Autonomous Shuttle Research: application scenarios further extend amidst policy promotion and continuous exploration

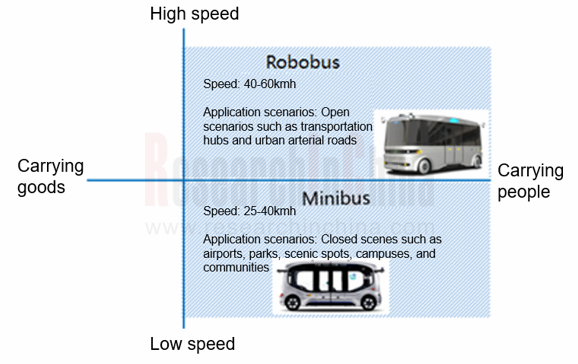

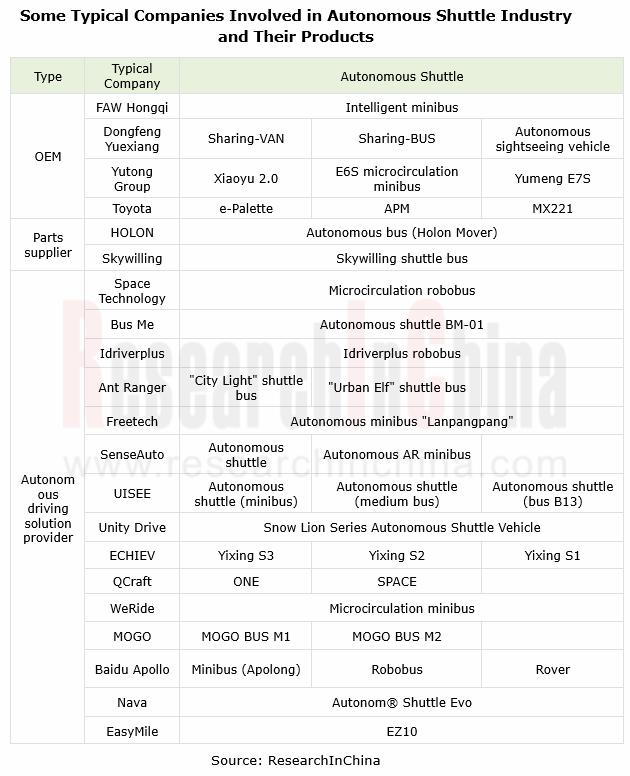

Autonomous shuttles are roughly categorized into minibuses and robobuses. Minibuses, namely micro-circulation shuttle buses, mostly work in airports, parks, scenic spots, campuses, communities and other scenarios at speeds of 25-45km/h. Typical minibuses are offered by FAW Hongqi, Baidu Apollo and UISEE.

Robobuses are autonomous minibuses running at 40-60 km/h under the control of software. They are often seen in open scenarios such as transportation hubs and urban trunk roads, and provide urban public transport services. Representative robobuses include Qcraft ONE and MOGO BUS M2.

I. Autonomous driving solution providers flood into the arena of shuttle buses.

In the arena of shuttle buses, main players embrace OEMs, auto parts companies and autonomous driving solution providers, among which L4 autonomous driving technology providers perform stunningly. For example, the robobus co-built by Shanghai Space and PIX Moving was delivered offline in March 2022, and officially began to provide short-distance shuttle services between Wangjiazhuang Subway Station and Xiantao Big Data Valley, Yubei District, Chongqing in June 2022. In July 2022, the driverless buses from Idriverplus landed in Beijing Dongsheng Science and Technology Park to start the normal operation and serve commuters in the park. In September 2022, MOGO officially released the autonomous OEM production buses - MOGO BUS M1 (autonomous minibus) and MOGO BUS M2 (autonomous bus), both equipped with the "vehicle-road-cloud integration" system.

As well robotaxises that adopt L4 technology, autonomous shuttles boast sensors such as LiDAR, radar and cameras, and combine cloud software and sensors to enable vehicle positioning, environmental perception, path planning & decision, and vehicle control & actuation. At present, many L4 technical solution providers like QCraft, UISEE, MOGO, WeRide and Baidu Apollo have laid out technology routes for both robotaxis and robobuses.

II. The operation scenarios of autonomous shuttles are extending from designated areas and low-speed scenarios to open environments and complex scenarios.

At present, autonomous shuttles are running from closed and semi-closed designated areas (parks, scenic spots, factories, communities, campuses, airports, etc.) to urban public roads as subway shuttle buses, urban microcirculation buses, and autonomous buses for ride-hailing services.

III. The current growth of the autonomous shuttle market is mainly driven by policies and smart road upgrades.

1. China, the United States, Japan, and South Korea have issued favorable policies for autonomous buses.

Japan, the United States and South Korea among other foreign countries have introduced policies to encourage the commercial operation of autonomous vehicles like autonomous shuttles.

