AUTOSAR Research Report: in the Era of Software Defined Vehicles (SDV), Will an OEM Acquire an AUTOSAR Software Firm?

Software defined vehicle (SDV) and architecture defined vehicle are hotly debated among insiders recently. Yet, the technical standard – AUTOSAR are essential for them.

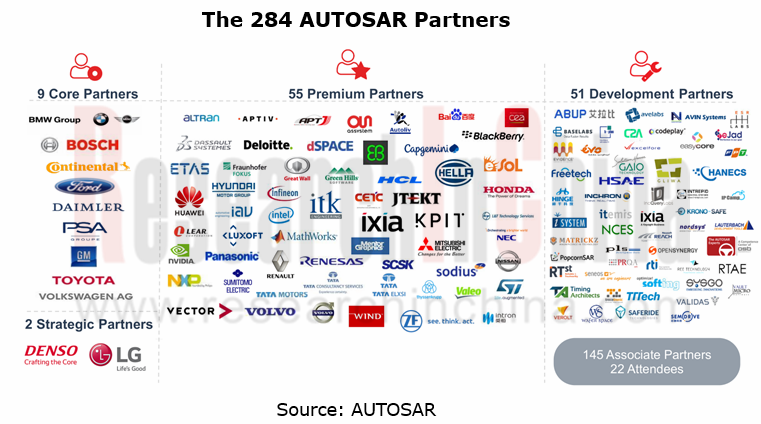

AUTomotive Open System ARchitecture (AUTOSAR) is a worldwide development partnership of vehicle manufacturers, suppliers, service providers and companies from the automotive electronics, semiconductor and software industry. Since 2003, they have been working on the development and introduction of several open, standardized software platforms for the automotive industry. The "Core Partners" of AUTOSAR are the BMW Group, Bosch, Continental, Daimler, Ford, General Motors, the PSA Group, Toyota and the Volkswagen Group.

As of May 2020, AUTOSAR has accommodated 284 members, including some Chinese companies, like Great Wall Motor, FAW, Dongfeng Motor, HiRain Technologies, iSoft Infrastructure Software, SAIC and Neusoft Reach.

It seems that not many Chinese companies are on the AUTOSAR member list. Nevertheless, the Automotive Software Ecosystem Member Organization of China (AUTOSEMO), founded in July 2020, involves 9 automakers (FAW, SAIC, GAC, NIO, Geely, Great Wall Motor, Dongfeng Motor, FAW Jiefang and Xiaopeng Motors) and 6 suppliers (Neusoft Reach, HiRain Technologies, Shanghai Nasn Automotive Electronics, Shenzhen VMAX Power, Shanghai Re-Fire Technology and Horizon Robotics). Based on AUTOSAR, AUTOSEMO is striving to develop basic software architecture standards and an industrial ecosystem that are led by Chinese companies. AUTOSEMO will temporarily not include the AUTOSAR’s application programming interface API standards (body, transmission, power, chassis, passive safety, HMI, multimedia and telematics) already under development in the business scope of its standard working groups. System software and testing standards of AUTOSEMO are consistent with AUTOSAR.

It can be seen that AUTOSEMO is basically compatible with AUTOSAR.

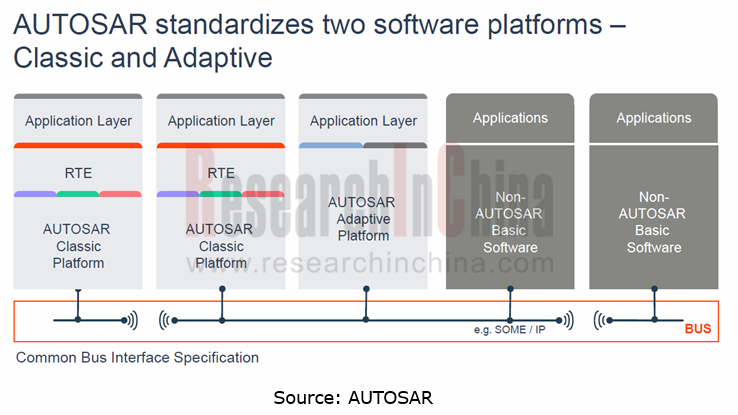

AUTOSAR standard aims to ensure standardization, reuse and interoperability of software. Currently, two complementary platforms, AUTOSAR Classic and AUTOSAR Adaptive (AP), have been introduced.

