Automotive OTA Research: 3.838 Million Passenger Cars Packed OTA Capability in China in 2019, Soaring by 60.6% Year on Year

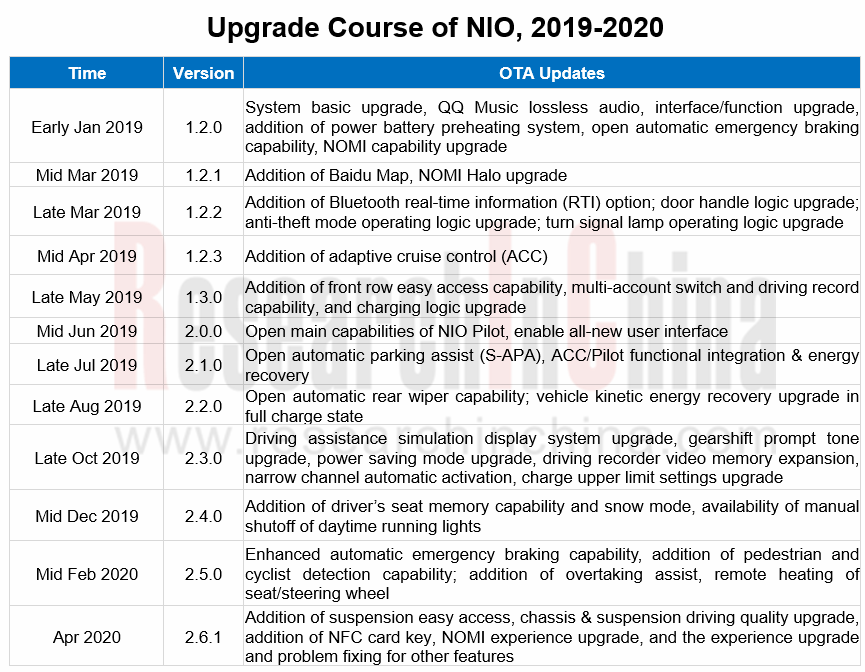

Against all odds, controversial Tesla and NIO were eventually out of the woods. What they live on is FOTA (Firmware-over-the-air). Upgrading software and hardware provides new experience for car owners, making them more satisfied and very loyal.

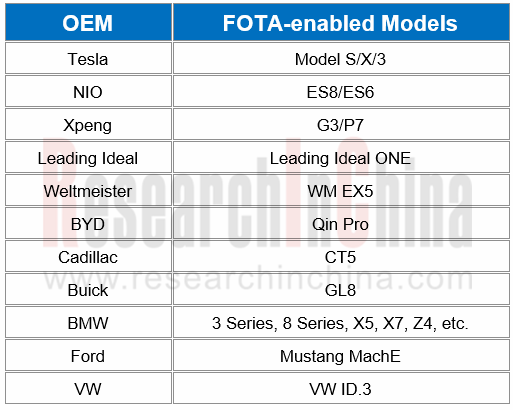

Even nowadays, few vehicle models enable FOTA, really a hard nut to crack.

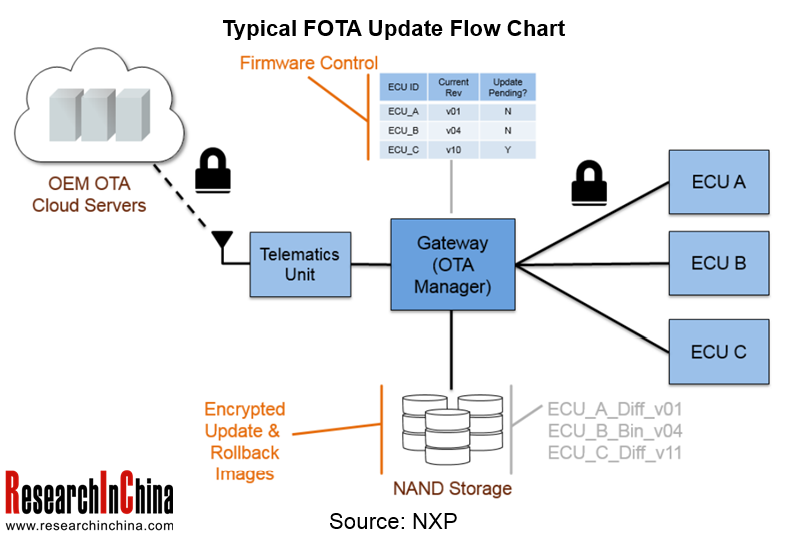

Considering safety and FOTA challenges, traditional automakers mostly choose to tap into vehicle system SOTA (Software-over-the-air) and act prudently in FOTA promotion. Through the lens of a typical FOTA flow, realizing FOTA needs E/E architecture disruption, and the support of new technologies like automotive Ethernet, cyber security, intelligent gateway, great computing power, and large memory.

