Cockpit-parking integration research: cockpit-parking vs. driving-parking, which one is the optimal solution for cockpit-driving integration?

Cockpit-parking vs. driving-parking, which one is the optimal solution for cockpit-driving integration?

Currently, automotive E/E architecture is evolving from the distributed to domain centralized architecture, and will eventually be integrated into a central computing platform. In this process both cockpit-parking integration and driving-parking integration are products of domain centralized E/E architecture, and the ultimate form in the future is cockpit-driving integration.

Subject to the maturity of current chip and software technologies, the cockpit-parking solution is a transitional form to cockpit-driving integration. The solution integrates the parking function into the cockpit and allows the cockpit domain controller to receive parking signals, eliminating the cost of parking controllers.

The cockpit-parking integration offers the following benefits: first, cost reduction: the implementation of APA in the cockpit domain only needs addition of ultrasonic sensor (USS) and connector, bringing little cost pressure; second, better human-computer interaction design: the integration of the parking function into the cockpit enable the cockpit domain controller to gain more parking signals and use the rendering capability of the cockpit to improve the overall user experience of HMI; third, the computing power on the cockpit can be brought into full play.

From the comparison between the cockpit chip and the intelligent driving chip, it can be seen that the cockpit domain controller main SoC more highlights CPU and GPU, favoring the realization of such functions as environment puzzle and 3D rendering.

In terms of application fields, the cockpit-parking integrated solution is fitter to integrate basic parking functions, while for advanced parking functions like HPA and AVP, the driving-parking integrated solution is more suitable due to the needs for the driving perception system, and the functional safety level requirements.

Considering cost, lowly configured vehicle models are thus more likely to use the cockpit-parking solution, while medium and highly configured models with medium- and high-compute domain controller platforms will apply the driving-parking integrated solution.

The cockpit-parking integration track is heating up, and there are already more than ten Tier 1 players.

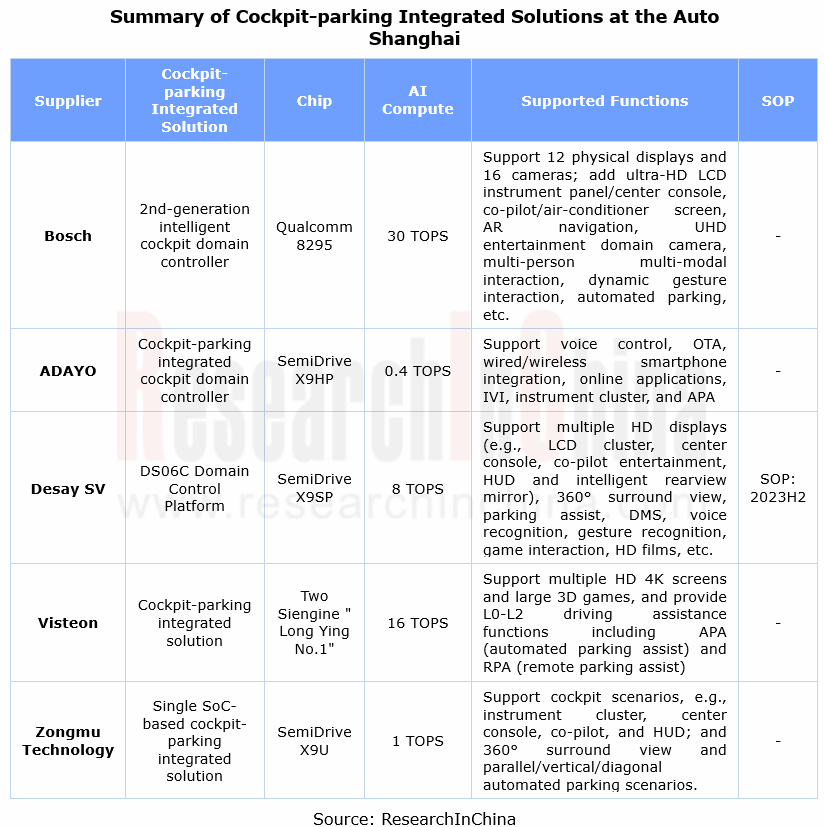

At present, more than ten Tier 1 suppliers have launched cockpit-parking integrated solutions. At the Auto Shanghai, six players introduced their solutions, including Bosch, ADAYO, Zongmu Technology and Voyager Technology. Among them, Bosch's Intelligent Cockpit Technology Interaction Experience 4.0, equipped with Qualcomm's high-compute chip, enables an infotainment domain platform providing seamless cockpit experience, and supports the cross-domain function of the "cockpit-parking integration".