On March 10, 2022, the National Highway Traffic Safety Administration (NHTSA) of the United States issued a first-of-its-kind final rule, the Occupant Protection Safety Standards for Vehicles Without Driving Controls, no longer requiring automated vehicle manufacturers to equip their ADS-enabled vehicles with traditional manual controls to meet crash standards.

On March 10, 2022, the National Highway Traffic Safety Administration (NHTSA) of the United States issued a first-of-its-kind final rule, the Occupant Protection Safety Standards for Vehicles Without Driving Controls, no longer requiring automated vehicle manufacturers to equip their ADS-enabled vehicles with traditional manual controls to meet crash standards.

Japan decided to allow for use of L4 autonomous vehicles (controlled by system) in transit and delivery services from April 1, 2023.

Japan decided to allow for use of L4 autonomous vehicles (controlled by system) in transit and delivery services from April 1, 2023.

South Korea proposed a goal of commercializing L4 (highly automated) autonomous buses and shuttle buses by 2025 under its “Mobility Innovation Roadmap”. On November 25, 2022, Seoul, capital of South Korea, opened the first autonomous bus line with a total mileage of about 3.4 kilometers, marking South Korea’s first step to commercialize autonomous shuttles.

South Korea proposed a goal of commercializing L4 (highly automated) autonomous buses and shuttle buses by 2025 under its “Mobility Innovation Roadmap”. On November 25, 2022, Seoul, capital of South Korea, opened the first autonomous bus line with a total mileage of about 3.4 kilometers, marking South Korea’s first step to commercialize autonomous shuttles.

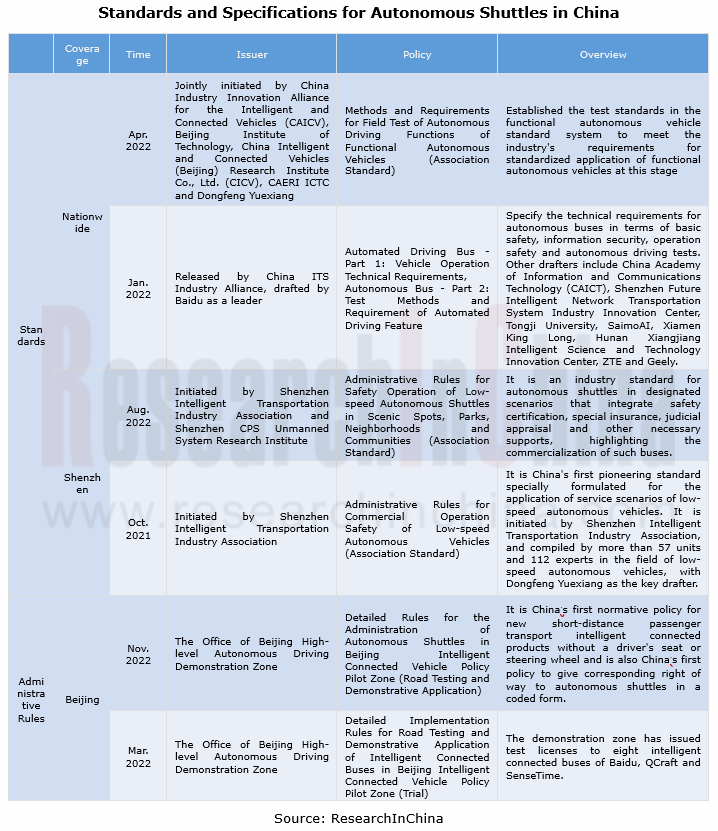

In China, Beijing, Shenzhen and other cities have standardized autonomous shuttles in terms of product standards and administration, setting an example for the development of the industry.

In January 2022, the "Automated Driving Bus” association standard jointly drafted by Baidu, China Academy of Information and Communications Technology (CAICT), ZTE and Geely was officially released. This standard covers two parts: Automated Driving Bus - Part 1: Vehicle Operation Technical Requirements, and Autonomous Bus - Part 2: Test Methods and Requirement of Automated Driving Feature. They specify the technical requirements for autonomous buses in terms of basic safety, information security, operation safety and autonomous driving tests.

In January 2022, the "Automated Driving Bus” association standard jointly drafted by Baidu, China Academy of Information and Communications Technology (CAICT), ZTE and Geely was officially released. This standard covers two parts: Automated Driving Bus - Part 1: Vehicle Operation Technical Requirements, and Autonomous Bus - Part 2: Test Methods and Requirement of Automated Driving Feature. They specify the technical requirements for autonomous buses in terms of basic safety, information security, operation safety and autonomous driving tests.

In March 2022, Beijing High-level Autonomous Driving Demonstration Zone issued the Detailed Implementation Rules for Road Testing and Demonstrative Application of Intelligent Connected Buses in Beijing Intelligent Connected Vehicle Policy Pilot Zone (Trial), posing specific administrative requirements for in-vehicle management, vehicle operation, road test, insurance and technical parameters.

