China Passenger Car Telematics Industry Report, 2017-2021

-

Jan.2018

- Hard Copy

- USD

$3,400

-

- Pages:200

- Single User License

(PDF Unprintable)

- USD

$3,200

-

- Code:

ZJF114

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,800

-

- Hard Copy + Single User License

- USD

$3,600

-

From January to October 2017, a total of 4.0993 million passenger cars were preinstalled with telematics in China, with market penetration standing at 21.02%, and the industrial scale will be up to RMB29 billion with a year-on-year surge of 38.1% and market penetration hitting 22% in 2017 around. As intelligent driving and autonomous driving get popular and commercialized, the telematics industry size will be developing faster in the future and is expected to report RMB70 billion in 2021 when the rate of telematics installations on passenger cars will be 39%.

As for price range of passenger cars, the models priced between RMB100,000 and RMB150,000 enjoyed the highest rate of telematics installations or 4.52% during January to October 2017, and the installation rate of telematics on the models priced below RMB250,000 is on the rise in the same period. It can be seen that OEMs are aggressively promoting the prevalence of telematics and low- and medium-end car models see a growing installation rate of telematics, which is naturally welcomed by the consumers.

Telematics is technically heading towards intelligence and networking, and the two technical routes are progressing simultaneously and making for a fusion. In respect of vehicle perception layer, the technological improvements are largely shown from novel automotive electronics and operating system. In the wake of technological advancements, automotive electronics are developing towards functional integration of sensors, high-performance computing chip and new human-computer interaction. The automotive operating system is gearing from single function towards the intelligent tiered, modularized and platform-based development.

China Passenger Car Telematics Industry Report, 2017-2021 highlights the following:

Telematics overview (national policy, favorable factors and impediments, Chinese telematics market size, industrial chains, market value chains, players and key solutions, etc.);

Telematics overview (national policy, favorable factors and impediments, Chinese telematics market size, industrial chains, market value chains, players and key solutions, etc.);

Telematics market in China (passenger car telematics in 2017 (by price/model/OEM/telematics brand) pre-installations, installation rate and penetration rate, the supporting of key telematics brands in the Chinese automotive market, business analysis of major telematics brands (like security function, navigation function, internet entertainment and comparison of charges);

Telematics market in China (passenger car telematics in 2017 (by price/model/OEM/telematics brand) pre-installations, installation rate and penetration rate, the supporting of key telematics brands in the Chinese automotive market, business analysis of major telematics brands (like security function, navigation function, internet entertainment and comparison of charges);

Study on telematics business of Joint-venture OEMs (OnStar/MyLink (SAIC-GM), G-BOOK (Toyota), HondaLink/Honda Connect (Honda), SENSUS/Volvo On Call (Volvo), SYNC (Changan Ford), CARWINGS+/ Nismo Watch (Dongfeng Nissan), UVO (Dongfeng Yueda KIA), Citro?n Connect (Dongfeng Citro?n), Blue-I (Dongfeng Peugeot), Mercedes-Benz CONNECT (Beijing Benz Automotive), BlueLink (Beijing Hyundai) and ConnectedDrive (BMW Brilliance), the car models supported, functions & services, package charges as well as user growth in Chinese market);

Study on telematics business of Joint-venture OEMs (OnStar/MyLink (SAIC-GM), G-BOOK (Toyota), HondaLink/Honda Connect (Honda), SENSUS/Volvo On Call (Volvo), SYNC (Changan Ford), CARWINGS+/ Nismo Watch (Dongfeng Nissan), UVO (Dongfeng Yueda KIA), Citro?n Connect (Dongfeng Citro?n), Blue-I (Dongfeng Peugeot), Mercedes-Benz CONNECT (Beijing Benz Automotive), BlueLink (Beijing Hyundai) and ConnectedDrive (BMW Brilliance), the car models supported, functions & services, package charges as well as user growth in Chinese market);

