ResearchInChina released "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022". This report combs through and summarizes status quo (installations, installation rate), function application, market layout, development trends, etc. of leading conventional OEMs in China in the current ADAS and autonomous driving market.

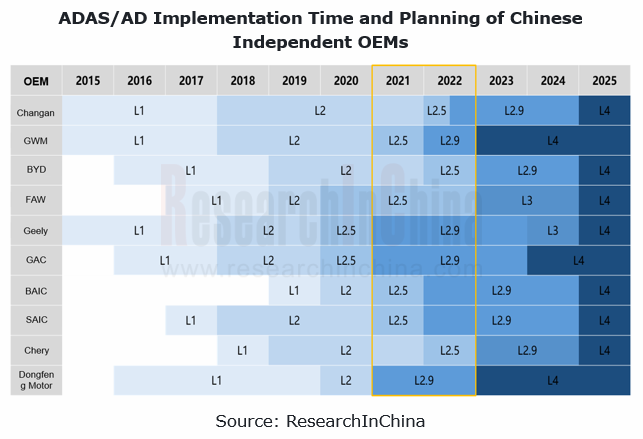

Chinese independent brands plan implementation of L4 autonomous driving in 2024/2025

This report sorts out the autonomous driving development plans and product implementation of each company. In terms of L4 autonomous driving, they set almost the same goal: implementation in 2024/2025.

In its strategy "Smart Geely 2025", Geely proposes commercialization of L4 autonomous driving, complete mastery of L5 autonomous driving, and realization of full-stack self-development in 2025.

In its strategy "Smart Geely 2025", Geely proposes commercialization of L4 autonomous driving, complete mastery of L5 autonomous driving, and realization of full-stack self-development in 2025.

GAC will release a strategic model (AH8) in 2024, which will be based on Huawei's MDC810 platform and support L4 autonomous driving.

GAC will release a strategic model (AH8) in 2024, which will be based on Huawei's MDC810 platform and support L4 autonomous driving.

In April 2022, HAOMO.AI, an autonomous driving subsidiary of Great Wall Motor, announced its roadmap for HPilot, an intelligent driving product for passenger cars, and the plan of launching HPilot 4.0 in 2023, a product that supports L4 autonomous driving.

In April 2022, HAOMO.AI, an autonomous driving subsidiary of Great Wall Motor, announced its roadmap for HPilot, an intelligent driving product for passenger cars, and the plan of launching HPilot 4.0 in 2023, a product that supports L4 autonomous driving.

Following their progressive development strategy, Chinese independent brands have kept rolling out vehicle models with L0-L2.9 functions. In sales’ term, their performance also shines.

Chinese independent brands have been in the battle position of L2 ADAS and launch an offensive in L2.5/2.9.

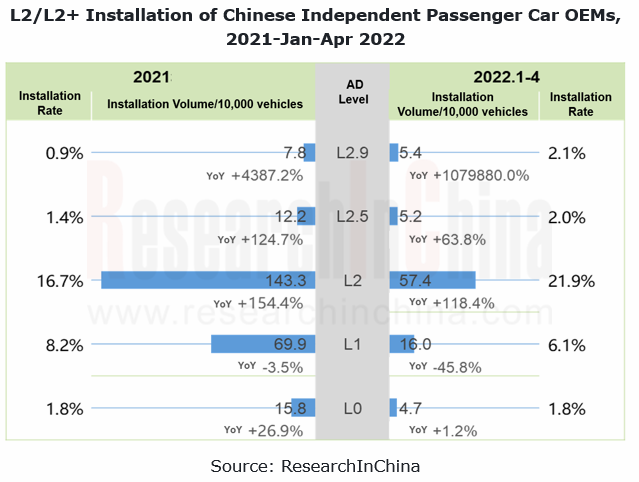

ResearchInChina’s data show that Chinese independent brands had 2.489 million vehicles equipped with ADAS functions in 2021 (installation rate: 29.1%), an upsurge of 69.6% year on year; from January to April 2022, the ADAS installations sustained growth, up from 636,000 vehicles in the same period of the previous year to 887,000 units (installation rate: 33.9%). It is clear that the ADAS installation has not been hampered by negative factors such as the epidemic or chip shortage, but instead taken a big step forward.

From sub-functions, it can be seen that with the battle position in L2 ADAS, Chinese independent brands go on the offensive in L2.5/L2.9. In 2021, Chinese auto brands gradually doubled down on L2, and thus enjoyed growth in both installations and installation rate. Between January and April 2022, L2 installations soared by 118.4% on the previous year to 574,000 units, and the installation rate also reached 21.9%; the installations of L2.5 and L2.9 surged to 106,000 units, and the combined installation rate rose to 4.1%.

