Our recent report Global and China Automotive Seating Industry Report, 2020-2021 highlights the following: development history of automotive seating, industry pattern, market size, supplier relationships, “CASE” (Connected, Autonomous, Shared, Electrified) and cooperation dynamics of major automotive seat manufacturers, and ten trends for automotive seating industry in an upsurge of CASE.

Automotive seat is the interior component that occupants contact for the longest time during the ride. Since the world’s first automobile came into being in 1885, automotive seat has evolved for over a century from a simple component into a practical tool offering comfort and safety.

Global automotive seating market is dominated by American, European and Japanese brands.

In 2019, North American, Japanese and European seat manufacturers commanded around 50%, 14% and 11% of the global market, separately. China’s automotive seating market is grabbed by foreign companies such as Adient and Lear and their affiliates and Toyota Boshoku, or foreign-funded joint ventures, which together sweep more than 60%.

Ten trends for automotive seating industry amid CASE

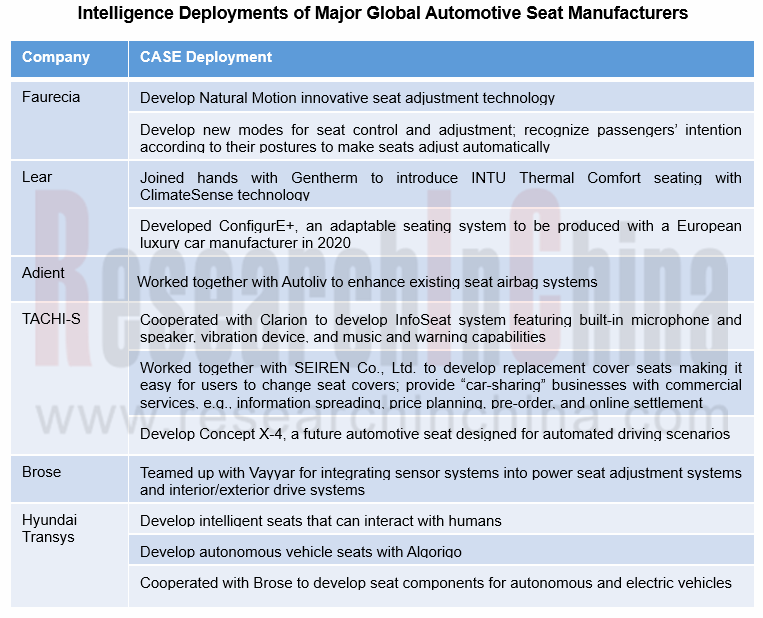

Under the development trend of CASE, the tide of software-defined cars is unstoppable. However, software cannot define everything about vehicles. Traditional auto parts manufacturers still have many core technologies, which cannot be replaced by emerging auto-making forces, such as automotive settings. Seat manufacturers have also made a lot of intelligent improvements to seats according to the development needs of intelligent connected vehicles. We summarized the ten development trends for automotive seating industry amid CASE boom.

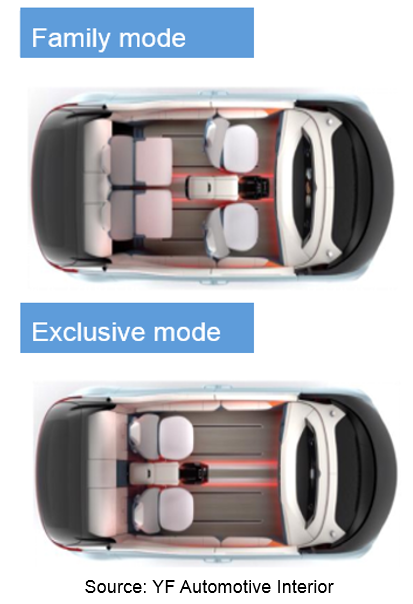

Trend 1: Multi-scenario Application

In future, autonomous vehicle cockpit will be a mobile space for office, living and entertainment, so seat needs to transform for different application scenarios. An example is the next-generation reconfigurable seating concept Magna showcased at CES 2019. Users can reconfigure seats via their smartphone APP, with reconfigurable modes including vehicle sharing, long journey, and autonomous shared mobility.

