Global and China RF Coaxial Cable Industry Report, 2019-2025

-

Aug.2019

- Hard Copy

- USD

$3,200

-

- Pages:154

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

ZLC087

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

Global market:

As the rapid application of 5G to areas from internet of things (IoT) to wireless communications across the world fuels demand for RF coaxial cables (especially for fine/ultrafine products), global RF coaxial cable market has been ballooning, being expectedly worth USD7,024 million in 2019, a year-on-year increase of 7.9%.

At present, global RF communication cable market features a relatively high concentration: players including Belden, Gore, Habia, Times, Nexans, Sumitomo and Hitachi, rule the roost. These multinational giants remain superior and fairly competitive in capital, technology, research and development and marketing, with quick response to market dynamics and technological updates.

Chinese market:

China as a key producer and consumer of RF coaxial cables, has already built the world’s biggest 4G network. As of June 2019, its mobile phone users had totaled 1.59 billion, including 1.23 billion 4G users, or 77.6% of the total. In the wake of IoT boom and growing demand for base stations, China’s mobile communication base stations have numbered 7.32 million, 4.45 million of which are 4G ones as a percentage of 60.8% in the total.

On June 6, 2019, the Ministry of Industry and Information Technology of China issued 5G business licenses to China Telecom, China Mobile, China Unicom and China Broadcasting Network, which marked that the country opened an era of commercial 5G.

With wide coverage of 4G and commercial use of 5G, the Chinese RF coaxial cable market has been on the rise, and is expected to be valued at RMB78.2 billion in 2019, an annualized upsurge of 10.3%. As 5G technology advances apace and other sectors like aerospace demand ever more, China’s coaxial cable market size is projected to show a CAGR of 8.4% between 2019 and 2025.

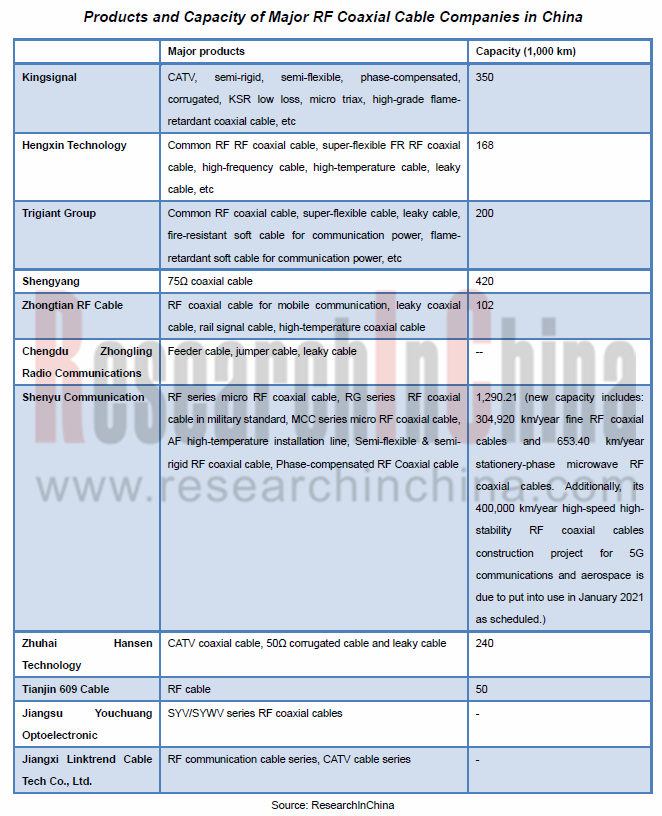

Key Chinese RF coaxial cable companies include: Kingsignal, Hengxin Technology, Trigiant Group, Zhejiang Shengyang Science and Technology, Zhongtian RF Cable, Chengdu Zhongling Radio Communications, Shenyu Communication and Zhuhai Hansen Technology. Among them, Shenyu Communication boasts the biggest capacity, 1,290,210 km a year.