Around 2021, quite a few OEMs such as Changan, GWM and BYD added the lane change turn signal capability, plus TJA+ICA+LKA, enabling highway assist (HWA), which meant they stepped into L2.5 autonomous driving. Furthermore, the upgrade of HD maps and sensors empowers vehicles with the function of navigation guided pilot (NGP) or navigate on pilot (NOP), realizing the L2.9 autonomous driving function. Examples include WEY Mocha, Lynk & Co 01EM-F and new ARCFOXαS HI version.

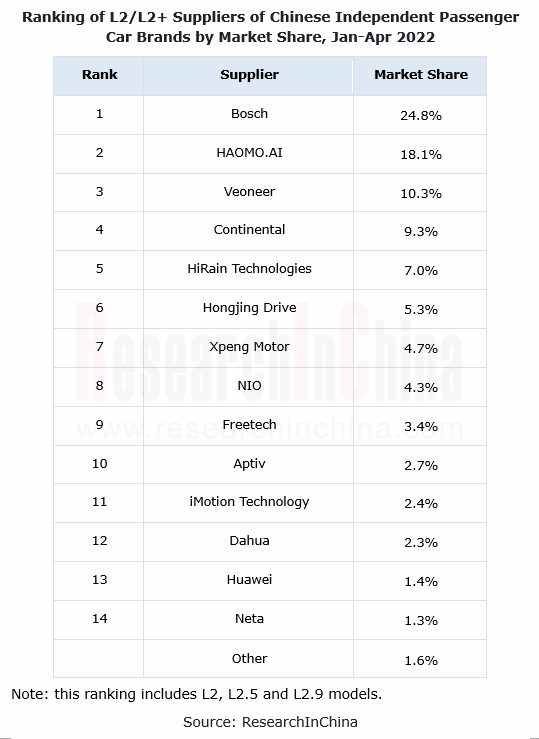

BYD is way ahead in L2 ADAS market, and local suppliers follow local OEMs to rise.

As of April 2022, among all the Chinese independent competitors (including emerging carmakers), 47 and 14 brands have delivered L2 and L2.5 models to users, respectively, of which BYD, Haval and Geely were at the forefront.

Entering 2022, BYD still gains popularity in market, becoming a sought-after brand among multiple consumers. The average monthly installations of L2 in Song PLUS and Han models outnumber 10,000, helping BYD to claim the top spot on the OEMs’ ranking list by L2 installations.

The boom of Chinese independent OEMs in the L2 passenger car market has also boosted local L2 suppliers, among which HAOMO.AI, Jingwei HiRain Technologies, Hongjing Drive and Freetech among others lead the way.

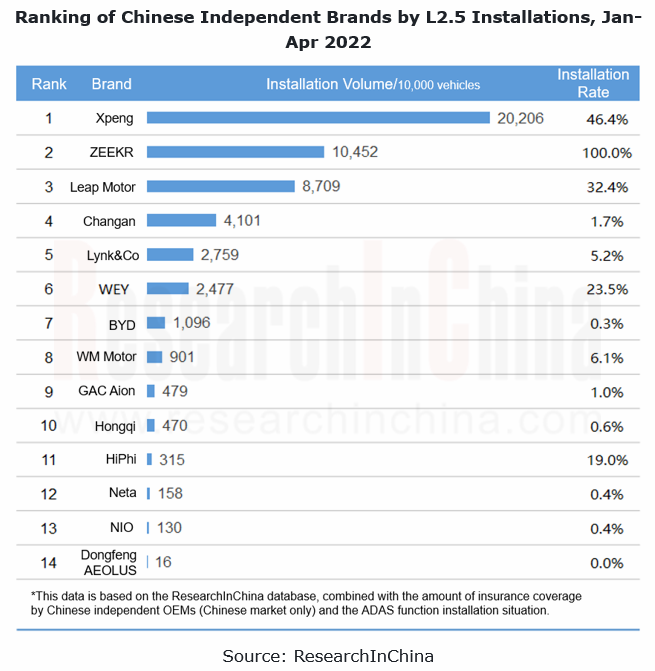

In the L2.5 camp, there are few companies, 14 in total, having actually delivered cars to users, of which 5 are conventional brands. From both installations and installation rate, it can be said that GWM WEY is an outstanding typical conventional automaker in L2.5.

Thanks to the full-stack self-development of autonomous driving algorithms of Great Wall Motor's autonomous driving subsidiary HAOMO.AI, the full range of WEY Mocha models rolled out in May 2021 carry standard L2.5 functions, gaining the lead in the industry. In addition, in April 2022 BYD introduced 2022 Han, a model equipped with highway assist (HWA) and interactive lane change assist (ILCA) systems. This model is expected to be a trump card for BYD to forge into the L2.5 market.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...