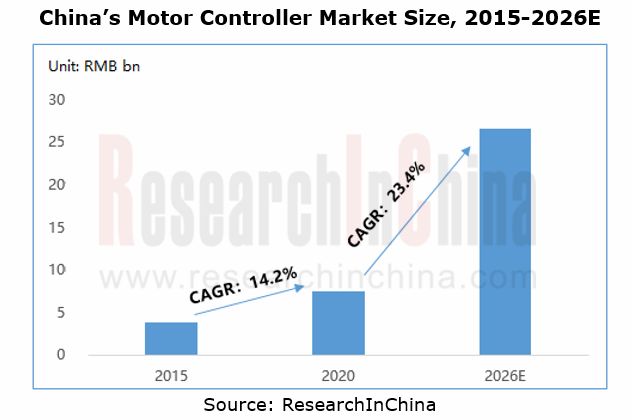

Automotive motor controller industry is expected to grow at CAGR of 23.4%, and local manufacturers are rising.

1) The growing new energy vehicle market gives a boost to the motor controller market.

The supply and demand in the electric vehicle motor controller market is dependent on the expansion of new energy vehicle market.

At present, countries and automakers worldwide have formulated their plans and requirements for the development of new energy vehicles. In future, new energy vehicle sales will be bound to surge. As the new energy vehicle market booms, the motor controller market will make steady growth. It is predicted that China’s motor controller market will sustain a CAGR of up to 23.4% between 2020 and 2026.

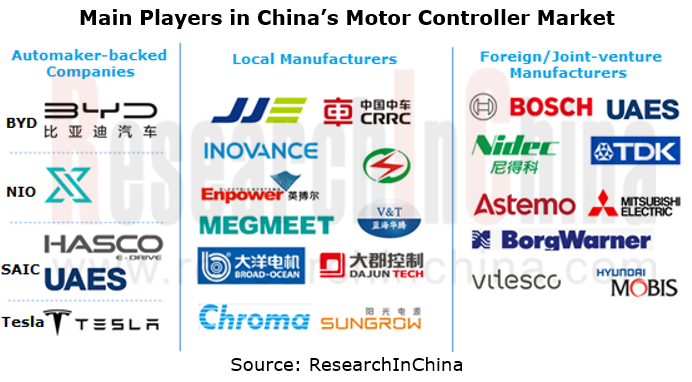

2) In the fiercely competitive motor controller market, local manufacturers lead the way.

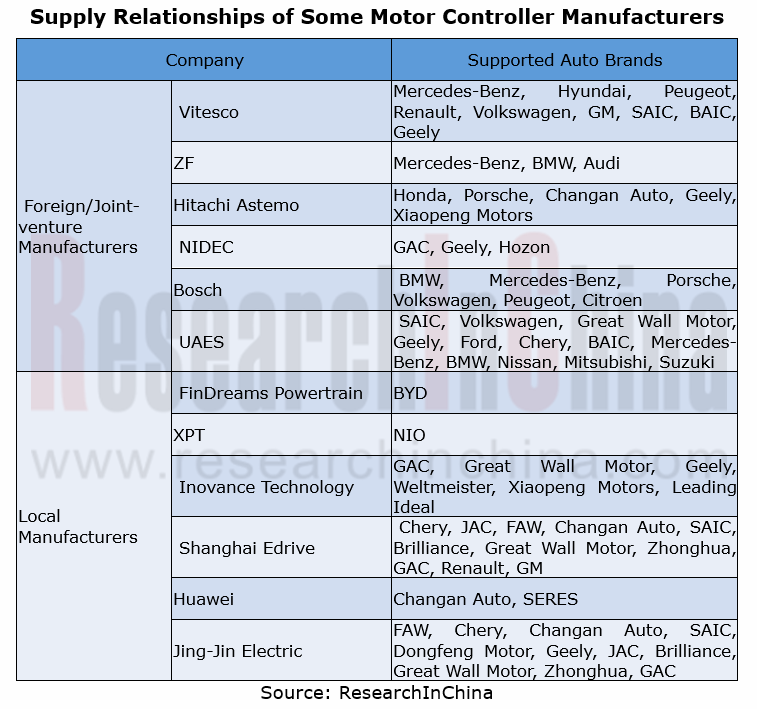

Currently, China’s electric vehicle motor controller market is intensely competitive. There are mainly three types of players: automaker-backed companies, local manufacturers, and foreign/joint-venture manufacturers. Among them, automaker-backed players support their own vehicles; local manufacturers are suppliers of Chinese independent auto brands; foreign/joint-venture companies build supply relationships with foreign/joint-venture auto brands.

