Automotive HUD research: AR HUD is being largely mounted on vehicles, and local suppliers lead the way.

1. AR HUD is being used widely, with 35,000 vehicles equipped in the first half of 2022.

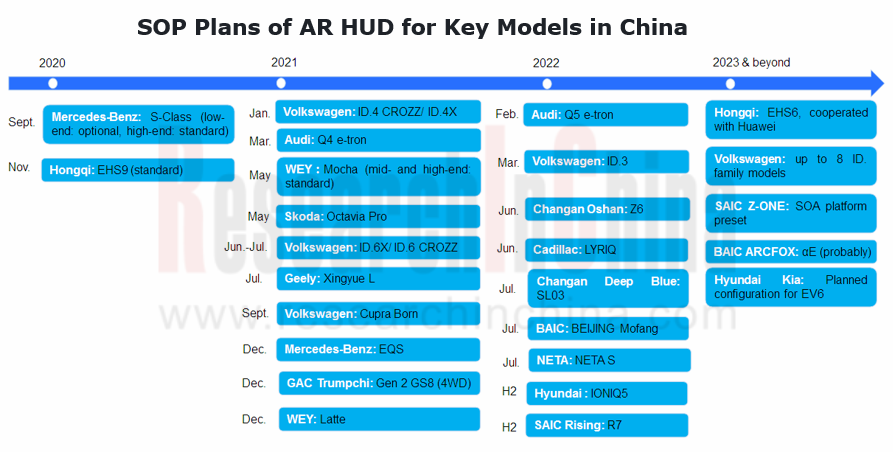

Since 2021, AR HUD has been installed in multiple new vehicle models, including Mercedes-Benz S-Class, Hongqi E-HS9, Great Wall Mocha, Geely Xingyue L, Volkswagen ID Series, GAC Trumpchi GS8, BAIC Mofang and Rising R7.

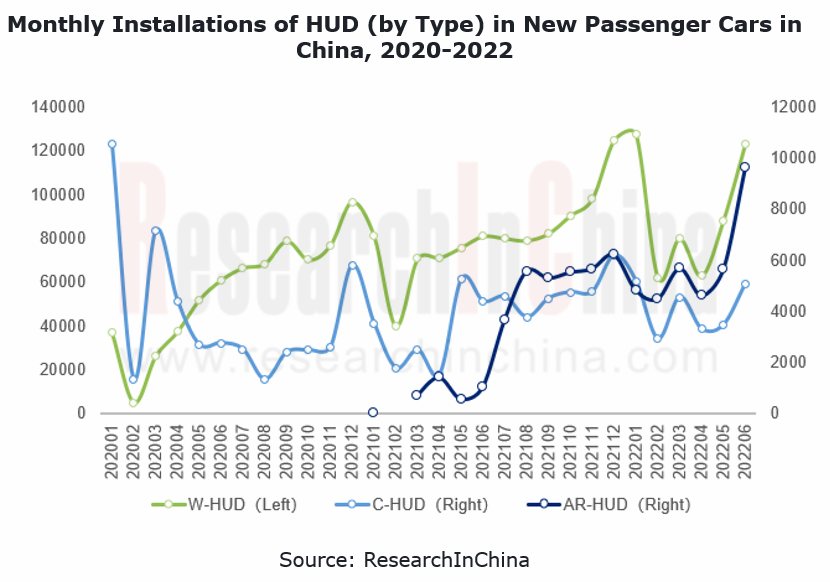

According to ResearchInChina, in the first half of 2021, 603,000 new passenger cars in China were equipped with HUD (C/W/AR), a like-on-like upsurge of 36.2%, of which 35,000 units packed AR-HUD, sharing 5.8% of the total, up 5.0 percentage points from the prior-year period.

From the monthly trend, it can be seen that the installations of AR HUD have been rising since mass production in early 2021, and began to surge in April 2022 after first outnumbering C-HUD in August 2021.

