China Car Navigation Industry Report, 2012-2013

-

Mar.2013

- Hard Copy

- USD

$2,400

-

- Pages:115

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

YSJ065

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,600

-

In 2012, 3,852 models of passenger cars under 104 brands were on sale in the Chinese market, including 1,210 models equipped with navigation systems before launch, with the installation ratio of 31.41%, higher than the proportion in the previous two years (only 19.58% and 26.05% in 2010 and 2011 respectively).

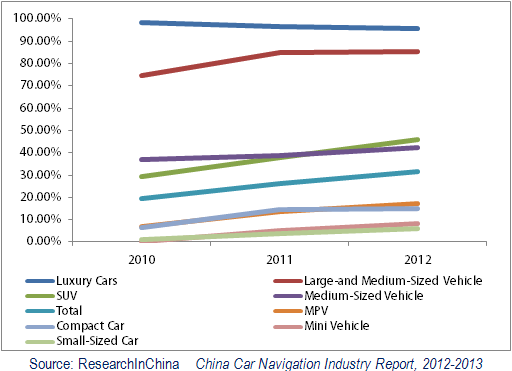

Compared with the previous two years, the installation proportion of car navigation systems in various models has been rising, especially mini cars saw a breakthrough with the installation ratio of 8.23%, while the ratio was 0 in 2010. In addition, the installation ratio of small cars, compact cars, mid-sized cars, MPV and SUV has ascended by varying degrees.

Installation Proportion of In-dash Navigation in Various Types of Automobiles in China, 2010-2012

?

In 2012, Chinese In-dash navigation market size reached 4.25 million units, with a year-on-year increase of about 8%. The PND market maintains the downward trend. In the future, with the rising installation ratio of In-dash navigation and the growing prevalence of smart phones, the PND market will further shrink.

In 2013, China started to promote BDS in large scale and BDS has been used in civil fields. Ministry of Transport of the People’s Republic of China requires 80% or more of large-sized buses, tourism coaches and dangerous goods transport vehicles in nine demonstration provinces and municipalities including Jiangsu, Anhui, Hebei, Shaanxi, Shandong, Hunan, Ningxia, Guizhou and Tianjin should be installed with BDS terminals before the end of March 2013. The demand for BDS terminals is expected to be 80,000 sets. With the expanding application scope of BDS, more and more car navigation manufacturers will commit to the research on BDS automotive terminals.

As one of the leading satellite navigation service providers, BDStar focuses on such businesses as satellite navigation and location information. With the civil application of BDS, BDStar has accelerated the expansion in the field of automotive electronics in recent years. Currently, BDStar has established production bases in Jiangsu, Shenzhen and Chongqing; at the same time, it has been perfecting the dealer network. It has conducted mass production of In-dash automotive and portable navigation terminals, with the annual capacity of over 100,000 sets. Along with the rising demand for BDS automotive terminals, BDStar will be the first beneficiary.

The traditional automotive navigation products of Huizhou Foryou Group, as one of the leading automotive navigation producers in China, are mainly based on GPS. With the application and development of BDS, the company has increased investments in R & D of Beidou products; besides, it has cooperated with OLinkStar to develop low-cost automotive GPS / Beidou dual-mode navigation systems. In February 2012, the company released an automotive GPS/Beidou dual-mode navigation system product.

The report highlights the followings:

?Chinese automotive navigation system industry chain and industry environments;

Installation, prices, models and series of Chinese automotive navigation systems;

The global automotive navigation system market size and structure;

Chinese automotive navigation system market size (including In-dash navigation systems and PND) and future trends;

Development of the world's leading automotive navigation system manufacturers;

Major Chinese automotive navigation system manufacturers and service providers.

