Intelligent Cockpit Domain Controller and SoC Market Analysis Report, 2023Q2

-

Sept.2023

- Hard Copy

- USD

$3,000

-

- Pages:110

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

YPX007

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,200

-

Cockpit domain controller and chip in 2023Q2: by intelligent cockpit level, L1 surged by 105% on a like-on-like basis, and L2 soared by 171%.

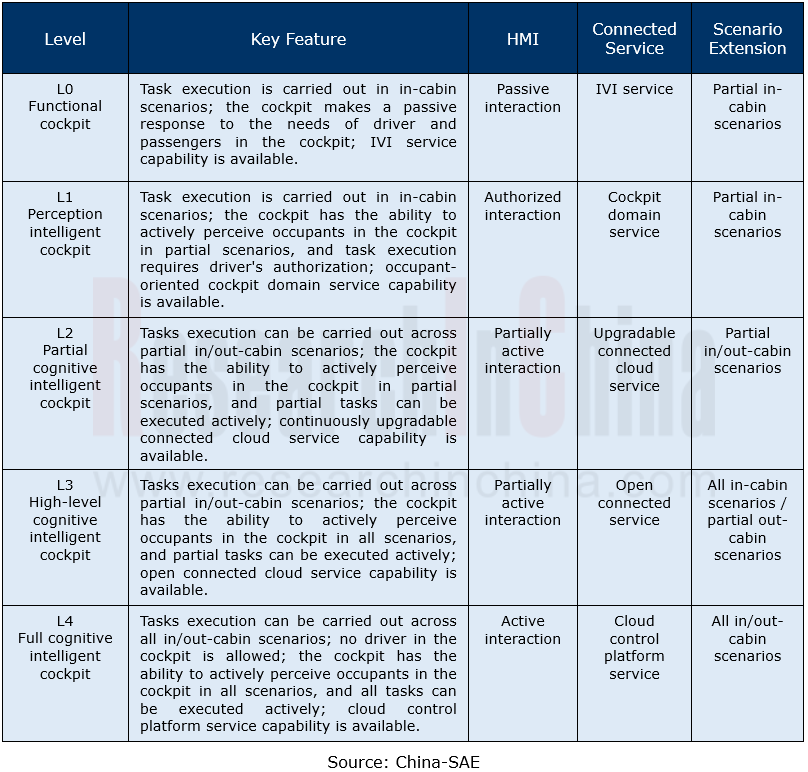

On May 17, 2023, the “White Paper on Automotive Intelligent Cockpit Levels and Comprehensive Evaluation” prepared by China-SAE together with industry professionals was officially released. It defines five levels of intelligent cockpits from L0 to L4.

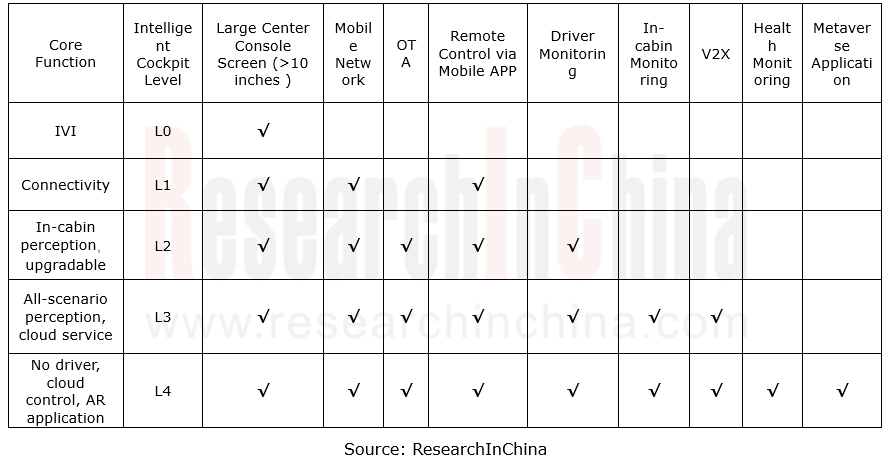

Referring to China-SAE's automotive intelligent cockpit levels and combining cockpit functions of mainstream vehicle models on market, ResearchInChina presents the intelligent cockpit levels in the form of specific function parameters, and divides intelligent cockpit into 4 levels.

