Global and China Sensor Industry Report, 2015-2018

-

Sep.2015

- Hard Copy

- USD

$2,500

-

- Pages:108

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

CYH039

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,700

-

In 2014, the global sensor market valued at USD126 billion, representing a year-on-year increase of 19.4%. The United States, Japan, Germany and China occupied 72.4% share of the global sensor market together, in which China accounted for about 10.8%.

Benefiting from the rapid development of Internet of Things and other industries, the Chinese sensor market grew at an average annual growth rate of 23.6% in 2009-2014, and reached RMB86.5 billion in 2014; it is expected to value at RMB247 billion by 2018.

Consumer electronics and automobiles are two major fields of sensor application, and made up 41.0% and 14.8% of China's total demand for sensor in 2014 respectively. In future, smart cars, wearable devices, industrial robots and other intelligent industries will promote the development of the sensor industry as main engines.

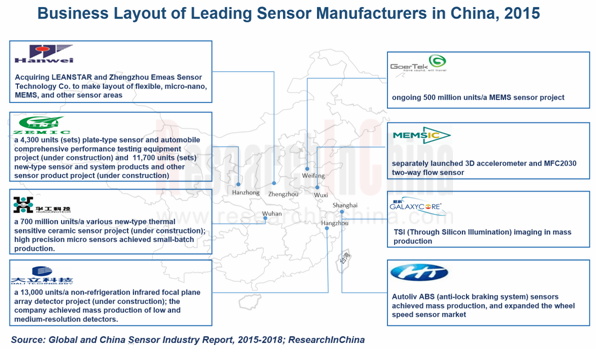

As for enterprises, about 70% of the Chinese sensor market is mastered by STMicroelectronics, Freescale and other foreign companies, while Chinese companies represented by Hanwei Electronics, Dali Technology and HGTECH seize small market share.

STMicroelectronics: The world's largest MEMS supplier of consumer electronics and mobile devices gained the revenue of USD3.447 billion in the first half of 2015. In September 2015, the company integrated advanced motion sensors and proximity sensors in the mobile phone model --- OnePlus 2 made by China's local mobile phone vendor OnePlus.

Freescale: As a major semiconductor company in the world, Freescale mainly produces pressure sensors, acceleration sensors and other types of sensors. As of the end of June 2015, the total sensor shipment of the company had hit over 2 billion.

HGTECH: By the end of 2014, the company had been able to produce 500 million heat sensitive sensors each year. In 2015, it is constructing a new-type thermal ceramic sensor project, which will raise the company’s capacity to 700 million/a after reaching production target. In addition, the company has achieved small batch production of high precision micro sensors.

Hanwei Electronics: The company focuses on gas sensors. The output amounted to 9.15 million in 2014. In the past two years, the company has made layout in flexible, micro-nano, MEMS and other sensor fields through the acquisition of Suzhou LEANSTAR and Zhengzhou Yidu.

Zemic: Following automotive testing equipment, the second business --- strain sensors contributed RMB115 million or 24.3% to the total revenue in the first half of 2015. The company’s ongoing project involved with 4,300 sets of plate sensors and automotive testing equipment as well as 11,700 sets of new-type sensors and system products annually is expected be completed by the end of 2015, which will further improve its share in the Chinese sensor market.

?

The report focuses on the following aspects:

Size, regional structure, competition pattern and the like of the global sensor market;

Size, regional structure, competition pattern and the like of the global sensor market;

Market size, regional structure, product structure, competition pattern, etc. of China sensor industry;

Market size, regional structure, product structure, competition pattern, etc. of China sensor industry;

Development and demand scale of major sensor applications such as smart phones, automobiles, industrial robots and wearable devices;

Development and demand scale of major sensor applications such as smart phones, automobiles, industrial robots and wearable devices;

Operation, sensor business and development strategies of 4 global and 11 Chinese sensor companies.

Operation, sensor business and development strategies of 4 global and 11 Chinese sensor companies.

