Global and China Automotive Finance Industry Report, 2013

-

Aug./2013

- Hard Copy

- USD

$2,300

-

- Pages:117

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

LMX038

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,400

-

- Hard Copy + Single User License

- USD

$2,500

-

China's automotive finance market is still in the early stage of development due to consumer attitude, risk management and control, etc. While the penetration of automotive finance has exceeded 80% in the United States, India and Brazil, 60% in Japan and Western Europe, and 40% in Russia, it only achieved 15% in China in 2012, indicating huge growth potential.

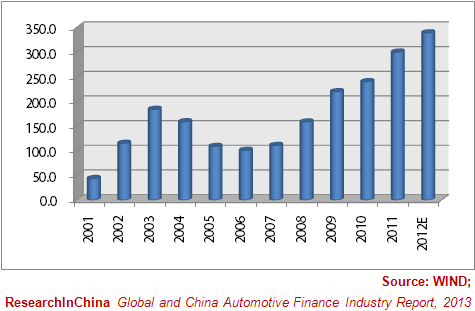

As the core business of automotive finance, retail financing broke a balance of RMB 300 billion in China in 2011, of which, RMB 136.7 billion (41%) was attributable to commercial banks. Affected by the automobile purchase control policy, the retail financing balance witnessed a growth slowdown in 2012, and only increased by 13% year on year to about RMB 339 billion.

Automotive Retail Financing Balance in China, 2001-2012 (Unit: RMB bn)

Besides the retail financing business, a mature automotive finance market shall include wholesale financing, car rental and leasing, and used car financing businesses. In 2012-2013, following the steps of Dongfeng Nissan and dealer groups, automotive finance companies, such as Mercedes-Benz Financial Services, Volkswagen Financial Services, Toyota Financial Services and BMW Financial Services, also plan to develop China’s automotive rental and leasing market.

Volkswagen Finance China Co., Ltd. is a wholly owned subsidiary of Volkswagen Financial Services AG in China. In 2012, Volkswagen Finance covered more than 240 cities in China, had over 1,350 cooperative dealers, and signed 149,168 contracts, up 91% year on year. In February, 2012, Volkswagen Financial Services established Volkswagen New Mobility Services Investment Co., Ltd. in China. In January 2013, Volkswagen New Mobility Services Investment Co., Ltd. announced the successful acquisition of Shanghai Zhenlang Transportation Equipment Leasing Co., Ltd. to carry out the automotive rental and leasing business.

Mercedes-Benz Financial is a subsidiary of Daimler Financial Services Group, and it has two business operations in China, namely, Mercedes-Benz Auto Finance Ltd. and Mercedes-Benz Leasing Co., Ltd. In 2011, Mercedes-Benz Financial covered nearly 400 cities and more than 200 dealers in China. In June 2012, Daimler Financial Services Group set up Mercedes-Benz Leasing Co., Ltd. in China to carry out rental and leasing business.

BMW Automotive Finance (China) Co., Ltd., established in 2010, is a joint venture of Germany's BMW AG (58%) and BMW Brilliance Automotive Ltd. (42%). As of August 2012, BMW Automotive Finance covered 233 of the 238 sales outlets in China, and the penetration of BMW Financial soared from the earliest 10% or so to 25%. BMW Automotive Finance mainly conducts the rental and leasing business in cooperation with automotive finance leasing companies.

Global and China Automotive Finance Industry Report, 2013-2016 of ResearchInChina analyzes the policy environment, development status, profit model, penetration and other industrial development indicators of the global and Chinese automotive finance markets, focuses on Chinese automotive finance market segments including wholesale financing, retail financing, rental and leasing, and used car financing, and sheds light on five major foreign automotive finance companies and 17 automotive finance companies in China.