Local manufacturers now have the upper hand on the strength of the development of homegrown new energy vehicle brands, especially emerging automakers. In 2020, seven out of the top ten manufacturers by market share were local companies, among which BYD still dominated the list with a 13.5% share; Inovance Technology, Sungrow and Huayu E-drive first edged into the top-ten list.

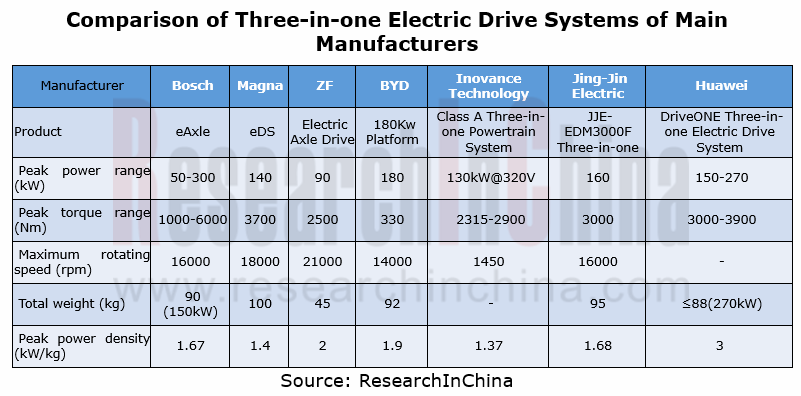

3) N-in-one products hold the trend, and three-in-one drive system will become the mainstream

Motor and ECU integration is a way to not only reduce weight and size of products but cut costs of production and procurement and improve efficiency. In current stage, most companies still stay at the two-in-one phase, while the three-in-one drive system will become the mainstream.

In 2020, China shipped more than 500,000 sets of three-in-one electric drive systems for passenger cars, or around 37% of the total motor controller shipments. Companies including Bosch, BYD, Inovance Technology and Jing-Jin Electric have rolled out their three-in-one electric drive systems. One example is Huawei DriveONE three-in-one electric drive system which boasts peak power density of 3kW/kg, the highest in the industry.

Through the lens of market share, the three-in-one system is still an oligopolistic market. In 2020, Tesla, BYD, XPT and NIDEC took a combined 82.1% of the total sales. Yet as Dongfeng SERES SF5 equipped with Huawei three-in-one system goes into mass production in 2021, the competition in the three-in-one electric drive system market will be more intense.

4) Power modules head in high voltage, and silicon carbide becomes a mainstream material.

New energy vehicles now use 400V electrical voltage systems. 80% SOC for a battery takes about 30 minutes, but the use of an 800V voltage system will cut the time down to 10 minutes. The need for fast charge makes high voltage power modules an inevitable trend.

Manufacturers like Hitachi Astemo, BorgWarner, Vitesco, Inovance Technology and ZF currently have introduced their 800V inverter/electric drive system products to meet fast charge needs, and all use silicon carbide (SiC) material except for Hitachi Astemo.

In BorgWarner’s case, its SiC inverter mass-produced in 2019 is the first 800V inverter using SiC power switch. The double-sided cooling structure makes the inverter 40% lighter and 30% smaller, improves its power density by 25%, and allows the inverter to perform better in thermal conductivity, high temperature stability and efficiency for shortening the charging time and extending the range.

Electric Controller Upstream Market

1) Automotive IGBT market—local companies gear up to scramble

IGBT module which plays a crucial role in new energy vehicles makes up roughly 45% of the cost of electric vehicle motor controller.

