TOP10 commercial vehicle T-Box suppliers: using terminal data to build telematics platforms will become a megatrend.

1. From the perspective of market size, the pace of popularizing T-Box accelerates in the era of Chinese Phase VI Emission Standards.

Since July 1, 2021, the Chinese Phase VI Emission Standards for heavy-duty diesel vehicles have been implemented in an all-round way. Before leaving factories, the vehicles subject to the standards should be equipped with compliant remote emission management terminals (T-Box). Driven by policies, China's commercial vehicle T-Box market has made a rapid expansion.

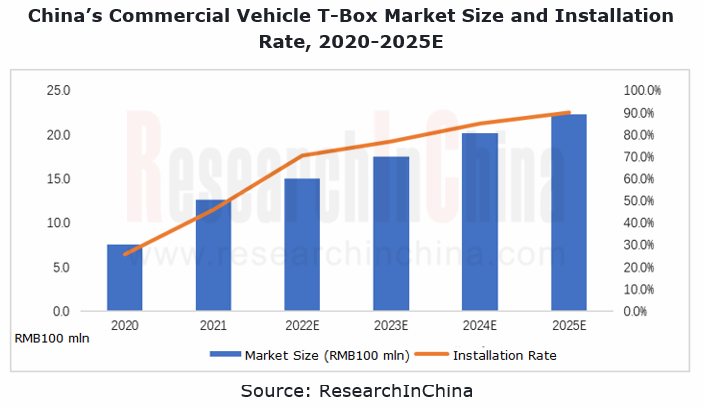

In 2021, China's commercial vehicle T-Box installation rate hit 45.9%, an increase of 20.3 percentage points over the previous year; the market was valued at RMB1.26 billion.

With the full implementation of the Chinese Phase VI Emission Standards and the growing demand for commercial vehicle telematics, the market demand for T-Box will sustain growth from 2022 to 2025. It is expected that in 2025, the installation rate of commercial vehicle T-Box in China will reach 90%, and the market will be worth over RMB2.2 billion, with an AAGR of around 24%.

2. Through the lens of products, data application centering on AD/ADAS and telematics will be a trend.

To support more abundant commercial vehicle telematics functions, T-Box technology keeps advancing. Boosted by 5G, big data and cloud computing among others, commercial vehicle T-Box that meet the basic national regulations will head in the following directions:

1).5G T-Box, C-V2X and high-precision positioning. For example, Jingwei Hirain Technologies and Shenzhen Yuwei Information and Technology Development have launched T-BOX products that support 5G and C-V2X technologies and are applicable to more fields such as vehicle data collection, audio and video surveillance, high-precision positioning, and intelligent driving warning.

2).Full vehicle OTA updates require that T-Box features powerful computing power, and fast and stable network speed. Compared with passenger cars that underline OTA updates on entertainment and intelligent driving, trucks focus more on practicality and engine modules. Some models launched by leading OEMs, like FAW Jiefang J6P/J7, pack such functions as multi-sensor fusion, perception & positioning, precise horizontal and vertical control, intelligent path decision & planning, backstage monitoring and scheduling, V2X & CVIS, remote OTA updates, and remote driving.

3).High integration (central gateways, Ethernet interfaces, antennas, six-axis gyroscopes, ETC, etc.). One example is the ETC OEM technology jointly unveiled by Foton Motor and Zhilian Network. In the production process, the OBU module is embedded into the built-in system of T-Box and shares the chip with the original device. They are integrated as an intelligent OEM T-Box.

4).Integrated with AD/ADAS. T-Box, AD/ADAS and connectivity function can achieve synergy, which allows addition of capabilities such as fatigue warning, video surveillance, intelligent cockpit, fleet control and V2X. In L0 systems, the use of vehicle data enables front-end monitoring and warning, and back-end operation and maintenance management; in L2, driving safety and energy-efficient driving; in L4, platooning, intelligent altitude, and energy supply, etc.