At the Auto Shanghai, Desay SV introduced DS06C, its cockpit domain control platform based on SemiDrive's latest chip X9SP. The single chip can support multiple HD displays such as LCD cluster, center console, co-pilot entertainment, HUD and intelligent rearview mirror, and are available to application scenarios like 360° surround view, parking assist, DMS, voice recognition, gesture recognition, game interaction, and HD films.

High-end intelligent cockpit platform master chips show the trend of replacing foreign counterparts.

In the field of high-end intelligent cockpit platform master chip, there is a trend of replacing foreign products. For example, the "Long Ying No.1", a 7nm cockpit chip that Siengine launched in 2021, has broken the monopoly of Samsung, Qualcomm and Nvidia in this field.

The chip is equipped with Arm China's self-developed "Zhouyi" NPU and Arm IP. It adopts the ultra-large multi-core heterogeneous SoC design and integrates 87-layer circuits with 8.80 billion transistors. It packs an 8-core CPU with integral computing power up to 90K, of which the large core is Cortex-A76; a 14-core GPU with up to 900G floating-point operations; integrated programmable NPU core with the INT8 computing power up to 8TOPS; high-bandwidth low-latency LPDDR5 memory channel. It features a built-in cyber security engine that complies with national cryptographic algorithms, and the ASIL-D-compliant safety island design. At present, the chip has been installed in cockpit-parking integrated solutions of Visteon and ECARX.

2023 is the first year of mass production of cockpit-parking integrated solutions, and software capability building facilitates an upgrade to the cockpit-driving integration.

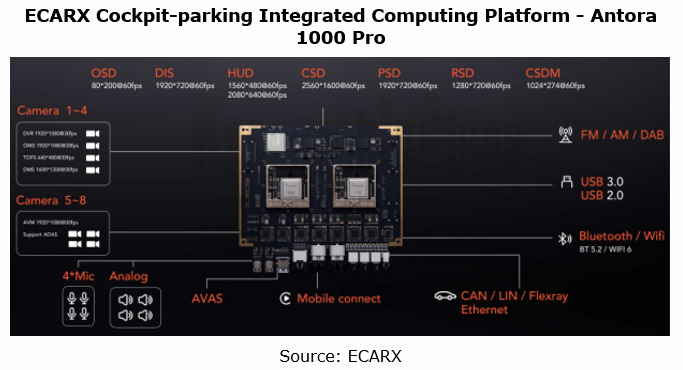

At present, the cockpit-parking integrated solution has been spawned and designated, including the cockpit-parking integrated platform jointly developed by Aptiv and ZEEKR and expected to debut in late 2023. Lynk 08 will carry ECARX’s Antora 1000 Pro computing platform with total NPU compute of 16 TOPS and total GPU compute of 1800G FLOPS, and is expected to be rolled out in August 2023. Dongfeng Forthing flagship MPV and Forthing Leiting will bear Yuanfeng Technology's intelligent cockpit platform based on Qualcomm 8155. In terms of production time, 2023 can be called the first year of volume production of cockpit-parking integrated solutions.

In response to the future trend for centralized architecture, Tier 1 suppliers work hard on planning and have even launched cockpit-driving integrated products. One example is Trinity Series, a cockpit-driving integrated product Zongmu Technology announced at the Auto Shanghai. SemiDrive is exploring centralized computing and has created a driving-parking-cockpit integrated solution which uses SemiDrive’s EMOS Platform to connect the centralized computing, cockpit and autonomous driving domains. The solution is based on service-oriented architecture (SOA) and introduces DDS communication.

The cockpit-driving integration requires an entire vehicle OS that manages all the tasks of the clusters for intelligent cockpit and autonomous driving. For this purpose, ECARX together with Volvo founded HaleyTek, an operating system company (with a 100-people team), and in March 2023 unveiled CloudPeak, an intelligent cockpit OS that features cross-domain system capabilities, is available to the Antora platform and also has access to 22 markets worldwide.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...