1 Introduction to Sensor

1.1 Definition

1.2 Classification

1.3 Industry Chain

2 Global Sensor Market

2.1 Market Size

2.2 Regional Structure

2.3 Competition Pattern

2.4 M&A

3 Chinese Sensor Market

3.1 Development Overview

3.2 Market Size

3.3 Product Structure

3.4 Regional Structure

3.5 Competition Pattern

3.6 Application Structure

4 Main Sensor Application Fields in China

4.1 Consumer Electronics

4.1.1 Development Overview

4.1.2 Sensor Demand

4.2 Automobile Industry

4.2.1 Development Overview

4.2.2 Sensor Demand

4.2.3 Major Automotive Sensor Vendors

4.3 Intelligent Wearable Devices

4.3.1 Development Overview

4.3.2 Market Size

4.3.3 Sensor Demand

4.4 Industrial Robots

4.4.1 Development Overview

4.4.2 Sensor Demand

4.5 Others

4.5.1 Smart Meter

4.5.2 Intelligent Home Appliances

5 Major Global Sensor Vendors

5.1 Bosch

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Sensor Business

5.1.5 Development in China

5.2 STMicroelectronics

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Sensor Business

5.2.5 Development in China

5.3 Freescale

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Sensor Business

5.3.5 Development in China

5.4 Honeywell

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 R&D

5.4.5 Sensor Business

5.4.6 Development in China

5.4.7 Development Plan

6 Major Chinese Sensor Vendors

6.1 Guide Infrared (002414)

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 R&D

6.1.5 Sensor Business

6.2 AAC Technologies (2018.hk)

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Customers and Suppliers

6.2.5 R&D and Projects under Construction

6.2.6 Sensor Business

6.2.7 Development Prospect

6.3 HGTECH (000988)

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Gross Margin

6.3.5 Customers and Suppliers

6.3.6 R&D

6.3.7 Sensor Business

6.3.8 Development Prospect

6.4 Zemic (300114)

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 Gross Margin

6.4.5 R&D and Projects under Construction

6.4.6 Sensor Business

6.4.7 Development Prospect

6.5 Dali Technology (002214)

6.5.1 Profile

6.5.2 Operation

6.5.3 Revenue Structure

6.5.4 Gross Margin

6.5.5 Customers and Suppliers

6.5.6 R&D and Projects under Construction

6.5.7 Sensor Business

6.5.8 Development Prospect

6.6 GoerTek (002241)

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Gross Margin

6.6.5 Customers and Suppliers

6.6.6 R&D and Projects under Construction

6.6.7 Sensor Business

6.6.8 Development Prospect

6.7 Hanwei Electronics (300007)

6.7.1 Profile

6.7.2 Operation

6.7.3 Revenue Structure

6.7.4 Gross Margin

6.7.5 R&D and Projects under Construction

6.7.6 Sensor Business

6.7.7 Development Prospect

6.8 Shanghai Aerospace Automobile Electromechanical (600151)

6.8.1 Profile

6.8.2 Operation

6.8.3 Revenue Structure

6.8.4 Sensor Business

6.9 MEMSIC

6.9.1 Profile

6.9.2 Operation

6.10 Galaxycore

6.10.1 Profile

6.10.2 Operation

6.11 Wissen

7 Summary and Forecast

7.1 Summary

7.2 Forecast

Definition of Sensor

Composition of Sensor

Classification of Sensor

Sensor Industry Chain

Global Sensor Market Size, 2009-2015

Global Sensor Market Size and Structure (by Region), 2014

Major Global Sensor Vendors

Main M&A Cases of Global Sensor Enterprises, 2014-2015

China's Sensor Development Course

China's Sensor Market Size and YoY Growth, 2009-2014

China's Sensor Output and YoY Growth, 2011-2015

China's Sensor Market Share (by Product), 2014

China's Sensor Regional Distribution, 2015

China's Sensor Market Share (by Application), 2014

Global Smartphone Shipment and YoY Growth, 2011-2018E

China's Smartphone Shipment and YoY Growth, 2011-2018E

Global and China's Smartphone Sensor Demand Scale, 2013-2018E

Sensor Installation by Car Model

Global Automotive Sensor Market Size, 2011-2014

China's Automotive Sensor Market Size and YoY Growth, 2011-2018E

Revenue Ranking of Global Automotive Sensor Vendors, 2014-2015

China's Wearable Device Market Size and YoY Growth Rate, 2011-2018E

China's Wearable Smart Device Shipment and YoY Growth, 2012-2015

Automotive Sensor Distribution