1. Overview of Car Navigation System

1.1 Introduction

1.2 Industry Chain

1.2.1 Overview

1.2.2 Main Taches

2. Chinese Car Navigation System Market Environment

2.1 Development Environments

2.1.1 Satellite Industry

2.1.2 Map Industry

2.1.3 Automobile Industry

2.2 Installation of Car Navigation Systems in China

3. Status Quo of Car Navigation System Market

3.1 Evolution

3.2 Market Breakdown

3.3 Global Car Navigation System Market

3.3.1 Market Size

3.3.2 Market Structure

3.4 Chinese Car Navigation System Market

3.4.1 Characteristics

3.4.2 In-Dash Navigation System Market

3.4.3 PND Market

3.4.4 Smart Phone Market

3.4.5 Navigation Map Market

3.5 Development Trends of Car Navigation Systems in China

4. Survey on Installation of In-dash Car Navigation Systems in China by Brand Nationality

4.1 Japan

4.2 South Korea

4.3 Europe

4.4 America

4.5 China

5. Foreign Car Navigation System Enterprises

5.1 Harman

5.1.1 Profile

5.1.2 Operation

5.1.3 Operation in China

5.2 Denso

5.2.1 Profile

5.2.2 Operation

5.2.3 Car Navigation System Business

5.3 Alpine

5.3.1 Profile

5.3.2 Operation

5.3.3 Car Navigation System Business

5.3.4 Operation in China

5.4 Aisin

5.4.1 Profile

5.4.2 Operation

5.4.3 Car Navigation System Business

5.5 Clarion

5.5.1 Profile

5.5.2 Operation

5.5.3 Car Navigation System Business

5.6 Pioneer

5.6.1 Profile

5.6.2 Operation

5.6.3 Car Navigation System Business

5.6.4 Operation in China

5.7 Panasonic Automotive System

5.8 Blaupunkt

6. Chinese Car Navigation System Enterprises

6.1 Satellite Navigation Service Providers

6.1.1 Beijing Unistrong Science and Technology Co., Ltd.

6.1.2 Beijing BDstar Navigation Co., Ltd.

6.1.3 Chengdu Goldtel Electronic Technology Company Limited

6.1.4 China Spacesat Co., Ltd.

6.1.5 Hwa Create Corporation

6.1.6 Guangzhou Hi-target Navigation Tech Co., Ltd.

6.2 Automotive Navigation Equipment Manufacturers

6.2.1 Hangsheng Electronics (Shenzhen) Stock Co., Ltd.

6.2.2 Foryou Group Co,Ltd.

6.2.3 Guangdong Coagent Electronics S&T Co., Ltd

6.2.4 Shinco Electronics Group

6.2.5 Mio Technology Limited

6.2.6 Shenzhen Link-Create Technology Co., Ltd.

6.2.7 Wanlida Group Co., Ltd.

6.2.8 CHINAGPS Co., Ltd. (Shenzhen)

6.2.9 Zhonghengxunshi Technology Development Co., Ltd

6.2.10 Skypine Electronics (Shenzhen) Co., Ltd.

Car Navigation Industry Chain

Satellite Launch of BDS

BDS-related Enterprises in China

Navigation E-map Enterprises in China

Automobile Sales Volume in China, 2007-2016

Passenger Car Sales Volume in China, 2007-2016

Top 10 Best-selling Mini Car Models and Proportion of the Ones Equipped with Navigation Systems as Standard Configuration, 2012

Top 10 Best-selling Small-sized Car Models and Proportion of the Ones Equipped with Navigation Systems as Standard Configuration, 2012

Top 10 Best-selling Compact Vehicle Models and Proportion of the Ones Equipped with Navigation Systems as Standard Configuration, 2012

Top 10 Best-selling Midium-sized Vehicle Models and Proportion of the Ones Equipped with Navigation Systems as Standard Configuration, 2012

Top 5 Best-selling Medium and Large-sized Vehicle Models and Proportion of the Ones Equipped with Navigation Systems as Standard Configuration, 2012

Top 10 Best-selling SUV Models and Proportion of the Ones Equipped with Navigation Systems as Standard Configuration, 2012

Top 10 Best-selling MPV Models and Proportion of the Ones Equipped with Navigation Systems as Standard Configuration, 2012

Global Shipment of In-dash Automotive Navigation Systems, 2007-2015

Global In-dash Automotive Navigation System Market Size, 2007-2015

Global OE Automotive Navigation System Market Structure, 2012

Global Automotive Navigation System Aftermarket Structure, 2012

Automotive Navigation System Suppliers of Major Vehicle Models in the World

Sales Volume of In-dash Navigation Systems in China, 2005-2015

Installation Proportion of In-dash Navigation in Various Types of Automobiles in China, 2010-2012

Proportion of Automobiles Equipped with Navigation Systems as Standard Configuration in China by Price Range, 2012

PND Sales Volume and Growth Rate, 2005-2015

Chinese PND Market Structure

Global Smartphone Shipment, 2003-2012

Shipment Proportion of Top Five Smartphone Vendors in the World, 2011-2012

Smartphone Shipment Proportion of Major Countries, 2011-2012

Chinese Navigation Map Market Scale, 2009-2013

Revenue Sources of Navigation E-map in China, 2009-2013

Development Trends of GPS Mobile Phones, Automotive Navigation Systems and PND in China

Proportion of Automobiles Equipped with Navigation Systems as Standard Configuration in China, 2010-2012

Proportion of Automobiles (Japanese Brands) Equipped with Navigation Systems as Standard Configuration in China, 2010-2012

Prices of Automobiles (Japanese Brands) Equipped with Navigation Systems as Standard Configuration in China, 2012

Key Suppliers of Automotive Navigation Systems of Toyota, 2012

Key Suppliers of Automotive Navigation Systems of Honda, 2012

Key Suppliers of Automotive Navigation Systems of Nissan 2012

Proportion of Automobiles (South Korean Brands) Equipped with Navigation Systems as Standard Configuration in China, 2010-2012

