Automotive gateway industry research: the gateway ushered in a significant transformation while high-performance processors became the hot cakes

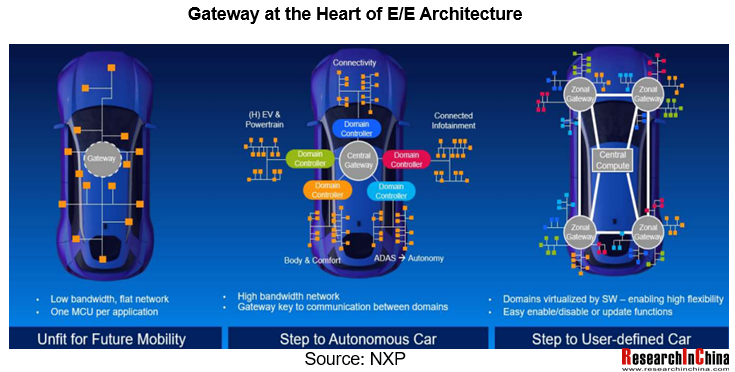

Gateway serves as the core hub of vehicle network, handling functions such as data transmission, security prevention and control, and remote diagnostics.

As the E/E architecture evolves from distributed to centralized domain architecture, the central gateway also provides functions such as interconnection and processing of data between safety and functional domains (powertrain, chassis and safety, body control, infotainment and ADAS, etc.).

In the future, the central gateway will evolve into an HPC or central computer in the "Central Computer + Zone Controller" architecture, while the Domain Gateway will evolve into a Zonal Gateway.

01 In line with market changes, the gateway suppliers introduced a series of new products

Since 2020, most Chinese OEMs make great efforts in functional domain architecture and achieve mass production in mid- to high-end models of Xpeng, FAW Hongqi, GWM, etc.

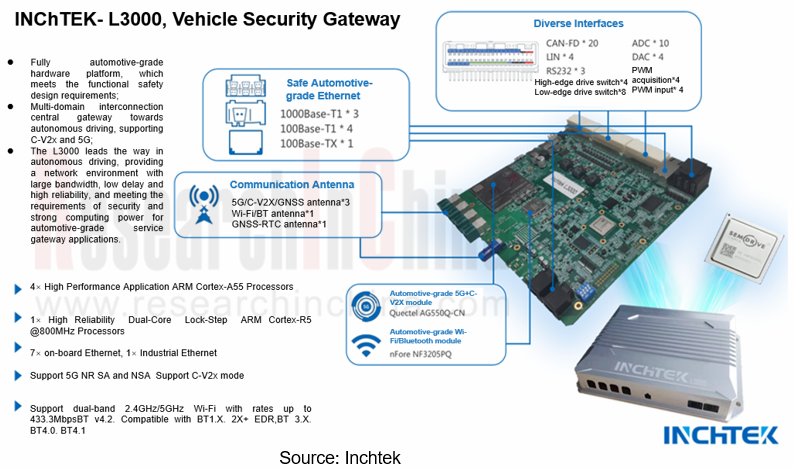

In accordance with the trend of change in automotive industry, automotive gateway suppliers, such as Inchtek, have launched a new generation of security gateway products.

In August 2021, Inchtek released L3000, the first automotive-grade 5G autonomous driving in-vehicle safety gateway, which adopts G9 series central gateway processor from SemiDrive and integrates automotive-grade Ethernet, 5G/C-V2X, Wi-Fi/BT and high-precision GNSS/IMU modules, enabling the high-level real-time transmission of data such as C-V2X and 5G.