In March 2022, Beijing High-level Autonomous Driving Demonstration Zone issued the Detailed Implementation Rules for Road Testing and Demonstrative Application of Intelligent Connected Buses in Beijing Intelligent Connected Vehicle Policy Pilot Zone (Trial), posing specific administrative requirements for in-vehicle management, vehicle operation, road test, insurance and technical parameters.

In November, 2022, Beijing High-level autonomous driving Demonstration Zone issued the "Detailed Rules for the Administration of Autonomous Shuttles in Beijing Intelligent Connected Vehicle Policy Pilot Zone (Road Testing and Demonstrative Application)". It is China’s first normative policy for new short-distance passenger transport intelligent connected products without a driver's seat or steering wheel and is also China’s first policy to give corresponding right of way to autonomous shuttles in a coded form.

In November, 2022, Beijing High-level autonomous driving Demonstration Zone issued the "Detailed Rules for the Administration of Autonomous Shuttles in Beijing Intelligent Connected Vehicle Policy Pilot Zone (Road Testing and Demonstrative Application)". It is China’s first normative policy for new short-distance passenger transport intelligent connected products without a driver's seat or steering wheel and is also China’s first policy to give corresponding right of way to autonomous shuttles in a coded form.

2. The construction and upgrading of smart roads accelerate the large-scale application of autonomous shuttles.

The construction of smart roads is the premise for operating autonomous shuttles. In particular, the planning of smart bus lines in various urban demonstration areas has favored the application of robobuses. So far, Beijing, Xiong'an New Area, Guangzhou, Ezhou, Zibo, Changsha, Wuxi, Zhengzhou, Chongqing, Hainan and the like have taken the lead in introducing autonomous shuttles on the basis of smart roads.

As of September 2022, Wuhan Economic & Technological Development Zone had opened 321km test roads in total for intelligent connected vehicles, of which 106km is fully covered by 5G and CVIS. It had deployed more than 1,800 intelligent roadside units such as cameras, LiDARs, radars and edge computing servers at 96 smart intersections to support real-time information exchange between vehicles, between vehicles and roads, between vehicles and the Internet. Among the autonomous shuttles landing in Wuhan Economic & Technological Development Zone, more than 30 Sharing-VANs from Dongfeng Yuexiang have come into normal operation, travelling a total of over 209,000 kilometers.

Guangzhou has opened a total of 353 test sections for intelligent connected vehicles, with a cumulative one-way mileage of 654.451 kilometers and a two-way mileage of 1,308.902 kilometers. From August 2022 to December 2023, Guangzhou starts an autonomous driving pilot project for urban mobility, and introduces 50 autonomous buses from different companies on the loop lines around Canton Tower and Guangzhou International Bio Island, providing at least 1 million rides for passengers.

Accompanied by the construction and upgrading of smart roads as well as the promotion of seamless mobility services, autonomous shuttles and robotaxi will be integrated into intelligent city transportation systems together to offer diversified smart mobility services.

IV. Autonomous shuttle companies are exploring new business models such as PRT

Autonomous shuttles are a solution to “first-mile and last-mile" mobility. As autonomous shuttles penetrate into urban communities, subway stations, etc., how to activate the "peripheral nerves" of urban traffic on large scale is one of the issues that need urgent consideration in urban governance.

For seamless mobility services, some companies are exploring new business models.

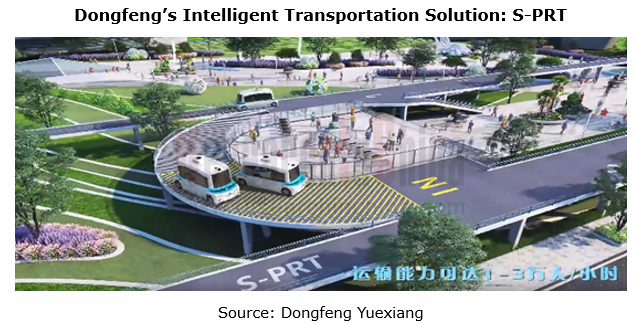

For example, Dongfeng Yuexiang's S-PRT (Sharing-Personal Rapid Transit) is a shared novel autonomous public transportation system composed of fully autonomous small vehicles and dedicated road networks. As a rapid nonstop public transportation tool with low construction cost (one-fifteenth of subways), it can transport an average of 10,000 to 30,000 people per hour at the average speed of 40-60km/h, and allows users to reserve without needing to wait. Dongfeng Yuexiang aims for test and demonstration of an operating mileage of more than 10 million kilometers in the Xiong'an New Area within three years, and promotes the "Xiong'an Solution" with partners in no less than 30 cities.

At the beginning of 2023, PIX Moving signed a strategic agreement with Common Rail (Hangzhou) Intelligent Industry Development Co., Ltd. on joint construction of a common rail project in Xiaoshan, Hangzhou. They will provide autonomous shuttles based on PIX’s chassis technology to solve the problems of large-scale commercialization of autonomous driving technology and urban traffic congestion.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...