China New Energy Vehicle Drive Motor Industry Report, 2014

-

June 2014

- Hard Copy

- USD

$2,150

-

- Pages:85

- Single User License

(PDF Unprintable)

- USD

$1,950

-

- Code:

TT001

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,950

-

- Hard Copy + Single User License

- USD

$2,350

-

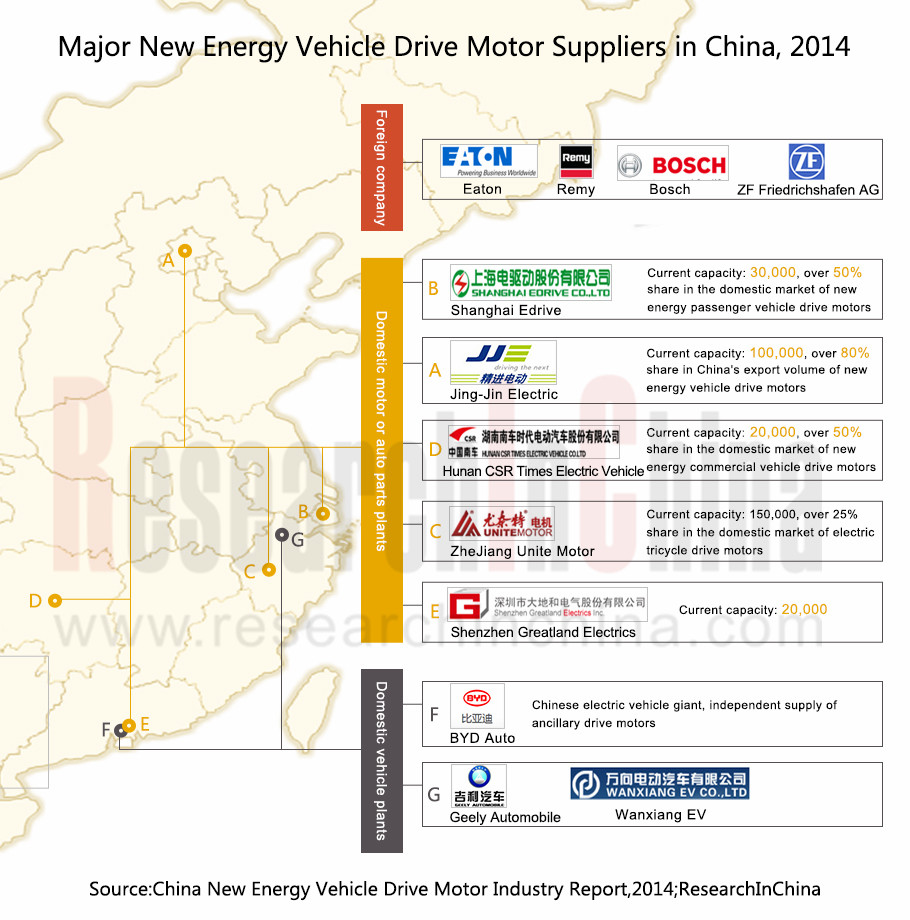

As of May 2014, about 30 companies in China, including complete vehicle factories, auto parts producers and independent motor manufacturers, can produce new energy vehicle drive motors, of which 15 could deliver goods in volume for complete vehicle factories. Among complete vehicle factories, BYD produces new energy vehicle drive motors by itself; Shanghai Edrive Co., Ltd. (Shanghai Edrive) is a leading new energy passenger vehicle drive motors player among independent motor or auto parts producers, and Hunan CSR Times Electronic vehicle Co., Ltd. is a champion in production of new-energy commercial vehicle drive motor.

Among foreign brands, complete vehicle companies like Toyota and Honda have established automobile motor factories in China to supply its industry chains; auto parts producers such as Bosch and ZF Friedrichshafen AG have set up joint ventures with domestic Chinese companies to develop and produce new energy vehicle drive motors; independent motor suppliers like Remy Inc. has built factories in China.

