In 2020, passenger car T-Box increased by 25.4% year-on-year, and the proportion of 5G T-Box jumped

ResearchInChina released Global and China Passenger Car T-Box Market Report 2021, analyzing and predicting T-Box technology and market trends, as well as conducting research on mainstream T-Box vendors at home and abroad.

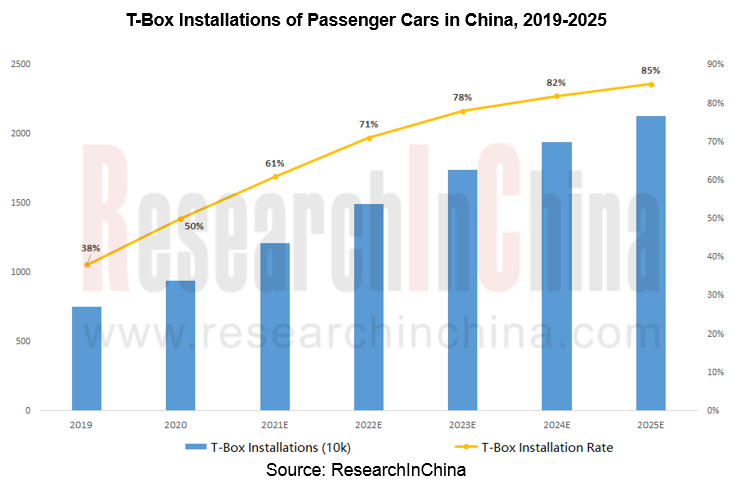

In 2020, 9.404 million passenger cars (50.0% of the total) were installed with T-Box by OEMs in China, a year-on-year increase of 25.4%. By 2025, the OEM T-Box installation rate of passenger cars in China will reach 85%, and over 20 million passenger cars will be installed with T-Box.

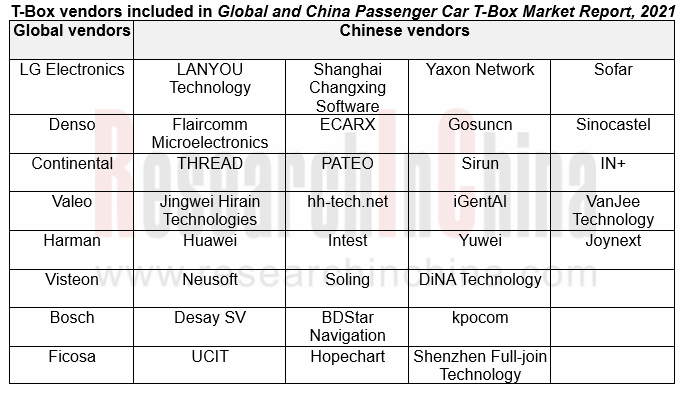

China's passenger car T-Box market is highly concentrated. Top 5 companies enjoy 45.6% market share and Top 10 companies 70.7%. The top vendors include LG Electronics, Valeo, Denso, LANYOU Technology, Continental, ECARX, Jingwei Hirain Technologies, etc. The first-ranked LG Electronics sees T-Box in 1.16 million vehicles, mainly serving GM, Lynk & Co, Kia, Hyundai, Geely, FAW Hongqi, etc.; its T-Box factory is located in Kunshan of Jiangsu.

DFS Industrial Group owns 80% stake in LANYOU Technology whose networked equipment model is TCU GEN2-A 4G. More than 90% of its T-Box products are available in Dongfeng’s models, such as Dongfeng Motor, Dongfeng Renault, Dongfeng Venucia, Dongfeng Nissan, etc.

Jingwei Hirain Technologies installed TBOX-Ext 4100 in 369,000 vehicles of FAW, JMC, GAC NE, Ford, Shanghai GM, etc. in 2020.