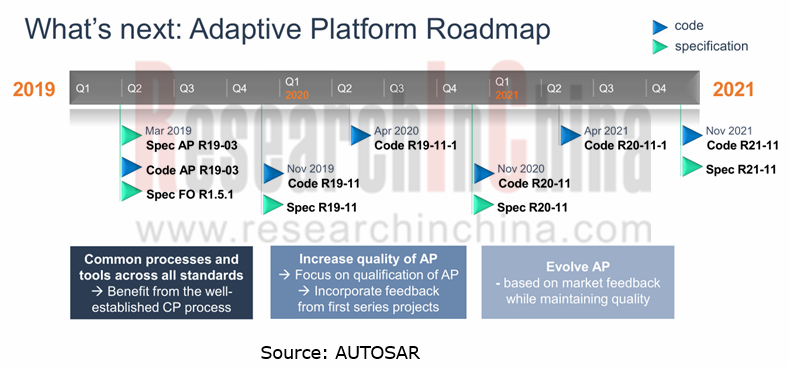

Thereof, AUTOSAR Adaptive Platform is launched to meet needs for developing new-generation autonomous, intelligent connected, electrified vehicles, with features of high flexibility, high performance, HPC support, dynamic communication, and management update. The latest version is R19-11 released in in November 2019.

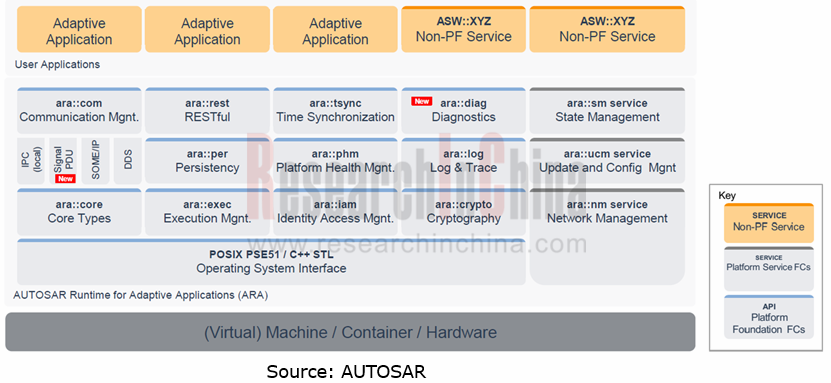

R19-11 is a layered architecture. It implements the AUTOSAR Runtime for Adaptive Applications (ARA) that consists of Foundation and Service, each of which is comprised of several modules with separate functions.

The Service is composed of three functional modules: State Management (SM), Network Management (NM) and Update & Configuration Management (UCM); the Foundation incorporates: Communication Management (COM), Cryptography (Crypto), Log & Trace (Log), Diagnostics (Diag), Persistency (Per), Execution Management (Exec), Time Synchronization (Tsync), etc.. In addition, for OS in the Foundation, the Adaptive Platform requires OS should be those subject to POSIX OS standards, e.g., Linux mcos and QNX.

The future version of AUTOSAR Adaptive Platform is expected to pack 23 new features up to multiple requirements such as better interaction between AUTOSAR Classic and AUTOSAR Adaptive, and upgrade of Security and Safety. According to the roadmap, AUTOSAR will offer a new software architecture version every year.

AUTOSAR Adaptive Platform supports all future vehicle APPs, e.g., IVI, V2X, multi-sensor fusion and autonomous driving. AUTOSAR is a standard option of next-generation automotive basic software architecture, for most automakers, components suppliers, software providers and other companies.

