China Automotive Shock Absorber Industry Report, 2018-2022

-

May 2018

- Hard Copy

- USD

$3,400

-

- Pages:135

- Single User License

(PDF Unprintable)

- USD

$3,200

-

- Code:

CYH074

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,800

-

- Hard Copy + Single User License

- USD

$3,600

-

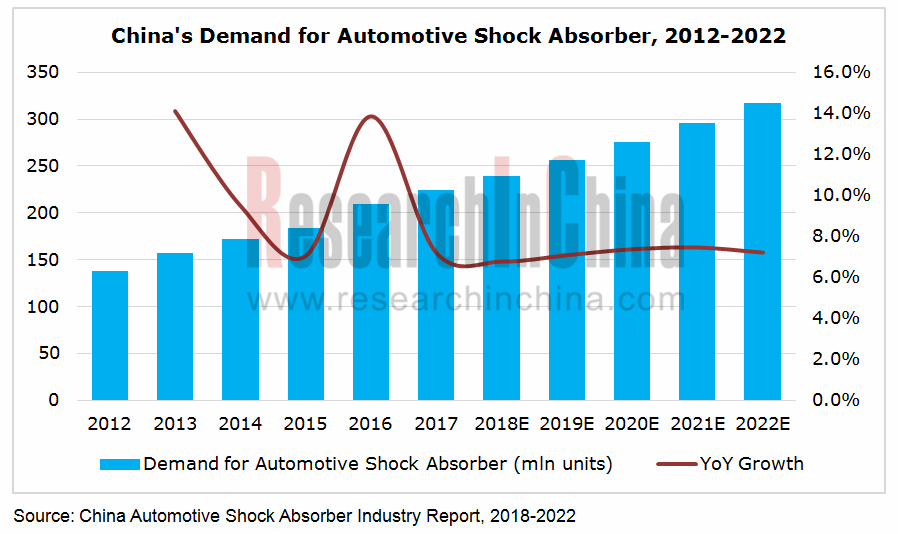

Shock absorber, an essential part of automotive suspension system, can absorb body vibration and make driving more smooth and comfortable. The Chinese market demand for automotive shock absorber reached 225 million units in 2017, a year-on-year rise of 7.2%, and is expected to hit 318 million units in 2022 thanks to rapid expansion of the automobile (NEV in particular) market.

OEM market: the demand for automotive shock absorber has much bearing on China’s automobile output. The country’s car production rose by 3.2% from a year ago to 29.02 million units in 2017 and is expected to reach 34.55 million units in 2022, boosting the demand for automotive shock absorber from 116 million units in 2017 to 138 million units in 2022, presenting a CAGR of 3.6%.

After-sales maintenance market: massive car ownership creates a large after-sales market. An estimated 180 million shock absorbers will be needed in the Chinese automotive aftermarket in 2022.

Enterprise landscape: the key players in the Chinese shock absorber market include sole proprietorships or joint ventures of world-renowned shock absorber firms (ZF, Tenneco, KYB, Mando, SHOWA, ThyssenKrupp, etc.) and local Chinese peers (Nanyang Xijian Auto Shock Absorber, ADD Industry (Zhejiang), Chengdu Jiuding Science & Tech. and BeijingWest Industries, etc.).

Attracted by China’s enormous AM demand, global and local Chinese shock absorber producers have quickened their presence in shock absorber market. The Tenneco’s new shock absorber project in Changzhou city, which began construction in Sept 2017, will be built at the end of 2018, adding 18 million units/a.

BeijingWest Industries, a joint venture of Shougang Group, has kept expanding its capacity worldwide since the acquisition of automotive suspension system business of US auto parts supplier- Delphi in 2009 and now is capable of producing 15.50 million shock absorbers annually. The company put its 4 million units/a new plant in Czech Republic into production in June 2017 and then began construction of a new plant in Indiana, U.S. which is expected to reach designed capacity (4 million units/a) in 2020.

Technically, there is an ever higher demanding on intelligence and comfort of shock absorber system. Adaptive adjustable shock absorber, compound shock absorber, intelligent shock absorber and electromagnetic-current shock absorber represent main development directions. Meanwhile, as the car becomes more lightweight, the lighter, smaller and higher-performance semi-active & active shock absorber systems will prevail.

