Integrated Die Casting Research: adopted by nearly 20 OEMs, integrated die casting gains popularity.?

Automotive Integrated Die Casting Industry Report, 2024 released by ResearchInChina summarizes and studies the status quo of integrated die casting industry and the industry chain products layout of OEMs and suppliers, and predicts the future development trends of the integrated die casting industry.??

?

1. Multiple breakthroughs have been made in the integrated die casting upstream supply chain (die casting machines, molds and non-heat-treatable materials).

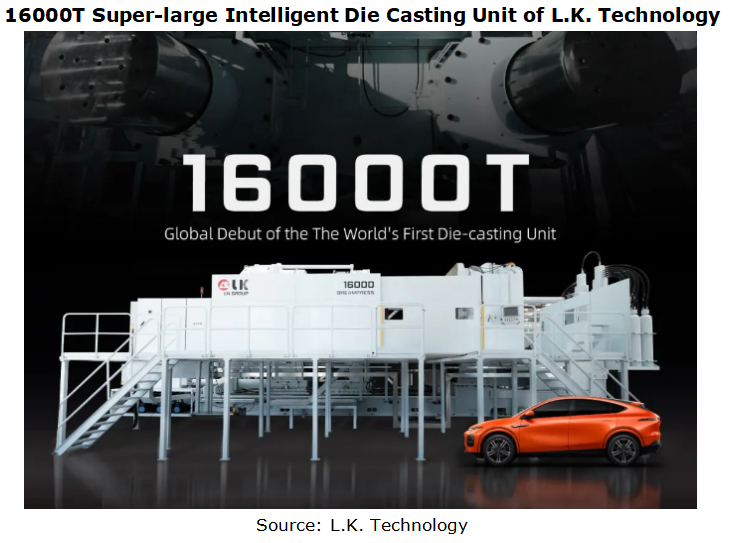

Super-large die casting machine: At present, the tonnage of super-large die casting machines has been increased from 6000T to 16000T, and die casting machine suppliers are developing 20000T die casting machines.

?

Large die casting machines are the basis for automotive integrated die casting. Generally speaking, integrated die casting requires die casting machines with >6000T clamping force. Currently, only IDRA, Brown, Boveri & Cie, L.K. Technology, Haitian Die Casting and YIZUMI can produce 6000T die casting machines. In October 2023, L.K. Technology unveiled a 16000T super-large intelligent die casting unit, making a breakthrough in clamping force increased from 6000T to 16000T in only three years. It is the largest die casting machine in the world so far, and is expected to cover class A0-C and SUV models.???

Now, Tesla, L.K. Technology and Haitian Die Casting among others have started deploying and developing >20000T die casting machines.??

In June 2023, Haitian Die Casting and Chongqing Millison Technologies announced that they would jointly develop 20000T super-large die casting machines.

In December 2023, L.K. Technology and Neta Auto signed a strategic cooperation agreement on joint R&D of >20000T super-large die casting equipment to expand the application of integrated die casting to the chassis of class B vehicles.?

?

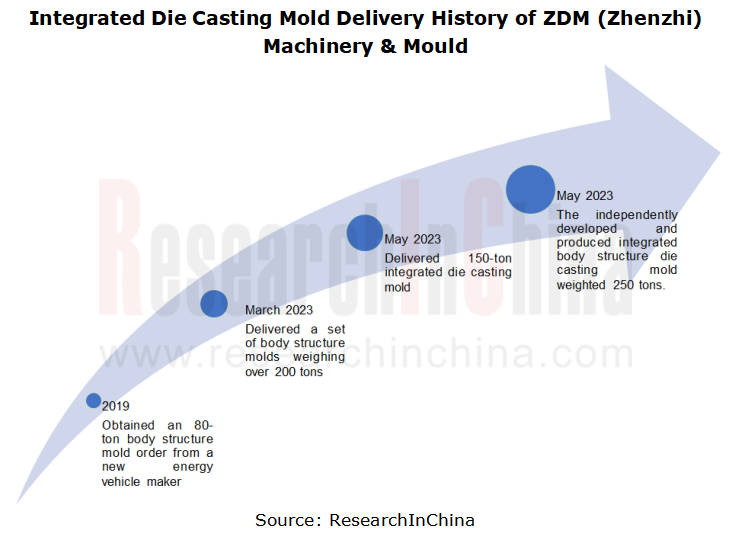

Integrated die casting mold: At present, the self-weight of an integrated die casting mold has exceeded 250 tons.