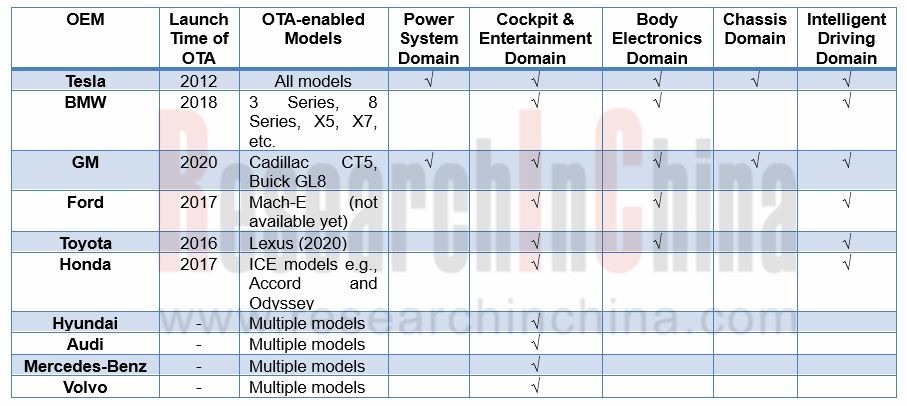

Conventional OEMs have made slow progress in FOTA development over the past several years. Yet they took a big step forward in 2019. It can be seen from the table below that there is a gap between main OEMs and Tesla. Success of Tesla Model 3 weighs so heavily on traditional automakers that they are highly endangered except sweating for rapid transformation.

VW is the most aggressive among OEMs, while its counterparts are also working hard. The race to roll out intelligent gateway chip in early 2020 is a reflection of OEM’s eager hoping to enable FOTA as early as possible just as Tesla has done.

Installation of SOTA easier to realize is soaring in both volume and rate. In 2019, 3.838 million passenger cars, or 19% of the total, were provided with SOTA, jumping by 60.6% compared with 2.39 million units, or 11.8% of the total in 2018, according to ResearchInChina.

Among typical OEMs, GM leads in OTA capability. Its new-generation electronic architecture enables FOTA updates on its ICE models, which means OTA is available to recalibrate or upgrade engine and transmission control modules, vehicle communication system, entertainment system, driving control and body control ECU at a later stage.

In 2020, Buick’s latest interconnection system, eConnect3.0 enables OTA updates of 9 major models such as OnStar module, IVI system, intelligent driving control module, body control module, and iBooster brake booster.

In 2020, the latest Cadillac CT5 model will pack GM’s new electronic architecture. CT5 allows OTA updates of more than 30 vehicle control modules including software modules (e.g., IVI and smart connectivity) and firmware electronic modules (e.g., powertrain, chassis and electrical control).

GM plans to apply its next-generation E/E architecture to most of its car lineups before 2023.

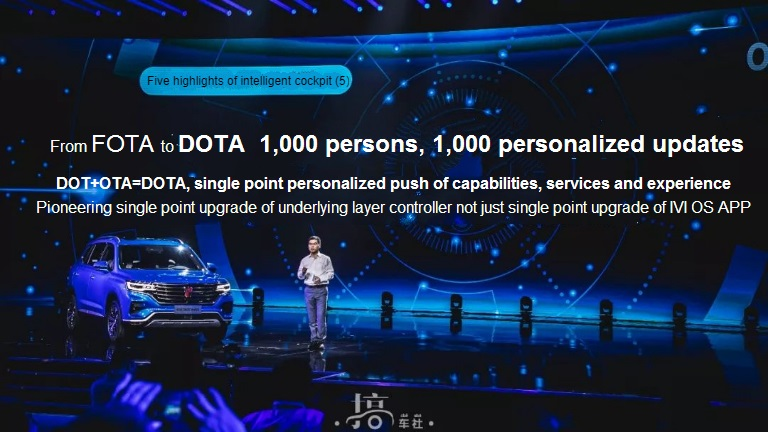

Chinese companies that excel in application layer innovation already make plenty of OTA micro-innovations. Examples include SAIC providing personalized OTA -- DOTA, and BYD and XPENG Motors both offering high temperature disinfection capability enabled by OTA updates.

In April 2020, BYD announced its new models like Tang added with “high temperature disinfection capability” enabled by OTA updates. This capability is not simple upgrade and introduction but involves a complete set of OTA-based working logic of multiple ECUs (e.g., multimedia, air-conditioner controller and PTC heater) in a safe way.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...