Global and China RF Coaxial Cable Industry Report, 2019-2025 highlights the following:

Global and Chinese RF coaxial cable market (development status, market size, competitive pattern, etc.);

Global and Chinese RF coaxial cable market (development status, market size, competitive pattern, etc.);

RF coaxial cable market segments (market demand and competitive pattern);

RF coaxial cable market segments (market demand and competitive pattern);

RF coaxial cable downstream sectors;

RF coaxial cable downstream sectors;

9 foreign and 13 Chinese RF coaxial cable companies (operation, revenue structure, gross margin, R&D and investment, RF coaxial cable business, development strategy, etc.).

9 foreign and 13 Chinese RF coaxial cable companies (operation, revenue structure, gross margin, R&D and investment, RF coaxial cable business, development strategy, etc.).

1. RF Coaxial Cable

1.1 Definition and Classification

1.1.1 Definition

1.1.2 Classification

1.2 Industry Chain

2. RF Coaxial Cable Market

2.1 Global

2.1.1 Development Course

2.1.2 Demand

2.1.3 Market Size

2.1.4 Competitive Landscape

2.2 China

2.2.1 Development

2.2.2 Market Size

2.2.3 Demand

2.2.4 Competitive Landscape

2.2.5 Summary and Forecast

3. Market Segments

3.1 Semi-flexible Cable

3.1.1 Market Demand

3.1.2 Competitive Landscape

3.2 Low Loss Cable

3.2.1 Market Demand

3.2.2 Competitive Landscape

3.3 Corrugated Cable

3.3.1 Market Demand

3.3.2 Competitive Landscape

3.4 Phase-compensated Cable

3.4.1 Market Demand

3.4.2 Competitive Landscape

3.5 Micro Coaxial Cable

3.5.1 Market Demand

3.5.2 Competitive Landscape

3.6 Leaky Cable

4. Downstream Industry Development

4.1 Mobile Phone & Notebook PC Industry

4.2 Automobile Industry

4.3 Mobile Communication Industry

4.4 Aerospace & Military Industry

5. Major Global RF Coaxial Cable Companies

5.1 Belden

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Business in China

5.2 Gore

5.2.1 Profile

5.2.2 RF Coaxial Cable Business

5.3 Habia

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Business in China

5.4 Amphenol

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Business in China

5.4.5 Amphenol Times Microwave

5.5 Sumitomo

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Capital Investment

5.5.5 Business in China

5.6 Commscope

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Andrew

5.6.5 Development in China

5.7 NEXANS

5.7.1 Profile

5.7.2 Operation

5.7.3 Revenue Structure

5.7.4 Business in China

5.8 HUBER+SUHNER

5.8.1 Profile

5.8.2 Operation

5.8.3 Revenue Structure

5.8.4 Business in China

5.9 Hitachi Metals

5.9.1 Profile

5.9.2 Operation

5.9.3 Revenue Structure

5.9.4 Cable-related Business

5.9.5 Business in China

6. Major Chinese RF Coaxial Cable Companies

