China Silicon Carbide Industry Report, 2019-2025

-

Aug.2019

- Hard Copy

- USD

$3,000

-

- Pages:118

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

ZHP097

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,200

-

Silicon carbide (SiC) is the most mature and the most widely used among third-generation wide band gap semiconductor materials. Over the past two years, global SiC market capacity, however, hovered around 3 million tons due to producers’ unwillingness to expand production, a result of high technical barriers (unstable quality of the raw material crystal column). China’s SiC market remains in large size despite a late start, with its capacity sharing roughly 70% of global total in 2018.

Although China boasts a large SiC capacity, most of Chinese companies make little use of their capacity, stopping production or just producing sometime on account of environmental campaigns. In 2018, China’s SiC output reached 910,000 tons (with capacity utilization close to 40%), an annualized slump of 15.7%. In the country, SiC products fall into black and green types, of which black SiC prevails in the market. In 2018, China produced 850,000 tons of black SiC (or 93.4% of the country’s total SiC output), 15% less than in the previous year; its green SiC output plunged by 25% to 60,000 tons. The ever wider use of diamond in solar wafer cutting was another big reason why SiC output took a nosedive.

In China, demand from SiC power devices will be a stimulus to SiC market growth, and traditional applied industries like refractories and abrasives will need less. It can be seen from the trends of the international market that foreign automotive semiconductor vendors have set about seeking for long-term partnerships with SiC wafer suppliers; in the Chinese market, the collaborations between the Institute of Electrical Engineering (IEE) of Chinese Academy of Sciences (CAS), Tsinghua University and Belgium’s CISSOID in 2019, are a boon for massive application of SiC devices to new energy vehicles. Additionally, SiC devices are extensively used in 5G base stations. In 2019, Xidian University succeeded in trial production of a 5G communication chip by using new-generation gallium nitride (GaN) material based on SiC substrate, breaking the overseas monopoly and paving the way for SiC being applied to domestic 5G market.

The burgeoning sectors like new energy vehicle and 5G will push up global SiC power semiconductor market size to a staggering $1.6 billion in 2025, compared with less than $400 million in 2018. The figure is expected to surge to virtually $5.0 billion in 2030, at an AAGR of at least 20%.

A combination of factors such as technological advances, favorable polices and growing demand will prop the Chinese SiC industry to soar.

China Silicon Carbide Industry Report, 2019-2025 highlights the following:

Global silicon carbide industry (smelting and processing, power semiconductors) (market size, key companies, etc.);

Global silicon carbide industry (smelting and processing, power semiconductors) (market size, key companies, etc.);

China silicon carbide industry (policy environment, industry status and development trend);

China silicon carbide industry (policy environment, industry status and development trend);

China silicon carbide smelting and processing market (supply and demand, import and export, key companies and price trend);

China silicon carbide smelting and processing market (supply and demand, import and export, key companies and price trend);

China silicon carbide semiconductor industry (market size, industry chain (substrates, epitaxies, devices, etc.), key companies, etc.);

China silicon carbide semiconductor industry (market size, industry chain (substrates, epitaxies, devices, etc.), key companies, etc.);

15 Chinese silicon carbide smelting and processing companies and 12 silicon carbide semiconductor vendors (operation, revenue structure, silicon carbide business, etc.).

15 Chinese silicon carbide smelting and processing companies and 12 silicon carbide semiconductor vendors (operation, revenue structure, silicon carbide business, etc.).

