Global and China RF Coaxial Cable Industry Report, 2015-2018

-

Dec.2015

- Hard Copy

- USD

$2,400

-

- Pages:102

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

CYH043

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,500

-

- Hard Copy + Single User License

- USD

$2,600

-

RF coaxial cable, a general term for coaxial cables that transmit electrical signal or energy within radio frequency range, is mainly used in communications equipment, communications terminals, aerospace, and military electronics.

Driven by fast-growing mobile communications industry, global RF coaxial cable market size continues to expand, approximating USD4.71 billion in 2014, up 9.8% from a year ago, and is expected to reach USD5.14 billion in 2015.

The upgrading of mobile communications industry in China has paced up in recent years. The Ministry of Industry and Information Technology (MIIT) issued 3G license in 2010 and TD-LTE 4G license and FDD-LTE trial license at the end of 2013. FDD-LTE license was officially granted in Feb 2015. Buoyed by this, the Chinese RF coaxial cable market is expected to hit RMB52.18 billion in 2015, a year-on-year growth of 16.7%, higher than the global growth pace during the same period.

According to the plan of MIIT, by 2018 all cities and rural areas will be covered by 4G network and more than 80% of administrative village will gain access to optical fiber. By then China’s 4G users will total 460 million and the country’s RF coaxial cable market is expected to hit RMB85.4 billion.

CATV cable and semi-flexible cable are main RF coaxial cable products in China, accounting for 73.6% and 11.0% of the country’s total RF coaxial cable output in 2014, respectively. However, challenged by China Telecom’s IPTV and OTT, cable TV will be gradually replaced by digital TV, network TV, and mobile TV, and CATV cable market size will shrink year after year. Thanks to a rise in total quantity of antennas in 4G market, semi-flexible cable market size will grow rapidly and be expected to become one of mainstay RF coaxial cable products.

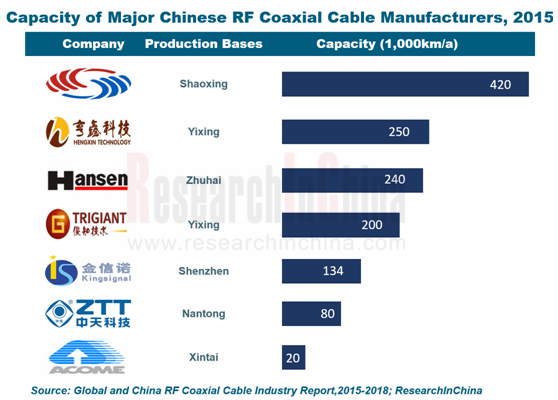

High-end products (low loss/phase-compensated/micro cable) market in RF coaxial cable industry in China is chiefly dominated by foreign players, while local Chinese companies operate mainly in mid- and low-end products (semi-flexible cable and corrugated cable) market. Large domestic Chinese producers include Hengxin Technology, Hansen Technology, Kingsignal Technology, Trigiant Group, Jiangsu Zhongtian Technology, Zhejiang Shengyang Science and Technology, etc.

Kingsignal Technology: China’s largest semi-flexible cable producer. The company sold 333,100km of RF coaxial cable in 2014, increasing by fourfold over the year-ago period. It extended its industry chain in 2015 by acquiring PC Specialties-China, L.L.C. and Dongguan HannStar Electronics.

Zhejiang Shengyang Science and Technology: a major producer of 75Ω RF coaxial cable in China with capacity of 420,000km/a. 80% of its revenue comes from overseas markets. The company is building the project of 50Ω RF coaxial cable for 3G and 4G mobile communications in 2015, and will see new capacity of 15,000km/a after the project goes into production.

Global and China RF Coaxial Cable Industry Report, 2015-2018 highlights the followings:

Global RF coaxial cable market size and development;

Global RF coaxial cable market size and development;

Chinese RF coaxial cable market size, market demand, product structure, competition among enterprises, etc.;

Chinese RF coaxial cable market size, market demand, product structure, competition among enterprises, etc.;

Development of market segments (semi-flexible cable, low loss cable, corrugated cable, phase-compensated cable, and leaky cable) in China;

Development of market segments (semi-flexible cable, low loss cable, corrugated cable, phase-compensated cable, and leaky cable) in China;

Operation and development in China of nine global RF coaxial cable companies;

Operation and development in China of nine global RF coaxial cable companies;

Operation and development strategy of nine Chinese RF coaxial cable companies.

