China Automotive Ultrasonic Radar and OEM Parking Roadmap Research Report, 2022

In 2021, ultrasonic radar shipments hit 100 million units, and intelligent parking became a crucial engine.

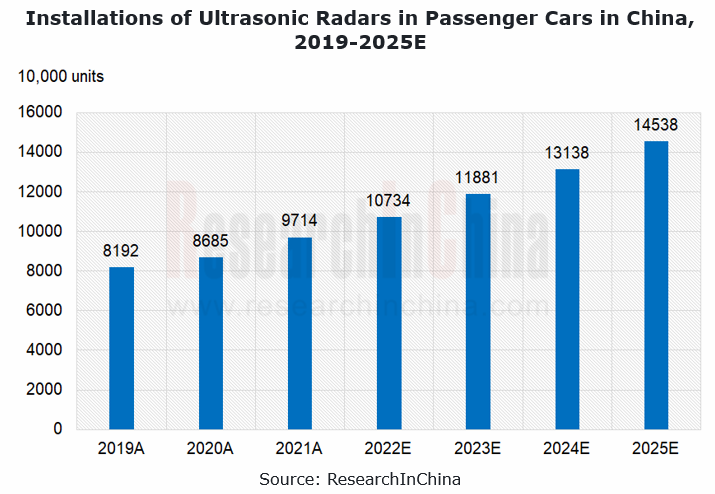

1. In 2025, China’s ultrasonic radar installations will exceed 140 million units.

According to ResearchInChina, in 2021 China’s ultrasonic radar installations in passenger cars jumped by 11.8% on the previous year to 97.138 million units, a figure projected to be more than 100 million units in 2022 and exceed 140 million units in 2025.

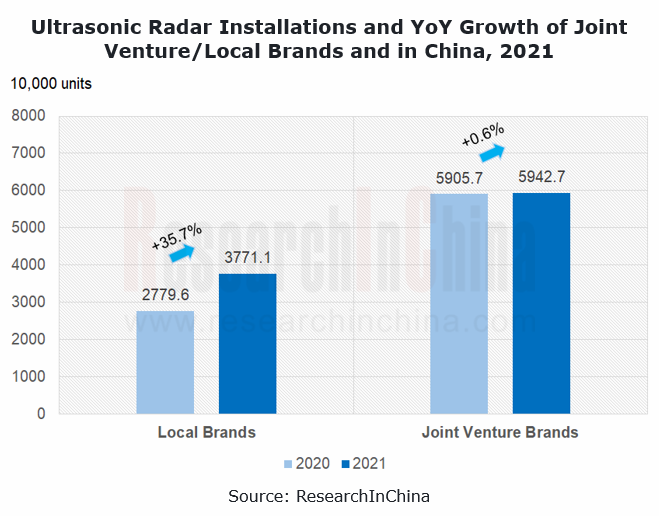

By auto brand in China, the installations of joint venture brands were higher than local brands, but from growth momentum, homegrown brands gained the upper hand.

In 2021, joint venture brands in China installed 59.427 million ultrasonic radars in their passenger cars, 1.6 times more than local brands (37.711 million units). In growth rate’s terms, the installations of local brands surged by 35.7% from a year earlier, compared with joint venture brands (a tiny 0.6%).