Preface

1. Automotive Finance

1.1 Concept

1.1.1 Definition

1.1.2 Business

1.1.3 Products

1.2 Main Functions and Effects

1.3 Global Auto Finance Development

1.3.1 Development Status

1.3.2 Profit Models

2. Development Environment for China’s Automotive Finance Industry

2.1 Development of China Automobile Industry

2.2 China’s Automotive Finance System

2.2.1 Credit Service System

2.2.2 Laws and Regulations

2.2.3 Supervision

2.3 China’s Automotive Finance Policies

2.3.1 Auto Finance Policy

2.3.2 Auto Consuming Policy

2.4 Chinese Consumers' Purchasing Cars by Loans

2.4.1 Consumption Habits

2.4.2 Attitude

3. Development for China’s Auto Finance Industry

3.1 Development Course

3.2 Development Status

3.3 Auto Finance Penetration Rate

3.4 Profit Models

3.4.1 Bank-based Profit Model

4.4.2 Vendor-based Profit Model

3.4.3 Profit Model Based on Non-bank Financial Institutions

4. Segmented Market Analysis of China’s Automotive Finance Industry

4.1 Wholesale Financing

4.1.1 Wholesale Market

4.1.2 Business

4.1.3 Market Bodies

4.1.4 Future Outlook

4.2 Retail Financing

4.2.1 Market Size

4.2.2 Main Products

4.2.3 Future Outlook

4.3 Car Rental and Leasing

4.3.1 Development Status

4.3.2 Automotive Finance Companies Enter into Leasing Market

4.3.3 Market Participants

4.4 Used Car Financing

4.4.1 Transaction Volume of Used Car

4.4.2 Development Features of Used Car Market

4.4.3 Development Status of Used Car Financing Market

4.4.4 Future Outlook

5. Global Automotive Finance Companies

5.1 Volkswagen Financial Services AG

5.1.1 Profile

5.1.2 Development Course

5.1.3 Operation

5.2 Toyota Financial Services

5.2.1 Profile

5.2.2 Operation

5.3 BMW Financial Services

5.3.1 Profile

5.3.2 Operation

5.4 Mercedes-Benz Financial Services

5.4.1 Profile

5.4.2 Operation

5.5 Volvo Financial Services

5.5.1 Profile

5.5.2 Operation

6. Chinese Automotive Finance Companies

6.1 GMAC-SAIC

6.1.1 Profile

6.1.2 Business

7.1.3 Operation

6.1.4 Dealer Finance Business

6.1.5 Financing Channel

6.2 Volkswagen Finance China Company Limited

6.2.1 Profile

6.2.2 Development Course

6.2.3 Business

6.2.4 Development Plan

6.3 Toyota Auto Finance (China)

6.3.1 Profile

6.3.2 Business

6.3.3 Establishment of Auto Leasing Company

6.4 Ford Motor Credit Company (China)

6.4.1 Profile

6.4.2 Business

6.5 Mercedes-Benz Auto Finance (China)

6.5.1 Profile

6.5.2 Business

6.6 Dongfeng Peugeot Citroen Auto Finance Company

6.6.1 Profile

6.6.2 Equity Change

6.6.3 Business

6.7 Volvo Automotive Finance (China) Co., Ltd.

6.7.1 Profile

6.7.2 Business

6.7.3 Cooperation with Shandong Lingong Construction Machinery

6.8 Dongfeng Nissan Auto Finance Co., Ltd.

6.8.1 Profile

6.8.2 Development Course

6.8.3 Business

6.8.4 INFITI Finance

6.8.5 Operation

6.8.6 Marketing Model and Financing Channels

6.9 Fiat Auto Finance Co., Ltd.

6.9.1 Profile

6.9.2 Business

6.10 Chery Motor Finance Service Co., Ltd.

6.10.1 Profile

6.10.2 Business

6.10.3 Operation

6.11 GAC-SOFINCO Automobile Finance Co., Ltd.

6.11.1 Profile

6.11.2 Operation

6.12 BMW Automotive Finance (China) Co., Ltd.

6.12.1 Profile

6.12.2 Business

6.13 Sany Auto Finance Co., Ltd.

6.13.1 Profile

6.13.2 Development Course

6.13.3 Business

6.13.4 Financing Channels

6.13.5 Overseas Expansion

6.13.6 Development Plan

6.14 FAW Auto Finance Co., Ltd.

6.14.1 Profile

6.14.2 Business

6.15 Beijing Hyundai Auto Finance Co., Ltd.

6.15.1 Profile

6.15.2 Operation

6.16 Chongqing Auto Finance Co., Ltd.

6.17 Fortune Auto Finance Co., Ltd.

7. Future Development Trends of China's Automotive Finance

7.1 Automotive Industry Forecast

7.2 Auto Finance Penetration Rate Forecast

7.3 Development Trend of Auto Finance Industry

Classification of Automotive Finance Business

Automobile Finance Products

Profit Distribution in American Automobile Market

Introduction to Global Automotive Finance Companies

Automobile Output and Sales Volume in China, 2005-2013

Passenger Car Output and Sales Volume in China, 2005-2013

Automobile Finance Policies and Regulations in China, 2004-2012

Automobile Consumption Policies in China, 2009-2012

Intention of Loans to Buy Car for Chinese Consumers

Development Course of Chinese Automotive Finance Industry

Automotive Finance Penetration Rate for Foreign Automotive Finance Companies in China, 2012