China Automotive Shock Absorber Industry Report, 2018-2022 focuses on the followings:

Policies on shock absorber and technical trends;

Policies on shock absorber and technical trends;

Development and trends of global automobile market and Chinese passenger car, commercial vehicle and new energy vehicle (NEV) market;

Development and trends of global automobile market and Chinese passenger car, commercial vehicle and new energy vehicle (NEV) market;

Chinese automotive shock absorber market (demand, OEM market, AM market, enterprise landscape, development trend, etc.);

Chinese automotive shock absorber market (demand, OEM market, AM market, enterprise landscape, development trend, etc.);

18 Global and Chinese shock absorber manufacturers (operation, development strategy, etc.).

18 Global and Chinese shock absorber manufacturers (operation, development strategy, etc.).

1 Overview of Automotive Shock Absorber

1.1 Definition and Classification

1.1.1 Definition

1.1.2 Classification

1.2 Industry Chain

1.3 Technical Trend

1.4 Industrial Policy

2 Global and Chinese Automobile Market

2.1 Global

2.2 China

2.2.1 Market Size

2.2.2 Passenger Car

2.2.3 Commercial Vehicle

2.2.4 New Energy Vehicle

3 Chinese Automotive Shock Absorber Market

3.1 Overview

3.2 Vehicle Supporting Market

3.3 After-sales Market

3.4 Competitive Landscape

3.5 Development Prospects

4 Major Foreign Manufacturers

4.1 Tenneco

4.1.1 Profile

4.1.2 Operation

4.1.3 Shock Absorber Business

4.1.4 Recent Acquisitions

4.1.5 Development in China

4.1.6 Tenneco (Beijing) Ride Control Systems

4.1.7 Tenneco (Suzhou) Ride Control Co., Ltd.

4.1.8 Tenneco (Changzhou) Rider Performance Co., Ltd.

4.2 ZF

4.2.1 Profile

4.2.2 Operation

4.2.3 Shock Absorber Business

4.2.4 Development in China

4.2.5 Shanghai Sachs Huizhong Shock Absorber

4.2.6 ZF Dongfeng Shock Absorber Shiyan

4.3 KYB

4.3.1 Profile

4.3.2 Operation

4.3.3 Shock Absorber Business

4.3.4 Wuxi KYB Top Absorber

4.3.5 Kyb Industrial Machinery (Zhenjiang)

4.3.6 Changzhou KYB Leadrun Vibration Reduction Technology

4.4 Mando

4.4.1 Profile

4.4.2 Operation

4.4.3 Shock Absorber Business

4.4.4 Development in China

4.5 Gabriel

4.5.1 Profile

4.5.2 Main Products

4.6 ACDelco

4.6.1 Profile

4.6.2 Main Products

4.7 Hitachi Automotive Systems

4.7.1 Profile

4.7.2 Operation

4.7.3 Shock Absorbers

4.7.4 Development in China

4.7.5 Tokico Automotive (Suzhou)

4.8 ThyssenKrupp

4.8.1 Profile

4.8.2 Operation

4.8.3 BILSTEIN

4.8.4 ThyssenKrupp Presta Shanghai

4.9 SHOWA Corporation

4.9.1 Profile

4.9.2 Operation

4.9.3 Shock Absorber Business

4.9.4 Development in China

4.9.5 Guangzhou Showa Auto Parts

4.9.6 Shanghai Showa Auto Parts

4.9.7 Chengdu Ningjiang Showa Auto Parts

5 Major Chinese Shock Absorber Manufacturers

5.1 China First Capital Group

5.1.1 Profile

5.1.2 Operation

5.1.3 Shock Absorber Business

5.1.4 R&D

5.1.5 Major Production Bases

5.2 Chengdu Jiuding Science & Tech. (Group)

5.2.1 Profile

5.2.2 Main Products and Capacity

5.2.3 Production Bases