Prices of Automobiles (South Korean Brands) Equipped with Navigation Systems as Standard Configuration in China, 2012

Key Suppliers of Automotive Navigation Systems of Hyundai Motor, 2012

Proportion of Automobiles (European Brands) Equipped with Navigation Systems as Standard Configuration in China, 2010-2012

Prices of Automobiles (European Brands) Equipped with Navigation Systems as Standard Configuration in China, 2012

Key Suppliers of Automotive Navigation Systems of Volkswagen, 2012

Key Suppliers of Automotive Navigation Systems of BMW, 2012

Key Suppliers of Automotive Navigation Systems of Benz, 2012

Proportion of Automobiles (American Brands) Equipped with Navigation Systems as Standard Configuration in China, 2010-2012

Prices of Automobiles (American Brands) Equipped with Navigation Systems as Standard Configuration in China, 2012

Key Suppliers of Automotive Navigation Systems of GM, 2012

Key Suppliers of Automotive Navigation Systems of Ford, 2012

Proportion of Automobiles (Chinese Brands) Equipped with Navigation Systems as Standard Configuration in China, 2010-2012

Prices of Automobiles (Chinese Brands) Equipped with Navigation Systems as Standard Configuration in China, 2012

Revenue and Operating Margin of Harman, FY2007-FY2012

Revenue of Harman by Business, FY2010-FY2012

Revenue of Harman by Business, FY2013H1

Gross Margin of Harman by Business, FY2010-FY2012

Revenue of Harman by Region, FY2006-FY2012

Customer Structure of Harman, FY2008-FY2012

Revenue of Harman in China, FY2009-FY2012

Net Sales and Net Income of Denso, FY2009-FY2013

Sales of Denso by Region, Q3, FY2012- 2013

Clients of Denso, FY2011-2012

Clients of Denso, Q3, FY2012- 2013

Sales of Denso by Division, FY2011-2012

Sales of Denso by Division, Q3, FY2012- 2013

Operating Revenue and Total Profit of DENSO TIANJIN ITS CO., LTD, 2008-2009

Revenue of Alpine, FY2008-FY2012

Revenue Breakdown of Alpine, FY2012

Net Income of Alpine, FY2008-FY2012

Number of Alpine’ Employees, FY2008-FY2012

Sales of Alpine in Automotive Navigation Business, FY2008-FY2012

Business Indicators of Alpine’s Production Bases in China, 2008-2009

Sales and Operating Margin of AISIN, FY2007-FY2013

Non-Toyota Client Structure of AISIN, FY2009-FY2011

Non-Toyota Client Structure of AISIN, FY2011-FY2012

Non-Toyota Client Structure of AISIN, Q1 FY2012/FY2013

Navigator Output of Aisin, FY2008-FY2013

Sales and Operating Margin of Clarion, FY2006-FY2013

Sales of Clarion by Region, FY2009-FY2012

Principle of Clarion’s Interactive Navigation System

GPS Production Bases of Clarion in China

Sales and Operating Margin of Pioneer, FY2006-FY2013

Sales of Pioneer’ by Division, FY2007-FY2012

Sales and Operating Margin of Pioneer's Automotive Electronics Division, FY2007-FY2012

Sales of Pioneer by Region, FY2012-FY2013

Capacity of Global Car Audio Production Bases of Pioneer

Subsidiaries of Pioneer in China

Major Clients of PAS

Revenue of PAS by Region, FY2012

Revenue of PAS by Product, FY2012

Main Business of Blaupunkt

Revenue and Gross Margin of Unistrong, 2007-2012

Revenue and Gross Margin of Unistrong by Business, 2011-2012

Industrial Bases and Service Network of BDStar

Revenue and Gross Margin of BDStar, 2007-2012

Revenue of BDStar and Gross Margin by Business, 2011-2012

Main Application Fields of BDStar, 2011-2012

Revenue and Gross Margin of Goldtel Electronic, 2007-2012

Revenue and Gross Margin of Goldtel Electronic by Business, 2011-2012

Revenue and Gross Margin of China Spacesat, 2007-2012

Revenue and Gross Margin of Hwa Create, 2007-2012

Revenue of Hwa Create and Gross Margin by Business, 2011-2012

Market Share of Chinese High-precision GNSS Enterprises

Revenue and Gross Margin of Hi-target Navigation, 2008-2012

Revenue and Gross Margin of Hi-target Navigation by Business, 2011-2012

Main Products of Hangsheng Electronics

Revenue of Hangsheng Electronics, 2004-2011

Major Product’s Sales Volume of Shenzhen Hangsheng, 2008-2010

Major Subsidiaries of Foryou Group

Automotive Navigation Products of Huizhou Foryou

R & D Staff of Huizhou Foryou

Major Automobile Models Equipped with Caska GPS

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...