intelligent Driving Reference Solution

6.10.4 High-level Driving-parking Integration Reference Solution

6.10.5 Lightweight Driving-parking Integration Reference Solution

6.10.6 Cooperation Model