Study on telematics business of local Chinese OEMs (inkaNet (SAIC Motor), In Call (Changan Automobile), G-Netlink/ G-Link (Geely) and Cloudrive (Chery), the car models supported, functions & services, package charges as well as user growth in Chinese market);

Study on telematics business of local Chinese OEMs (inkaNet (SAIC Motor), In Call (Changan Automobile), G-Netlink/ G-Link (Geely) and Cloudrive (Chery), the car models supported, functions & services, package charges as well as user growth in Chinese market);

Chinese internet firms including NavInfo, LAUNCH Tech, PATEO, WirelessCar, China TSP, TimaNetworks, Careland, Beijing Carsmart Technology, YESWAY and AutoNavi (telematics customers, products, revenue structure, etc.)

Chinese internet firms including NavInfo, LAUNCH Tech, PATEO, WirelessCar, China TSP, TimaNetworks, Careland, Beijing Carsmart Technology, YESWAY and AutoNavi (telematics customers, products, revenue structure, etc.)

1 Overview of Telematics

1.1 National Policies for Developing Telematics (2016-2017)

1.2 Obstacles and Stimuli to China’s Telematics Industry

1.3 Development Trends in the Chinese Telematics

1.4 Three Major Trends of Onboard Terminals

1.5 China’s Telematics Industry Size

1.6 China’s Telematics Penetration

1.7 China’s Telematics Industry Chain and Market Participants

1.8 Structure of Telematics Industry Chain

1.8.1 Telematics Industry Chain-Automobile Manufacturing

1.8.2 Telematics Industry Chain-Automotive Semiconductor

1.8.3 Telematics Industry Chain-Onboard Electronics

1.8.4 Telematics Industry Chain - Software, Applications and Services

1.9 Telematics System Architecture

1.10 Value Chain of Telematics Market

1.11 Major Telematics Market Participants

1.12 Main Solutions for Telematics

1.13 Main Solutions for OEM Telematics

2 Development of China’s Telematics Market

2.1 Cumulative Pre-installation and Penetration of Passenger Car Telematics in China, 2017

2.2 Monthly Connected Pre-installation (units) and Penetration of Passenger Car Telematics in China, 2017

2.3 Installation Rate of Telematics Installed in Vehicles for Sale in China, as of Oct. 2017

2.4 Price Structure of All Vehicles for Sale Equipped with Telematics in China, as of Oct. 2017

2.5 Percentage of All Vehicles for Sale Equipped with Telematics by Price in China, as of Oct. 2017

2.6 Percentage of Models for Sale in China Equipped with Telematics by Models, as of Oct. 2017

2.7 Pre-installation of Telematics System in China, 2016-2021E

2.8 Installation Rate of New Vehicles Released in China by Price in the First Ten Months of 2017

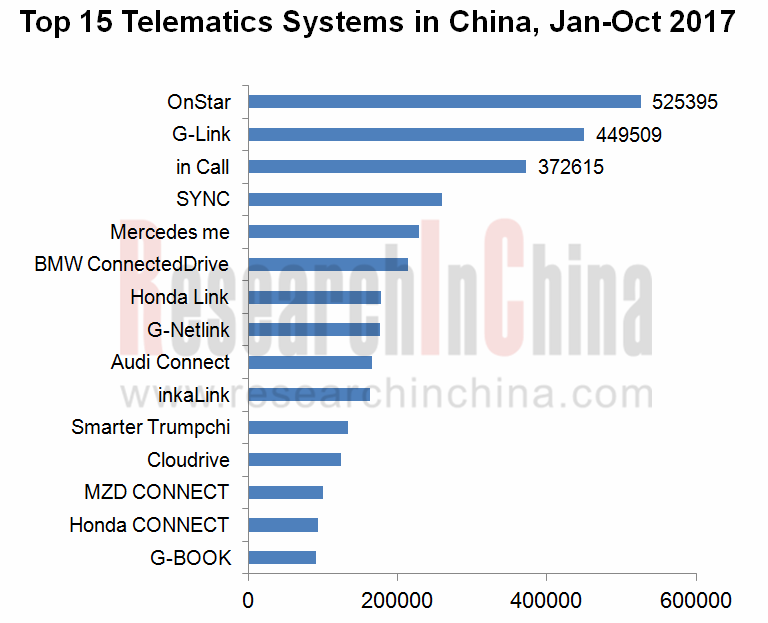

2.9 Top 15 Telematics Systems by OEMs, Jan.-Oct.2017

2.10 Top 15 Telematics Systems by Installation, Jan.-Oct.2017

2.11 Supporting of Telematics Brands in the Chinese Automobile Market (as of Oct. 2017)

2.12 Main Telematics Brands