5.3 ADD Industry (Zhejiang)

5.3.1 Profile

5.3.2 Operation

5.3.3 Capacity and Output

5.3.4 R&D

5.3.5 Customers and Suppliers

5.3.6 Supporting Relations

5.4 Chongqing Endurance Zhongyi Shock Absorber

5.4.1 Profile

5.4.2 Operation

5.5 Shanghai Powered Auto Parts

5.5.1 Profile

5.5.2 Operation

5.5.3 Production Bases

5.6 Jinzhou Leader Shock Absorber

5.6.1 Profile

5.6.2 Operation

5.6.3 Supporting Relations

5.7 Fawer Automotive Parts

5.7.1 Profile

5.7.2 Operation

5.7.3 R&D

5.7.4 Customers and Suppliers

5.7.5 FAW-Tokico Shock Absorber

5.7.6 Supporting Relations

5.8 Guangxi Huali Group

5.8.1 Profile

5.8.2 Operation

5.8.3 Liuzhou Keleila Automobile Absorber

5.9 BeijingWest Industries

5.9.1 Profile

5.9.2 Operation

Functions of Shock Absorber

Location of Shock Absorber in Automobile

Internal Structure of Shock Absorber

Working Principle of Hydraulic Shock Absorber

Internal Structures of Hydraulic Shock Absorber and Pneumatic Shock Absorber

Classification of Automotive Shock Absorber

Automotive Shock Absorber Industry Chain

New Technologies about Shock Absorber and Suspension Launched by Major Companies in the World

Policies on Automotive Shock Absorber in China

Global Automobile Output by Type, 2006-2022E

TOP20 Countries by Automobile Output and Share, 2017

China’s Automobile Ownership, 2008-2017

China’s Automobile Output, 2011-2017

China’s Automobile Sales, 2011-2017

China’s Automobile Output and Sales, 2017-2022E

China’s Automobile Sales Structure by Type, 2011-2017

China’s Automobile Sales Structure by Type, 2017-2022E

Ranking of TOP10 Automobile (by Type) Manufacturers by Sales in China, 2017

China’s Passenger Car Sales, 2011-2017

China’s Passenger Car Output and Sales, 2017-2022E

China’s Passenger Car Sales by Type, 2011-2017

China’s Passenger Car Sales Structure by Type, 2011-2017

China’s Commercial Vehicle Output, 2011-2017

China’s Commercial Vehicle Sales, 2011-2017

China’s Commercial Vehicle Output and Sales, 2017-2022E

China’s Commercial Vehicle Sales by Type, 2011-2017

China’s Commercial Vehicle Sales Structure by Type, 2011-2017

Policies on New Energy Vehicle Industry in China, 2009-2018

China’s New Energy Vehicle Output and Sales, 2011-2017

Monthly Output of New Energy Vehicle in China by Type, 2016-2017

Monthly Sales of New Energy Vehicle in China by Type, 2016-2017

China’s Automotive Shock Absorber Market Size, 2009-2022E

OEM Demand for Automotive Shock Absorber in China, 2009-2022E

Aftermarket Demand for Automotive Shock Absorber in China, 2008-2022E

Major Chinese Shock Absorber Manufacturers and Their Capacity, 2018

China’s Automotive Shock Absorber Market Structure, 2017&2022E

Main Business of Tenneco

Main Clients of Tenneco

Tenneco’s Revenue and Net Income, 2009-2017

Tenneco’s Revenue by Business, 2015-2017

Tenneco’s Revenue by Region, 2016-2017

Tenneco’s Revenue by Country/Region, 2015-2017

Tenneco’s Revenue from Main Clients, 2017

Supporting by Tenneco’s Shock Absorbers

Business of “Aftermarket and Suspension System Company” Tenneco Projects to Build

