Global and China Automotive Magnesium Alloy Industry Report, 2012-2015

-

May.2013

- Hard Copy

- USD

$1,900

-

- Pages:72

- Single User License

(PDF Unprintable)

- USD

$1,800

-

- Code:

LPJ024

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,800

-

- Hard Copy + Single User License

- USD

$2,100

-

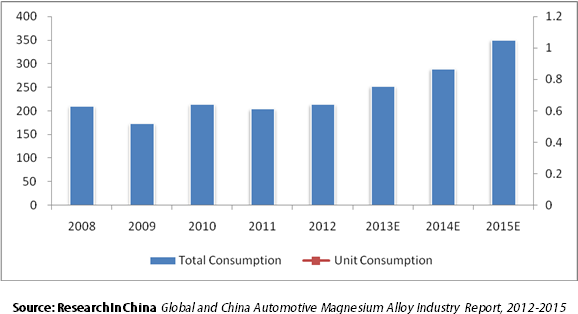

Global automotive magnesium alloy industry in recent years is getting out of the shadow of the financial crisis and magnesium price skyrocketing, both production and consumption have been restored. Favorable factors such as the rapid recovery of American and Japanese automobile industry, the upgrading of product structure of China’s automotive industry, international magnesium-aluminum price ratio back to less than 1.3, and the lightweight of vehicle all have provided impetus for the rebound of automotive magnesium alloy market. In 2012, the global automotive magnesium alloy consumption reached 214,000 tons, a year-on-year increase of 4.9%. During this period, China with rich magnesium resources and a huge automotive industry has become a hot spot for investments in the industry.

Global Automotive Magnesium Alloy Consumption, 2008-2015E (Unit: kt)

After 2008, affected by the increased tax rate of magnesium alloy exports as well as the rapid development of automobile industry, China’s automotive magnesium alloy industry showed contrarian growth against the financial crisis worldwide, thus changing the previous situation that domestic magnesium alloy auto parts mainly relied on imports. In 2012 China’s capacity of magnesium alloy auto parts reached 47,000 tons/a, and the demand over the corresponding period was 45,000 tons, a basic balance between supply and demand. However, as a great number of automotive magnesium alloy producers in China are the new entrants with weak technical reserves and products concentrated in the middle and low ends, high-end automotive magnesium alloys still depend on imports.

In nowadays China, joint venture branded vehicles occupy the main medium- and high-end market, which is precisely the most important consumer market for automotive magnesium alloy. These automakers are extremely concerned about the supply quality and stability of automotive magnesium alloy, which is also the basic literacy that some new manufacturers lack. For these reasons, magnesium alloy parts used in joint venture branded vehicles are often provided by regular suppliers, which increasingly becomes an obstacle to the development of new entrants. Moreover, products of Chinese firms are mostly concentrated in magnesium alloy wheel, steering wheel and other several products, with relatively single variety and narrow coverage, which to some extent also limits their development.

In China, following the structural upgrade of automobile industry, a step-by-step increase in the proportion of medium- and high-end cars, the clearer trend of automotive lightweight, the gradually improved production technology of automotive magnesium alloy, coupled with the effect of cancelling magnesium alloy export duties in January 2013 by China Customs, the demand for automotive magnesium alloy is expected to achieve sustained growth in future.

In addition to a detailed analysis on the development status of the global and China automotive magnesium alloy industry, this report also highlights the automotive magnesium alloy business of five multinational companies i.e. Meridian, STOLFIG, TAKATA, Autoliv and GF as well as 21 domestic companies e.g. Nanjing Yunhai Special Metals Co., Ltd., DongGuan EONTEC Co., Ltd. and Shanghai Meridian Magnesium Products Co., Ltd..

In response to the financial crisis, Meridian as the global automotive magnesium alloy industry leader has implemented strategic adjustment in industrial distribution since 2009, which has significantly improved capacity in key areas. In 2011, Meridian expanded operations in the UK and raised the capacity of local factories twice that of 2010. In May, 2012, the production capacity of Meridian’s joint venture in Shanghai, China saw an increase of 20%; followed by another rise of 30% in early 2013.

Beijing Guangling Jinghua Science & Technology Co., Ltd. (also known as “Gonleer”) is one of the major automotive magnesium alloy manufacturers in China. By 2004, the company has completed the whole industry chain layout from the upstream minerals to the downstream smelting and processing. In 2013, its products have covered five major areas i.e. magnesium and magnesium alloys, sacrificial anode, mechanical parts, sections and magnesium sheet, with annual capacity up to 50,000 tons, becoming a supplier of magnesium alloy auto parts for Volkswagen, Hyundai, Ford and other well-known carmakers.

Relying on its rich resources of magnesium and magnesium alloys, Nanjing Yunhai Special Metals Co., Ltd. has also achieved comprehensive coverage of the whole industry chain over the past few years. As a key supplier of magnesium alloy auto parts for Chery Automobile, the company reaches capacity of 3,000 tons/a automotive magnesium alloy in 2013.