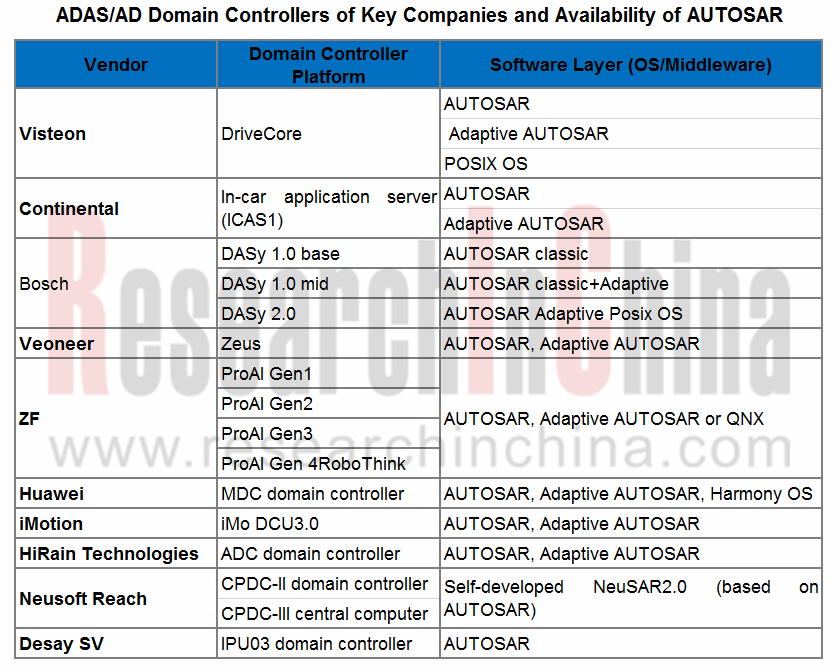

ADAS/AD is an applied field of AUTOSAR Adaptive. All autonomous driving domain controllers rolled out by Bosch, Visteon, Continental, Huawei and more, support AUTOSAR Adaptive.

Most of companies make partial use of AUTOSAR standard and few use in a full set, because AUTOSAR Adaptive came out late (the first version became available in 2017) and allows no mixed use of versions and AUTOSAR is complex and expensive with separate charge for every tool chain.

AUTOSAR has built a fairly complex technology system over a decade of development. Tool providers already develop support software to help OEMs accelerate application of AUTOSAR. Well-known AUTOSAR tool software developers include: WindRiver, EB, VECTOR, Mentor, ETAS, KPIT, Neusoft Reach, iSoft Infrastructure Software, HiRain Technologies, TaTa Elxsi and Autron. These AUTOSAR software firms also enrich product lines through mergers and acquisitions for greater competitive edges.

In 2014, Mentor Graphics announced to purchase the AUTOSAR assets, including the Mecel Picea AUTOSAR Development kit, from Mecel AB.

In September 2018, Vector acquired the Swedish embedded software specialist ARCCORE. This acquisition strengthens Vector’s portfolio of products and services in the field of AUTOSAR.

In the coming age of software defined vehicles, AUTOSAR software developers are playing an increasingly important role. It is hard for OEMs to build veteran teams shortly to develop automotive software due to lack of talent, even though they already set up their software firms or software departments in no time. Investing or purchasing AUTOSAR software firms may after all be an option.

In May 2020, Evergrande High Technology Group led the investment of tens of millions of yuan in a Series A funding round of Novauto (Beijing) Co., Ltd.. The “Basic Software Support Platform”, a product of the investee, carries the features: subject to ISO26262 ASIL D; support of AUTOSAR ADAPTIVE; compatibility with AUTOSAR Classic and ROS2; availability of middleware DDS for real-time data communication service; building of a unified, multi-QoS in-vehicle/V2V communication mechanism with high reliability, low latency and high scalability.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...