China Passenger Car Brake-by-Wire and AEB Market Research Report, 2022

-

July 2022

- Hard Copy

- USD

$4,200

-

- Pages:301

- Single User License

(PDF Unprintable)

- USD

$4,000

-

- Code:

SY002

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$6,000

-

- Hard Copy + Single User License

- USD

$4,400

-

Brake-by-wire research: with an astonishing growth in installation rate, One-Box has commanded much more of the market.

In new energy vehicles, especially intelligent vehicles, the bake-by-wire technology plays an irreplaceable, important role in regardless of intelligent driving systems or various control systems. Brake-by-wire system that replaces vacuum booster with electronic booster is a solution to the lack of stable vacuum sources in new energy vehicles, and is capable of recovering energy, a crucial function to increase the cruising range of new energy vehicles. As autonomous driving technologies gain ever greater popularity, brake-by-wire becomes more superior in quick response and precise execution, and is serving as a key factor to facilitate electrified and intelligent upgrades of vehicles.

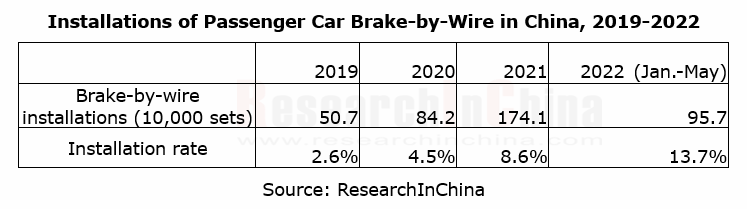

In current stage, brake-by-wire is still in its infancy, still with a low overall penetration. Yet the installation rate of brake-by-wire in new energy vehicles is relatively high. According to our statistics, the installation rate of brake-by-wire in passenger cars in China reached 8.6% in 2021 compared with 2.6% in 2019. The soaring EV sales in China drove the installation rate of brake-by-wire to 13.7% in the first five months of 2022.

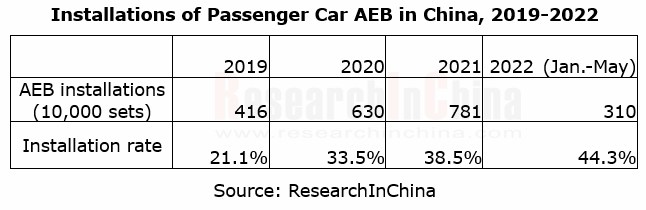

As well as brake-by-wire, AEB and AUTOHOLD, the other two functions related to Braking System, also boasted surging installation rates. In the first five months of 2022, the penetration rate of AEB in China's passenger car market reached up to 44.3%.

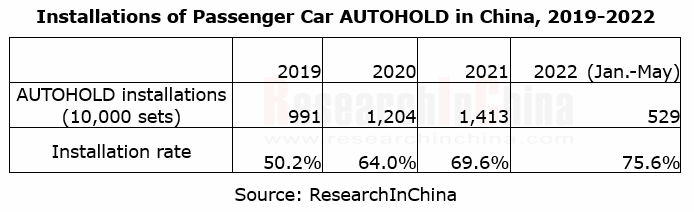

In the first five months of 2022, the penetration rate of AUTOHOLD in China's passenger car market hit 75.6%.

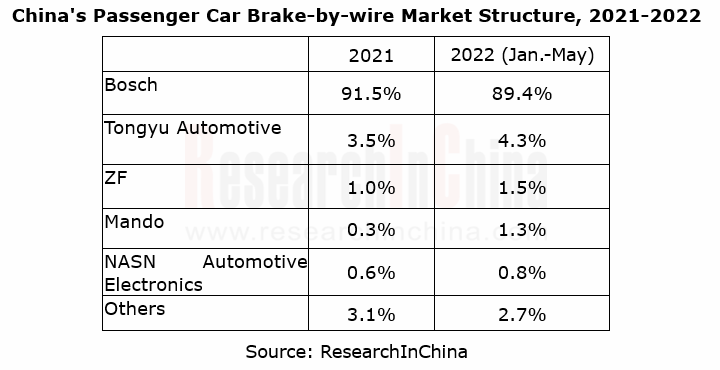

Bosch takes a lion’s share, and Chinese suppliers are expanding their shares.