2.12.1 Comparison: Safety Protection Functions

2.12.2 Comparison: Navigation Functions

2.12.3 Comparison: Interconnection and Entertainment Functions

2.12.4 Comparison: Charge Packages

3 Research on Telematics of Joint-ventured OEMs in China

3.1 SAIC-GM

3.1.1 Development History of GM Onstar

3.1.2 Introduction to Onstar Services

3.1.3 Onstar Charge Packages

3.1.4 Technology Roadmap for Onstar

3.1.5 Functions and Parameters of MyLink 2.0

3.1.6 New Onstar Users in Chinses Passenger Car Market, 2016-2017

3.2 Toyota

3.2.1 Comparison of Mobile Phone Connected G-BOOK and DCM Connected G-BOOK

3.2.2 New G-BOOK Users in China, 2016-2017

3.3 Honda

3.3.1 Functions and Services of HondaLink

3.3.2 Honda’s New-Generation Telematics Honda CONNECT

3.3.3 New HondaLink/ Honda CONNECT Users in China, 2016-2017

3.4 Volvo

3.4.1 Functions and Services of Sensus Connect

3.4.2 Functions and Services of Volvo On Call

3.4.3 New Sensus Users in China, 2016-2017

3.5 Chang'an Ford

3.5.1 Functions and Services of SYNC

3.5.2 New SYNC Users in China, 2016-2017

3.6 Dongfeng Nissan

3.6.1 Functions and Services of CARWINGS Zhixing+

3.6.2 Functions and Parameters of Nismo Watch

3.6.3 New CARWINGS Zhixing+ Users in China, 2016-2017

3.7 Dongfeng YuedaKia

3.7.1 UVO System Services

3.7.2 UVO Packages

3.7.3 New UVO Users in China, 2016-2017

3.8 Dongfeng Citro?n

3.8.1 Functions and Services of Citro?n Connect

3.8.2 New Citro?n Connect Users in China, 2016-2017

3.9 Dongfeng Peugeot

3.9.1 Functions and Services of Blue-i System

3.9.2 New Blue-i Users in China, 2016-2017

3.10 Beijing Benz

3.10.1 Functions and Services of Mercedes-Benz CONNECT

3.10.2 New Mercedes-Benz CONNECT Users in China, 2016-2017

3.11 Beijing Hyundai

3.11.1 BlueLink Charge Packages

3.11.2 Services of Blue Link System

3.11.3 New Blue Link Users in China, 2016-2017

3.12 BMW Brilliance

3.12.1 Functions and Services of ConnectedDrive

3.12.2 New ConnectedDrive Users in China, 2016-2017

4 Research on OEM Telematics in China

4.1 SAIC Motor

4.1.1 Functions and Services of inkaNet

4.1.2 inkaNet Charge Packages

4.1.3 New inkaNet Users in China, 2016-2017

4.2 Changan Automobile

4.2.1 Functions and Services of In Call

4.2.2 Models Supported by In Call System and Charge Packages

4.2.3 New In Call Users in China, 2016-2017

4.3 Geely Automobile

4.3.1 Development Course of Geely Telematics

4.3.2 Vertical Comparison of Geely Telematics

4.3.3 Models Equipped with Geely Telematics

4.3.4 Growth of G-Netlink/ G-Link Users in China, 2016-2017

4.4 Chery Automobile

4.4.1 Profile of Cloudrive

4.4.2 Cloudrive3.0 Launched

4.4.3 Growth of Cloudrive Users in China, 2016-2017

4.5 Guangzhou Automobile Group Co., Ltd.

4.5.1 Introduction to Smarter Trumpchi

4.5.2 Smarter Trumpchi Pre-installations to Key Models

4.5.3 Installations and Installation Rate of Smarter Trumpchi, 2015-2017H1