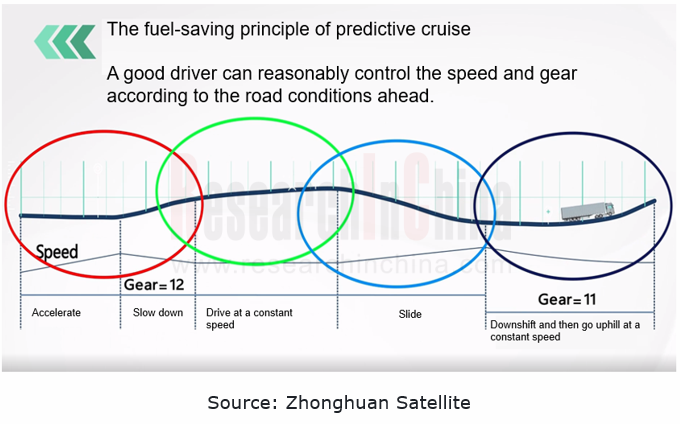

For example, the predictive cruise P-BOX developed by Zhonghuan Satellite reserves a HD map interface on its T-BOX. With a built-in ADAS map and the predictive cruise control (PCC), the optimal control over the vehicle can save fuel and relieve much driver's fatigue without changing driving behaviors or vehicle powertrain matching.

3. For suppliers, using T-Box to build a telematics platform will become mainstream.

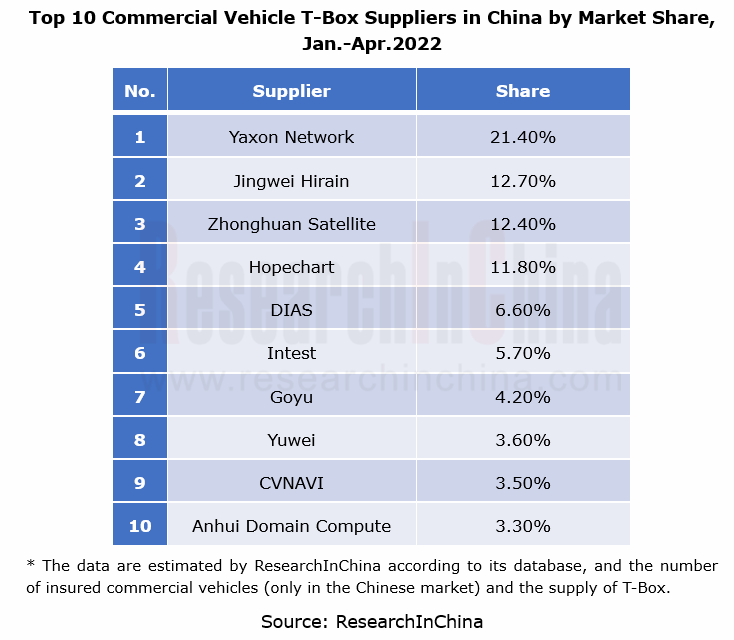

There are a large number of commercial vehicle T-Box suppliers in China, including bellwethers like Yaxon Network, Hopechart, Zhonghuan Satellite and Jingwei Hirain. Yaxon Network boasts a wide customer base, covering Foton, BYD, King Long and Yutong. Hopechart supports Dongfeng Motor and Shaanxi Automobile. Zhonghuan Satellite is a supplier to FAW Jiefang, Dongfeng Motor, SAIC Hongyan, Sinotruk and the like. Jingwei Hirain's major customers are FAW Jiefang, Sinotruk and JMC.

In their efforts to improve the integration of T-Box hardware with 4G/5G, C-V2X, high-precision positioning and other modules, Chinese mainstream T-Box vendors are also striving to build telematics platforms for an expansion from hardware to data services, with the ultimate purpose of commercial vehicle telematics solutions that integrate software and hardware.