?

Before 2023, in China only a few mold manufacturers such as GZDM Technology, Ningbo Sciveda Mould (SWD), and ZDM (Zhenzhi) Machinery & Mould had the capacity to produce ultra-large integrated molds. However quite a few companies including Chongqing Millison, Rayhoo Motor Dies, Chongqing Borun Mould Manufacturing and Ningbo Xinlin Mould Technology can produce super-large molds now. Although HLGY and Qixin Mould have yet to mass-produce actual products, they are vigorously making layout.???

?

From the perspective of mold technology, significant breakthroughs have been made in R&D of integrated die casting molds. In 2019 when only having experience in producing 50T molds, ZDM (Zhenzhi) Machinery & Mould secured an order from a new energy vehicle company for a body structure mold weighing 80 tons, which was the largest mold in the world at that time. The integrated body structure die casting mold self-developed by Ningbo ZDM in May 2023 weighs 250 tons and can assist OEMs in integrated die casting of front and rear chassis. From 50T and 80T to current 150T, 200T and 250T, ZDM (Zhenzhi) Machinery & Mould has kept breaking records.?????

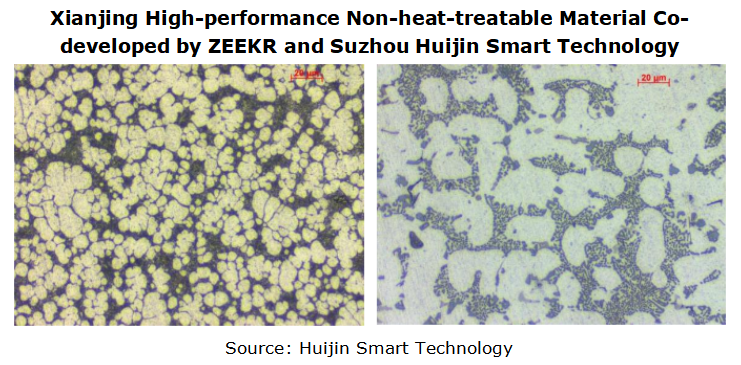

Non-heat-treatable materials: domestic manufacturers have embarked on non-heat-treatable materials by way of patent licensing, independent R&D, and cooperation with universities or automakers, accelerating localization.

??

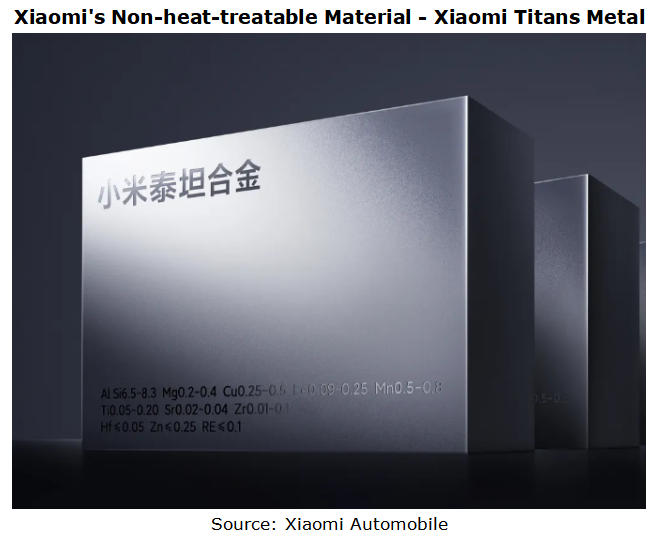

The composition of non-heat-treatable materials is complex. First movers have obvious advantages. Alcoa and Rheinfelden announced their non-heat-treatable materials as early as the 1990s, while China’s first entrant Lizhong Group stepped into the market in 2020. Nowadays, many manufacturers and universities in China, such as Shanghai Yongmaotai Automotive Technology, Hubei Xinjinyang, Weiqiao Pioneering, Suzhou Huijin Smart Technology, Xiaomi, Shanghai Jiao Tong University and Guangdong Hongtu Technology, have acquired non-heat-treatable materials patents by way of independent or cooperative R&D.??????