4.5.4 Comparison between Different Versions

4.5.5 GAC Partnered with AutoNavi (amap.com) to Launch “Cloud Navigation”

5. Chinese Telematics Companies

5.1 NavInfo Co., Ltd.

5.1.1Operating Results, 2013-2017

5.1.2 Operating Results by Sector, 2015-2016

5.1.3 Research and Analysis -- R & D Investment

5.1.4 Top 5 Customers

5.1.5 Telematics Service Ecosystem

5.1.6 Research and Analysis -- Acquisition Modes of Geographic Information Resources

5.1.7 Subsidiary: Beijing Mapbar Science and Technology Co., Ltd.

5.1.8 Subsidiary: China Satellite Navigation and Communications Co., Ltd.

5.1.9 Product Analysis -- Aerohuanyou Vehicle information Comprehensive Service Platform

5.1.10 Product Analysis -- WeDrive3.0

5.1.11 Strategic Cooperation Framework Agreement with Neusoft

5.1.12 Research on New Layout “Chip+Algorithm+Data+Software”

5.1.13 Dynamics

5.2 LAUNCH Tech Company Limited

5.2.1 Revenue and YoY Growth, 2011-2017

5.2.2 Net Income and YoY Growth, 2011-2017

5.2.3 Revenue Structure (by Product), 2014-2016

5.2.4 R&D Costs and % of Total Revenue, 2009-2016

5.2.5 Latest Developments

5.2.6 “Intelligent Diagnosis” System

5.3 PATEO

5.3.1 Related Companies

5.3.2 Business Positioning

5.3.3 Product Platform System

5.3.4 Core Technologies and Architecture

5.3.5 Product HMI Features

5.3.6 Telematics Business

5.3.7 Application Cases

5.3.8 Latest News

5.4 WirelessCar

5.4.1 Application Case -Volvo On Call

5.4.2 Application Case - Nissan Infiniti InTouch and new Nissan Connect

5.4.3 Application Case - QorosQloud

5.5 China TSP

5.5.1 Development Course

5.5.2 Product Structure

5.5.3 Product Application

5.5.4 Application Cases

5.6 TimaNetworks

5.6.1 Three Functions of CarNet Telematics Solutions in Aftermarket

5.6.2 Comparison with Counterpart Telematics System Products

5.6.3 Product Application Structure

5.6.4 Main Function Modules of Products

5.7 Careland

5.7.1 Revenue and Net Income, 2012-2017

5.7.2 R & D Investment, 2012-2016

5.7.3 Revenue Distribution, 2015 & 2016

5.7.4 M330 Connected Intelligent Rearview Mirror Navigation

5.8 Beijing Carsmart Technology Co., Ltd

5.8.1 Profile

5.8.2 Revenue and YoY Growth, 2010-2017

5.8.3 Autofun and UBI Business

5.8.4 Autofun

5.9 YESWAY

5.9.1 Customers

5.9.2 Revenue and YoY Growth, 2011-2017

5.9.3 Net Income and YoY Growth, 2011-2017

5.9.4 OEM Telematics Services

5.9.5 Aftermarket Telematics Services

5.9.6 Intelligent Driving Services

5.9.7 Revenue Structure (by Business), 2011-2016

5.9.8 Gross Margin and R & D Investment, 2011-2016

5.9.9 Revenue from Top 5 Customers, 2013-2016

5.9.10 Latest News

5.9.11 Y-CONNECT is Intelligent Driving Interconnected System

5.10 AutoNavi

5.10.1 Map Business

5.10.2 Partners

5.10.3 Autonavi (amap.com) and Qianxun SI Cooperate in “HD Map+ High-accuracy Positioning”

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...