2. PGU becomes the key technology for realizing mass production of AR HUD.

At present, although many an OEM has launched AR HUD-enabled models, almost all of them are testing water on small scale. As for wide adoption, such problems as image distortion, sunlight inversion, high cost, and large size have yet to be solved. As a core component of AR HUD, PGU has become the key solution to the above problems.

There are four PGU technologies: TFT-LCD, DLP, LCOS, and laser scanning projection (LSP). Wherein, TFT-LCD and DLP are the mainstream solutions used in the current AR HUD-enabled production vehicle models in China. Volkswagen ID Series, Hongqi E-HS9 and WEY Mocha among others all bear TFT-LCD solutions. The DLP technology monopolized by TI delivers good imaging effects but its cost is high. The applied models include Mercedes-Benz S-Class and the 2nd-generation GAC Trumpchi GS8.

LCOS offering high resolution has made its way into the market in recent years. Typical vendors include Envisics, Huawei, ASU Tech, and Hardstone. SAIC Rising R7 released in May 2022 carries the LCOS-based AR HUD created by Huawei. The HUD features field of view of 13°*5°, luminance of 12000nits, and resolution of up to 1920×730.

MEMS laser scanning projection (LSP) is also a R&D direction for some companies like Panasonic, Pioneer and Shenzhen Dianshi Innovation Technology. In 2022, the dual-vision laser holographic AR HUD jointly developed by Panasonic and Envisics is to be first mounted on Cadillac LYRIQ. With two projection display areas, far and near, the system can display real-scene markers at the destination, real-scene navigation, forward collision warning, and lane change command.

3. Local suppliers like Foryou lead in mass production of AR HUD.

OEMs’ increasing demand for AR HUD expedites technology iteration and product commercialization by suppliers. Thereof, China’s local suppliers like Foryou Multimedia have secured multiple mass production orders.

Foryou Multimedia is a HUD leader in China. As of June 2022, the company has shipped a total of more than 560,000 units, with customers including Great Wall Motor, Changan Automobile, GAC, BAIC, Chery and Vietnam’s VINFAST. In late June 2022, it signed a letter of intent with Huawei on in-depth strategic cooperation on intelligent vehicle accessories, especially AR HUD.

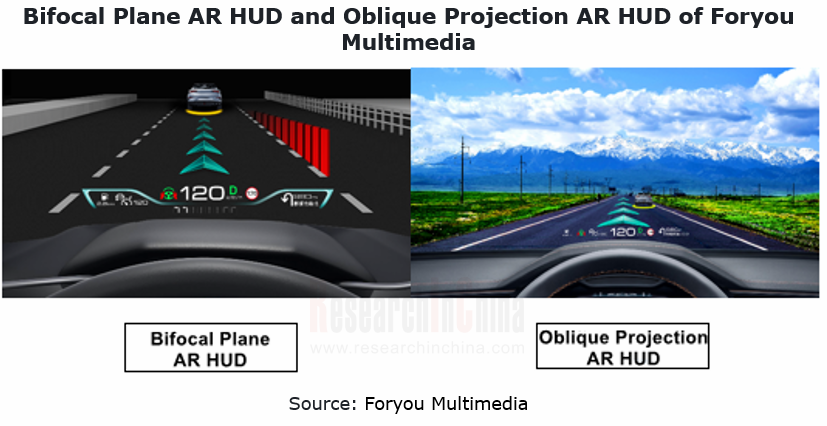

Foryou Multimedia also steps up its pace of new product iteration, having launched bifocal plane AR HUD and oblique projection AR HUD. Currently the bifocal plane AR HUD has been designated by Great Wall Motor, and the oblique projection AR HUD has been a substantive cooperative project of many automakers.