In August 2023, Xiaomi Automobile secured a non-heat-treatable material patent for "Xiaomi Titans Metal", its self-developed alloy material.

?

In November 2022, "Xianjing” (fiber crystal), a new non-heat-treatable high-strength high-toughness aluminum alloy material co-developed by ZEEKR and Suzhou Huijin Smart Technology Co., Ltd., officially came into production.??

2. Application of integrated die casting in vehicle body: from rear underbody to front cabins, middle integrated die cast parts and battery trays.?

?

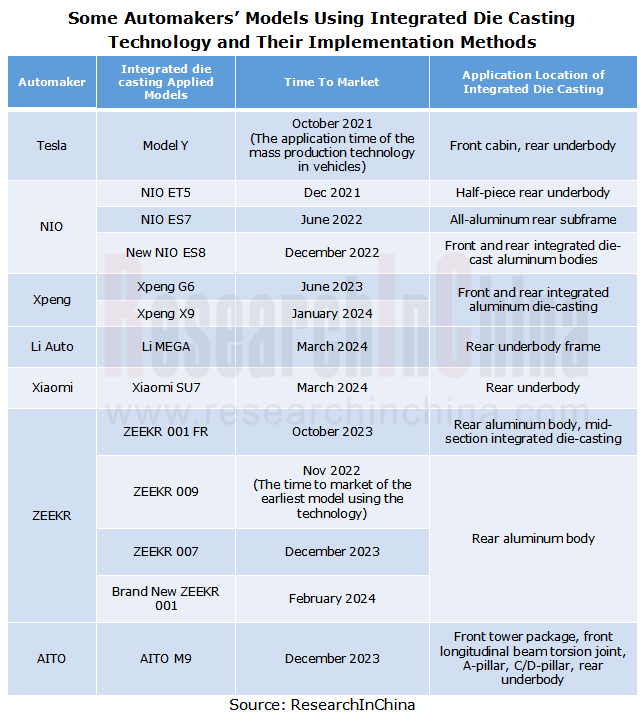

Since Tesla used a 6000T die casting machine to mass-produce the rear underbody assembly for Model Y for the first time in 2020, other automakers in China such as NIO, Xpeng, Li Auto, Xiaomi, ZEEKR, AITO and Neta have also laid out integrated die casting. At present this technology has been adopted in multiple models, and finds application in front cabins and middle integrated die cast parts in addition to rear underbodies.??????

?

As of April 2024, integrated die casting had been used in mass production of rear underbodies, front cabins and middle integrated die cast parts and battery trays, as shown below:???

Rear underbody: Chinese emerging carmakers have gradually realized the mass production of integrated die cast rear underbodies for models such as NIO ET5, Xiaomi SU7, ZEEKR 009/007/ New ZEEKR 001 and AITO M9.?

Front cabin: some automakers can mass-produce front cabin components for models such as new NIO ES8 and Xpeng G6/X9.??

Middle integrated die cast parts: the middle integrated die cast parts for ZEEKR 001 FR has been mass-produced.???

Battery tray: L.K. Technology has mass-produced the world's largest integrated battery tray, which is about 2180*1500*110 in size.

It is expected that integrated die casting will cover battery case upper cover, middle floor, and underbody assembly in 2027. Tesla, FAW and Xpeng already have plans:??

Tesla: it plans to replace the 370-component underbody assembly with 2-3 large die cast parts in 2025. The weight will be reduced by 30% and the manufacturing cost by 40%.?

FAW: in November 2023, the integrated die casting super factory of FAW Foundry Co., Ltd. planned to build a new 9000T die casting unit and processing line. The project mainly produces integrated front cabins, rear underbodies and CTC battery case upper covers for Hongqi's new models E802 and EHS9. With the annual capacity of 85,700 die-cast parts, it is expected to be completed in June 2024.??

Xpeng: in October 2023, He Xiaopeng revealed that the internal team was pre-researching the next-generation CIB + center floor integrated die casting technology and expanding a 16000T die casting machine which can produce larger die cast parts, such as large-size battery case.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...