Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.39 million 5G base stations, established over 2,300 virtual private networks and hybrid private networks, and seen over 1,800 5G+ industrial Internet projects under construction. Viewed from 5G coverage, all prefecture-level cities, at least 97% of counties, and 40% of townships in China have already been covered by 5G, to the amount of 450 million 5G terminal users in China, taking a lion’s share above 80% of the world’s total.

The accelerated construction of 5G networks will set the stage for deeper commercialization of 5G vehicles. To date, China's Internet of Vehicles (IoV) projects based on 5G communications have spread from pilot areas to commercialized scenarios, calling for the synergy of automakers, parts suppliers and internet firms as well as 5G ecosystem partners for the sake of cross-platform interconnection and interoperability.

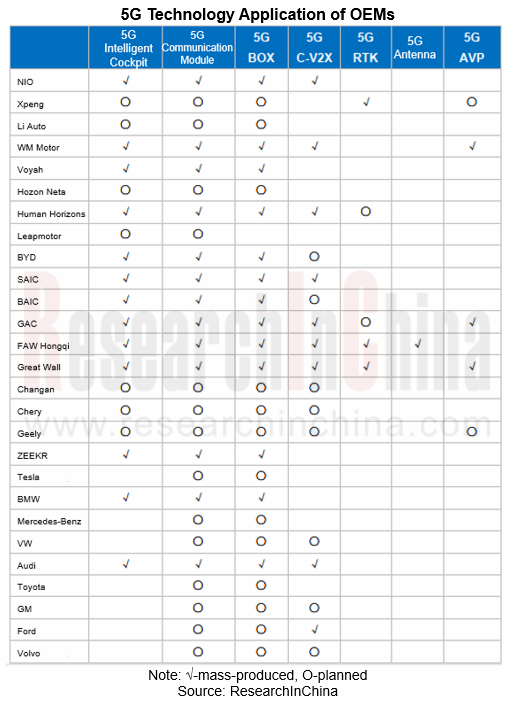

5G has become the sales highlight of many brand models

Many Chinese automakers are aggressively exploring the use of 5G technology in autonomous driving and intelligent connectivity, and they have launched 5G production models as a main selling point:

In February 2021, SAIC R officially launched MARVEL R, the world's first "5G smart electric SUV" with the SRRC certificate and being the first model that passed the automotive-grade 5G /C-V2X terminal certification;

NIO ET7, which will be mass-produced in 2022, will use the 3rd-Gen Qualcomm Snapdragon? automotive digital cockpit platform and Qualcomm Snapdragon? 5G automotive platform. It is possessed of 5G, C-V2X, Bluetooth 5.0, WiFi-6, UWB, among others;

ARCFOX α-T, the first production SUV of BAIC BJEV ARCFOX, officially called "the 5G smart electric vehicle", is equipped with the MH5000 T-BOX based on Huawei's next-generation 5G chips;

In August 2021, BYD Han unveiled a 5G version, adding a 5G optional package (including Dynaudio loudspeakers and 5G chips) to the 2021 BYD Han EV flagship version;

Great Wall Motor's 5G automotive wireless terminal has been granted the “Radio Transmission Equipment Type Approval Certificate” by the Ministry of Industry and Information Technology of the People’s Republic of China.

Among foreign OEMs, BMW, Ford, and Audi also quicken the pace of 5G vehicle production:

BMW's flagship battery-electric SUV, BMW iX, has debuted with 5G connectivity technology and Gigabit Ethernet for the first time;

The Ford C-V2X System has been officially spawned and applied since January 1, 2021. Ford has therefrom become the first automaker in China that accomplished the mass production of C-V2X technology which is now available in Wuxi, Changsha and Guangzhou. In the next step, Ford will ramp up production of models using 5G C-V2X technology;

For Audi, the upcoming Audi A7 L and A6 L made in China will be equipped with 5G communication modules that support C-V2X.

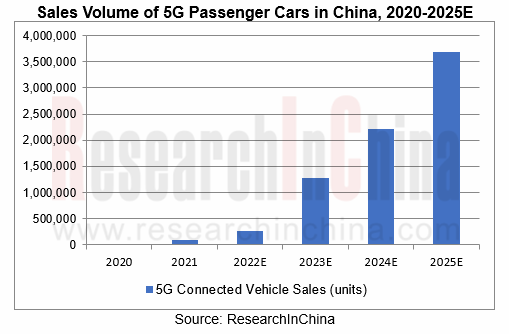

According to the production and assembly data of 5G passenger cars in China, the penetration rate of 5G vehicles constituted less than 0.4% of connected vehicles in 2021. As 5G feature gains popularity in medium and high-end passenger cars, China's 5G passenger car sales will reach 3.684 million units by 2025, with the penetration above 15% then.

