An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupant protection information for a very brief period of time before, during and after a crash.

EDR gets compulsorily installed to new passenger cars starting from 2022

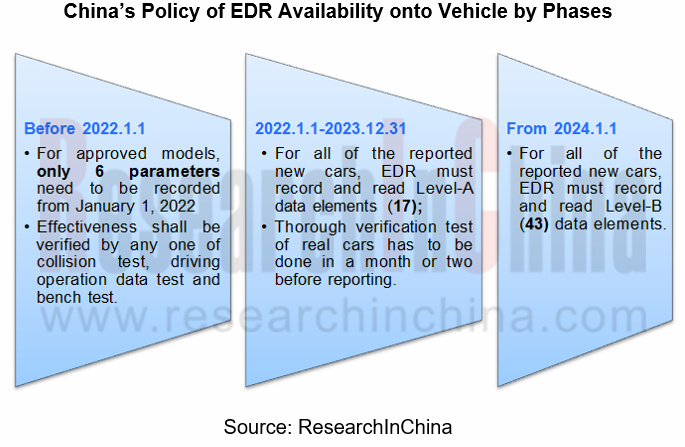

In December 2020, China publicized GB39732-2020 Vehicle Event Data Recorder System to replace GB39732-2017, requiring passenger cars be equipped with EDR from January 1, 2022.

Abide by the new national standards, some requirements are posed on EDR to record crashes, i.e., 1) have certain trigger threshold; 2) the recorded data will be locked automatically and cannot be modified; 3) the system can record data of at least three consecutive collision events.

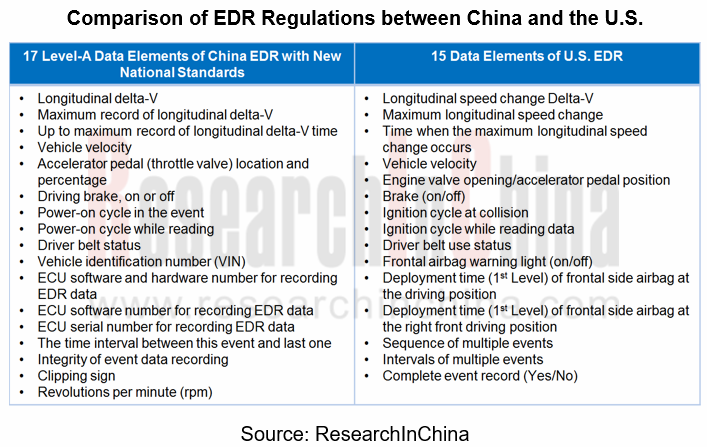

The data recorded by EDR is divided into Level-A and Level-B, including 17 Level-A data and 43 Level-B data, effective from January 1, 2022 and January 1, 2024 respectively.

It is in 2006 that the U.S. formulated regulations concerning EDR, and it is clearly stipulated in NHTSA CFR regulations in 2012 that all vehicles sold after September 2014 need to be equipped with EDR.

In Europe, EDR is compulsory in all new cars from March 2022 on (pursuant to the general safety regulation issued in March 2019), and corresponding CDR must be purchased on the market. By March 2024, stock vehicles require to be installed with EDR as well.

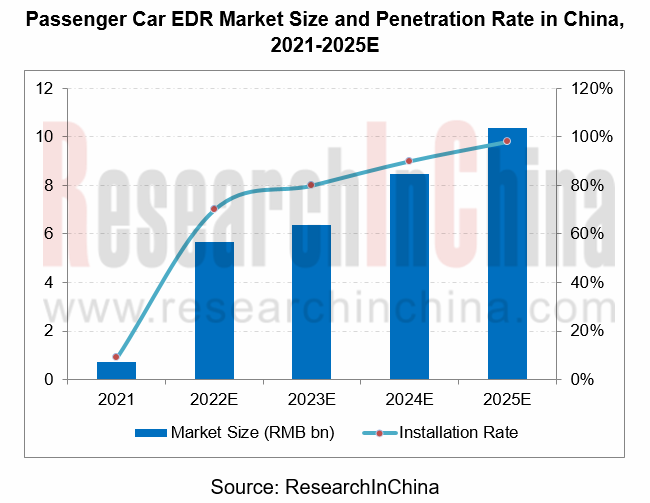

The incremental market size of passenger car EDR will surpass RMB5 billion in 2022