Operation and development strategy of nine Chinese RF coaxial cable companies.

1 Industry Overview

1.1 Definition and Classification

1.1.1 Definition

1.1.2 Classification

1.2 Industry Chain

2 RF Coaxial Cable Market

2.1 Global

2.2 China

2.2.1 Market Overview

2.2.2 Market Size

2.2.3 Demand

2.2.4 Product Structure

2.2.5 Characteristics of Market Competition

3 Market Segments

3.1 Semi-flexible Cable

3.1.1 Market Demand

3.1.2 Competitive Landscape

3.2 Low Loss Cable

3.2.1 Market Demand

3.2.2 Competitive Landscape

3.3 Corrugated Cable

3.3.1 Market Demand

3.3.2 Competitive Landscape

3.4 Phase-compensated Cable

3.4.1 Market Demand

3.4.2 Competitive Landscape

3.5 Micro Coaxial Cable

3.5.1 Market Demand

3.5.2 Competitive Landscape

3.6 Leaky Cable

4 Major Global RF Coaxial Cable Companies

4.1 Belden

4.1.1 Profile

4.1.2 Operation

4.1.3 Revenue Structure

4.1.5 Business in China

4.2 Gore

4.3 Habia

4.3.1 Profile

4.3.2 Operation

4.3.3 Revenue Structure

4.3.4 Business in China

4.4 Amphenol

4.4.1 Profile

4.4.2 Operation

4.4.3 Revenue Structure

4.4.4 Business in China

4.4.5 Amphenol Times Microwave

4.5 Sumitomo

4.5.1 Profile

4.5.2 Operation

4.5.3 Revenue Structure

4.5.4 Business in China

4.6 CommScope

4.6.1 Profile

4.6.2 Operation

4.6.3 Revenue Structure

4.6.4 Andrew

4.7 Nexans

4.7.1 Profile

4.7.2 Operation

4.7.3 Revenue Structure

4.7.4 Business in China

4.8 HUBER+SUHNER

4.8.1 Profile

4.8.2 Operation

4.8.3 Revenue Structure

4.8.3 Business in China

4.9 Hitachi Metals

4.9.1 Profile

4.9.2 Operation

4.9.3 Revenue Structure

4.9.4 Cable-related Business

4.9.5 Business in China

5 Major Chinese RF Coaxial Cable Companies

5.1 Kingsignal Technology Co., Ltd.

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Customers and Suppliers

5.1.6 RF Coaxial Cable Business

5.1.7 Development Prospects

5.2 Jiangsu Hengxin Technology Co., Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Customers and Suppliers

5.2.6 RF Coaxial Cable Business

5.3 Trigiant Group

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 Customers and Suppliers

5.3.6 RF Coaxial Cable Business

5.4 Zhejiang Shengyang Science and Technology Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Gross Margin

5.4.5 Customers and Suppliers

5.4.6 RF Coaxial Cable Business

5.5 Zhongtian Hitachi RF Cable Co., Ltd.

5.5.1 Profile

5.5.2 Operation

5.5.3 RF Coaxial Cable Business

5.6 Chengdu Zhongling Radio Communications Co., Ltd.

5.6.1 Profile

5.6.2 Operation

5.7 Zhuhai Hansen Technology Co., Ltd.

5.7.1 Profile

5.7.2 Operation

5.8 Others

5.8.1 Acome Xintai Cables Co., Ltd.

5.8.2 Tianjin 609 Cable Co., Ltd.

6 Summary and Forecast

6.1 Summary

6.2 Forecast

Structure of RF Coaxial Cable

Classification of RF Coaxial Cable

Global RF Coaxial Cable Market Size, 2007-2015

Global RF 75Ω Coaxial Cable Market Capacity, 2012-2018E

Global Market Size of RF Coaxial Cable for 2G Network, 2006-2015

Global Market Size of RF Coaxial Cable for 3G Network, 2006-2015

India’s Demand for RF Coaxial Cable, 2006-2015

Brazil’s Demand for RF Coaxial Cable, 2006-2015

Russia’s Demand for RF Coaxial Cable, 2006-2015

Chinese RF Coaxial Cable Market Capacity, 2007-2015

RF Coaxial Cable Sales and Import & Export in China, 2011-2014

Output of and Demand for RF Coaxial Cable for Mobile Communications in China, 2011-2015