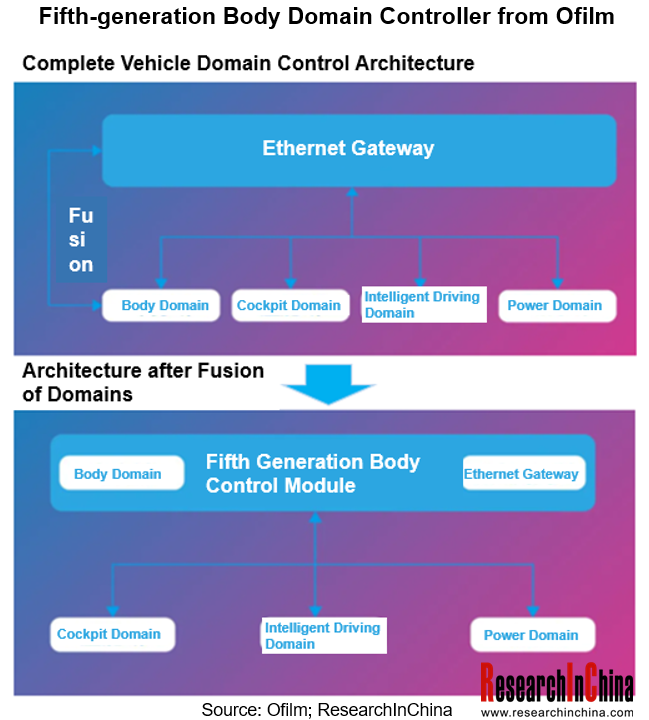

So as to further simplify the architecture, centralize the computing power, improve the communication transmission rate and OTA efficiency of the whole vehicle, some OEMs have started to try solutions such as domain convergence or HPC. Among them, the integration of body and Ethernet gateway has been the preferred solution.

In December 2020, Ofilm rolled out the fifth generation of body domain controller, which integrates body domain with Ethernet gateway, reducing the delay of bus signal transmission and improving the depth of information sharing between systems.

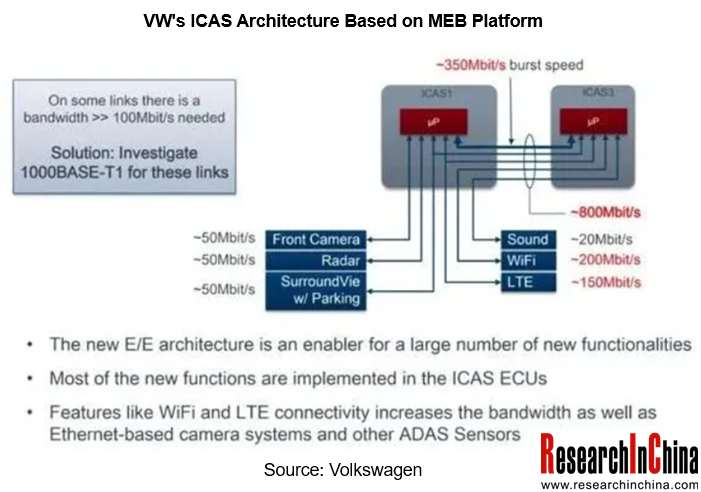

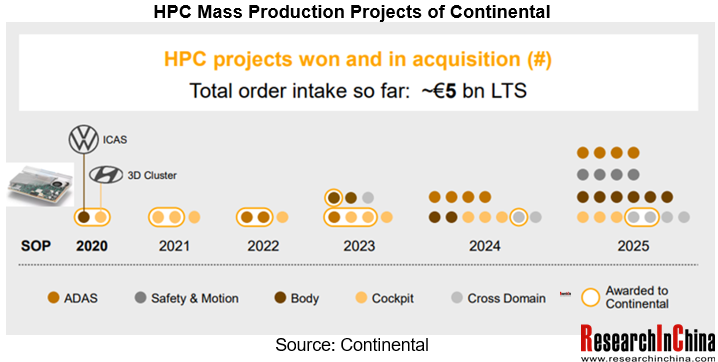

In 2020, the first generation of Continental's Body High Performance Computing Unit (Body HPC), as an in-vehicle application server (ICAS1), went into mass production on ID.3 of MEB-based platform at Volkswagen. In 2021, it was mass production again on ID.4.

The body HPC from Continental combines the previously separately implemented gateway function with the body controller function to act as a central gateway for all connected services, providing data processing and data security functions, as well as supporting vehicle OTA updates.