2. Advanced automated parking solutions will be the main application scenario of ultrasonic radars.

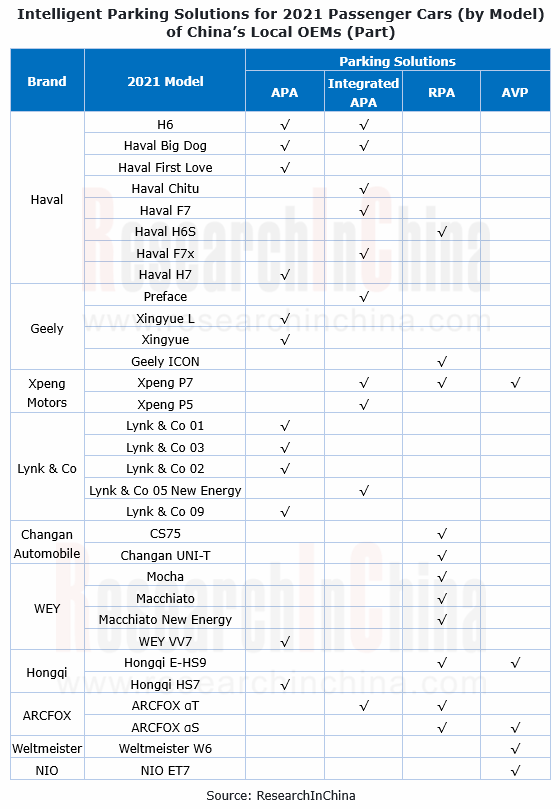

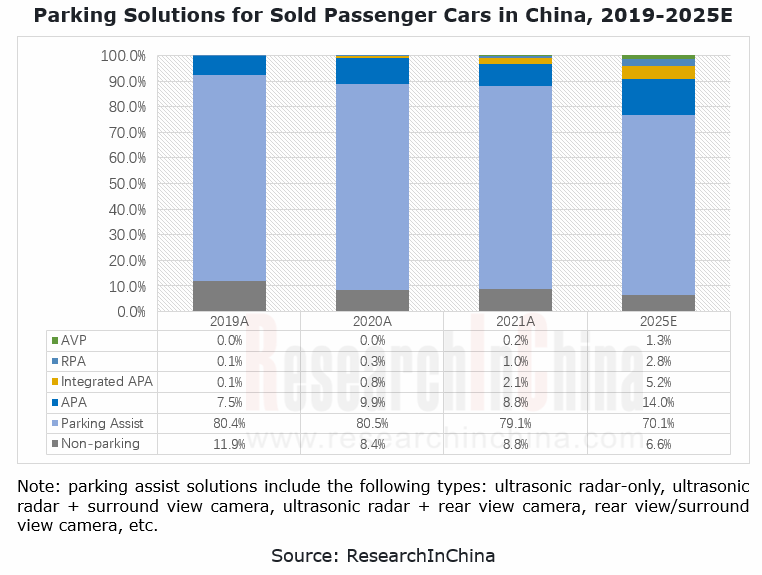

As L2+ automated driving develops, parking solutions including parking assist (e.g., ultrasonic radar-only, ultrasonic radar + surround view camera, ultrasonic radar + rear view camera, rear view/surround view camera, etc.), automated parking assist (APA), remote parking assist (RPA), and automated valet parking (AVP) are being mounted on new vehicles in China.

In 2021, in China the brands that equipped their new vehicle models with APA (including integrated APA) contained Haval, Geely and Lynk & Co; the RPA-enabled brands incorporated Changan Automobile, ARCFOX and WEY. In addition, Xpeng Motors, Hongqi, Weltmeister, and NIO were the first ones to deploy AVP solutions.

Our statistics show that in 2021, there were 1.787 million passenger cars equipped with the APA function in China, or 8.8% of the total; 432,000 passenger cars packed the integrated APA capability, accounting for 2.1%; 206,000 passenger cars, or 0.1% of the total, carried the RPA function.

3. Suppliers: Valeo and Bosch are leaders, and local players rise swiftly to prominence

Tier 1 suppliers such as Valeo and Bosch are monopolies in the Chinese ultrasonic radar market, of which Bosch already has 6 generations of ultrasonic radar products used in such scenarios as parking assist, side distance warning, side assistance, and emergency braking at low speeds.

In the parking field, Bosch has mass-produced APA, RPA and AVP solutions among others. Wherein, the RPA solution has been applied to production models such as Aion V and ARCFOX αT; AVP has been first available to New Mercedes-Benz S-Class, a production sedan.