1. Overview

1.1 Definition and Classification

1.2 Properties and Applications

1.3 Industry Chain

2. Development of Global Silicon Carbide Industry

2.1 Silicon Carbide Smelting and Processing

2.1.1 Market Situation

2.1. 2 Key Companies

2.2 Silicon Carbide Power Semiconductor

2.2.1 Overview

2.2.2 Market Situation

2.2.3 Silicon Carbide Substrate

2.2.4 Silicon Carbide Epitaxial Wafer

2.2.5 SiC Power Devices

2.2.6 Key Companies

3. Development of China Silicon Carbide Industry

3.1 Policies

3.2 Status Quo

3.3 Development Trend

4 China Silicon Carbide Smelting and Processing Market

4.1 Supply and Demand

4.1.1 Supply

4.1.2 Demand

4.1.3 Blade Grade Silicon Carbide

4.2 Import and Export

4.2.1 Export

4.2.2 Import

4.3 Price Trend

4.4 Corporate Competition

5 China Silicon Carbide Semiconductor Market

5.1 Market Situation

5.2 SiC Substrate

5.2.1 Status Quo

5.2.2 Key Companies

5.3 Silicon Carbide Epitaxial Wafer

5.4 Silicon Carbide Device

5.5 Application

6. Upstream and Downstream Sectors of China Silicon Carbide Industry

6.1 Upstream Sectors

6.1.1 Quartz Sand

6.1.2 Anthracite

6.1.3 Petroleum coke

6.2 Downstream Sectors

6.2.1 Abrasives

6.2.2 Refractories

6.2.3 Iron & Steel

6.2.4 Special Ceramics

6.2.5 LED

6.2.6 PV

6.2.7 New Energy Vehicles

6.2.8 Microwave Device

6.2.9 5G Communication Base Station

7 Key Chinese Silicon Carbide Smelting and Processing Companies

7.1 Henan Yicheng New Energy Co., Ltd.

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Gross Margin

7.1.5 R&D and Investment

7.1.6 Clients and Suppliers

7.1.7 Silicon Carbide Business

7.1.8 Prediction and Outlook

7.2 Ningxia Orient Tantalum Industry Co., Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Gross Margin

7.2.5 Silicon Carbide Business

7.2.6 Development Strategy

7.3 JiangSu HaoBo New Materials Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.3.3 Revenue Structure

7.3.4 Gross Margin

7.3.5 Silicon Carbide Business

7.4 Pingluo Binhe Sic Co., Ltd.

7.4.1 Profile

7.4.2 Silicon Carbide Business

7.5 Lanzhou Heqiao Resource Co., Ltd.

7.5.1 Profile

7.5.2 Silicon Carbide Business

7.6 NingXia Tianjing Long Ding Silicon Carbide Co., Ltd.

7.6.1 Profile

7.6.2 Silicon Carbide Business

7.7 Tianzhu Zhengyu Silicon Carbide Co., Ltd.

7.7.1 Profile

7.7.2 Silicon Carbide Business

7.8 Ningxia Jinjing Metallurgicals & Minerals Industrial Co., Ltd.

7.8.1 Profile

7.8.2 Silicon Carbide Business

7.9 Tonghua Hongxin Abrasive Co., Ltd.

7.9.1 Profile

7.9.2 Silicon Carbide Business

7.10 Linshu Zhengyu Silicon Carbide Factory

7.10.1 Profile

7.10.2 Silicon Carbide Business

7.11 Jiangsu Leyuan New Materials Group Co., Ltd.

7.11.1 Profile

7.11.2 Silicon Carbide Business

7.12 Hanjiang Hongyuan Xiangyang Silicon Carbide Special Ceramics Co., Ltd.

7.12.1 Profile

7.12.2 Silicon Carbide Business

7.12.3 Development Advantages

7.13 Yili Master Carborundum Products Co., Ltd.