China’s Demand for RF Coaxial Cable for Mobile Phone and Notebook PC, 2007-2015

RF Coaxial Cable Output and Output Value in China by Product, 2014

Global Market Capacity of Semi-flexible Cable for Mobile Communications, 2007-2015

Market Capacity of Semi-flexible Cable for Mobile Communications in China, 2007-2015

Market Share of Major Semi-flexible Cable Companies in China, 2015

Capacity of Major Semi-flexible Cable Companies in China, 2015

Global Low Loss Cable Market Capacity, 2007-2015

Chinese Low Loss Cable Market Capacity, 2007-2015

Market Share of Major Low Loss Cable Companies in China, 2015

Chinese Corrugated Cable Market Capacity, 2007-2015

Market Share of Major Corrugated Cable Companies in China, 2015

Capacity of Major Corrugated Cable Companies in China, 2015

Global Phase-compensated Cable Market Capacity, 2007-2015

Chinese Phase-compensated Cable Market Capacity, 2007-2015

Market Share of Major Global Phase-compensated Cable Companies, 2015

Global Micro Coaxial Transmission Device Market Capacity, 2007-2015

Chinese Market Capacity of Micro Coaxial Cable for Mobile Communication Terminal, 2011-2015

Market Share of Major Micro Coaxial Cable Companies in China, 2015

Chinese Leaky Cable Market Capacity, 2011-2020E

Business Changes of Belden, 2005-2015

Five Business Solutions of Belden, 2015

Development of Belden’s Five Businesses, 2014

Revenue and Operating Profit of Belden, 2009-2015

Gross Margin of Belden, 2005-2014

Factories of Belden by Business/Region as of the End of 2014

Revenue Structure of Belden by Product, 2011-2015

Revenue and Gross Margin of Belden by Business, 2015Q3

Revenue Structure of Belden by Region, 2011-2014

Belden’s Revenue in China and YoY Growth, 2011-2014

Belden’s Subsidiaries in China

Coaxial and Microwave/RF Cable Products of Gore

Gore’s Organizations in China

Net Revenue and Net Income of Habia, 2009-2015

Operating Margin of Habia, 2009-2014

Cable Revenue Structure of Habia by Sector, 2013

Revenue Structure of Habia by Region, 2013

Net Revenue and Net Income of Amphenol, 2009-2015

Revenue Structure of Amphenol by Product, 2011-2015

Revenue Structure of Amphenol by Region, 2011-2014

Amphenol’s Revenue in China and YoY Growth, 2011-2014

Number of Subsidiaries and Plants of Sumitomo by Region by the end of Mar 2015

Development Planning of Sumitomo, 2017

Net Sales and Net Income of Sumitomo, FY2010-FY2015

Sumitomo’s Sales from Regions outside Japan and Proportion, FY2008-FY2015

Net Sales of Sumitomo by Business, FY2014

Sumitomo’s Sales from Automotive Business by Product, FY2013-FY2015

Sumitomo’s Sales from Infocommunications Business by Product, FY2013-FY2015

Sumitomo’s Sales from Electronics Business by Product, FY2013-FY2015

Sumitomo’s Sales from Environment and Energy Business by Product, FY2013-FY2015

Sumitomo’s Sales from Industrial Materials and Others Business by Product, FY2013-FY2015