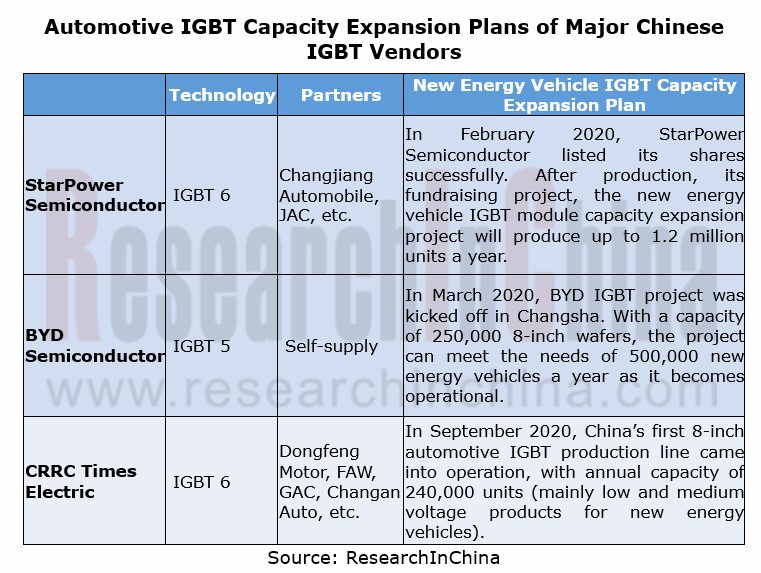

Current local companies such as BYD Semiconductor, StarPower Semiconductor and CRRC Times Electric already work hard on new energy vehicle IGBT development, and race to expand their capacity to rival their foreign peers.

China’s automotive IGBT market is dominated by international vendors like Infineon, Mitsubishi Electric, Semikron and Denso, among which Infineon shares over half the market, up to 58.2% in 2019. BYD Semiconductor, StarPower Semiconductor and CRRC Times Electric were however on the list of the top ten automotive IGBT vendors in 2019, especially BYD Semiconductor which became the runner-up with market share of 18%, far higher than the third-ranking Mitsubishi Electric which occupied just 5.2%.

2) Silicon carbide power devices are expected to be an alternative to IGBT, a key component of motor controller.

Globally, there is a belief that silicon carbide is the next-generation semiconductor material.

Compared with Si-based IGBT power devices, silicon carbide (SiC) power devices feature lighter weight, smaller size, higher power density, longer range, lower controller loss, better thermal conductivity, and stronger high temperature resistance. Motor controllers using SiC power devices are an effective way for new energy vehicles to improve range, power mass density, and electric energy conversion efficiency. So SiC power devices are expected to replace IGBT as a key component of motor controller.

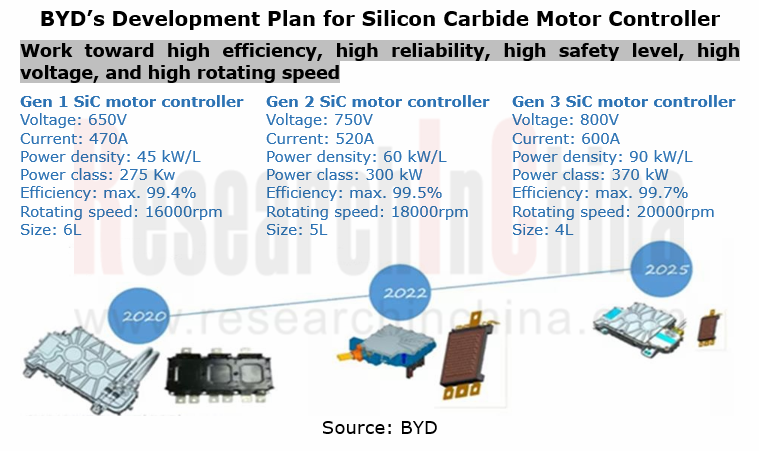

Manufacturers such as Delphi and BYD have set about making deployments in SiC motor controller. BYD indicated that from 2020 to 2025, its SiC motor controllers will have three iterations, with applicable voltage platforms up to 800V, power density up to 90kW/L, efficiency up to 99.7%, and rotating speed up to 20,000 rpm.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...