7.13.1 Profile

7.13.2 Silicon Carbide Business

7.14 Xinjiang Longhai Silicon Industry Development Co., Ltd.

7.14.1 Profile

7.14.2 Silicon Carbide Business

7.15 Shandong Jinmeng New Material Co., Ltd.

7.15.1 Profile

7.15.2 Silicon Carbide Business

8 Key Chinese Silicon Carbide Semiconductor Vendors

8.1 Beijing TanKeBlue Semiconductor Co., Ltd.

8.1.1 Profile

8.1.2 Operation

8.1.3 Revenue Structure

8.1.4 Gross Margin

8.1.5 Clients and Suppliers

8.1.6 R&D and Investment

8.1.7 Silicon Carbide Business

8.1.8 Development Strategy

8.2 SICC Science & Technology Co., Ltd.

8.2.1 Profile

8.2.2 Silicon Carbide Business

8.3 Hebei Synlight Crystal Co., Ltd.

8.3.1 Profile

8.3.2 Silicon Carbide Business

8.4 Beijing Century Goldray Semiconductor Co., Ltd.

8.4.1 Profile

8.4.2 Silicon Carbide Business

8.5 Yangzhou Yangjie Electronic Technology Co., Ltd.

8.5.1 Profile

8.5.2 Operation

8.5.3 Silicon Carbide Business

8.6 Global Power Technology (Beijing) Co., Ltd.

8.6.1 Profile

8.6.2 Silicon Carbide Business

8.7 EpiWorld International Co., Ltd.

8.7.1 Profile

8.7.2 Silicon Carbide Business

8.8 Semiconductor Business Unit of Zhuzhou CRRC Times Electric Co., Ltd.

8.8.1 Profile

8.8.2 Silicon Carbide Business

8.9 Dongguan Tianyu Semiconductor Technology Co., Ltd.

8.9.1 Profile

8.9.2 Silicon Carbide Business

8.10 Xiamen Xinguangrunze Technology Co., Ltd.

8.10.1 Profile

8.10.2 Silicon Carbide Business

8.11 Roshow Technology CO., Ltd.

8.11.1 Profile

8.11.2 Silicon Carbide Business

8.12 CISRI-Zhongke Energy Conservation and Technology Co., Ltd.

8.12.1 Profile

8.12.2 Silicon Carbide Business

SiC Industry Chain

Global Silicon Carbide Capacity, 2012-2019E

Structure of Downstream Demand for Silicon Carbide Worldwide, 2009-2019

Major SiC Smelting and Processing Enterprises Worldwide

Advantages of Third-generation SiC Semiconductor

Main Applications of SiC Power Devices

Policies on Supporting the Development of SiC Materials in Some Countries

Global SiC Power Semiconductor Market Size, 2015-2025E

Application Structure of Global SiC Semiconductor, 2016-2022E

Global SiC n-type Substrate Shipment and Output Value, 2016

Global SiC Epi-house & Epi-Service Suppliers

Classification of SiC Power Devices

Global Power Device Manufacturers

Major Companies in Global SiC Semiconductor Industry Chain

SiC MOSFET Roadmap of ST

Policies on Silicon Carbide Industry in China, 2011-2018

China’s SiC Capacity (by Product), 2015-2019E

China’s SiC Semiconductor Industry Chain

China’s Silicon Carbide Output by Type, 2011-2019E

China’s Silicon Carbide Output by Region, 2019

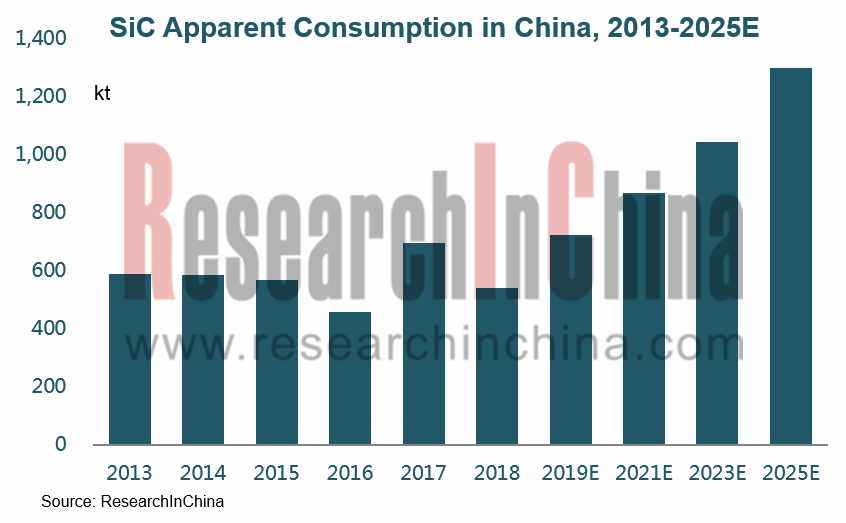

China’s SiC Apparent Consumption, 2013-2025E

China’s SiC Demand Structure (by Product), 2019

Comparison between Mortar Line Cutting and Diamond Wire Cutting

Penetration Rate of Diamond Wire Cutting in Photovoltaic Industry