Sales Structure of Sumitomo by Country/Region, FY2014

Sumitomo’s Sales in China, FY2011-FY2014

Business Presence of Sumitomo’s Subsidiaries in China

Development Course of CommScope

Operating Revenue Structure of CommScope by Business, 2012-2015

Wireless Solutions of CommScope, 2015

Revenue Structure of CommScope by Region, 2012-2014

Business of Nexans, 2014

Revenue and Net Income of Nexans, 2009-2015

Revenue Structure of Nexans by Business, 2013-2015

Revenue Breakdown of Nexans by Business, 2014

Revenue Structure of Nexans by Region, 2015

Nexans’ Presence in China

Nexans’ Development in China

Global Presence of HUBER+SUHNER, 2015

3D Diagram for Business Development of HUBER+SUHNER, 2015H1

Revenue and Net Income of HUBER+SUHNER, 2009-2015

Order Intake of HUBER+SUHNER, 2009-2014

Revenue Structure of HUBER+SUHNER by Product, 2013-2015

Order Intake Structure of HUBER+SUHNER by Product, 2013-2015

Revenue and YoY Growth of HUBER+SUHNER by Product, 2014-2015

Revenue Structure of HUBER+SUHNER by Market, 2014-2015

Revenue Breakdown of HUBER+SUHNER by Market, 2014-2015

Net Sales and Net Income of Hitachi Metals, FY2012-FY2015

Sales Structure of Hitachi Metals by Business, FY2014-FY2015

Sales Structure of Hitachi Metals in Different Regions by Business, FY2015

Cable-related Business of Hitachi Metals, 2015

Hitachi Metals’ Production Bases and Companies that Get Involved in Cable-related Business

Revenue and Net Income of Kingsignal, 2009-2015

Revenue Structure of Kingsignal by Region, 2009-2014

Operating Revenue Structure of Kingsignal by Product, 2009-2015

Gross Margin of Kingsignal by Product, 2009-2015

Kingsignal’s Procurement from Top5 Suppliers and % of Total Procurement, 2009-2015

Kingsignal’s Revenue from Top5 Customers and % of Total Revenue, 2008-2015

RF Coaxial Cable Sales Volume of Kingsignal, 2009-2014

Kingsignal’s Revenue from Main RF Coaxial Cable Products, 2009-2014

Revenue and Net Income of Kingsignal, 2014-2018E

Revenue and Net Income of Hengxin Technology, 2009-2015

Revenue Structure of Hengxin Technology by Product, 2009-2015

Revenue Structure of Hengxin Technology by Region, 2013-2015

Gross Margin and Net Profit Margin of Hengxin Technology, 2009-2015

Hengxin Technology’s Revenue Percentage from Top5 Customers, 2009-2014

Hengxin Technology’s Procurement Percentage from Top5 Suppliers, 2010-2014

RF Coaxial Cable Revenue of Hengxin Technology, 2013-2015

Revenue and Net Income of Trigiant Group, 2009-2015

Revenue Structure of Trigiant Group by Product, 2010-2015

Gross Margin of Trigiant Group by Product, 2010-2015

Trigiant Group’s Revenue Percentage from Top5 Customers, 2010-2014

Trigiant Group’s Procurement Percentage from Top5 Suppliers, 2010-2014

RF Coaxial Cable Sales Volume of Trigiant Group, 2009-2014

RF Coaxial Cable Capacity of Trigiant Group, 2009-2015

Revenue and Net Income of Shengyang Science and Technology, 2012-2015

Operating Revenue Structure of Shengyang Science and Technology by Product, 2012-2015

Operating Revenue Structure of Shengyang Science and Technology by Region, 2012-2015

Gross Margin of Shengyang Science and Technology by Product, 2012-2015

Shengyang Science and Technology’s Revenue from top 5 Customers and % of Total Revenue, 2012-2014

Shengyang Science and Technology’s Procurement from Top5 Suppliers and % of Total Procurement, 2012-2014

RF Coaxial Cable Output and Sales Volume and Sales/Output Ratio of Shengyang Science and Technology, 2012-2014

Revenue and Net Income of Zhongtian Hitachi RF Cable, 2009-2015

Output and Sales Volume of Zhongtian Hitachi RF Cable, 2012-2014

Gross Margin of Zhongtian Hitachi RF Cable, 2009-2015

Revenue and Net Income of Zhongling Radio Communications, 2013-2015

Capacity, Sales Volume, and Revenue of Major RF Coaxial Cable Producers in China, 2014-2015

Chinese RF Coaxial Cable Market Size, 2013-2018E

Global and China RF Coaxial Cable Industry Report, 2019-2025

Global market:As the rapid application of 5G to areas from internet of things (IoT) to wireless communications across the world fuels demand for RF coaxial cables (especially for fine/ultrafine produc...