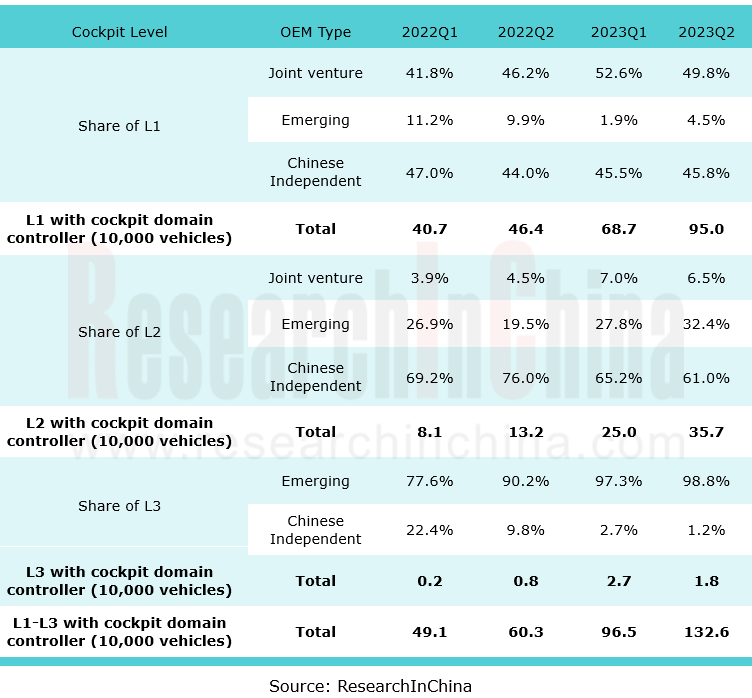

This Report only studies vehicle models with both L1+ intelligent cockpit functions (including L1, L2, L3 and L4) and cockpit domain controllers.

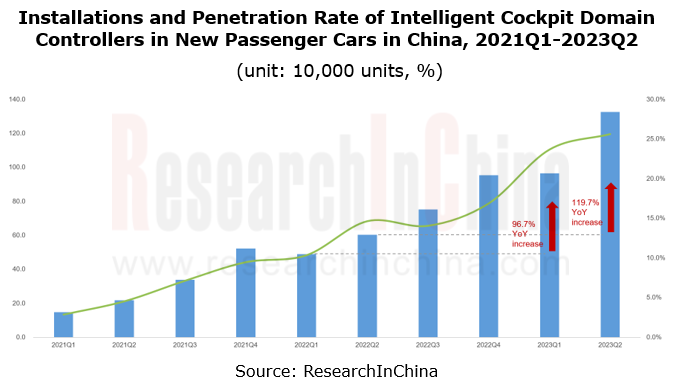

According to ResearchInChina, from 2021Q1 to 2023Q2, the installations of intelligent cockpit domain controllers in passenger cars in China showed an overall upward trend. In 2023Q1, the installations surged by 96.7% on an annualized basis to 964,800 units, and the installation rate was 23.7%; in 2023Q2, the installations reached 1,325,700 units, soaring by 119.7%, and the installation rate was 25.6%.

Currently, cockpit domain controller and intelligent driving domain controller are very similar in hardware architecture, both being the SoC+MCU solution. The core of cockpit domain controller is cockpit SoC, and single-chip multi-system solutions prevail at present. In 2023Q2, single-SoC solutions swept 92.6%, largely from Qualcomm and AMD; dual-SoC solutions made up 7.4%, mainly Qualcomm 8155.

From the sales of models of differing intelligent cockpit levels, it can be seen that in 2023Q2, the sales of models equipped with L1 intelligent cockpit with cockpit domain controller reached 950,000 units, jumping by 104.7% from the prior-year period, of which joint venture and Chinese independent automakers each occupied more than 40%; the sales of models with equipped with L2 intelligent cockpit with cockpit domain controller were 357,000 units, a like-on-like spurt of 170.5%, of which Chinese independent automakers accounted for 61%, and emerging car brands shared 32.4%; the sales of models equipped with L3 intelligent cockpit with cockpit domain controller were 1,8000 units, of which emerging car brands swept 98.8%.

Different types of OEMs vary greatly not only in layout of intelligent cockpit level but also in selection of cockpit domain control chip for vehicle models in different price range.