6.1 Kingsignal Technology

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 R&D and Investment

6.1.6 RF Coaxial Cable Business

6.1.7 Development Strategy

6.2 Jiangsu Hengxin Technology Co., Ltd

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 RF Coaxial Cable Business

6.2.6 Development Strategy

6.3 Trigiant Group

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Gross Margin

6.3.5 RF Coaxial Cable Business

6.3.6 Development Strategy

6.4 Zhejiang Shengyang Science and Technology Co., Ltd.

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 Gross Margin

6.4.5 R&D Investment

6.4.6 RF Coaxial Cable Business

6.4.7 Development Strategy

6.5 Zhongtian Radio Frequency Cable Co., Ltd.

6.5.1 Profile

6.5.2 Operation

6.5.3 Output and Sales Volume

6.6 Chengdu Zhongling Radio Communications Co., Ltd.

6.6.1 Profile

6.6.2 Operation

6.7 Zhuhai Hansen Technology Co., Ltd.

6.7.1 Profile

6.7.2 Development Course

6.8 Shenyu Communication Technology Inc.

6.8.1 Profile

6.8.2 Operation

6.8.3 Revenue Structure

6.8.4 Output & Sales Volume

6.8.5 R&D Investment

6.8.6 Development Strategy

6.9 Others

6.9.1 AcomeXintai Cables Co., Ltd.

6.9.2 Tianjin 609 Cable Co., Ltd.

6.9.3 Twinlink Communication Technology (Shenzhen) Co., Ltd.

6.9.4 Jiangsu Youchuang Optoelectronic Co., Ltd.

6.9.5 Jiangxi Linktrend Cable Tech Co., Ltd.

Structure of RF Coaxial Cable

Development Course of Global RF Coaxial Cable Industry

Downstream Development of Global RF Coaxial Cable

Global Market Size of RF Coaxial Cable, 2007-2019

Global RF Coaxial Cable Market Size, 2019-2025E

Global RF 75Ω Coaxial Cable Market Capacity, 2012-2019

Revenues of Key RF Coaxial Cable Companies Worldwide, 2013-2018

Number of Mobile Phone Base Stations in China, 2017-2019

Chinese RF Coaxial Cable Market Size, 2007-2019

Market Size of RF Coaxial Cable in China, 2019-2025E

Global Market Capacity of Semi-flexible Cable for Mobile Communications, 2007-2019

Market Capacity of Semi-flexible Cable for Mobile Communications in China, 2007-2019

Market Share of Major Semi-flexible Cable Companies in China, 2019

Global Low Loss Cable Market Capacity, 2007-2019

Chinese Low Loss Cable Market Capacity, 2007-2019

Market Share of Major Low Loss Cable Companies in China, 2019

Chinese Corrugated Cable Market Capacity, 2007-2019

Market Share of Major Corrugated Cable Companies in China, 2019

Global Phase-compensated Cable Market Capacity, 2007-2019

Chinese Phase-compensated Cable Market Capacity, 2007-2019

Market Share of Major Global Phase-compensated Cable Companies, 2019

Global Micro Coaxial Transmission Device Market Capacity, 2007-2019

Chinese Market Capacity of Micro Coaxial Cable for Mobile Communication Terminal, 2011-2019