Market Share of Major Electroplated Diamond Wire Manufacturers in China, 2016

China’s Export Volume and Value of Silicon Carbide, 2013-2019

China’s Import Volume and Value of Silicon Carbide, 2013-2019

China’s SiC Ex-factory Price (tax included), 2016-2019

Black SiC Price Trend in Ningxia, 2017-2019

Capacity of Major SiC Smelting and Processing Companies in China, 2019

Major Companies in Chinese SiC Industry Chain

China’s SiC Semiconductor Output Value (by Industrial Chain Link), 2019

International SiC Monocrystal Substrate Size and Share in Power Electronics, 2005-2020E

Competitive Landscape of Global SiC Wafer Market (including R&D Institutions), 2019

Development History of SiC Epitaxy

China’s Import Value and Export Value of Silica Sand and Quartz Sand, 2014-2019

Anthracite Price Trend in North China, 2016-2019

China’s Petroleum Coke Output, 2010-2019

Operating Rate of Petroleum Coke in China, 2017-2019

Price Trend of Petroleum Coke in China, 2016-2019

China’s Petroleum Coke Import Structure (by Country), 2019

Diagram of Silicon Wafer Cutting

China’s Output of Refractory Materials, 2010-2025E

China’s Output of Refractory Materials (by Type), 2010-2019

Application of SiC in Steel Industry

China’s Output of Crude Steel, 2010-2025E

China’s Output of Electric Furnace Steel and Proportion, 2013-2025

Top 10 Enterprises by Crude Steel Output in China, 2019

Ceramic Matrix Composite Industry Chain

Comparison between Three LED Chip Substrate Materials

SiC Substrate LED Chip

China’s LED Output Value (by Production Process), 2011-2025E

Market Share of LED Chip Vendors in Mainland China, 2016-2019

Cost Structure of LED Chip

China’s Cumulative PV Installed Capacity, 2009-2025E

China’s Output and Sales of NEVs (by Type), 2013-2019

Electric Vehicle Charging Pile Ownership and Pile-to-vehicle Ratio in China, 2015-2025E

Revenue and Net Income of Yicheng New Energy, 2011-2019

Revenue Breakdown of Yicheng New Energy by Business, 2016-2019

Revenue Breakdown of Yicheng New Energy by Region,2011-2019

Gross Margin of Yicheng New Energy,2011-2019

R&D Expenditure of Yicheng New Energy and % of Total Revenue, 2012-2019

Yicheng New Energy’s Procurement from Top5 Suppliers, 2015-2019

Yicheng New Energy’s Sales from Top5 Customers, 2015-2019

Output, Sales, and Inventory of Yicheng New Energy (by Product), 2013-2019

SiC Revenue and Gross Margin of Yicheng New Energy, 2013-2019

Revenue and Net Income of Yicheng New Energy’s Silicon Carbide-related Subsidiaries, 2019

Revenue and Net Income of Yicheng New Energy, 2017-2025E

Revenue and Net Income of Ningxia Orient Tantalum Industry,2011-2019

Revenue Breakdown of Ningxia Orient Tantalum Industry (by Business), 2012-2019

Revenue Breakdown of Ningxia Orient Tantalum Industry (by Region),2012-2019

Gross Margin of Ningxia Orient Tantalum Industry, 2012-2019

Revenue from and Gross Margin of Silicon Carbide Business of Ningxia Orient Tantalum Industry, 2012-2019