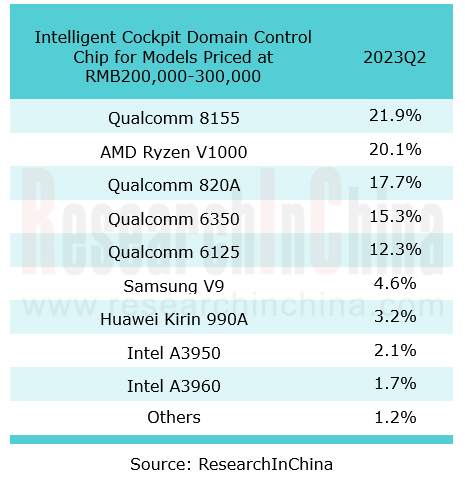

When it comes to intelligent cockpit chips, people often think that the vast majority of master chips for models with an intelligent cockpit are Qualcomm SA8155P. Actually, ResearchInChina's statistics shows that in models priced at RMB100,000-200,000, Qualcomm SA8155P boasts the highest share, but only 38%. In the intelligent cockpit domain control master chip market for models in the price ranges of RMB200,000-300,000 and RMB300,000-500,000, Qualcomm SA8155P makes up 21.9% and 31.2%, respectively.

The huge development potential of intelligent cockpits and the high differentiation in market segments bring market opportunities to latecomers of intelligent cockpit chips and domain controllers as well.

This Report provides in-depth analysis of intelligent cockpit domain controller and master chip market segments via a detailed and accurate database, and also demonstrates the industry development trends through expert interviews. Intelligent cockpit domain controller and SoC players and participants can also know the competitive pattern of the industry in this Report, and thus find their niche.

Intelligent Cockpit Levels Defined in the "White Paper on Automotive Intelligent Cockpit Levels and Comprehensive Evaluation"

Intelligent Cockpit Levels Defined by ResearchInChina: Referring to the "White Paper on Automotive Intelligent Cockpit Levels and Comprehensive Evaluation" and Presenting in the Form of Specific Parameters

1 Overall Data Trends

1.1 Overall Installation of Cockpit Domain Controller

1.1.1 Installations of Cockpit Domain Controller, 2021Q1-2023Q2

1.1.2 Installations of Cockpit Domain Controller (by Price Range), 2021Q1-2023Q2

1.1.3 Penetration Rate of Cockpit Domain Controller (by Price Range), 2021Q1-2023Q2

1.1.4 Installations and Penetration Rate of Cockpit Domain Controller (by OEM Type), 2021Q1-2023Q2

1.1.5 Installations and Penetration Rate of Cockpit Domain Controller (by Energy Type), 2021Q1-2023Q2

1.1.6 TOP 15 Passenger Car Brands in China by Installations of Cockpit Domain Controller, and Their Penetration Rate, 2023Q2

1.1.7 TOP 15 Passenger Car Models in China by Installations of Cockpit Domain Controller, 2023Q2

1.2 Installation by Cockpit Level

1.2.1 Structure of Vehicle Models of Differing Cockpit Levels with Cockpit Domain Controller

1.2.2 Sales of Vehicle Models of Differing Cockpit Levels with Cockpit Domain Controller (by OEM Type)

1.2.3 Sales Structure of Vehicle Models of Differing Cockpit Levels with Cockpit Domain Controller (by OEM Type), 2023Q2

1.2.4 Sales Structure of Vehicle Models of Differing Cockpit Levels with Cockpit Domain Controller (by Energy Type), 2021Q1-2023Q2

1.2.5 Sales Structure of Vehicle Models of Differing Cockpit Levels (by Energy Type), 2023Q2

1.3 Market Share of Cockpit Domain Controller Vendors

1.3.1 TOP 10 Cockpit Domain Controller Vendors, 2023Q2

1.3.2 TOP 10 Cockpit Domain Controller Vendors for Chinese Independent OEMs, 2023Q2

1.3.3 TOP 10 Cockpit Domain Controller Vendors for Joint Venture OEMs, 2023Q2

1.4 Market Share of Cockpit Domain Controller SoC Vendors

1.4.1 Market Share of Cockpit Domain Controller SoC Vendors, 2023Q2

1.4.2 Market Share of Cockpit Domain Controller SoCs by Type, 2023Q2

1.4.3 Market Share of Qualcomm 8155 SoC, 2023Q2

1.4.4 Cockpit Domain Controller SoC Market Share of Chinese Independent OEMs, 2023Q2

1.4.5 Cockpit Domain Controller SoC Market Share of Joint Venture OEMs, 2023Q2

1.5 Market Data of Intelligent Cockpits for Vehicle Models Priced at RMB100,000-200,000

1.5.1 Sales and Penetration of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB100,000-200,000

1.5.2 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB100,000-200,000 (by OEM Type)

1.5.3 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB100,000-200,000 (by Energy Type)