Market Share of Major Micro Coaxial Cable Companies in China, 2019

Chinese Leaky Cable Market Capacity, 2011-2025E

China Smart Phone Shipments, 2009-2019

Global Notebook PC Shipments, 2012-2019

Output and Sales Volume of Automobile in China, 2012-2019

Number of Base Stations for Mobile Communication in China, 2016-2019

China Defense Budget, 2010-2019

Distribution of Belden’s Production Bases

Revenue and Net Income of Belden, 2009-2019

Gross Margin of Belden, 2015-2018

Belden’s Revenue in China and YoY Growth, 2011-2018

Global Layout of Habia

Development Course of Habia

Revenue Structure of Habia by Segment, 2018

Revenue Structure of Habia by Region, 2018

Global Layout of Amphenol

Revenue and Net Income of Amphenol, 2009-2019

Revenue of Amphenol by Product, 2014-2019

Revenue Structure of Amphenol by Product, 2011-2019

Revenue of Amphenol by Region, 2014-2019

Revenue Structure of Amphenol by Region, 2011-2019

Amphenol’s Revenue in China and YoY Growth, 2011-2019

Mid-term Management Plan of Sumitomo, 2022E

Number of Subsidiaries and Plants of Sumitomo by Region by the end of Mar. 2018

Net Sales and Net Income of Sumitomo, FY2010-FY2019

Net Sales of Sumitomo by Region, FY2012-FY2018

Net Sales Structure of Sumitomo by Region, FY2012-FY2018

Net Sales of Sumitomo by Segment, FY2012-FY2019

Net Sales Structure of Sumitomo by Segment, FY2012-FY2019

Revenue of Sumitomo Infocommunications by Product, FY2018-FY2019

Capital Investment of Sumitomo by Region and Segment, FY2015-FY2018

R&D expenditures of Sumitomo by Segment, FY2012-FY2019

Sumitomo’s Sales in China, FY2010-FY2017

Development Course of CommScope

Revenue and Net Income of CommScope, 2010-2019

Revenue Structure of CommScope by Segment, 2014-2019

Revenue of CommScope by Region, 2014-2018

Revenue Structure of CommScope by Region, 2014-2018

Staff Distribution of Nexans, end-2017

Original Business Segment of Nexans

New Business Segment of Nexans

Revenue and Net Income of Nexans, 2009-2019

Operating Results of NEXANS by Business, 2017-2019

Nexans’ Presence in China

Nexans’ Development Course in China

3D Diagram for Business Development of HUBER+SUHNER

Equity Structure of HUBER+SUHNER, 2017-2018

Global Presence of HUBER+SUHNER

Revenue and Net Income of HUBER+SUHNER, 2009-2018

Order Intake of HUBER+SUHNER, 2009-2018

Revenue Breakdown of HUBER+SUHNER by Product, 2013-2018

Revenue Structure of HUBER+SUHNER by Product, 2013-2018

Order Intake of HUBER+SUHNER by Product, 2013-2018

Order Intake Structure of HUBER+SUHNER by Product, 2013-2018

Revenue Breakdown of HUBER+SUHNER by Regions, 2017-2018

Main Subsidiaries of HUBER+SUHNER in China

Net Sales and Net Income of Hitachi Metals, FY2012-FY2018

Net Sales of Hitachi Metals by Segment, FY2014-FY2018

Net Sales Structure of Hitachi Metals by Segment, FY2014-FY2018

Net Sales of Hitachi Metals by Region, FY2014-FY2018

Net Sales Structure of Hitachi Metals by Region, FY2014-FY2018

Revenue of Cable-related Business of Hitachi Metals, FY2014-FY2018

Hitachi Metals’ Production Bases and Companies that Get Involved in Cable-related Business

Main Subsidiaries of Hitachi Metals in China

Hitachi Metal's Presence in China

Revenue and Net Income of Kingsignal, 2009-2019

Revenue Breakdown of Kingsignal by Product, 2014-2018

Revenue Structure of Kingsignal by Product, 2014-2018

Gross Margin of Kingsignal by Product, 2014-2018

R&D Input and % of Kingsignal, 2013-2018

Main RF Coaxial Cable Products of Kingsignal

Output and Sales Volume of Communication Cable and Optical Cable of Kingsignal, 2013-2018

Key Customers of Hengxin Technology

Revenue and Net Income of Hengxin Technology, 2009-2018

Revenue Structure of Hengxin Technology by Product, 2011-2018

Gross Margin of Hengxin Technology, 2011-2018

RF Coaxial Cable Revenue of Hengxin Technology, 2013-2018

Revenue and Net Income of Trigiant Group, 2011-2018

Revenue breakdown of Trigiant Group by Product, 2013-2018

Revenue Structure of Trigiant Group by Product, 2013-2018

Gross Margin of Trigiant Group, 2013-2018

Feeders Sales Volume of Trigiant Group, 2013-2018

Feeders Revenue of Trigiant Group, 2013-2018

Feeders Gross Margin of Trigiant Group, 2013-2018

Revenue and Nei Income of Shengyang Science and Technology, 2012-2019

Revenue, Operating Cost and Gross Margin of Shengyang Science and Technology by Product, 2018

Revenue of Shengyang Science and Technology by Region, 2015-2018

Revenue Structure of Shengyang Science and Technology by Region, 2015-2018

Gross Margin of Shengyang Science and Technology, 2014-2018

Gross Margin of Shengyang Science and Technology by Region, 2014-2018

R&D Investment of Shengyang Science and Technology, 2015-2018

Revenue of RF Coaxial Cable of Shengyang Science and Technology, 2015-2018

RF Coaxial Cable Output and Sales Volume of Shengyang Science and Technology, 2014-2018