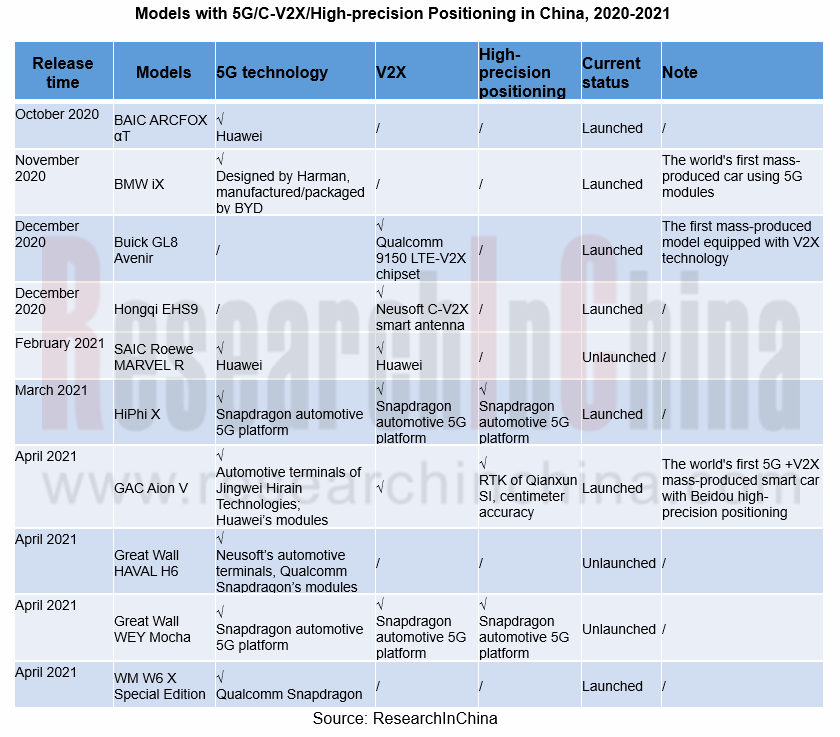

With the popularization and development of Telematics, T-Box is developing towards hardware integration and diversified functions. T-Box will not only collect, clean, sort, store, process and forward data, but also closely coordinate calculations with related functional components to reduce redundancy, improve efficiency, and enhance safety so as to achieve the effect of 1+1>2. For example, it integrates central gateway, 5G, C-V2X, high-precision positioning, vehicle FOTA, etc.

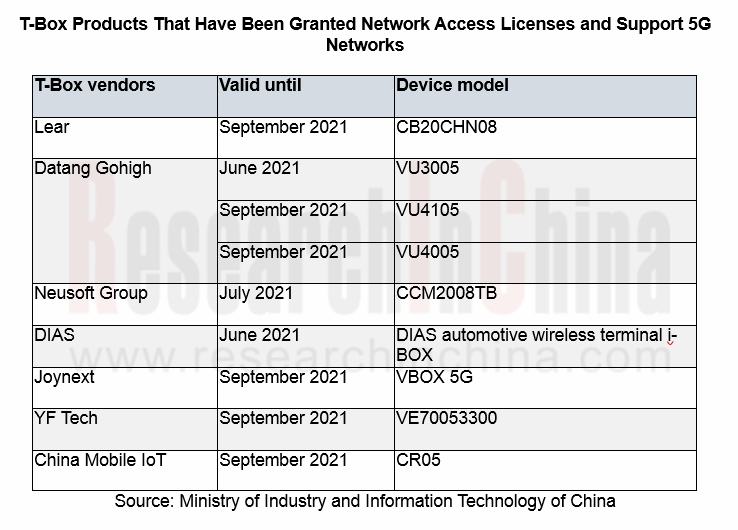

As of May 2021, China had issued network access licenses for 368 T-Box products, of which 9 models from Lear, Datang Gohigh, Neusoft, DIAS, YF Tech, and China Mobile IoT support 5G networks. At the Shanghai Auto Show, VanJee Technology, Joynext, and Huawei also exhibited 5G C-V2X T-Box.

Domestic and foreign OEMs are actively launching 5G models. The 5G models on the market include BAIC ARCFOX αT, BMW iX, Buick GL8 Avenir, etc. The upcoming models embrace SAIC Roewe MARVEL R, Great Wall HAVAL H6, Great Wall WEY Mocha and so on.

This report analyzes main T-Box vendors at home and abroad:

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...