Localization of 5G auto parts

While 5G vehicles are in full swing, there have emerged more than fifty 5G terminal and technical solution providers in the Chinese intelligent vehicle industry chain. Here are a few typical 5G automotive product/solution suppliers:

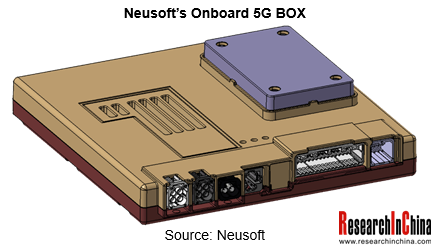

1. 5G Box

As the first enterprise certified by A-SPICE CL3 and 5G SRRC, Neusoft has cooperated with over 20 world-renowned automakers in the field of intelligent communication for 100+ models, with the annual capacity up to one million units.

By far, Neusoft has spawned 5G/V2X BOX on a large scale, which will be installed in dozens of mid-to-high-end models from well-known OEMs such as Geely and Great Wall in the near future. The Neusoft 5G BOX carried by ZEEKR 001 integrates functions such as Gigabit Ethernet, WiFi 6 and BLE 5.0 to enable precise time synchronization, high-precision satellite positioning, and multi-channel data transmission, and to offer a data access channel for intelligent driving assistance system, coupled with the high speed, high bandwidth and low latency of 5G.

2. 5G communication modules

AN958-AE, the 5G automotive-grade module of Fibocom, has been certified by CCC (China Compulsory Product Certificate), SRRC (Radio Type Approval), and NAL (Network Access License for Telecom Equipment), indicating that AN958-AE meets the standard design goals in RF performance and data performance and fully suits the complex network environment of Chinese operators. It is qualified for mass production and shipment, so that Fibocom can accelerate the upgrade of automotive OEM module business from 4G to 5G.

AN958 is independently developed and designed by Fibocom Auto, Fibocom’s wholly-owned subsidiary engaged in automotive OEM module business. It is a 5G NR Sub-6 automotive communication module targeting the global market. Based on Qualcomm’s SA515M 5G automotive platform, AN958 supports 5G SA and NSA.

3. 5G antennas

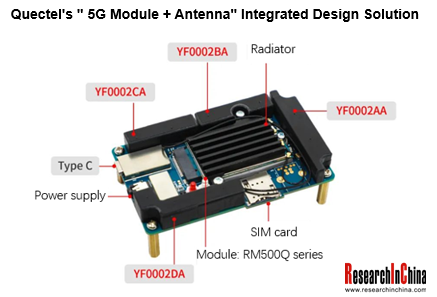

Quectel believes that the integrated design of wireless modules and antennas by a supplier that can provide application solutions at the same time will be the mainstream trend of terminal antenna design in the 5G era. Quectel's "wireless module + antenna" integrated design solution not only makes full use of its technical superiority and experience in modules, but also exerts its full-custom antenna design, integration and manufacturing capabilities.

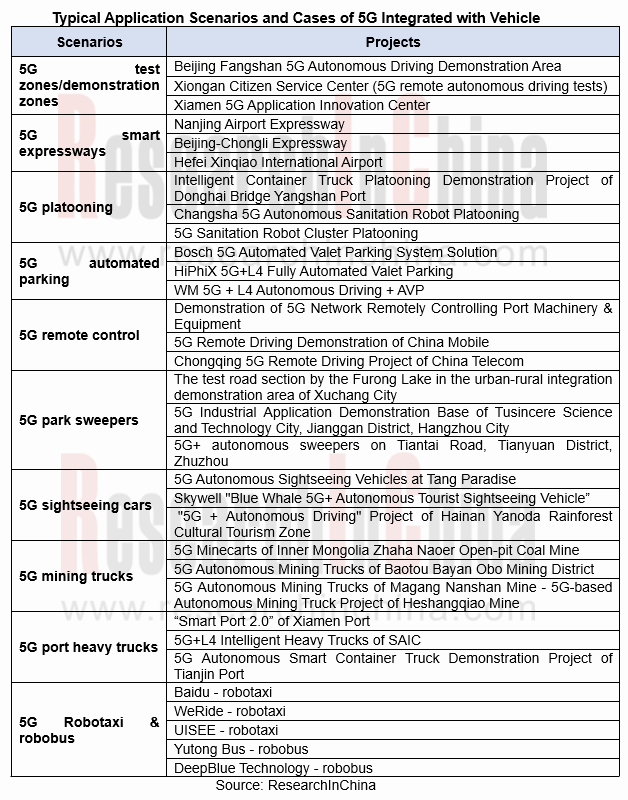

Typical scenarios where the ‘5G + vehicle’ fusion prevails

5G technology has been given full play in excess of 10 scenarios such as test areas/demonstration areas, smart expressways, platooning, automated parking, remote control and remote chauffeur, low-speed autonomous driving in parks, special self-driving, and intelligent public transportation.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...