A total of about 46,000 sets of new-energy vehicle drive motors were made in China in 2013, generating output value of RMB 1.86 billion. Small industry size and slower expansion of production capacity are largely due to dismal popularization of new energy vehicles in China. However, China has stepped up its efforts to promote new energy vehicles in 2014, with growth rate of output and sales volume accelerating. In April 2014, China produced 3,850 new energy vehicles, soaring by 70.1% year on year. The accelerated growth of new energy vehicle market will promote the development of new energy vehicle drive motor market.

From application of various new energy vehicle drive motors in China, AC asynchronous induction motor and switched reluctance motor are primarily used in new energy commercial vehicles, especially new energy buses, with the latter less applied in practical assemblage; permanent-magnet synchronous motors are mainly applied in new energy passenger vehicles. China Tex Mechanical & Electrical Engineering Ltd. takes the leadership in the field of switched reluctance motor, and Shanghai Edrive, Jing-Jin Electric Technologies (Beijing) Co., Ltd. (JJE) and Shenzhen Greatland Electrics Inc. are leading producers in permanent-magnet synchronous motor, of which JJE is the largest exporter of new energy drive motors in China.

China New Energy Vehicle Drive Motor Industry Report, 2014 covers the following:

Overview of new energy vehicle drive motor, including definition, classification and industry chain of vehicle drive motor;

Overview of new energy vehicle drive motor, including definition, classification and industry chain of vehicle drive motor;

Operating environment of China new energy vehicle drive motor industry, including policy environment, development of new energy vehicle market and its impact on automobile drive motor industry;

Operating environment of China new energy vehicle drive motor industry, including policy environment, development of new energy vehicle market and its impact on automobile drive motor industry;

Development of China new energy vehicle drive motor industry, covering costs, historical supply and demand, demand forecast and competition among mainstream manufacturers;

Development of China new energy vehicle drive motor industry, covering costs, historical supply and demand, demand forecast and competition among mainstream manufacturers;