Our statistics shows that Bosch swept 91.5% of China’s passenger car brake-by-wire market in 2021, a figure edging down to 89.4% in the first five months of 2022. The market shares of Tongyu Automotive, ZF, Mando and NASN Automotive Electronics all rose.

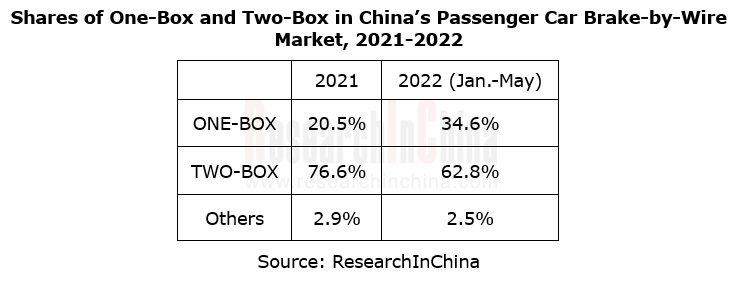

Two-Box still prevails in the brake-by-wire market, and One-Box gathers pace.

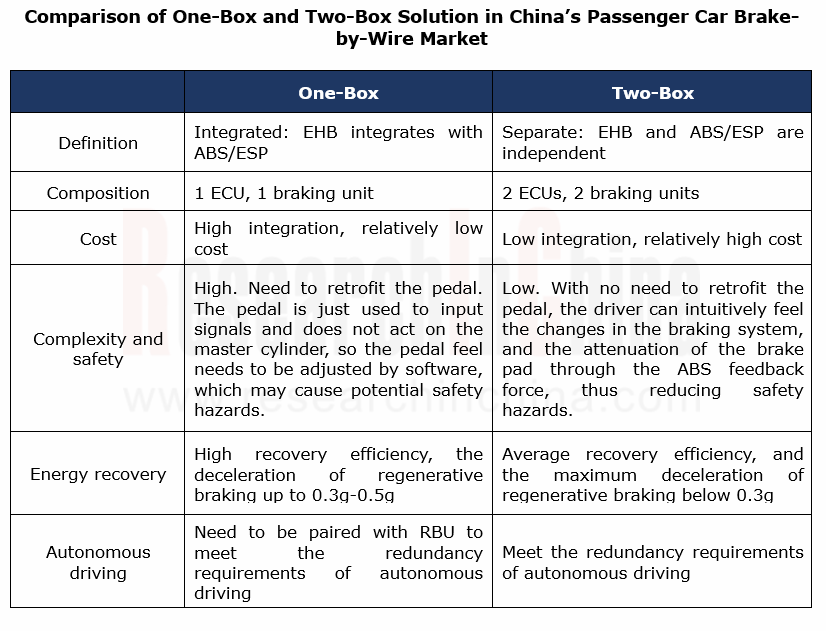

The Two-Box solution with independent electronic booster and ESP/ABS features lower integration and higher price. In the One-Box solution, the integration of electronic booster and ESP/ABS leads to high complexity and potential safety hazards, so an RBU (Redundant Brake Unit) needs to be added to meet the redundancy requirements.

Our data indicate that Two-Box is still a mainstay in the brake-by-wire market, but its market share fell from 76.6% in 2021 to 62.8% in the first five months of 2022, while the share of One-Box jumped from 20.5% to 34.6%.