Business Scale of Aftermarket and Suspension System Company

Tenneco’s Revenue in China and % of Total Revenue, 2015-2017

ZF’s Main Brands

ZF’s Revenue and Net Income, 2009-2017

ZF’s Revenue by Division, 2016-2017

ZF’s Revenue Structure by Region, 2017

ZF’s Revenue by Region, 2016-2017

ZF’s R&D Costs (EUR mln), 2013-2017

Supporting by ZF’s Shock Absorbers

KYB’s Global Presence

KYB’s Net Sales and Net Income, FY2010-FY2018

KYB’s Revenue by Business, FY2012-FY2018

KYB’s Revenue by Region, FY2012-FY2017

KYB’s Shock Absorbers

KYB’s Sales from Shock Absorbers by Purpose, FY2015-FY2018

KYB’s Shock Absorber Sales by Market, FY2017&FY2020E

KYB’s Plan for Shock Absorber Capacity Expansion, FY2017-FY2020

Supporting by KYB’s Shock Absorbers

Major OE Suppliers and Supporting Models of KYB’s Shock Absorbers in China

Organizational Structure of Mando

Mando’s Sales, Operating Income and Net Income, 2014-2017

Mando’s Main Clients

Supporting by Mando’s Shock Absorbers

Mando’s Sales in China, 2012-2017

Mando’s Net Income in China, 2012-2017

Distribution of Mando’s Plants in China

Gabriel’s Main Shock Absorbers

ACDelco’s Main Shock Absorbers

Revenue of Hitachi Automotive Systems, FY2012-FY2017

Revenue Structure of Hitachi Automotive Systems by Business, FY2016

Main Shock Absorber Products of Hitachi Automotive Systems

Supporting by Hitachi Automotive Systems’ Shock Absorbers

Distribution of Hitachi Automotive Systems’ Subsidiaries in China

Net Sales and Net Income of ThyssenKrupp, FY2010-FY2018

Order Structure of ThyssenKrupp (by Business), FY2016-FY2017

Sales Structure of ThyssenKrupp (by Business), FY2016-FY2017

Sales Structure of ThyssenKrupp (by Region), FY2016-FY2017

Sales Share of ThyssenKrupp (by Market), FY2017

Gross Margin of ThyssenKrupp, FY2010-FY2018

Main Shock Absorbers of ThyssenKrupp Bilstein

Main Auto Parts of SHOWA

Global Presence of SHOWA

Revenue and Net Income of SHOWA, FY2011-FY2018

Revenue of SHOWA (by Division), FY2013-FY2017

Shock Absorbers of SHOWA

SHOWA’s Revenue in China and % of Total Revenue, FY2015-FY2017

Footprint of SHOWA in China

Shock Absorbers of Shanghai Showa Auto Parts

Organizational Structure of China First Capital Group

Revenue and Net Income of China First Capital Group, 2009-2017

Revenue Structure of China First Capital Group (by Division), 2015-2017

Gross Profit Structure of China First Capital Group (by Business), 2016-2017

Sales Volume of China First Capital Group’s Automotive Shock Absorbers, 2012-2017

Main Vehicle Models Supported by China First Capital Group’s Automotive Shock Absorbers

China First Capital Group’s R&D Costs and % of Total Revenue, 2012-2017

Shock Absorbers Capacity of Chengdu JiuDing Science & Tech. (by Base), 2018

Supporting by Tianjin Tiande Suspension Systems Co., Ltd’s Shock Absorbers

Revenue and Net Income of ADD Industry, 2012-2018

Revenue of ADD Industry (by Product), 2012-2017

Revenue Structure of ADD Industry (by Region), 2013-2017

Gross Margin of ADD Industry (by Product), 2012-2017

Main Shock Absorbers of ADD Industry

Shock Absorber Capacity, Output and Sales of ADD Industry, 2012-2017

Shock Absorber Sales Structure of ADD Industry (by Market), 2016-2017

Selling Prices of ADD Industry’s Main Shock Absorbers, 2012-2016

ADD Industry’s R&D Costs and % of Total Revenue, 2012-2017

ADD Industry’s Revenue from Top 5 Customers and % of Total Revenue, 2012-2017

ADD Industry’s Procurement from Top 5 Suppliers and % of Total Revenue, 2012-2017

Supporting by ADD Industry’s Shock Absorbers

Operation of Chongqing Endurance Zhongyi Shock Absorber, 2015

Global Presence of Shanghai Powered

Main Vehicle Models Supported by Shanghai Powered’s Shock Absorbers

Sales Structure of Jinzhou Leader Shock Absorber

Main Automakers Supported by Jinzhou Leader Shock Absorber

Supporting by Jinzhou Leader Shock Absorber’s Products

Revenue and Net Income of Fawer Automotive Parts, 2011-2018

Revenue Structure of Fawer Automotive Parts (by Product), 2012-2017

Revenue Structure of Fawer Automotive Parts (by Region), 2012-2017

Gross Margin of Fawer Automotive Parts (by Product), 2012-2017

R&D Costs of Fawer Automotive Parts and % of Total Revenue, 2013-2017

Revenue of Fawer Automotive Parts from Top 5 Customers and % of Total Revenue, 2017

Procurement of Fawer Automotive Parts from Top 5 Suppliers and % of Total Revenue, 2017

Revenue and Net Income of Faw-Tokico Shock Absorber, 2014-2017

Supporting by Fawer Automotive Parts’ Shock Absorbers

Supporting by Guangxi Huali Group’s Shock Absorbers

Global Presence of BeijingWest Industries

Revenue Structure of BeijingWest Industries (by Product), 2016-2017

Main Operating Data of BeijingWest Industries, 2016-2017

OE Suspensions and Shock Absorbers of BeijingWest Industries

Main Customers of BeijingWest Industries

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...