Types of Wearable Device Sensor

China's Demand for Wearable Smart Device Sensor, 2013-2018E

Global Industrial Robot Sales Volume and YoY Growth, 2008-2015

Smart Meter Market Size (by Product), 2015

Bosch's Revenue and Net Income, 2010-2014

Bosch's Sales Structure (by Business), 2013-2014

Bosch's Sales Structure (by Country), 2009-2014

Bosch's Consumer Electronic Sensor Development Course, 2005-2015

Bosch's Sales and YoY Growth in China, 2009-2014

Product Structure of STMicroelectronics

Revenue and Net Income of STMicroelectronics, 2010-2015

Sales and Structure of STMicroelectronics (by Product), 2012-2015

Sales and Structure of STMicroelectronics (by Region), 2012-2014

Main Sensor Products of STMicroelectronics

Development of STMicroelectronics in China, 2015

Freescale's Sales and Net Income, 2012-2015

Freescale's Sales and Structure (by Product), 2013-2015

Freescale's Sales and Structure (by Country / Region), 2012-2014

Honeywell's Net Sales and Net Income, 2010-2015

Honeywell's Net Sales and Structure (by Business), 2012-2015

Honeywell's Net Sales (by Region), 2009-2014

Honeywell's R&D Costs and % of Total Revenue, 2009-2014

Honeywell's Development Course in China by Business, 1994-2015

Honeywell's Business Planning, 2015-2020

Revenue and Net Income of Guide Infrared, 2010-2015

Infrared Thermal Imager Output and Sales Volume, Inventory and Sales-Output Ratio of Guide Infrared, 2013-2014

Infrared Thermal Imager Revenue and YoY Growth of Guide Infrared, 2010-2015

Operating Revenue of Guide Infrared (by Region), 2010-2014

R&D Costs and % of Total Revenue of Guide Infrared, 2013-2015

R&D Centers and Production Bases of AAC Technologies

Revenue and Net Income of AAC Technologies, 2010-2015

Operating Revenue Structure of AAC Technologies (by Product), 2013-2015

Revenue Structure of AAC Technologies (by Region), 2010-2014

Revenue from Top 5 Clients and % of Total Revenue of AAC Technologies, 2010-2014

Procurement from Top 5 Suppliers and % of Total Procurement of AAC Technologies, 2011-2014

R&D Costs and % of Total Revenue of AAC Technologies, 2010-2015

MEMS Component Revenue and YoY Growth of AAC Technologies, 2010-2015

Revenue and Net Income of AAC Technologies, 2014-2018E

HGTECH's Revenue and Net Income, 2010-2015

HGTECH's Operating Revenue Structure (by Product), 2012-2015

HGTECH's Operating Revenue (by Region), 2010-2015

HGTECH's Gross Margin (by Product), 2010-2015

HGTECH's Revenue from Top 5 Clients and % of Total Revenue, 2009-2014

HGTECH's Procurement from Top 5 Suppliers and % of Total Procurement, 2007-2014

HGTECH's R&D Costs and % of Total Revenue, 2011-2015

HGTECH's Sensor Capacity and Output (by Product), 2011-2014

HGTECH's Sensor Business Revenue and YoY Growth, 2010-2015

HGTECH's Sensor Output, Sales Volume and Sales-Output Ratio (by Product), 2011-2014

HGTECH's Revenue and Net Income, 2014-2018E

Zemic's Revenue and Net Income, 2010-2015

Zemic's Main Business Structure (by Product), 2010-2015

Zemic's Operating Revenue (by Region), 2010-2014

Zemic's Gross Margin (by Product), 2010-2015

Zemic's R&D Costs and % of Total Revenue, 2011-2015

Zemic's Main R&D Projects and Progress, 2015

Zemic's Main Projects under Construction, 2015

Zemic's Sensor Revenue and YoY Growth, 2010-2015

Zemic's Sensor Revenue and Structure (by Product), 2010 & 2014

Zemic's Sensor Output and Sales Volume, 2013-2014

Zemic's Revenue and Net Income, 2014-2018E

Revenue and Net Income of Dali Technology, 2010-2015

Operating Revenue Structure of Dali Technology (by Product), 2010-2015

Operating Revenue of Dali Technology (by Region), 2010-2015

Gross Margin of Dali Technology (by Product), 2010-2015

Revenue from Top 5 Clients and % of Total Revenue of Dali Technology, 2010-2014

Procurement from Top 5 Suppliers and % of Total Procurement of Dali Technology, 2010-2014

Main Raw Material Consumption and Structure of Dali Technology, 2013-2014

R&D Costs and % of Total Revenue of Dali Technology, 2013-2015

Main Projects under Construction of Dali Technology, as of the end of August 2015