1 Overview of Automotive Brake Industry

1.1 Overview of Automotive Brake Industry

1.1.1 Preface

1.1.2 Definition of Automotive Braking System

1.1.3 Classification of Automotive Braking Systems

1.1.4 Conventional Automotive Braking System Products: Drum Brake

1.1.5 Conventional Automotive Braking System Products: Disc Brakes

1.1.6 Conventional Automotive Braking System Products: Vacuum Booster

1.1.7 Conventional Automotive Braking System Products: Brake Master Cylinder & Wheel Cylinder

1.1.8 Conventional Automotive Braking System Products: Parking Brake

1.1.9 Conventional Automotive Braking System Products: AutoHold

1.1.10 Conventional Automotive Braking System Products: ABS

1.1.11 Conventional Automotive Braking System Products: EPB

1.1.12 Conventional Automotive Braking System Products: Relationship between EPB and AutoHold

1.1.13 Conventional Automotive Braking System Products: ESC

1.1.14 Development Directions of Automotive Braking System

1.2 Automotive Brake-by-wire System

1.2.1 Automotive Brake-by-wire System

1.2.2 Automotive Brake-by-wire System: EHB

1.2.3 Automotive Brake-by-wire System: Two Technology Routes of EHB

1.2.4 Automotive Brake-by-wire System: EMB

1.2.5 Automotive Brake-by-wire System: Status Quo and Development Trends of EMB

1.2.6 Automotive Brake-by-wire System: Horizontal Comparison between EMB and EHB

1.2.7 Automotive Brake-by-wire System: Global Tier 1 Suppliers

1.2.8 Automotive Brake-by-wire System: Chinese Independent Tier 1 Suppliers

1.3 Installation of Passenger Car AUTOHOLD

1.3.1 Installations and Installation Rate of Passenger Car AUTOHOLD, 2019-2025E

1.3.2 TOP15 Brands by Passenger Car AUTOHOLD Installations and Their Installation Rates, 2021/2022

1.3.3 TOP30 Vehicle Models by Passenger Car AUTOHOLD Installations, 2021/2022

1.3.4 Installations and Installation Rate of Passenger Car AUTOHOLD (by China-made/Joint Venture), 2021/2022

1.3.5 Installations and Installation Rate of Passenger Car AUTOHOLD (by Price Range), 2021/2022

1.4 Installation of Passenger Car AEB

1.4.1 Installations and Installation Rate of Passenger Car AEB, 2019-2025E

1.4.2 TOP15 Brands by Passenger Car AEB Installations and Their Installation Rates, 2021/2022

1.4.3 TOP30 Vehicle Models by Passenger Car AEB Installations, 2021/2022

1.4.4 Installations and Installation Rate of Passenger Car AEB (by Price Range), 2019-2022

1.4.5 Installations and Installation Rate of Passenger Car AEB (by China-made/Joint Venture), 2019-2022

1.5 Installation of Passenger Car Brake-by-wire System

1.5.1 Installations and Installation Rate of Passenger Car Brake-by-wire Systems, 2019-2025E

1.5.2 TOP10 Brands by Passenger Car Brake-by-wire System Installations and Their Installation Rates, 2021/2022

1.5.3 TOP15 Vehicle Models by Passenger Car Brake-by-wire System Installations, 2021/2022

1.5.4 Installations and Installation Rate of Passenger Car Brake-by-wire Systems (by China-made/Joint Venture), 2019-2022