Main RF Coaxial Cable Products of Zhongtian RF Cable

Revenue and Net Income of Zhongtian RF Cable, 2009-2018

Coaxial Cable Output and Sales Volume of Zhongtian RF Cable, 2012-2015

Revenue and Net Income of Zhongling Radio Communications, 2013-2018

Revenue and Net Income of Shenyu Communication, 2013-2019

RF Coaxial Cable Revenue of Shenyu Communication, 2015-2019

RF Coaxial Cable Output and Sales Volume of Shenyu Communication, 2013-2018

R&D Investment of Shenyu Communication, 2013-2019

Capacity of Shenyu Communication

Attenuation Rate of AcomeXintai Cables’ Hypercell Feeder Cable Series

Key Partners of Twinlink Communication Technology

Main RF Cable Products of Jiangsu Youchuang Optoelectronic

Revenue and Net Income of Jiangxi Linktrend Cable Tech, 2017-2018

Classification of RF Coaxial Cable

Major RF Coaxial Cable Companies Worldwide

Demand for RF Coaxial Cable from Downstream Industries

Comparison of RF Coaxial Cable Markets and Companies in China and Overseas Countries

Products and Capacity of Major RF Coaxial Cable Companies in China

Sales Volume of RF Coaxial Cable of Major RF Coaxial Cable Companies in China, 2013-2018

Revenue of Major RF Coaxial Cable Companies in China, 2013-2018

Net Income of Major RF Coaxial Cable Companies in China, 2013-2018

Global Mobile Phone Shipments, 2017-2019

Global Automobile Output, 2006-2019

Financial Goals of Belden, 2019-2022E

Revenue Structure of Belden by Segment, 2016-2019

Revenue Structure of Belden by Region, 2016-2018

Belden’s Subsidiaries in China

Coaxial and Microwave/RF Cable Products of Gore

Performance of Habia, 2014-2018

Major Subsidiaries of Amphenol in China

Business Presence of Sumitomo’s Subsidiaries in China

Progress of Kingsignal’s Fundraising Projects, 2018

Development Course of Zhuhai Hansen Technology

Classification of AcomeXintai Cables’ Hypercell Feeder Cables

Global and China RF Coaxial Cable Industry Report, 2019-2025

Global market:As the rapid application of 5G to areas from internet of things (IoT) to wireless communications across the world fuels demand for RF coaxial cables (especially for fine/ultrafine produc...

Global and China RF Coaxial Cable Industry Report, 2018-2022

Benefitted from fast development of downstream sectors, and constant increase of category and technology requirement of RF coaxial cable from high-end equipment, the market size of RF coaxial cable sw...

Global and China RF Coaxial Cable Industry Report, 2015-2018

RF coaxial cable, a general term for coaxial cables that transmit electrical signal or energy within radio frequency range, is mainly used in communications equipment, communications terminals, aerosp...

Global and China RF Coaxial Cable Industry Report, 2014-2017

Benefiting from a surge in mobile phone users and gradual replacement of 2G by 3G and 4G in developing countries, global RF coaxial cable market size has been growing, registering an average annual gr...

Global and China Mobile Phone (Cell Phone) Assembly Industry Report, 2012-2013

The report highlights: 1. Global Mobile Phone Market and Industry 2. China Mobile Phone Market and Industry 3. China Mobile Phone Export &...

Global and China Mobile (Cell) Phone Assembly Industry Report, 2011-2012

In 2011, the mobile phone output in China increased by 15.5% over 2010 to 1.172 billion sets, among which, the export volume rose by 13.9% over 2010 to 885 million sets, with the export value climbed ...

Latin America Telecommunication Market Report, 2010-2011

Latin America is a potential market with a population and GNP over 580 million and USD2.3 trillion respectively. Telecommunication industry has started reformation since 1980s and gradually realized p...