22 Chinese companies and 6 global players, containing operation, new energy vehicle drive motor business.

22 Chinese companies and 6 global players, containing operation, new energy vehicle drive motor business.

1. Overview of New Energy Vehicle Drive Motor Industry

1.1 Definition and Classification

1.2 Industry Chain

1.2.1 Upstream

1.2.2 Downstream

2. Operating Environment of China New Energy Vehicle Drive Motor Industry

2.1 Policy Environment

2.2 Impact of New Energy Vehicle Development on Drive Motor

2.2.1 Hybrid Vehicle

2.2.2 Battery Electric Vehicle

2.2.3 Status Quo and Trends of New Energy Vehicle in China

3. Development of China New Energy Vehicle Drive Motor Industry

3.1 Status Quo

3.2 Supply and Demand

3.2.1 Costs

3.2.2 Supply and Demand

3.3 Competitive Landscape

3.4 Opportunities and Trends

3.4.1 Technological Trend

3.4.2 Opportunities and Market Trend

4. Key Chinese New Energy Vehicle Drive Motor Manufacturers

4.1 Zhongshan Broad-ocean Motor Co., Ltd.

4.1.1 Profile

4.1.2 Operation

4.1.3 Revenue Structure

4.1.4 Gross Margin

4.1.5 New Energy Vehicle Motor Business

4.1.6 Forecast and Outlook

4.2 Jiangxi Special Electric Motor Co., Ltd.

4.2.1 Profile

4.2.2 Operation

4.2.3 Revenue Structure

4.2.4 Gross Margin

4.2.5 New Energy Vehicle Motor Business

4.2.6 Forecast and Outlook

4.3 Wanxiang Qianchao Co., Ltd.

4.3.1 Profile

4.3.2 Operation

4.3.3 Revenue Structure

4.3.4 Gross Margin

4.3.5 New Energy Vehicle Motor Business

4.4 Zhejiang Founder Motor Limited Company

4.4.1 Profile

4.4.2 Operation

4.4.3 Revenue Structure

4.4.4 Gross Margin

4.4.5 New Energy Vehicle Motor Business

4.5 Wolong Electric Group Co., Ltd.

4.5.1 Profile

4.5.2 Operation

4.5.3 Revenue Structure

4.5.4 Gross Margin

4.5.5 New Energy Vehicle Motor Business

4.6 Xin Zhi Motor Co., Ltd.

4.6.1 Profile

4.6.2 Operation

4.6.3 Revenue Structure

4.6.4 Gross Margin

4.6.5 New Energy Vehicle Motor Business

4.7 Shanghai Edrive Co., Ltd.

4.7.1 Profile

4.7.2 Operation

4.7.3 New Energy Vehicle Motor Products

4.7.4 Forecast and Outlook

4.8 Hunan CSR Times Electronic vehicle Co., Ltd.

4.8.1 Profile

4.8.2 Operation

4.8.3 New Energy Vehicle Motor Products

4.8.4 Forecast and Outlook

4.9 China Tex Mechanical & Electrical Engineering Ltd.

4.9.1 Profile

4.9.2 Operation

4.9.3 New Energy Vehicle Motor Products

4.10 Jing-Jin Electric Technologies (Beijing) Co., Ltd.

4.10.1 Profile

4.10.2 Operation

4.10.3 New Energy Vehicle Motor Products

4.10.4 Forecast and Outlook

4.11 Zhejiang Unite Motor Co. Ltd.

4.11.1 Profile

4.11.2 Operation

4.11.3 New Energy Vehicle Motor Products

4.12 Other Players

4.12.1 Dalian Motor Co., Ltd.

4.12.2 Shenzhen Greatland Electrics Inc.

4.12.3 Shanghai Dajun Technologies Inc.

4.12.4 United Automotive Electronic Systems Co., Ltd.

4.12.5 Jinan Lanji New Energy Vehicle Co., Ltd.

4.12.6 Huayu Automotive Electric System Co., Ltd.

4.12.7 Jiangsu Weiteli Motors-Manufacturing Co., Ltd.

4.12.8 Wuxi MyWay Electric Technology Co., Ltd.

4.12.9 Shanghai Win Double Electric Co., Ltd.

4.12.10 Jinzhou Halla Electrical Equipment Co., Ltd.

4.12.11 New Ananda Drive Techniques (Shanghai) Co., Ltd.

5. Key Global New Energy Vehicle Drive Motor Players

5.1 Robert Bosch GmbH

5.1.1 Profile

5.1.2 New Energy Vehicle Motor Business

5.2 ZF Friedrichshafen AG

5.2.1 Profile

5.2.2 New Energy Vehicle Motor Business

5.3 Continental AG

5.3.1 Profile

5.3.2 New Energy Vehicle Motor Business

5.4 Aisin AW Co., Ltd.

5.4.1 Profile

5.4.2 New Energy Vehicle Motor Business

5.5 Hyundai Mobis

5.5.1 Profile

5.5.2 New Energy Vehicle Motor Business

5.6 AC Propulsion

5.6.1 Profile

5.6.2 New Energy Vehicle Motor Business

Basic Structure of New Energy Vehicle Motor Driving System

Comparison of Main Parameters of New Energy Vehicle Drive Motor and Traditional Motor

Classification and Characteristics of New Energy Vehicle Drive Motors

Structure Comparison of New Energy Vehicle and Conventionally Fuelled Vehicle

China’s Main Policies on New Energy Vehicle

Purchase Restrictions in Major Cities in China, 2014

Classification and Auxiliary Motor of Hybrid Vehicle

Operating Principle Diagraph of Battery Electric Vehicle

Output and Sales Volume of New Energy Vehicles in China, 2010-2014

Cost Structure of Components of Motor

Cost Structure of Motor Controller

Price Composition of Permanent-magnet Drive Motor

Size of China New Energy Vehicle Drive Motor Market (Including Exports), 2010-2014

Chinese Brand New Energy Passenger Vehicles --Top 5 Motor Manufacturers by Supported Models

Auxiliary Motors of Mainstream New Energy Passenger Vehicles

Chinese Brand New Energy Commercial Vehicles -- Top 5 Motor Manufacturers by Supported Models

