China Automotive Integrated Die Casting Industry Research Report, 2022

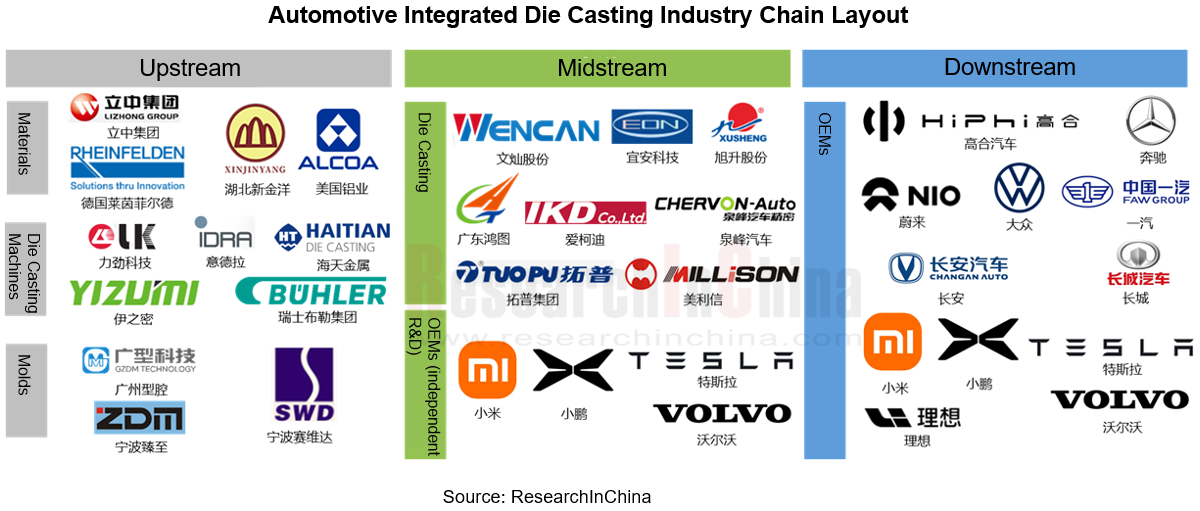

Integrated Die Casting Research: Upstream, midstream and downstream companies are making plans and layouts in this booming field

Automotive integrated die casting is an automotive manufacturing process proposed and put into practice by Tesla. It redesigns and highly integrates multiple separate and scattered small parts in the original design, then uses a large die casting machine to perform high-pressure die casting at one time, and directly produces a complete large part without the welding process. Compared with traditional automotive manufacturing, automotive integrated die casting has advantages in manufacturing cost, production efficiency, labor cost, model development cycle, performance, materials recycling, etc.

Against the traditional concept that product and process design hinges on the existing conditions and capabilities, Tesla prefers reverse thinking. Taking automotive integrated die-casting as an example, Tesla determines how large the part can be to achieve the best effect, then deduces how much equipment, tooling and materials are needed. Afterwards, it cooperates with suppliers to develop new equipment, corresponding molds, materials and new processes. This kind of thinking has greatly inspired the innovation of the traditional industry and brought upheaval and the secondary innovation to the industry.

OEMs master the know-how of integrated die casting through independent research and development

After Tesla Model Y adopted the integrated die casting process for the first time, a new wave of integrated die casting has staged worldwide. A complete industrial chain layout has been formed between upstream die casting machine manufacturers, material manufacturers and mold manufacturers, as well as midstream die-casting companies and downstream automakers.

There are currently two main business modes:

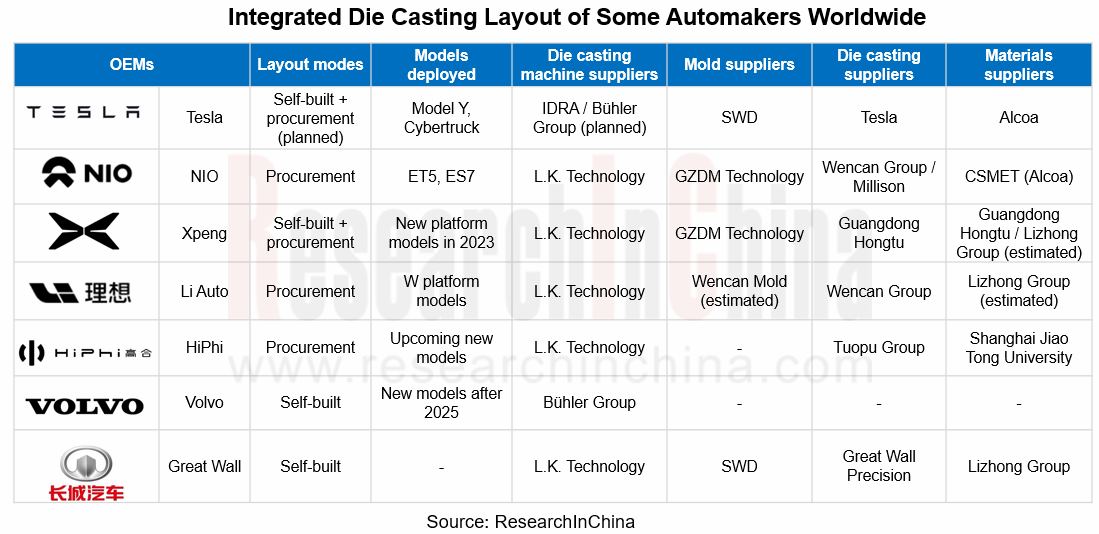

Independent research and development of OEMs: OEMs: directly purchase die casting machines, molds and materials, and then build their own factories to produce die casting parts. Tesla, Xpeng and Volvo adopt this mode.

Independent research and development of OEMs: OEMs: directly purchase die casting machines, molds and materials, and then build their own factories to produce die casting parts. Tesla, Xpeng and Volvo adopt this mode.

Procurement: OEMs directly purchase die casting parts from die-casting manufacturers who buy relevant materials to produce die casting parts and deliver them to OEMs. HiPhi, NIO and Li Auto follow this mode.

Procurement: OEMs directly purchase die casting parts from die-casting manufacturers who buy relevant materials to produce die casting parts and deliver them to OEMs. HiPhi, NIO and Li Auto follow this mode.

In the long run, automotive integrated die casting will gradually return to the procurement mode. OEMs have to invest heavily in building their own production lines, and they may be extremely concerned about the later operation and management. Tesla, the representative of the independent R&D mode, has cooperated with die casting manufacturers in order to add new capacity by outsourcing in the future. The main purpose of the OEM's self-research is to master the know-how of integrated die-casting, which is convenient for technical communication with suppliers in the future.

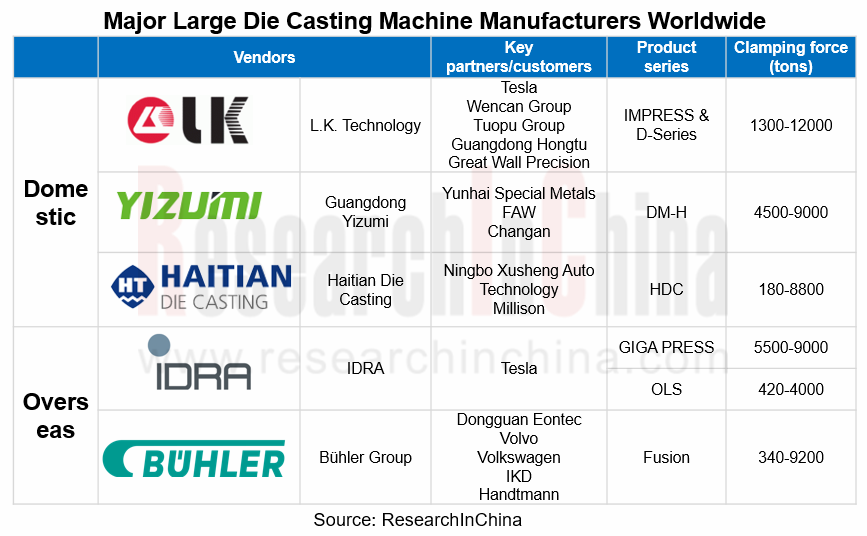

Upstream: Super-large die casting machines debuted, helping vehicle-level integrated die casting

Large die casting machines are the key to realizing automotive integrated die casting. At present, integrated die casting requires 6000T (or above) die casting machines. Globally, IDRA (a wholly-owned subsidiary of L.K. Technology), Bühler Group, as well as China-based L.K. Technology, Haitian Die Casting and Guangdong Yizumi can produce die casting machines over 6000T.

Higher-tonnage die casting machines can facilitate breakthroughs in die casting size and structure. Now, Tesla, L.K. Technology, Guangdong Hongtu, Haitian Die Casting and other companies have started research and development of die casting machines above 12,000T. In September 2022, L.K. Technology and Guangdong Hongtu successfully released a 12,000T super-large intelligent die casting unit jointly, marking the advent of world's highest-tonnage die casting machine. This is expected to boost vehicle-level integrated die-casting.