Global and China RF Coaxial Cable Industry Report, 2018-2022

Benefitted from fast development of downstream sectors, and constant increase of category and technology requirement of RF coaxial cable from high-end equipment, the market size of RF coaxial cable sw...

Global and China RF Coaxial Cable Industry Report, 2015-2018

RF coaxial cable, a general term for coaxial cables that transmit electrical signal or energy within radio frequency range, is mainly used in communications equipment, communications terminals, aerosp...

Global and China RF Coaxial Cable Industry Report, 2014-2017

Benefiting from a surge in mobile phone users and gradual replacement of 2G by 3G and 4G in developing countries, global RF coaxial cable market size has been growing, registering an average annual gr...

Global and China Mobile Phone (Cell Phone) Assembly Industry Report, 2012-2013

The report highlights: 1. Global Mobile Phone Market and Industry 2. China Mobile Phone Market and Industry 3. China Mobile Phone Export &...

China Mobile Payment Industry Report, 2012-2014

Among the current mobile payment means, remote payment is widely used in China, while less than 6% of payments are realized through NFC (Near Field Communication) payment mode. Now, mobile payment tra...

China Optical Communication Industry Report, 2012-2014

The global optical fiber and cable market maintained stable growth in 2011, and the total demand in 2011 rose by 15% year on year to over 200 million core km. In 2012, the demand remained strong, with...

Global and China Mobile (Cell) Phone Assembly Industry Report, 2011-2012

In 2011, the mobile phone output in China increased by 15.5% over 2010 to 1.172 billion sets, among which, the export volume rose by 13.9% over 2010 to 885 million sets, with the export value climbed ...

China Mobile Communication Antenna Industry Report, 2011

At the end of 2010, mobile phone users amounted to 859 million and 3G subscribers totaled 47.1 million in China. In July 2011, mobile phone users jumped to 930 million, including 87.2 million 3G subsc...

Global and China RF Coaxial Cable Industry Report, 2010-2013

RF coaxial cable is widely applied in fields including mobile communication, broadcast and television, communication terminal and aerospace etc. With rapid development of downstream industries especia...

Latin America Telecommunication Market Report, 2010-2011

Latin America is a potential market with a population and GNP over 580 million and USD2.3 trillion respectively. Telecommunication industry has started reformation since 1980s and gradually realized p...

Africa Telecom Market Report, 2010-2011

Africa is poor and underdeveloped. Among the 48 least developed countries published by the United Nations in 2011, 33 are located in Africa, where the telecom investment accounts for only 2% of the to...

Global and China Mobile Phone and Tablet PC Processor Industry Report, 2010-2011

Mobile phone processor mainly covers baseband processor and application processor, while tablet PC processor mostly refers to GPU. The mobile phone processors are undergoing great changes and the orig...

China Optical Communication Industry Report, 2010-2011

The optical communication network construction in China has transferred to the extensive upgrading of access network since 2010, and the centralized procurement quantity of FTTx by three telecom opera...

Southeast Asia and Oceania Telecommunication Industry Report, 2010-2011

Singapore boasts the highest level of telecommunication development and the most comprehensive service coverage in Southeast Asia. Along with the in-depth application of 3G during the recent years, th...

China Local Independent Design House (IDH) Survey Report, 2010-2011

To find out the development status and trends of local independent design houses (IDH), Mobile Phone Journal and ResearchInChina implemented an IDH survey jointly in March 2011.Questionnaire:1. &...

Global and China Mobile Phone RF (Radio Frequency) Industry Report, 2010-2011

Mobile phone RF system consists mainly of transceiver, power amplifier (PA) and front-end module (FEM). The RF system of a general mobile phone is simply inclusive of a transceiver and a PA. FEM can b...

Global and China Mobile Phone Manufacture Industry Report, 2010-2011

The global mobile phone shipment increased substantially in 2010 by 20.8% to 1.425 billion after the recession in the previous year, which was mainly fueled by smart phones whose shipment climbed to 3...