1 Overview of Automotive Magnesium Alloy

1.1 Profile

1.2 Classification and Application

1.3 Industry Chain

2 Development of Global Automotive Magnesium Alloy Industry

2.1 Development Course

2.2 Production

2.3 Demand

2.3.1 Consumption

2.3.2 Main Customers

2.4 Market Competition

2.5 United States

2.5.1 Development Environment

2.5.2 Market Status

2.6 Europe

2.6.1 Development Environment

2.6.2 Market Status

2.7 Japan

2.7.1 Development Environment

2.7.2 Market Status

Summary

3 Development of China Automotive Magnesium Alloy Industry

3.1 Development Course

3.2 Development Environment

3.2.1 Policy Environment

3.2.2 Industry Environment

3.3 Production

3.4 Demand

3.5 Market Competition

3.6 Key Projects Planned and Under Construction

3.7 Problems

Summary

4 Key Companies Worldwide

4.1 Meridian

4.1.1 Profile

4.1.2 Automotive Magnesium Alloy Business

4.2 STOLFIG

4.2.1 Profile

4.2.2 Automotive Magnesium Alloy Business

4.3 TAKATA

4.3.1 Profile

4.3.2 Operation

4.3.3 Automotive Magnesium Alloy Business

4.4 Autoliv

4.4.1 Profile

4.4.2 Operation

4.5 GF

4.5.1 Profile

4.5.2 Automotive Magnesium Alloy Business

Summary

5 Key Companies in China

5.1 Nanjing Yunhai Special Metals Co., Ltd.

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Automotive Magnesium Alloy Business

5.2 DongGuan Eontec Co., Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Production and Marketing

5.2.4 Key Projects

5.2.5 Automotive Magnesium Alloy Business

5.3 Shanghai Meridian Magnesium Products Co., Ltd.

5.3.1 Profile

5.3.2 Automotive Magnesium Alloy Business

5.4 Qingcoo Technology

5.4.1 Profile

5.4.2 Automotive Magnesium Alloy Business

5.5 Chongqing Magnesium Science and Technology Co.,Ltd

5.5.1 Profile

5.5.2 Automotive Magnesium Alloy Business

5.6 Faw Foundry Co.,Ltd

5.6.1 Profile

5.6.2 Automotive Magnesium Alloy Business

5.7 DY Group

5.7.1 Profile

5.7.2 Key Projects

5.7.3 Automotive Magnesium Alloy Business

5.8 Yinguang Magnesium Group

5.8.1 Profile

5.8.2 Capacity Expansion

5.8.3 Automotive Magnesium Alloy Business

5.9 Chongqing BoAo Mg-Al Manufacture Co.,Ltd

5.10 Yuyao Ruide Auto Parts Co., Ltd

5.11 Gonleer

5.11.1 Profile

5.11.2 Automotive Magnesium Alloy Business

5.12 Shenyang Jinbei Magnesium Auto-parts Co.,Ltd

5.13 Stolfig(Huaihua)

5.13.1 Profile

5.13.2 Automotive Magnesium Alloy Business

5.14 Huaying Magnesium Group

5.14.1 Profile

5.14.2 Key Projects

5.15 Ningxia Huameite Magnesium Alloy Manufacturing Co., Ltd.

5.15.1 Profile

5.15.2 Automotive Magnesium Alloy Projects

5.16 Chongqing Sun Magnesium Co.,Ltd

5.16.1 Profile

5.16.2 Automotive Magnesium Alloy Business

5.17 Jiangsu Yuantong Auto-parts Co.,Ltd

5.17.1 Profile

5.17.2 Automotive Magnesium Alloy Projects

5.18 Wuhu Magnesium Industrial Co., Ltd.

5.19 Others

5.19.1 Changzhou Precision Machinery Manufacturing Co., Ltd.

5.19.2 Weihai Wanfeng Magnesium Industry Science and Technology Development Co.,Ltd

5.19.3 Zhongshan Yuefumei Electrical Appliance Company Limited

Summary

Applications of Magnesium Alloy Auto Parts

Operational Performance of Typical Magnesium Alloy Auto Parts

Automotive Magnesium Alloy Industry Chain

Effects of Mass Reduction on 41 Kinds of Auto Parts by Adopting Magnesium Alloy Materials

Global Automotive Magnesium Alloy Output, 2008-2015E

Global Sedan/Commercial Vehicle/Car Production, 2008-2015E

Global Automotive Magnesium Alloy Consumption (Total vs. Per Vehicle), 2008-2015E

Application of Magnesium Alloy Parts in the World’s Major Car Brands, 2006-2012

Capacity and Products of the World’s Leading Automotive Magnesium Alloy Manufacturers, 2012