1.5.4 Share of Cockpit Domain Controllers Vendors for Vehicle Models Priced at RMB100,000-200,00

1.5.5 Share of Cockpit Domain Controller Master Chip Vendors for Vehicle Models Priced at RMB100,000-200,000

1.5.6 Market Share of Cockpit Domain Controller Master Chips (by Type) for Vehicle Models Priced at RMB100,000-200,000

1.6 Market Data of Intelligent Cockpits for Vehicle Models Priced at RMB200,000-300,000

1.6.1 Sales and Penetration of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB200,000-300,000

1.6.2 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB200,000-300,000 (by OEM Type)

1.6.3 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB200,000-300,000 (by Energy Type)

1.6.4 Share of Cockpit Domain Controllers Vendors for Vehicle Models Priced at RMB200,000-300,000

1.6.5 Share of Cockpit Domain Controller Master Chip Vendors for Vehicle Models Priced at RMB200,000-300,000

1.6.6 Market Share of Cockpit Domain Controller Master Chips (by Type) for Vehicle Models Priced at RMB200,000-300,000

1.7 Market Data of Intelligent Cockpits for Vehicle Models Priced at RMB300,000-500,000

1.7.1 Sales and Penetration of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB300,000-500,000

1.7.2 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB300,000-500,000 (by OEM Type)

1.7.3 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB300,000-500,000 (by Energy Type)

1.7.4 Share of Cockpit Domain Controllers Vendors for Vehicle Models Priced at RMB300,000-500,000

1.7.5 Share of Cockpit Domain Controller Master Chip Vendors for Vehicle Models Priced at RMB300,000-500,000

1.7.6 Market Share of Cockpit Domain Controller Master Chips (by Type) for Vehicle Models Priced at RMB300,000-500,000

2 Data and Dynamics of Cockpit Domain Controller Companies

2.1 FindDreams Technology

2.1.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

2.2 Megatronix

2.2.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

2.3 Continental

2.3.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

2.3.2 Latest Dynamics

2.4 Desay SV

2.4.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

2.4.2 Latest Dynamics

2.5 Yanfeng Visteon

2.5.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

2.5.2 Latest Dynamics

2.6 Harman

2.6.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

2.7 Bosch

2.7.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

2.8 Panasonic

2.8.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3 Data and Dynamics of Cockpit Domain Controller SoC Vendors

3.1 Qualcomm

3.1.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.1.2 Qualcomm SA8155P to Be Installed in BMW Models

3.1.3 Cooperation between Qualcomm and Leapmotor

3.1.4 Leapmotor’s Qualcomm-based Cockpit-driving Integrated Solution

3.2 AMD

3.2.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.3 Intel

3.3.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.4 Renesas

3.4.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.5 Samsung

3.5.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.5.2 Latest Dynamics

3.6 NVIDIA

3.6.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.6.2 Latest Dynamics

3.7 MediaTek

3.7.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.8 Huawei

3.8.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.9 TI

3.9.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.10 Dynamics of Other Cockpit SoC Players

3.10.1 UNISOC

3.10.2 SiEngine

4 Forecast Data and Trends

4.1 Forecast Data

4.1.1 Cockpit Domain Controller Installations and Penetration Rate, 2021Q1-2024Q4E

4.1.2 Cockpit Domain Controller Installations and Penetration Rate by Vendor Type, 2021Q1-2024Q4E

4.1.3 Cockpit Domain Controller Installations and Penetration Rate by Cockpit Level, 2021Q1-2024Q4E

4.1.4 Cockpit Domain Controller Installations by Price, 2021Q1-2024Q4E

4.1.5 Cockpit Domain Controller and SoC Market Size, 2021Q1-2024Q4E

4.2 Trends

4.2.1 Purchase Prices of Current Mainstream Cockpit SoCs and Domain Controllers Based on the SoCs

4.2.2 Advantages and Shortcomings of Current Mainstream Cockpit SoCs

4.2.3 MCU Purchase Price, Chinese Alternative Solutions and Integration

4.2.4 Development Trends of Cockpit Domain Controller and SoC

4.2.5 Views on Cockpit-driving Integration Trend of Central Computing Platforms

4.3 Qualcomm SA8255P May Once Again Sweep up the Intelligent Cockpit Market

4.3.1 Comparison between Qualcomm SA8255P, 8155 and 8295

4.3.2 Functional Safety Design of SA8255P

4.3.3 Further Comparison between SA8255P and 8295P

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...