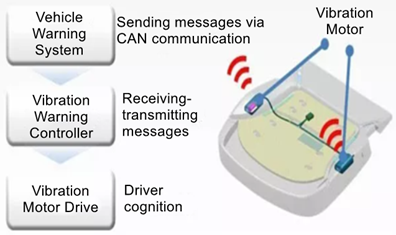

Trend 2: Integration with ADAS

In future, automotive seat that plays a crucial role in vehicle safety will integrate with ADAS to deliver more driving assistance capabilities. Examples include InfoSeat, an automotive seating system TACHI-S and Clarion co-developed and launched in 2019: when the vehicle travels too close to the front vehicle or the driver is drowsy, the vibration device installed in the seat will send a vibrative warning to occupants.

Trend 3: Intelligent Control

At present, CASE is reshaping the automotive industry. Facing the disruption in automotive industry, seat manufacturers race to double down on intelligence deployment by way of such as cooperation and independent development. Future intelligent seats can not only provide comfortable experience but learn to “know” what passengers want with AI technology and adjust and control themselves without any active operation. For instance, the fusion of sensors and seats makes seat control mode change from conventional button to intelligent control methods, e.g., APP, gesture control and intention perception.

Trend 4: Intelligent Monitoring

In future, automotive seat will also act as a “health manager” that can monitor heart and breath rates. Examples include HiRain Technologies’ intelligent automotive seating system with the ability to intelligently monitor health, heart and breath rates, and temperature.

Trend 5: Personalization

As well as function intelligence, personalized design holds a trend for automotive seat, helping users to create a more private interior space. In the case of gender-targeted design, ambient lamps are used to build exclusive private sound areas.

Trend 6: Modularization

Automotive modular platform that helps automakers reduce cost, development time, vehicle weight and fuel consumption will be well-welcomed. For example, Brose’s complete seat modular structure allows for higher uniformity of motors in size for quick response to different customers’ needs for—any drive for basic capabilities such as adjusting length, height, seat tilt and backrest tilt, serving as an efficient supplement in comfort and safety.

Trend 7: Application of Intelligent Surface

As intelligent cockpit booms, decorative, functional intelligent automotive surface attracts ever more attention from industry players. Examples include BWM Vision iNext, a concept car fully demonstrating which direction intelligent automotive surface will head in. iNext allows users to operate the infotainment system by interacting with and tracking symbols on seat or side panel woven fabrics with their fingers, which replaces traditional buttons and touch screen control capability.

Trend 8: Replacement Cover Seat

The growing awareness of hygiene and disinfection in car comes with popularity of car sharing and current pandemic. The emergence of replacement cover seat will be an efficient way to reduce the spread of viruses and bacteria and better protect the health of occupants.

An example is the replacement cover seat co-developed by TACHI-S and SEIREN Co., Ltd. Users can replace seat covers as they like in any time. For car sharing, corporate LOGO or QR code can be printed on the cover of the seat in support of offering commercial services from information spreading and price planning to pre-order and online settlement.

Trends 9: Lightweight

Seats make up 6% of vehicle curb weight, and 5% of total vehicle cost, the second highest share among all components. Lightweight seats are an effective solution to vehicle energy conservation and emission reduction. Reducing the weight of seats lies in use of lightweight seat frames or complete seats.

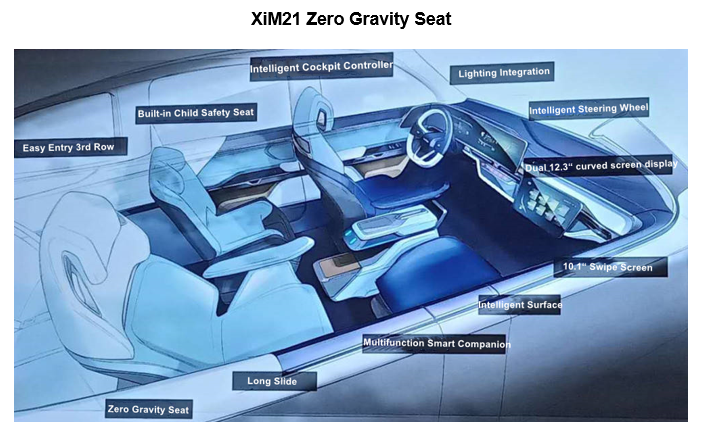

Trends 10: Zero Gravity

Statistics shows that in autopilot mode, the comfortable recumbent mode (zero gravity) gives users the greatest pleasure. A zero gravity seat is a boon for them to feel less tired during the journey. For example, in June 2020 Yanfeng Automotive Interiors introduced XiM21, a self-developed intelligent cockpit featuring a zero gravity seat that affords a large angle tilt, integrates with massage function and lets passengers relax their body and mind with fragrance from the hidden air outlet.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...