Starting from 2007, coal prices have constantly been on the upward trend both at home and abroad and coke price has had the fastest surge.

The global crude steel output reached 1.34 billion tons in 2007, up 7.5% year on year, and meanwhile, China's crude steel output hit 489 million tons, up 15.7% year on year. With the rapid expansion of pig iron production capacity, China's demand for coke is expected to enjoy a further increase.

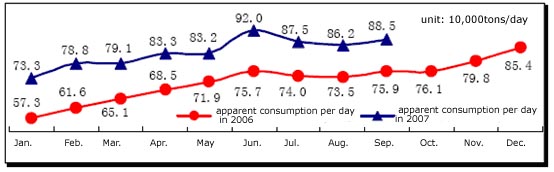

Comparison between Average Daily Coke Consumption in 2006-2007

Source: China Coal Transport and Distribution Association

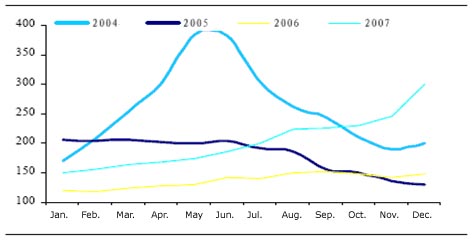

China's coke export price was on the downward trend all along in the period 2005 to 2006, but began to have a month-on-month rise in 2007. From Jan. to Sept., 2007, the average coke price was USD183 per ton, which was USD45 higher than the annual average price in the previous year and equal to the average level in the year of 2005.

In April 2008, Nippon Steel Corporation, JFE Steel Corporation, Sumitomo Metal Industries Ltd. (SMI) and BHP Billiton Mitsubishi Alliance or BMA, Australian largest coke supplier reached an agreement to more than triple coke price in 2008. Prime quality hard coking coal price, for instance, has been raised to US$300 per ton from less than US$100 per ton at the end of 2007.

Coke price hovering at high level in international market will have an effect on domestic market. It is predicted that China's coke price will still be on the upward trend in 2008.

Comparison between Coke Export Prices in 2004-2007

Based on the authoritative and abundant statistics from Ministry of Commerce, China Coal Transport and Distribution Association, the General Administration of Customs of China, State Information Center and the National Bureau of Statistics, this report makes an in-depth analysis of the current situation, supply & demand and some key coke producers of China coke industry.