Yaxon Network

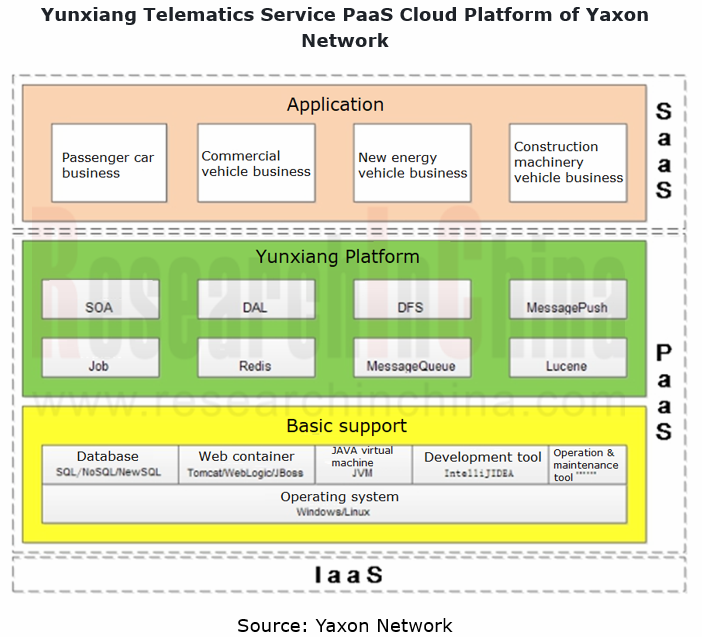

Yaxon Network's Yunxiang Telematics Service PaaS Cloud Platform supports concurrent services for tens of millions of vehicle terminals, and allows intelligent storage, mining and application of massive data.

Features of the Platform

Features of the Platform

High concurrent access: easy to expand, concurrent access for tens of millions of vehicles

- Big data storage: easy to store, PB-level data storage and processing capabilities

- Big data analysis: driving behavior analysis, active security and other big data mining functions

- On-demand customization: flexible enough secondary development capabilities, quick response to customization needs

- Flexible expansion: elastic expansion, soft load or hard load for smooth system expansion

Performance indicators

Performance indicators

-

Concurrency: the system enables concurrent access for tens of millions of vehicles, and a single server allows concurrency of 30,000 vehicle terminals.

-

Storage: the system can support PB-level data storage and a data increment of 10TB per day.

-

Throughput: the system processes up to 500,000 transactions per second.

Availability: not less than 99.9%.

Jingwei Hirain

Based on 4G/5G/V2X communication, Jingwei Hirain's commercial vehicle telematics system connects intelligent vehicles with data backstage and establishes fleet scheduling & monitoring system, fleet remote driving system, CVIS, and on-site operation and maintenance management information system, in a bid to realize automated operation management in the whole process from fleet departure and operation to final run and return to garage.

Zhonghuan Satellite

The commercial vehicle telematics platform developed by Zhonghuan Satellite based on intelligent terminal hardware boasts 1,000+ items of telematics data, including 200+ items of vehicle raw data, 500+ items of label data preprocessed by terminals, and 300+ items of scenario data deeply processed by model algorithms. The advanced big data algorithms help to output a range of functions such as vehicle fuel consumption analysis, dedicated operating line analysis, regional driving behavior statistics, service station heat location selection, vehicle failure statistics, truck driver profiling, and comprehensive vehicle operation efficiency, so as to build all-round commercial vehicle intelligent connected big data output capabilities.

By virtue of the four core capabilities, independent development and production of intelligent connected sensors, full life cycle telematics construction, human-vehicle-road-goods cooperation big data analysis and processing, and AI algorithms based on logistics scenarios, Zhonghuan Satellite is committed to providing intelligent truck solutions to empower the logistics industry. It has helped 10 mainstream commercial vehicle manufacturers, more than 10 provincial traffic and transportation authorities, and hundreds of logistics and ecological enterprises to launch commercial vehicle intelligent connected service solutions, and has served more than 2.6 million commercial vehicles.

The intelligent terminals with T-Box as the core favor wide adoption of big data, cloud computing and AI in commercial vehicles. The continuous efforts to excavate and improve value of information will not only bring lower cost and higher efficiency to companies in real terms, but also assist automakers achieving management transition from a decentralized to intensive way and building platforms that offer transparent information instead of data silos.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...