1.5.5 Installations and Installation Rate of Passenger Car Brake-by-wire Systems (by Price Range), 2019-2022

1.5.6 Ranking of Passenger Car Brake-by-Wire Suppliers by Market Share, 2021-2022

2 Foreign Passenger Car Braking System Suppliers

2.1 Continental

2.1.1 Layout in China

2.1.2 Development Trend of Continental Automotive Braking Systems Has Changed

2.1.3 Development History of Braking System

2.1.4 MK C1 Targets Highly Automated Driving

2.1.5 MK C2 Leads the Innovation of Future Automotive Architecture Braking Systems

2.1.6 MK C2 Integrated Brake-by-wire System

2.1.7 Technical Highlights of MK C2 Integrated Brake-by-wire System

2.1.8 MK Cx HAD Redundant Brake-by-Wire System

2.1.9 MK C2 Integrated Brake-by-Wire System Products

2.1.10 DIAS Automotive Electronic Systems and Continental Jointly Promoted Implementation of Two-Box

2.1.11 Production & R&D Layout in the Capacity of 1 Million Sets of MK C2

2.1.12 Application of Brake Products

2.1.13 Future Planning and Layout in Braking System

2.2 Robert Bosch

2.2.1 Layout in China

2.2.2 Development History of Automotive Braking System

2.2.3 Classification of Braking Systems

2.2.4 The Latest Antilock Braking System (ABS): Version 9.2

2.2.5 The Latest ESP System: Version 9.3

2.2.6 Application of ABS Integrating with ESP, ADAS, etc.

2.2.7 iBooster System

2.2.7 iBooster System Technology Route

2.2.8 iBooster + ESP

2.2.9 iBooster IPB

2.2.10 Production & R&D Layout in Braking System

2.2.11 Main Customers and Application Vehicle Models of iBooster System Products

2.2.12 Mass Production and Application of Braking System Products

2.2.13 Future Planning and Layout in Automotive Braking System

2.3 ZF

2.3.1 Layout in China

2.3.2 Development History of Automotive Braking System

2.3.3 New Automotive Braking System: EBB

2.3.4 Integrated Brake Control System (IBC)

2.3.5 2nd-generation Brake-by-wire System

2.3.6 Automotive Braking System Products

2.3.7 Production & R&D Layout in Braking System

2.3.8 Main Customers and Application Vehicle Models of Braking System Products

2.3.9 Mass Production and Application of Braking System Products

2.3.10 Future Planning and Layout in Automotive Braking System

2.4 Hitachi Astemo

2.4.1 Layout in China

2.4.2 Development History of Automotive Braking System

2.4.3 Automotive Braking System Products

2.4.4 E-ACT

2.4.5 Automotive Parking Brake System: APB

2.4.6 Automotive Parking Brake Systems and Products

2.4.7 Production & R&D Layout in Braking System

2.4.8 Main Customers and Application Vehicle Models of Braking System Products

2.4.9 Mass Production and Application of Braking System Products

2.4.10 Future Planning and Layout in Automotive Braking System

2.5 Brembo

2.5.1 Layout in China

2.5.2 Development History of Braking System

2.5.3 Automotive Braking System Products

2.5.4 GREENTIVE Brake Disc

2.5.5 Enesys Energy Saving System

2.5.6 Brake-by-Wire Solutions

2.5.7 Production & R&D Layout in Braking System

2.5.8 Mass Production and Application of Braking System Products

2.5.9 Future Planning and Layout in Automotive Braking System

2.6 ADVICS

2.6.1 Layout in China

2.6.2 Development History of Braking System

2.6.3 Braking System Products

2.6.4 Electronically Controlled Brake System: ECB2

2.6.5 Brake Assist (BA) System and Regenerative Coordinated Brake System

2.6.6 Braking Systems: ADS-A2 & ADS-V2G

2.6.7 Production & R&D Layout in Braking System

2.6.8 Mass Production and Application of Braking System Products

2.6.9 Future Planning and Layout in Automotive Braking System

2.7 Mando

2.7.1 Layout in China

2.7.2 Development History of Braking System

2.7.3 Automotive Braking System Products

2.7.4 AHB III & IDB

2.7.5 MGH-100

2.7.6 IDB2 HAD

2.7.7 Production & R&D Layout in Braking System

