ResearchInChina has released “Global and China Flying Car Industry Research Report, 2022".

A flying car is a three-dimensional vehicle. Broadly speaking, it is a low-altitude intelligent autonomous transportation tool carrying cargo or people, namely electric vertical take-off and landing (eVTOL). It features electric vertical take-off and landing, intelligent autonomous driving, amphibious transport and so on.

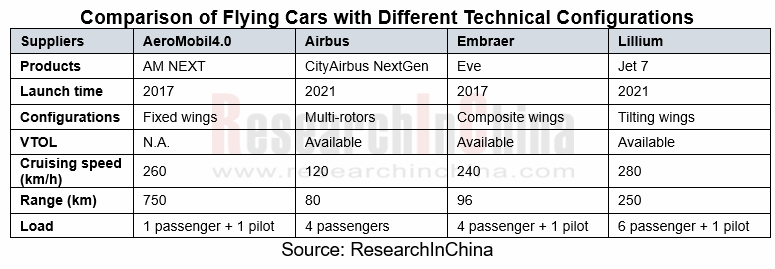

Multi-rotor configuration is the current mainstream

The technical configurations of flying cars mainly include four types: fixed wings, multi-rotors, composite wings and tilting wings. Among them, the most traditional fixed wings are rarely used due to the inability to take off and land vertically and hover. On the market, the most used multi-rotors take off and land vertically, hover precisely, are simple to operate with little technical difficulty, and land quickly. But, they are only suitable for short-distance transportation because of a short range.

In the future, with the improvement of the route network and the growth of long-distance transportation demand, composite wings and tilting wings with longer range and faster cruising speed will gradually become the mainstream.

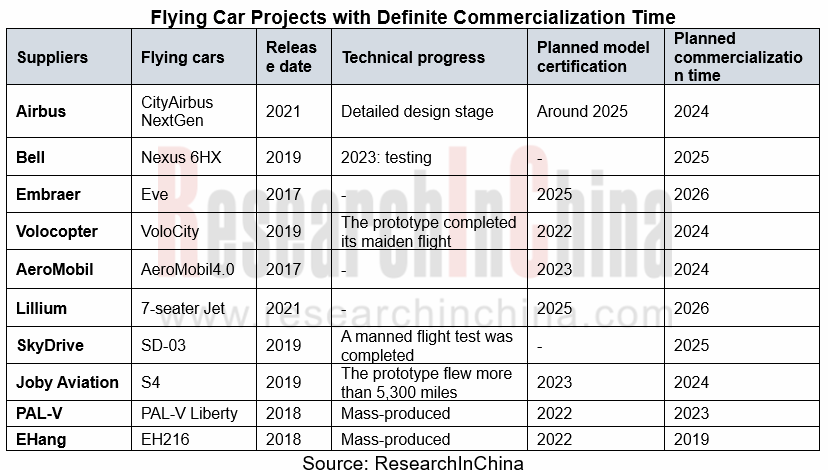

Around 2025, flying cars will spring up

As per the planning announced by vendors, the commercialization of flying cars will happen around 2025. By then, the Paris 2024 Summer Olympics and the Expo 2025 Osaka will be in the global spotlight. Therefore, both Paris and Osaka have deployed flying cars.

The city of Paris hopes to create two dedicated flight paths to ferry passengers for the 2024 Olympics and Paralympics. One route will carry passengers via Paris-Charles de Gaulle and Le Bourget airports, while the second will travel between two suburbs southwest of the French capital.

At present, Volocopter and Airbus have commercial plans for the Paris Olympics. Volocopter successfully flew its electric air taxi ‘helicopter’, the VoloCity, from Le Bourget airport in 2021. Also in 2021, Airbus revealed CityAirbus NextGen, an all-electric, four-seat eVTOL multicopter concept featuring a wing, for the general public during the 2024 Olympic Games.

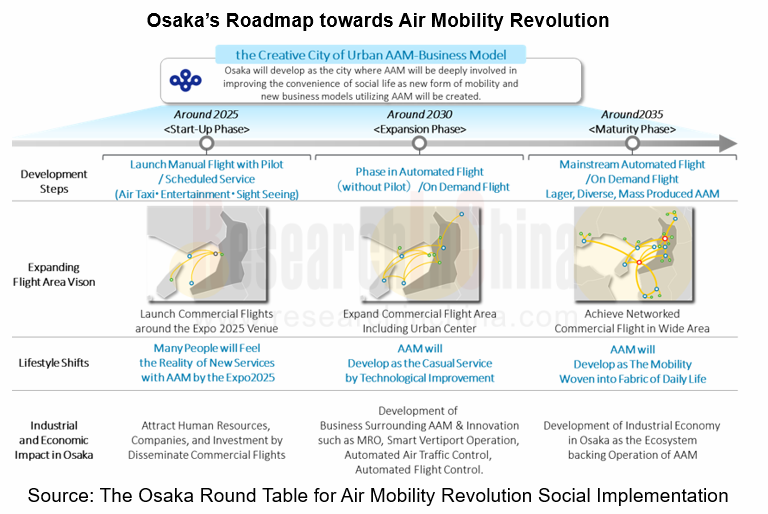

Osaka, Japan has made a very detailed roadmap for the commercialization of flying cars: regular flights will be opened in 2025, routes will be added in 2030, and aircrafts will be larger and diversified in 2035. SkyDrive and Joby Aviation have planned to provide commercial services during the Expo 2025 Osaka (in February 2022, ANA HOLDINGS, INC. and Joby Aviation announced they were forming a partnership that will see Japan's largest airline join with Joby to bring aerial ridesharing services to cities and communities across Japan. Toyota Motor Corporation also joined the partnership).

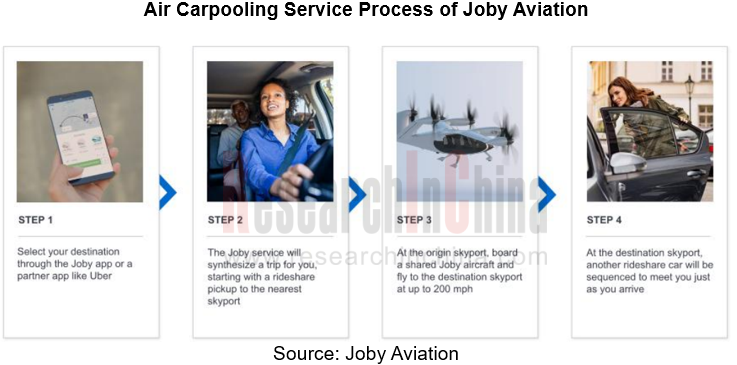

How do flying cars become possible? The platform operation mode is the prerequisite

Usually, a flying car costs more than USD300,000 (for instance, PAL-V Liberty sells the standard model, known as the Liberty Sport, for USD399,000). As the automation technology is not yet perfect, most eVTOLs require operators with pilot certificates or pilots. Therefore, the platform operation mode is the main business model in the initial stage.

For example, Joby Aviation plans to launch an App-based air ride-sharing service in 2024. Volocopter also plans a complete air carpooling service process, allowing customers to learn about carpooling services through Volocopter website, app, and VoloPort kiosk before placing orders, enjoying services and then evaluating them. In addition, EHang's carpooling service process includes “finding a suitable route in the APP - selecting a destination - selecting an EHang AAV and making a reservation”.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...