Shared Mobility Industry Research--Autonomous Driving Leads Shared Mobility 3.0

The global shared mobility industry is experiencing a hard time. It is since 2019 that shared mobility enterprises have been exposed to financial fragility and have closed down one after another amid a nosedive in financing amount and rounds. The COVID-19 pandemic makes things worse. Shared mobility companies such as Uber and Lyft have cut jobs, while many automakers and Robotaxi companies have dabbled in the shared mobility market.

Tan Yi from GoFun believes that Shared Mobility 1.0 refers to the current public transit system, 2.0 means the new formats -- ride-hailing and timeshare rental occurring now, and 3.0 represents the application of autonomous driving in the future.

Shared mobility is closely related to autonomous driving. It is difficult for both of them to make money at this stage.

By 2030, the global Robotaxi fleet market will be worth at least US$2 trillion annually, 12% of new cars will be sold to Robotaxi fleets globally, and 26 million Robotaxis will be in operation, as estimated by UBS Evidence Lab.

To have a bite of the future shared mobility market, the giants have offered subsidies to squeeze small and medium-sized mobility firms. Only the full exertion of autonomous driving can make the shared mobility market scale up, but the current immature autonomous driving technology, regulations and business models makes the goal impossible.

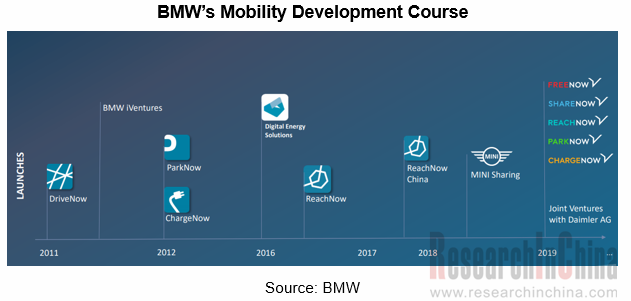

The shared mobility market is the battlefield of vibrant players who still need fight in alliance. WAYMO has tested Robotaxi for ten years. BMW has been groping for shared mobility business for almost a decade, but it eventually allied with Daimler to push on deeper cooperation on autonomous driving and shared mobility.

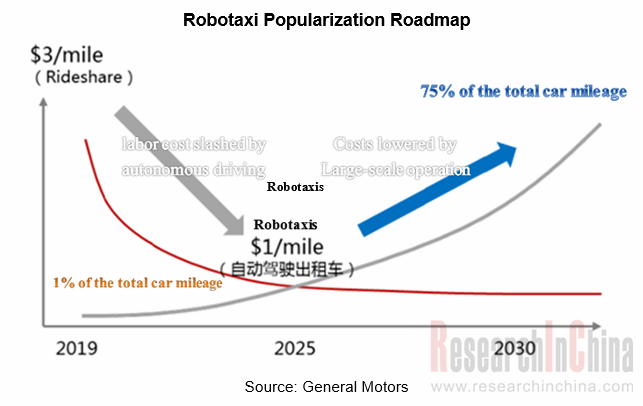

A study by General Motors shows that the cost of shared mobility will be slashed from $ 3 / mile to $1 / mile through autonomous driving by 2025, thereby diluting the operation cost through a large scale. After 2030, the mobility mileage of Robotaxis will constitute 75% of the total.

That is to say, autonomous driving will not give much impetus to shared mobility until 2025. From now on, it is a challenge for ambitious companies to make a layout in just five years. Looking back at the players’ Robotaxi trials in 2019, we can see that fiercer rivalry is under way.

Trial Operation of Robotaxi

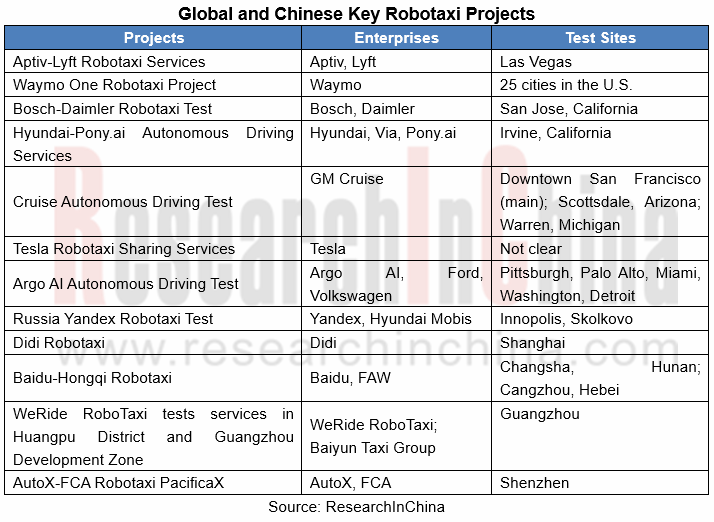

Three major forces are competing for the Robotaxi market, including:

(1) Didi, Uber, Lyft and other mobility platforms;

(2) Waymo, Aptiv, Baidu, Pony.ai and other Robotaxi solution providers;

(3) OEMs. Tesla plans to launch a Robotaxi network involving over a million Robotaxis on the road. Waymo has secured US$3 billion in financing for enlarging the Robotaxi test fleet. Baidu announced in April 2020 the availability of China's first Robotaxi services which are being offered on mobile apps to the public.

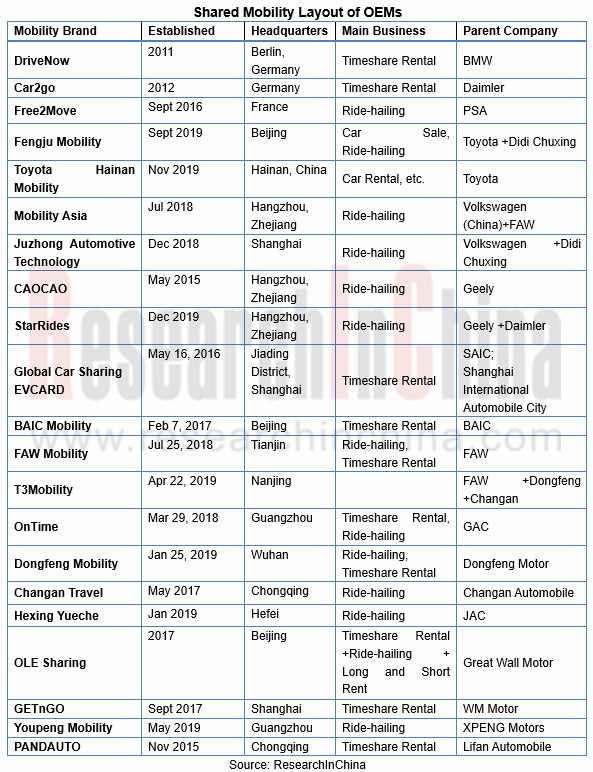

Although a few giants and top Robotaxi startups are making long-term plans, it is still too early for most automakers, most of which have launched their own mobility service brands successively and made attempts in the lucrative but fiercely contested mobility market.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...