Automotive Material Structure in North America, 2020

Sedan / Commercial Vehicle / Car Production in the United States, 2008-2015E

Automotive Magnesium Alloy Consumption in the United States, 2008-2015E

Sedan / Commercial Vehicle / Car Production in Europe, 2008-2015E

Automotive Magnesium Alloy Consumption in Europe, 2008-2015E

Sedan / Commercial Vehicle / Car Production in Japan, 2008-2015E

Automotive Magnesium Alloy Consumption in Japan, 2008-2015E

Global Automotive Magnesium Alloy Production and Consumption, 2008-2015E

Policies on Automotive Magnesium Alloy Industry in China, 2007-2012

Primary Magnesium Production and Sales in China, 2008-2015E

Magnesium Alloy Production and Sales in China, 2008-2015E

China’s Magnesium Aluminum Spot Prices and Price Ratio, 2007-2013

China’s Automotive Magnesium Alloy Capacity, 2008-2015E

China’s Automotive Production by Type, 2008-2015E

China’s Automotive Magnesium Alloy Demand and Consumption per Vehicle, 2008-2015E

Capacity and Products of China’s Top 10 Automotive Magnesium Alloy Manufacturers, 2012

Client Distribution of China’s Top 10 Automotive Magnesium Alloy Manufacturers, 2012

Key Automotive Magnesium Alloy Projects Planned or Under Construction in China, 2013

China’s Automotive Magnesium Alloy Capacity and Demand, 2008-2015E

Capacity and Clients of Major Magnesium Alloy Auto Parts of Meridian, 2013

Production Bases and Corresponding Markets of Major Magnesium Alloy Auto Parts of Meridian, 2013

Major Clients of Magnesium Alloy Auto Parts Business of Meridian, 2013

Products and SOP Time of STOLFIG’s Production Bases

Magnesium Alloy Auto Parts Products and Clients of STOLFIG

Revenue and Net Income of TAKATA, FY2008-FY2015E

Sales and Profit of TAKATA by Region, FY2012

Revenue and Net Income of Autoliv, 2010-2015E

Revenue Breakdown of Autoliv by Region, 2012

Revenue Breakdown of Autoliv by Client, 2012

Output of Main Products of Autoliv, 2012

Production Bases and Capacity of Magnesium Alloy Auto Parts of GF

Capacity of the World’s Leading Automotive Magnesium Alloy Manufacturers, 2012

Revenue and Net Income of Nanjing Yunhai Special Metals, 2007-2015E

Revenue Structure of Nanjing Yunhai Special Metals by Product, 2010-2012

Gross Margin of Nanjing Yunhai Special Metals by Product, 2010-2012

Automotive Magnesium Alloy Capacity, Product Type and Clients of Nanjing Yunhai Special Metals, 2013

Revenue and Net Income of Dongguan Eontec, 2009-2016E

Revenue Structure of Dongguan Eontec, 2009-2012

Capacity, Output and Capacity Utilization of Products (by Product Weight), 2009-2016E

Output, Sales Volume and Sales-Output Ratio of Products (by Product Quantity), 2009-2011

Key Automotive Magnesium Alloy Projects of Dongguan Eontec

Revenue and Gross Margin of Magnesium Alloy Business of Dongguan Eontec, 2009-2012

Auto Parts Products and Clients of Shanghai Meridian Magnesium Products, 2013

Capacity of Qingoo Technology by Product, 2013

Magnesium Alloy Die Casting Project of Qingoo Technology, 2010-2011

Magnesium Alloy Auto Parts of Qingoo Technology

Automotive Magnesium Alloy Products of Chongqing Magnesium Science and Technology, 2013

Main Products and Capacity of Subordinate Units of Faw Foundry, 2013

Automotive Magnesium Alloy Products of Faw Foundry

Magnesium Alloy Deep-Processing Projects of DY Group

Capacity of Yinguang Magnesium Group by Product, 2013

Capacity of Magnesium Alloy Deep-Processing Products of Yinguang Magnesium Group, 2006-2015E

Automotive Magnesium Alloy Products of Yinguang Magnesium Group, 2013

Magnesium Alloy Auto Parts Products and Clients of Chongqing BoAo Mg-Al Manufacture, 2013

Automotive Magnesium Alloy Products of Yuyao Ruide Auto Parts

Organizational Structure of Gonleer

Capacity of Shenyang Jinbei Magnesium Auto-parts by Product, 2012

Automotive Magnesium Alloy Projects of Stolfig(Huaihua)

Sun Mountain Magnesium Alloy and Coal Chemical Recycling Economy Industrial Park Project of Huaying Group

Automobile Hub Project of Ningxia Huameite Magnesium Alloy Manufacturing

Capacity of Chongqing Sun Magnesium, 2012-2013

Magnesium Alloy Automobile Hub Project of Jiangsu Yuantong Auto-parts

Capacity of Magnesium Alloy Products of Wuhu Magnesium Industrial, 2013

Capacity, Products and Clients of Major Automotive Magnesium Alloy Manufacturers in China, 2012

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...