Comparison of Two Driving Methods

Distribution of Global Electric Vehicle Ownership (Including Electric, Plug-in Hybrid and Fuel Cell Electrical Vehicles), 2012

Operation of Zhongshan Broad-ocean Motor, 2010-2014

Revenue Breakdown of Zhongshan Broad-ocean Motor by Sector, 2013

Revenue Structure of Zhongshan Broad-ocean Motor by Region, 2009-2013

Gross Margin of Zhongshan Broad-ocean Motor, 2008-2013

Gross Margin of Zhongshan Broad-ocean Motor by Product, 2010-2013

Revenue from New Energy Vehicle Motor Business of Zhongshan Broad-ocean Motor, 2010-2012

New Energy Vehicle Power Assembly Projects under Construction of Zhongshan Broad-ocean Motor

Zhongshan Broad-ocean Motor’s Subsidiaries Primarily Engaged in New Energy Vehicle Business

Revenue and Net Income of Jiangxi Special Electric Motor, 2010-2014

Revenue Structure of Jiangxi Special Electric Motor by Product, 2010-2013

Revenue of Jiangxi Special Electric Motor by Product, 2010-2013

Revenue Structure of Jiangxi Special Electric Motor by Region, 2010-2013

Gross Margin of Jiangxi Special Electric Motor, 2011-2014

Gross Margin of Jiangxi Special Electric Motor by Product, 2011-2013

Jiangxi Special Electric Motor’s Subsidiaries Primarily Engaged in New Energy Vehicle Business

New Energy Vehicle Motor R &D of Jiangxi Special Electric Motor, 2013

Revenue and Net Income of Wanxiang Qianchao, 2010-2014

Acquisitions Made by Wanxiang Qianchao, 2013

Revenue Structure of Wanxiang Qianchao by Product, 2010-2013

Revenue Breakdown of Wanxiang Qianchao by Product, 2010-2013

Revenue Structure of Wanxiang Qianchao by Region, 2010-2013

Wanxiang Qianchao’s Revenue from Top 5 Customers, 2013

Gross Margin of Wanxiang Qianchao, 2011-2014

Gross Margin of Wanxiang Qianchao by Product, 2010-2013

Revenue and Net Income of Zhejiang Founder Motor, 2010-2014

Revenue Structure of Zhejiang Founder Motor by Product, 2010-2013

Revenue Breakdown of Zhejiang Founder Motor by Product, 2010-2013

Revenue Structure of Zhejiang Founder Motor by Region, 2010-2013

Zhejiang Founder Motor’s Revenue from Top 5 Customers, 2013

Gross Margin of Zhejiang Founder Motor, 2011-2014

Gross Margin of Zhejiang Founder Motor by Product, 2010-2013

Electric Vehicle Drive Motor System Projects of Zhejiang Founder Motor, 2013

Revenue and Net Income of Wolong Electric, 2010-2014

Revenue Structure of Wolong Electric by Product, 2010-2013

Revenue Breakdown of Wolong Electric by Product

Revenue Structure of Wolong Electric by Region, 2010-2013

Gross Margin of Wolong Electric, 2011-2014

Gross Margin of Wolong Electric by Product, 2010-2013

Revenue and Net Income of Xin Zhi Motor, 2010-2014

Revenue Structure of Xin Zhi Motor by Product, 2010-2013

Revenue Structure of Xin Zhi Motor by Region, 2010-2013

Xin Zhi Motor’s Revenue from Top 5 Customers, 2013

Gross Margin of Xin Zhi Motor, 2011-2014

Gross Margin of Xin Zhi Motor by Product, 2010-2013

Types and Parameters of New Energy Vehicle Motor Systems Already Produced by Shanghai Edrive

Dimensions and Appearance of Shanghai Edrive’s New Energy Vehicle Motor Systems

Types and Parameters of New Energy Vehicle Motor Systems Already Produced by Hunan CSR Times Electric Vehicle

Main Specifications of New Energy Vehicle SRD Motors Already Produced by China Tex Mechanical & Electrical Engineering

Main Specifications of New Energy Vehicle Motors Already Produced by JJE

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...