In 2021, Continental has also engaged in a strategic cooperation with GAC R&D Center, which will bring in high-performance central computing unit hardware and basic software platform development for GAC for creating a leading E/E architecture.

In the future, more features will be integrated into Continental's HPC, such as ADAS.

02 High-performance Gateway Processor Sparks New Round of "Battle"

High-performance gateway processor, as the core of the SOA change for smart vehicles, has triggered a new round of "scramble".

Since 2020, NXP, Renesas Electronics, TI, Infineon and other market-leading gateway processor suppliers have unveiled a new generation of gateway chips and solutions.

? In January 2020, TI released the DRA829V gateway processor based on Jacinto 7 processor platform;

? In March 2020, ST unveiled the SGP, a smart gateway platform targeted at automotive gateway and domain controller applications;

? In June 2021, the mass production of new S32G automotive network processor by NXP based on 16nm process;

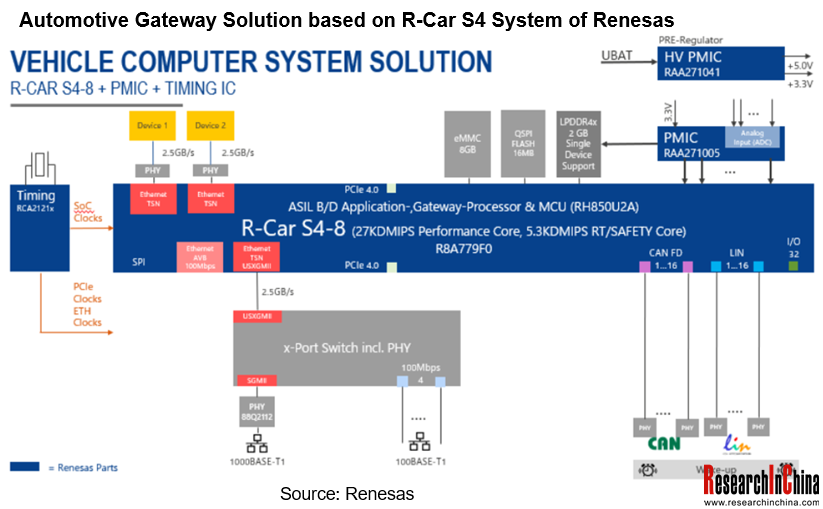

? In October 2021, Renesas announced a new automotive gateway solution based on R-Car S4 system;

......

Among them, the above-mentioned Volkswagen ID series, which applied Continental's body HPC, uses the high-performance R-Car M3 system-on-chip (SoC) from Renesas Electronics, while the novel gateway solution developed based on the R-Car S4 system solution with SoC and power management IC will be used for next-generation automotive computers, communication gateways, domain servers and application servers.

The second-generation body HPC, a product produced by collaboration between Continental and GAC, is equipped with the new S32G automotive network processor based on 16nm process, the latest mass production of NXP.

NXP S32G processor adopts 16nm process and has more than 10,000DMIPS of computing power which shows over 10 times of computing power than traditional NXP gateway chip. It combines ASIL D-level functional safety, hardware HSE encryption module and dedicated communication accelerator for service gateway, domain controller and co-processor of security domain.

In 2020, SemiDrive, a Chinese company, released G9X central gateway chip; based on G9X, it has joined hands with FAW General Research and Development Institute to launch "Longchi" central gateway platform, which will be installed in models such as Hongqi SUV and intelligent minibus.

In 2021, SemiDrive has launched G9Q, upgrading the single-core CPU to quad-core CPU so as to further enhance its computing power.

03 Industrial Chain

Currently, the gateway industry is undergoing a great evolution, and all involved players are racing to grab the dividends of "software-defined vehicles". In this campaign, the gateway processor in the core is expected to become the focus of competition. At the same time, with the application of higher computing power, lower power consumption and lower cost gateway chip, it will certainly accelerate the advent of the era of unmanned vehicles.

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...