Infrared Thermal Imager Output, Sales Volume and Inventory of Dali Technology, 2013-2014

Development Course of Focal Plane Array Detectors of Dali Technology

Revenue and Net Income of Dali Technology, 2014-2018E

GoerTek's Revenue and Net Income, 2010-2015

GoerTek's Electronic Component Output and Sales Volume, 2013-2014

GoerTek's Operating Revenue (by Product), 2010-2015

GoerTek's Operating Revenue Structure (by Product), 2014

GoerTek's Operating Revenue (by Region), 2010-2015

GoerTek's Gross Margin (by Product), 2010-2015

GoerTek's Revenue from Top 5 Clients and % of Total Revenue, 2009-2014

GoerTek's Product Distribution (by Client)

GoerTek's Procurement from Top 5 Suppliers and % of Total Procurement, 2009-2014

GoerTek's R&D Costs and % of Total Revenue, 2012-2015

GoerTek's Projects under Construction and New Product Capacity, as of the end of August 2015

GoerTek's Revenue and Net Income, 2014-2018E

Revenue and Net Income of Hanwei Electronics, 2010-2015

Main Business Structure of Hanwei Electronics (by Product), 2010-2015

Operating Revenue of Hanwei Electronics (by Region), 2010-2014

Gross Margin of Hanwei Electronics (by Product), 2010-2015

R&D Costs and % of Total Revenue of Hanwei Electronics, 2009-2015

Main Business Layout of Hanwei Electronics, 2014-2015

Gas Sensor Revenue, Gross Margin and YoY Growth Rate of Hanwei Electronics, 2010-2015

Sensor Output and Sales Volume of Hanwei Electronics, 2010-2014

Revenue and Net Income of Hanwei Electronics, 2014-2018E

Revenue and Net Income of Shanghai Aerospace Automobile Electromechanical, 2010-2015

Operating Revenue of Shanghai Aerospace Automobile Electromechanical (by Business), 2010-2015

MEMSIC's New Sensor Products, 2014-2015

Galaxycore's Sensor Chip shipment, 2010 & 2014

Galaxycore's Sensor Products

Wissen's Main Sensor Business Events, 2012-2015

Revenue, Output and Sales Volume of Major Sensor Enterprises in China, 2014-2015

Global Sensor Market Size, 2014-2018E

China's Sensor Market Size and YoY Growth, 2014-2018E

Next-Generation Embodied AI Robot Communication Network Topology and Chip Industry Report, 2026

AI Robot Communication Network and Chip Research: Six Evolution Trends and Chip Transformation

Embodied AI robots, namely the new generation of AI robots integrating large AI models and physical enti...

Swarm Intelligence and Robotic Collaboration Application Report, 2025

Research on swarm intelligence and robotic collaboration: Swarm intelligence and robotic collaboration will break through the boundaries of individual intelligence and will be widely adopted across va...

Robot Controllers (Brain & Cerebellum) Research Report, 2025

Robot Controller Research: Brain-Cerebellum Integration Becomes a Trend, and Automotive-Grade Chips Migrate to Robots

ResearchInChina has released the Robot Controllers (Brain & Cerebellum) Resea...

Tactile Sensor Research Report, 2025

ResearchInChina has released the "Tactile Sensor Research Report, 2025", which conducts research, analysis and summary on the basic concepts, technical principles, advantages and disadvantages o...

Embodied AI and Humanoid Robot Market Research 2024-2025: Product Technology Outlook and Supply Chain Analysis

Six Trends in the Development of Embodied AI and Humanoid Robots

In 2025, the global humanoid robot industry is at a critical turning point from technology verification to scenario penetration, and t...

Global and China Smart Meters Industry Report, 2022-2027

Meters are widely used in the national economy and are an important part of metering to promote the development of metering. As a legal measuring tool, meters are mainly used in the supply process of ...

China Smart Agriculture and Autonomous Agricultural Machinery Market Report, 2022

Research on smart agriculture and autonomous agricultural machinery: top-level design, agricultural digitization and automation present a potential marketAmid the pandemic, the conflict between Russia...

Global and China Heat Meters Industry Report, 2022-2027

A heat meter is an instrument used to measure, calculate and display the value of heat released or absorbed by water flowing through a heat exchange system, and is mainly used for measuring the heatin...

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...