Millions of passenger cars and light-duty trucks worldwide are equipped with EDR, as is revealed by Bosch data, and a total of more than 200 million vehicles are installed with EDR in the U.S. and Canada where roughly 98% of the new cars on the market carry EDR.

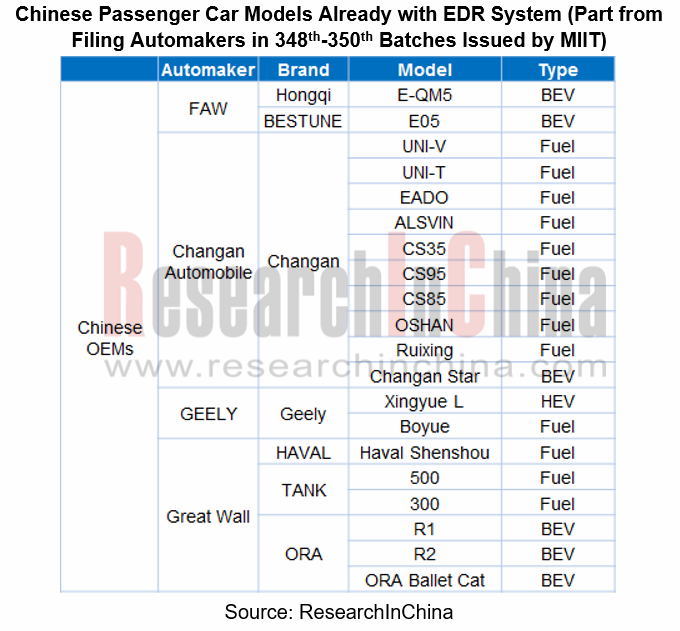

The brands like BMW, Mercedes-Benz, Lexus, Tesla, Toyota, BYD, XPENG and Haval first employ EDR. Through our analysis of the motor vehicle filing enterprises in 348th-350th batches issued (from Sept.2021 to Dec.2021) by the Ministry of Industry and Information Technology (MIIT), the passenger cars reported are all nearly with EDR, indicating the readiness of Chinese automakers for the policy about compulsory installation of EDR, and thus ushering in the explosive EDR market in 2022.

In 2021, the rate of EDR installations onto passenger cars in China remained low, about 9%, a figure projected to climb over 70% in 2022 along with compulsory installation of EDR, and even surge to at least 90% in 2024, according to ResearchInChina.

If with EDR data retrieval tools unconsidered, EDR hardware alone is priced between RMB300 and RMB500, and then the market in 2022 is valued at RMB4.85 billion to RMB8.03 billion.

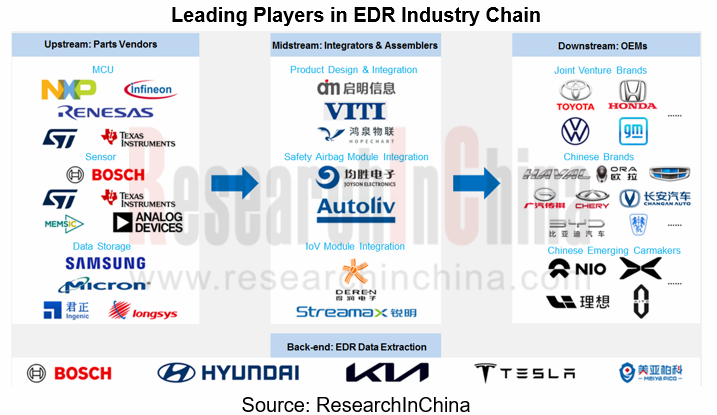

The players in the industrial chain are scrambling for EDR market dividends

EDR market ushers in explosive growth from 2022 when the new national standards for EDR take effect, and the players in the EDR industry chain are stepping up efforts in this lucrative segment.