2.7.8 Mass Production and Application of Brake Products

2.7.9 Future Planning and Layout in Automotive Braking System

3 Chinese Passenger Car Braking System Suppliers

3.1 GLOBAL Technology

3.1.1 Profile

3.1.2 Development History

3.1.3 Braking System Product: GIBS

3.1.4 Integrated Brake-by-wire System: GIBC

3.1.5 Important Redundant Braking System: EPB

3.1.6 Important Chassis Domain Controllers

3.1.7 Comparison between Two-box and One-box

3.1.8 Brake Control System Products

3.1.9 Production & R&D Layout in Braking System

3.1.10 Capital Support

3.1.11 Application and Customers of Braking System Products

3.1.12 Future Planning and Layout in Automotive Braking System

3.2 Trinova Technology

3.2.1 Profile

3.2.2 Development History

3.2.3 Passenger Car Brake-by-wire System

3.2.4 T-IBC & T-EPB & TBS

3.2.5 ABS & ESC/EPBi & Sensor

3.2.6 Production & R&D Layout in Automotive Braking System

3.2.7 Capital Support

3.2.8 Applications and Customers of Automotive Braking System Products

3.2.9 Future Planning and Layout in Automotive Braking System

3.3 Tongyu Technology

3.3.1 Profile

3.3.2 Development History of Automotive Braking System

3.3.3 Automotive Electronic Hydraulic Brake-by-wire System: EHB

3.3.4 Automotive Autonomous Emergency Braking System (AEB)

3.3.5 Automotive Braking System Products

3.3.6 Production & R&D Layout in Automotive Braking System

3.3.7 Capital Support

3.3.8 Applications and Customers of Automotive Braking System Products

3.3.9 Future Planning and Layout in Automotive Braking System

3.4 NASN Automotive Electronics

3.4.1 Profile

3.4.2 Development History of Automotive Braking System

3.4.3 NBooster Intelligent Braking System

3.4.4 Electronic Stability Control System (ESC)

3.4.5 Chassis Domain Controller: NXU

3.4.6 NBooster+ESC Redundant Brake-by-Wire Solution

3.4.7 Production & R&D Layout in Automotive Braking System

3.4.8 Capital Support

3.4.9 Application and Customers of Automotive Braking System Products

3.4.10 Future Planning and Layout in Automotive Braking System

3.5 KUNTYE Vehicle System

3.5.1 Profile

3.5.2 Development History of Automotive Braking System

3.5.3 Automotive Braking System Products

3.5.4 EBOOSTER

3.5.5 EPB CALiper

3.5.6 Automotive Brake Corner Modules

3.5.7 Production & R&D Layout in Automotive Braking System

3.5.8 Application and Customers of Automotive Braking System Products

3.5.9 Future Planning and Layout in Automotive Braking System

3.6 Zhejiang Asia-Pacific Mechanical & Electronic

3.6.1 Profile

3.6.2 Development History

3.6.3 Production Layout

3.6.4 Operation

3.6.5 Presiding over Formulation of Industry Standards

3.6.6 Main Products - Transmission and Brake Products

3.6.6 Main Braking System Products

3.6.7 Relationship between Products and Core Customers

3.6.8 Brake-by-Wire Layout

3.7 Zhejiang VIE Science & Technology

3.7.1 Profile

3.7.2 Development History

3.7.3 Strategic Layout and Production and R&D Bases

3.7.4 Operation and Operating Revenue

3.7.5 Main Braking System Products

3.8 Bethel Automotive Safety Systems

3.8.1 Profile

3.8.2 Development History

3.8.3 Production and R&D Bases

3.8.4 Main Braking System Products

3.8.5 WCBS & EPB & ESC

3.8.6 Production and R&D Layout in Braking System

3.8.7 Future Planning and Layout in Braking System

3.9 Wanxiang Qianchao

3.9.1 Profile

3.9.2 Conventional Braking System Products

3.9.3 Electronic Brake Booster (QBooster) for Braking System

3.9.4 Production & R&D Layout in Braking System

3.9.5 Future Planning and Layout in Automotive Braking System

3.10 Tuopu Group

3.10.1 Profile

3.10.2 Development History

3.10.3 Automotive Braking System Products

3.10.4 Intelligent Braking System: IBS-PRO

3.10.5 Production & R&D Layout in Automotive Braking System

3.10.6 Future Planning and Layout in Automotive Braking System