Specifications of Ningxia Orient Tantalum Industry’s Silicon Carbide Products

Development History of Haobo New Materials

Revenue and Net Income of Haobo New Materials, 2013-2019

Revenue Breakdown of Haobo New Materials (by Business), 2013-2019

Gross Margin of Haobo New Materials, 2013-2019

Development History of Lanzhou Heqiao Resource

Shareholding Structure of Lanzhou Heqiao Resource

Specifications of Lanzhou Heqiao Resource’s Black SiC Grit

Specifications of Lanzhou Heqiao Resource’s Black SiC Powder

Specifications of Lanzhou Heqiao Resource’s High-density Large-crystal Black Silicon Carbide

Lanzhou Heqiao Resource’s High-density Large-crystal Black Silicon Carbide

Specifications of Lanzhou Heqiao Resource’s Black SiC Sand

Major Economic Indices of NingXia Tianjing Long Ding, 2017-2019

Specifications of Ningxia Jinjing Metallurgicals & Minerals Industrial’s Black Silicon Carbide

Shareholding Structure of TonghuaHongxin Abrasive

Main Products of Jiangsu Leyuan New Materials Group

Revenue and Net Income of TankeBlue Semiconductor, 2014-2019

Revenue Breakdown of TankeBlue Semiconductor by Product, 2014-2019

Revenue Breakdown of TankeBlue Semiconductor (by Region), 2014-2019

Gross Margin of TankeBlue Semiconductor, 2014-2019

TankeBlue Semiconductor’s Sales from Top5 Customers, 2014-2019

TankeBlue Semiconductor’s Procurement from Top5 Suppliers, 2014-2019

TankeBlue Semiconductor’s R&D Expenditure, 2014-2016

TankeBlue Semiconductor’s 6-inch Conductive SiC Crystal

TankeBlue Semiconductor’s 2 to 4-inch Conductive SiC Wafers

TankeBlue Semiconductor’s X-inch Semi-insulating SiC Crystal

TankeBlue Semiconductor’s 2 to 4-inch Semi-insulating SiC Wafers

TankeBlue Semiconductor’s 2-inch SiC Wafer Standards

TankeBlue Semiconductor’s 3-inch SiC Wafer Standards

TankeBlue Semiconductor’s 4-inch SiC Wafer Standards

TankeBlue Semiconductor’s 6-inch SiC Wafer Standards

TankeBlue Semiconductor’s Dummy Grade SiC Wafer Standards

Shareholding Structure of SICC Materials

Foreign Sales Network of SICC Materials

Domestic Sales Network of SICC Materials

Specifications of SICC Materials’ N-type 2-inch Substrate

Specifications of SICC Materials’ N-type 3-inch Substrate

Specifications of SICC Materials’ N-type 4-inch Substrate

4-inch SiC Products and Performance of Hebei Synlight Crystal

6-inch SiC Products and Performance of Hebei Synlight Crystal

Development History of Beijing Century Goldray Semiconductor

SiC-related Products and Applications of Beijing Century Goldray Semiconductor

Development History of Yangzhou Yangjie Electronic Technology

Revenue of Yangzhou Yangjie Electronic Technology (by Product), 2013-2019

Development History of Xiamen XinGuangRunZe Technology

Products of Xiamen XinGuangRunZe Technology

Global and China Photoresist Industry Report, 2021-2026

Since its invention in 1959, photoresist has been the most crucial process material for the semiconductor industry. Photoresist was improved as a key material used in the manufacturing process of prin...

Global and China Needle Coke Industry Report, 2021-2026

Needle coke is an important carbon material, featuring a low thermal expansion coefficient, a low electrical resistivity, and strong thermal shock resistance and oxidation resistance. It is suitable f...