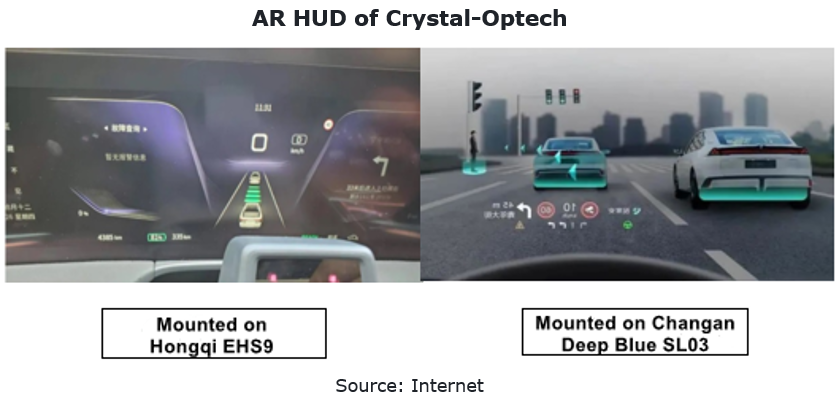

Zhejiang Crystal-Optech has partnered with quite a few OEMs to develop HUDs, and tries hard to mass-produce and market these products. Its AR HUD was produced in tiny quantities for Hongqi E-HS9 in March 2021, and was applied to Changan Deep Blue SL03 in July 2022. In the second half of 2022, Crystal-Optech is to provide HUDs including WHUD and AR HUD, for some models of Hongqi, Changan Automobile, BYD and Great Wall Motor.

4. AR HUD will be integrated with multiple vehicle systems.

AR HUD has become a new window for human-vehicle interaction, which is accompanied by the evolution of intelligent driving to L2+. It will be integrated with multiple systems from dashboard, navigation and ADAS to DMS, infotainment and V2X.

In January 2021, Qualcomm announced its 4th-generation Snapdragon Automotive Cockpit Platform, a digital cockpit solution that supports multi-ECU and multi-domain fusion, covering dashboard and cockpit, AR-HUD, infotainment, rear seat display, electronic rearview mirror and in-vehicle monitoring. The system will be first available to cars of JIDU Auto and is projected to be mass-produced and delivered in 2023.

At the CES 2022, Harman demonstrated its AR HUD technology, which combines AR vision with the voice assistant that helps to recommend nearby points of interest. This technology can intelligently activate the autonomous driving mode, or allow the driver as an AR avatar to have a meeting with colleagues. In February 2022, HARMAN acquired Apostera, aiming to use Apostera’s augmented reality (AR) and mixed reality (MR) software solutions to cement its position as a leader in the automotive AR/MR field. Before that, Apostera had provided technical support of AR HUD for Audi Q4 e-tron.

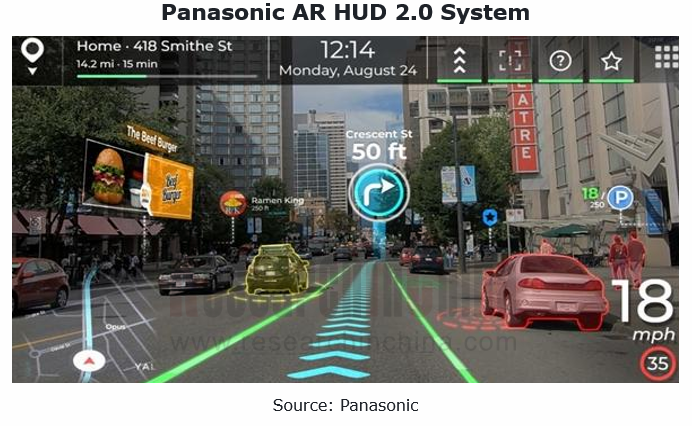

At the CES 2022, Panasonic unveiled its AR HUD 2.0 system. Powered by Panasonic’s SkipGen2, its eCockpit infotainment controller, AR HUD 2.0 adds the eye tracking system (ETS), a patented technology that enables automatic driver height adjustment, dynamic parallax compensation, dynamic auto focus and driver monitoring capability. “The Panasonic AR HUD 2.0 continues the trend of up-integration of display domains, such as Cluster and HUD, into the central infotainment compute module,” said Andrew Poliak, CTO, Panasonic Automotive Systems Company of America.

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...