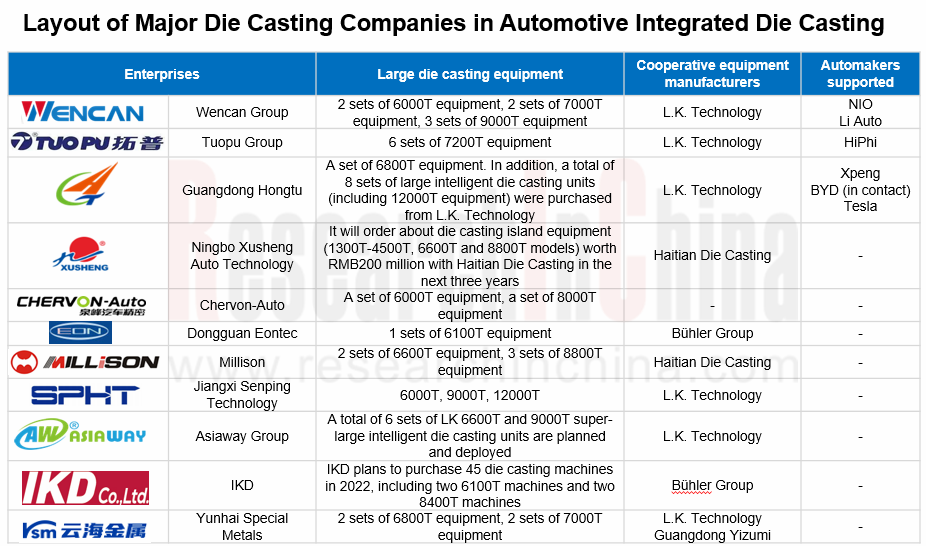

Midstream: Die casting leaders emerged

As midstream die-casting companies, Wencan Group, Tuopu Group, Guangdong Hongtu, Xusheng Auto Technology, Millison, etc., have deployed automotive integrated die casting by purchasing large die casting equipment and cooperating with automakers.

Currently, Wencan Group, Tuopu Group and Guangdong Hongtu have first-mover advantages in experience accumulation and order intake. All three have established cooperation with automakers and successfully completed the trial production of integrated die casting parts. Especially, Guangdong Hongtu is superior to others thanks to its heat-treatment-free aluminum alloy patent and the yield rate of 85%-90%. So far, it has not only obtained the designation from Xpeng, but also become Tesla's only die casting partner in integrated die casting.

Downstream: Automakers scramble to deploy integrated die casting in a bid to integrate the upper and lower car body

At present, Tesla, NIO, Xpeng, HiPhi, Volvo, Great Wall and other automakers have made layout in the field of automotive integrated die casting.

In terms of emerging automakers, Tesla has officially delivered Model Y with integrated die casting floors. NIO ET5 with an integrated die casting rear subframe is about to be delivered. In addition, Xpeng, Li Auto and HiPhi have put integrated die casting on the agenda, and they may apply it to vehicles in 2023.

In terms of emerging automakers, Tesla has officially delivered Model Y with integrated die casting floors. NIO ET5 with an integrated die casting rear subframe is about to be delivered. In addition, Xpeng, Li Auto and HiPhi have put integrated die casting on the agenda, and they may apply it to vehicles in 2023.

As for traditional automakers, Volkswagen and Volvo have a long-term timetable for the layout of integrated die casting, and they expect to achieve mass production around 2025. Chinese automakers Changan and Great Wall have started bidding for integrated die casting projects, and they are likely to accomplish mass production in the next two to three years.

As for traditional automakers, Volkswagen and Volvo have a long-term timetable for the layout of integrated die casting, and they expect to achieve mass production around 2025. Chinese automakers Changan and Great Wall have started bidding for integrated die casting projects, and they are likely to accomplish mass production in the next two to three years.

Now, major OEMs mainly apply integrated die casting to the rear floor, the front cockpit, etc. With the advent of higher-tonnage die casting machines, integrated die casting is expected to spread to lower body assembly, upper body integrated casting parts, and even body-in-white in the future.

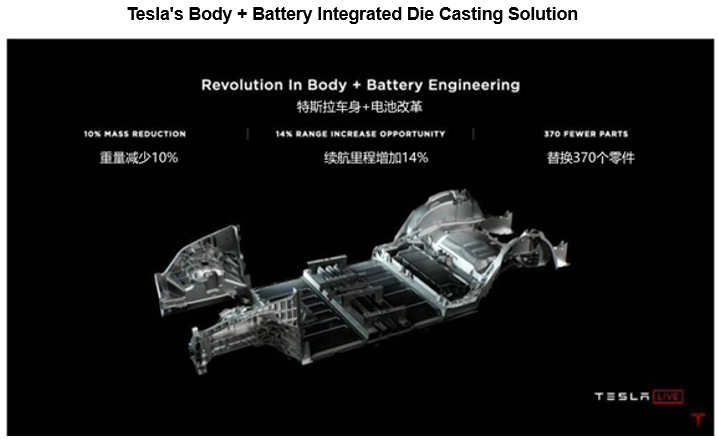

Tesla plans to replace the 370-part lower body assembly with 2-3 large die casting parts. Tesla has extended the integrated die casting to the front and rear floors. At the same time, the upper cover of the battery pack and the middle floor of the vehicle are combined into one for integrated die casting, which can reduce the vehicle weight by 10% and increase the cruising range by 14%.

In addition, Wencan Group has successfully trial-manufactured large integrated casting parts on the upper body, and it will deliver samples in small batches later.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...