TOP 10 Dealer Groups in Chinese Automobile Distribution Industry, 2012

Wholesale Financing Products and Corresponding Demand of Dealers in China

Major Finance Institutions Contrast in Chinese Auto Wholesale Financing Market

Stock Finance Product Based on Single Car Loan of Automotive Finance Companies

Responsibility and Benefits for Related Parties in Stock Finance Service of Joint Loan

Auto Dealers’ Finance Consumption

Auto Consumption Loan Balance in China, 2001-2012

Personal Automobile Consumption Loan of Commercial Banks in China, 2008-2011

Suppliers Contrasts of Automotive Consumption Finance Products in China

Market Shares of Automotive Consumption Credit in China, 2011

Market Shares Forecast of Automotive Retail Financing in China, 2015E

Classification of Automobile Leasing Companies in China

Automotive Operation Lease Companies in China

Financing Channels of Automotive Leasing of Hertz

Business Model of Auto Finance Lease Companies

Business Model of Leasing and Used Car Trading

Finance Lease Sample of Mercedes-Benz Auto Finance (China)

Trading Volume of Used Car and Its YoY Change in China, 2000-2012

Used Car Trading Flow in American Market

Managed Brands of Volkswagen Financial Services AG

Development Course of Volkswagen Financial Services AG

Main Operating Indicators of Volkswagen Financial Services AG, 2008-2012

Contracts Number of Volkswagen Financial Services AG by the end of 2012

Global Distribution of Toyota Financial Services

Organization Structure of Toyota Financial Services

Main Operating Indicators of TMCC, FY2009-FY2013

Products and Services of TMCC

Main Operating Indicators of BMW, 2008-2012

Retail Finance of Financial Services of BMW (by Region), 2012

Revenue Structure of BMW (by Segments), 2012-2013

EBIT-Margin of BMW, 2012-2013

Automotive Finance Business of Daimler AG

Main Operating Indicators of Automotive Finance of Daimler AG, 2010-2012

Revenue Structure of Daimler AG (by Segments), 2012-2013

EBIT Structure of Daimler AG (by Segments), 2012-2013

Main Operating Indicators of Volvo Group, 2008-2012

Revenue Structure of Volvo Group (by Segments), 2012

Net Sales and Operating Income of Volvo Group (by Segments), 2012-2013

Assets of Volvo Group, 2012-2013

Automotive Finance Companies in China

GMAC-SAIC’s Operation in 2012

Marketing Network of GMAC-SAIC

Automotive Loan Products of GMAC-SAIC

Main Operating Indicators of GMAC-SAIC, 2009-2012

Asset-liability Ratio, Capital Adequacy Ratio and NPL Ratio of GMAC-SAIC, 2011-2012

Wholesale Finance of GMAC-SAIC, 2012

Franchise Model of GMAC-SAIC

Financing Measures of GMAC-SAIC

Development Course of Volkswagen Finance China Company Limited

Management Brands of Volkswagen Finance China Company Limited

Automotive Loan Products of Volkswagen Finance China Company Limited

Automotive Loans Products of SKODA Finance

Automotive Loan Products of Toyota Auto Finance (China)

Finance Solution of LEXUS Finance

Automotive Loan Products of Ford Motor Credit Company (China)

Used Car Trade-in Flow of Ford Motor Credit Company (China)

Used Car Certification Flow of Ford Motor Credit Company (China)

Loan Sample of Mercedes-Benz Auto Finance (China)

Leasing Example of Mercedes-Benz Auto Finance (China)

Auto Insurance Program of Mercedes-Benz Auto Finance (China)

Auto Loan Process of Dongfeng Peugeot Citroen Auto Finance Company

Finance Service of Construction Equipments of Volvo Automotive Finance (China)

Shareholders Introduction of Dongfeng Nissan Auto Finance

Development Course of Dongfeng Nissan Auto Finance

Automotive Loan Products of Dongfeng Nissan Auto Finance

Automotive Loan Products of INFITI Finance

Main Operating Indicators of Dongfeng Nissan Auto Finance, 2012-2013

Auto Loan Products of Chery Motor Finance Service

Main Operating Indicators of GAC-SOFINCO Automobile Finance, 2012

Auto Loan Products of BMW Automotive Finance (China)

Development Course of Sany Auto Finance

Business Introduction of Sany Auto Finance

Overseas Companies of Sany Auto Finance

Automotive Loan Products of FAW Auto Finance

Main Operating Indicators of Beijing Hyundai Auto Finance, Q1 2013

Passenger Car Sales in China, 2013-2016

Automotive Finance Penetration Rate in China, 2013-2016

Ecological System of Auto Finance

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...