3.11 Nanjing JWD Automotive Technology

3.11.1 Profile

3.11.2 Development History

3.11.3 Production & R&D Layout

3.11.4 iCAS-Brake

3.11.5 ICAS-AEB

3.11.7 Capital Support

3.11.8 Future Planning and Layout in Braking System

3.12 Shanghai Huizhong Automobile Manufacturing

3.12.1 Profile

3.12.2 Development History

3.12.3 Production & R&D Layout

3.12.4 Distribution of Braking System Customers

3.12.5 Future Planning and Layout in Braking System

4 Automotive Braking System Layout of Passenger Car OEMs

4.1 Braking Systems of Geely

4.1.1 Braking System, AEB and Collision Avoidance System of Main Vehicle Models

4.1.2 Four Collision Avoidance Modes of Typical Vehicle Models

4.1.3 Cooperation, Layout and Planning in Braking System

4.2 Braking Systems of BYD

4.2.1 Braking Systems of Main Vehicle Models

4.2.2 Active Safety System of Typical Model Han

4.2.3 Cooperation, Layout and Planning in Braking System

4.3 Braking Systems of Great Wall Motor

4.3.1 Braking Systems of Main Vehicle Models

4.3.2 Active Safety Systems of Typical Vehicle Models

4.3.3 Cooperation, Layout and Planning in Braking System

4.4 Braking Systems of Changan Automobile

4.4.1 Braking Systems of Main Vehicle Models

4.4.2 Active Safety System of Typical Model UNI-V

4.4.3 Cooperation, Layout and Planning in Braking System

4.5 Braking Systems of SAIC Motor Passenger Vehicle

4.5.1 Braking Systems of Main Vehicle Models

4.5.2 Active Safety System of Typical Model Roewe RX

4.5.3 Cooperation, Layout and Planning in Braking System

4.6 Braking Systems of Chery

4.6.1 Braking Systems of Main Vehicle Models

4.6.2 Active Safety System of Typical Model Tiggo 8

4.6.3 Cooperation, Layout and Planning in Braking System

4.7 Braking Systems of FAW Hongqi

4.7.1 Braking Systems of Main Vehicle Models

4.7.2 Collision Mitigation Systems of Typical Vehicle Models

4.7.3 Cooperation, Layout and Planning in Braking System

4.8 Braking Systems of Voyah

4.8.1 Braking Systems of Main Vehicle Models

4.8.2 Active Safety System of Typical Model FREE

4.8.3 Cooperation, Layout and Planning in Braking System

4.9 Braking Systems of NIO

4.9.1 Braking Systems of Main Vehicle Models

4.9.2 Active Safety Configuration of Typical Model ES8

4.9.3 Cooperation, Layout and Planning in Braking System

4.10 Braking Systems of Xpeng Motors

4.10.1 Braking Systems of Main Vehicle Models

4.10.2 Intelligent Driving Assistance System of Typical Model P7

4.10.3 Cooperation, Layout and Planning in Braking System

4.11 Braking Systems of Li Auto

4.11.1 Braking Systems of Main Vehicle Models

4.11.2 Full-stack Self-developed AEB of Typical Model L9

4.11.3 Cooperation, Layout and Planning in Braking System

4.12 Braking Systems of Leapmotor

4.12.1 Braking Systems of Main Vehicle Models

4.12.2 FCW and AEB of Typical Vehicle Models

4.12.3 Cooperation, Layout and Planning in Braking System

4.13 Braking Systems of HiPhi

4.13.1 Braking Systems of Main Vehicle Models

4.13.2 Active Safety Systems of Vehicle Models

4.13.3 Cooperation, Layout and Planning in Braking System

4.14 Braking Systems of Tesla

4.14.1 Braking Systems of Main Vehicle Models

4.14.2 Active Safety Systems of Typical Vehicle Models

4.14.3 Cooperation, Layout and Planning in Braking System

5. Passenger Car Braking Industry Development Trend

5.1 Automotive “Electrification, Intelligence, Lightweight, and Connectivity” Promote the Development of Brake-by-wire

5.2 Brake-by-wire System (EHB) Layout of Mainstream Passenger Car OEMs in China

5.3 Automotive Brake-by-wire System: Development Trends

5.4 Trend 1

5.5 Trend 2

5.6 Trend 3

5.7 Trend 4

5.8 Trend 5

5.9 Trend 6

5.10 Trend 7

5.11 Trend 8

5.12 Trend 9

5.13 Trend 10

5.14 Trend 11

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...