Global and China 3D Glass Industry Report, 2021-2026

3D curved glass is light and thin, transparent and clean, anti-fingerprint, anti-glare, hard and scratch-resistant, and performs well in weather resistance. It is applicable to terminals such as high-...

Global and China Graphene Industry Report, 2020-2026

Graphene, a kind of 2D carbon nanomaterial, features excellent properties such as mechanical property and super electrical conductivity and thermal conductivity. Its downstream application ranges from...

Global and China 3D Glass Industry Report, 2020-2026

Global 3D glass market has been enlarging over the recent years amid demetallization of smartphone back covers and popularity of smart wearables, to approximately $2.86 billion in 2019 and to an estim...

Global and China Photoresist Industry Report, 2020-2026

In 2019, global photoresist market was valued at $8.3 billion, growing at a compound annual rate of 5.1% or so since 2010, and it will outnumber $12.7 billion in 2026 with advances in electronic techn...

Global and China Synthetic Diamond Industry Report, 2020-2026

While its mechanical property is given full play in fields like grinding and cutting, diamond with acoustic, optical, magnetic, thermal and other special properties, as superconducting material, intel...

Global and China Needle Coke Industry Report, 2020-2026

With the merits like small resistivity, excellent resistance to impact and good anti-oxidation property, needle coke has been widely used in ultra-high power graphite electrodes, nuclear reactor decel...

Global and China Optical Fiber Preform Industry Report, 2019-2025

Optical fiber preform, playing an important role in the optical fiber and cable industry chain, seizes about 70% profits of optical fiber. Global demand for optical fiber preform stood at 16.2kt in 20...

China Silicon Carbide Industry Report, 2019-2025

Silicon carbide (SiC) is the most mature and the most widely used among third-generation wide band gap semiconductor materials. Over the past two years, global SiC market capacity, however, hovered ar...

Global and China Photoresist Industry Report, 2019-2025

Photoresist, a sort of material indispensable to PCB, flat panel display, optoelectronic devices, among others, keeps expanding in market size amid the robust demand from downstream sectors. In 2018, ...

Global and China Graphene Industry Report, 2019-2025

Graphene is featured with excellent performance and enjoys a rosy prospect. The global graphene market was worth more than $100 million in 2018, with an anticipated CAGR of virtually 45% between 2019 ...

Global and China 3D Glass Industry Chain Report, 2019-2025

The evolution of AMOLED conduces to the steady development of 3D curved glass market. In 2018, the global 3D glass market expanded 37.7% on an annualized basis and reached $1.9 billion, a figure proje...

China Wood Flooring Industry Report, 2019-2025

With the better standard of living and the people’s desire for an elegant life, wood flooring sees a rising share in the flooring industry of China, up from 33.9% in 2009 to 38.9% in 2018, just behind...

Global and China Photovoltaic Glass Industry Report, 2019-2025

In China, PV installed capacity has ramped up since the issuance of photovoltaic (PV) subsidy policies, reaching 53GW in 2017, or over 50% of global total. However, the domestic PV demand was hit by t...

Global and China ITO Targets Industry Chain Report, 2019-2025

Featured by good electrical conductivity and transparency, ITO targets are widely applied to fields of LCD, flat-panel display, plasma display, touch screen, electronic paper, OLED, solar cell, antist...

Global and China MO Source Industry Report, 2019-2025

MO source is a key raw material for metal-organic chemical vapor deposition (MOCVD) process. Global MO source output ranged at 102.6 tons in 2018, a rise of roughly 4.6% from a year earlier, a figure ...

Global and China Bi-Metal Band Saw Blade Industry Report, 2018-2023

Chinese manufacturing rebounded in the wake of a pick-up in infrastructure construction between 2016 and 2018, so did the bi-metal band saw blade as a key integral of metal processing industry. In 201...