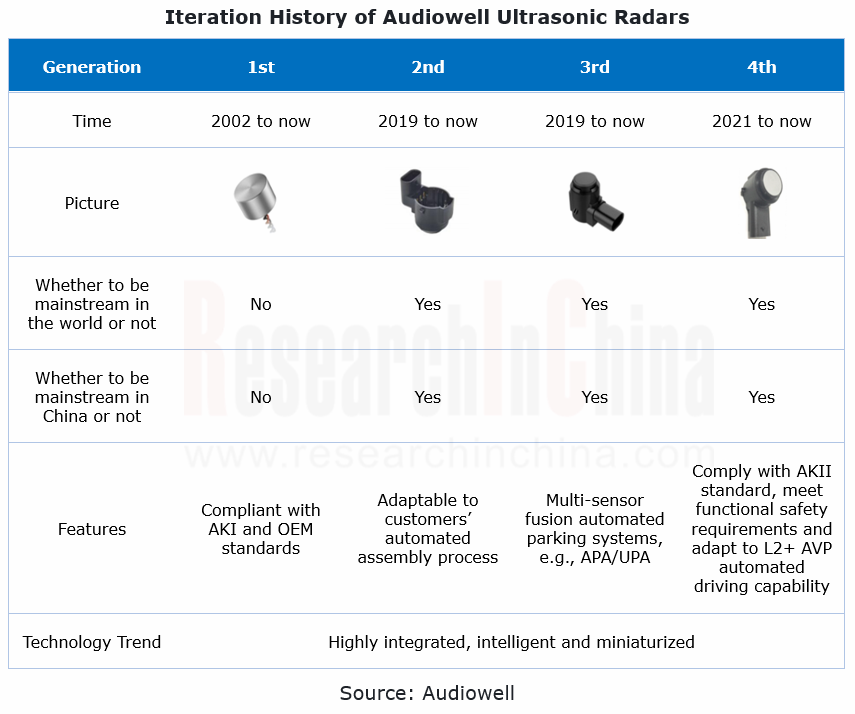

Among local companies in China, Audiowell, Shenzhen Longhorn Automotive Electronic Equipment, Coligen, TungThih Electronic and Zongmu Technology are at the leading edge. Thereof, Audiowell’s vehicle ultrasonic radars have undergone 4 iterations, and its fourth-generation AK2 ultrasonic radar core was unveiled in 2021, the up-to-date technology that enables L2+ AVP automated driving capability following UPA and APA. Audiowell also got the investment from Desay SV in 2021 and successfully went public on June 14, 2022.

As well as Audiowell, SOFTEC, Coligen, and Forvision (ThunderSoft acquired 51.48% of its shares in 2021) have also launched AK2 series ultrasonic radars, some of which have been produced in quantities.

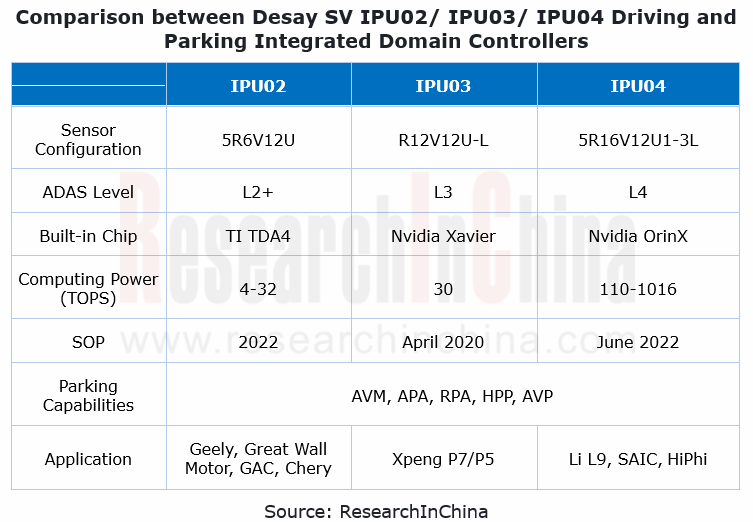

As intelligent parking solutions like Home-AVP and AVP come out, independent controllers can no longer meet the existing needs, and the parking domain begins to integrate into the autonomous driving domain. On this basis, the driving and parking integrated solutions come into being.

So far, quite a few companies in China including Neusoft Reach, Desay SV, Freetech and iMotion have rolled out their driving and parking integrated solutions, and have secured designated OEM orders for production vehicle models.

Desay SV IPU03 domain controller having been used in Xpeng P7, enables driving and parking integration, and supports on/off-ramp and automatic lane change in highway scenarios, automatic follow in urban traffic jams, and automated parking and valet parking in low-speed scenarios.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...