EDR gets increasingly used onto passenger cars besides commercial vehicle.

The providers of data storage, chips, data retrieval tool, etc. race to beef up production lines and technology input.

OEMs expedite the testing and verification of their products and make them available onto cars.

Qiming Information Technology: It started in 2020 to develop products in line with national standards for EDR, has boasted a rich portfolio of EDR related data storage products and got them used in commercial vehicle.

Bosch: a world-renowned provider of EDR data retrieval tools has got its CDR (crash data retrieval) available for information acquisition of EDR on passenger cars and light-duty trucks since 2000.

As of January 2022, Bosch CDR has been iterated to the version 21.4, which fully supports a multitude of vehicle models (2022) in China such as Bentley, Maserati, Ferrari, Chrysler, Fiat, Jeep, and Toyota Corolla.

GigaDevice Semiconductor (Beijing) Inc.: MCUs have been used in EDR devices and shipped massively, particularly the MCUs like 105 and 305 with handsome deliveries; wherein, GD32F105 is the EDR used for commercial vehicle.

Ingenic Semiconductor Co., Ltd.: It grows into a leading supplier of automotive memories through acquisition of ISSI (Beijing) in 2019. For automotive sector, the company delivers FLASH memory for EDR.

On the whole, it takes quite a period of time for independent suppliers’ products to be verified for access to the OEM passenger car market although without a high technical barrier for EDR. The technology provider, by contrast, is faced with more opportunities. No matter which side it is, overall competence is vital in competition.

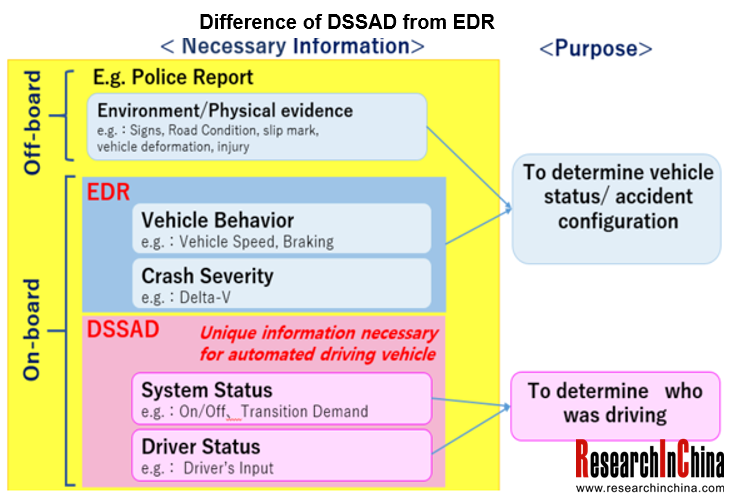

For autonomous driving, EDR is gearing towards DSSAD.

EDR alone can no longer meet the future market demand amid the prevailing autonomous vehicle. With a focus on recording information about vehicle and the driver when an accident occurs, EDR is unable to record whether the driver or the automated driving system is held accountable. To that end, DSSAD, short for data storage system for automated driving, is needed.

It is clearly required in the world’s first international regulations in June 2020 on L3 autonomous vehicle that autonomous vehicle must be equipped with DSSAD. The Chinese DSSAD standards is still being formulated.

In the DSSAD market, the competitors such as CalmCar and Duvonn Electronic Technology have made preemptive moves and rolled out DSSAD products. Noticeably, CalmCar DSSAD system suited for more than a dozen vehicle models in 2021.

Hopefully, DSSAD system will be popularized as the policy on L3 autonomy gets enforced and advanced autonomous vehicle is produced on a large scale.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...