Automotive XR (Extended Reality) is an innovative technology that integrates VR (Virtual Reality), AR (Augmented Reality) and MR (Mixed Reality) technologies into vehicle systems. It can bring drivers and passengers richer and more intuitive information interaction experiences. It is an important embodiment of differentiation between intelligent cockpits of the future.???

XR is integrated with IVI and smartphones to create multi-terminal integration experience.

In March 2023, Rokid and Li Auto announced Rokid Max, their cooperative AR glasses which support L series models. Li Auto’s IVI APP can be projected onto VR glasses for viewing, gaming, online office, etc. In addition, it allows handheld game consoles to be projected onto the center console screen and then to the glasses, so that users can control IVI and play games through gesture interaction.???

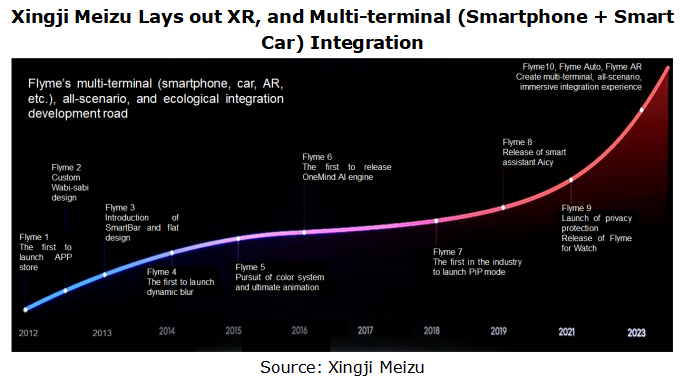

In November 2023, Xingji Meizu released MYVU intelligent AR glasses based on Flyme AR OS. The integration with Meizu smartphones via Flyme Link (a smartphone-IVI integration solution) not only allows for circulation of phone calls, music, videos, navigation, important application notifications and more to the AR glasses, but also makes it share computing power and network with the smartphone, thereby reducing the power consumption of the glasses and enabling a long cruising range. In the future, MYVU AR glasses will be integrated with cars and smartphones to create multi-terminal integration experience through seamless flow of applications and data.??

?

Therefore, at the “Meizu Flyme Ecosystem Launch”, Xingji Meizu upgraded the operating system Flyme to FlymeOS. Composed of Flyme 10 (smartphone OS), Flyme Auto (Meizu IVI system), and Flyme AR (AR glasses OS), FlymeOS covers three major areas: smartphone, XR and intelligent vehicle. FlymeOS features "Internet of Everything, Boundless and Infinite", and becomes the base for connecting all terminals.?????

AI+AR to enhance voice interaction experience

?

At CES 2024, Rayneo unveiled Rayneo X2 Lite, a stereo full-color MicroLED optical waveguide AR glasses that introduce Rayneo AI (released in December 2023), a foundation model voice assistant. With Rayneo AI, Rayneo X2 Lite enables multiple capabilities including multi-round natural language conversations, trip planning, easy encyclopedic Q&A and brainstorming, and supports AI-assisted translation, 3D spatial navigation, and first-person perspective video creation. In March 2024, Rayneo Technology closed a new funding round and raised RMB100 million which will be used to develop and spawn next-generation AR glasses and expedite the construction of the AI+AR glasses ecosystem.????

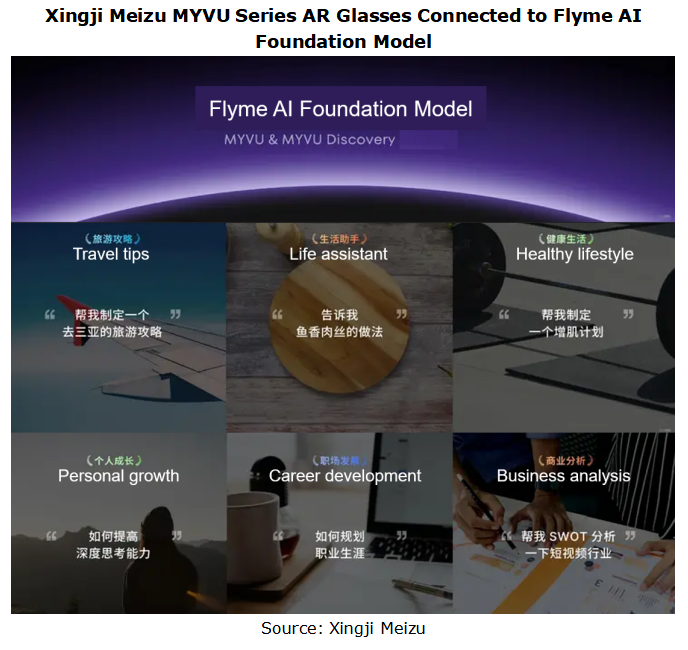

Xingji Meizu is also laying out AI+AR. In November 2023, Xingji Meizu released two MYVU series AR glasses, connected to the Flyme AI foundation model. Based on AI, AI assistant can be awakened in real time to provide travel tips, study plans, business analysis, and other daily life and work collaboration. At the same time, AR glasses can realize scenario functions such as teleprompter, real-time translation (in Chinese and English), and cycling navigation.

Automotive XR scenarios expand from entertainment to driving assistance and vehicle control.

Currently, XR mainly caters to users’ needs for cockpit entertainment, for example, viewing and gaming. Moreover suppliers are also exploring other application scenarios such as driving assistance and vehicle control.?

?

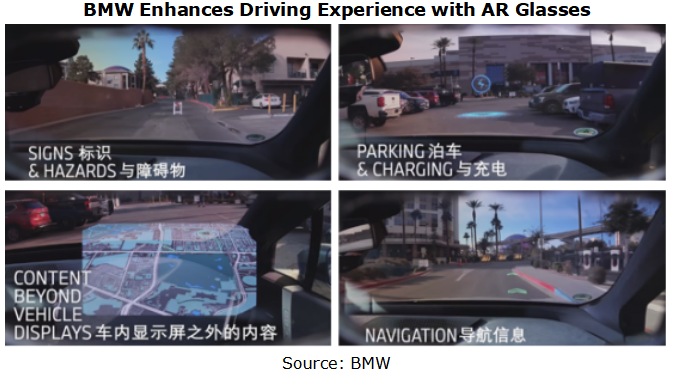

At CES 2024, BMW and XREAL together demonstrated XREAL Air 2 AR glasses, a device which integrates vehicle information, infotainment, vehicle electronic and electrical information, BMW cloud information and other data. Wearing the glasses, users can see how navigation instructions, hazard warnings, entertainment content, information on charging stations and supporting visualizations in parking situations are embedded perfectly into the real-world environment by the “XREAL Air 2”.???

?

At CES 2023, Audi presented activesphere, a concept car which is equipped with four AR headsets. Wearing Magic Leap 2 AR glasses, the driver can view trip data, road conditions, location and navigation information in real time the MR visual interface with a 70° FOV; the passengers can control air conditioning temperature, airflow, and audio system next to their seats via gestures.??

?

Furthermore, AR technology can be available beyond the cockpit. In off-road scenarios, the topographic map can be projected into the surroundings; in commuting, traffic information, routes and safety warnings can be projected in layers into the driver's view.????

?

?

?

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...