Global and China Touch Screen (Panel)Industry Report, 2014-2015

-

Dec.2014

- Hard Copy

- USD

$2,600

-

- Pages:151

- Single User License

(PDF Unprintable)

- USD

$2,400

-

- Code:

ZYW193

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,800

-

The report covers the followings:

1, Development trends of touch screen technology

2, Trends of touch screen market

3, Analysis on the touch screen industry

4, Study on 22 major touch screen vendors

5, Research on 5 touch screen glass vendors

The core of the touch screen market is reflected in smartphones and Tablet PCs, both of which will be in trouble in the next three years. The smartphone market has obviously been saturated and slowed down. China exceeds the United States to see the highest smartphone penetration rate. However, the Chinese smartphone market where a person often holds two smartphones is the first one that suffers recession in the world. From January to October of 2014, China's smartphone shipment dropped down 10.4% year on year to 312 million. China's sluggish economy is also a reason for the decline.

The Tablet PC market witnesses saturation as well. Impacted by bigger and bigger mobile phone screens, the market of Tablet PCs featured with simple functions stopped growth to descend in 2014. In terms of willingness-to-buy, adults would like to buy Tablet PCs for children, marking low replacement frequency. In the next few years, the Tablet PC market will be in a mild recession, which even can not be reversed by Apple’s upcoming 12.9-inch Tablet PCs.

Touch laptops may disappear completely, especially clamshell ones which are mainly used in offices with meaningless touch function. 2in1 laptops are inferior to clamshell laptops in performance, but are much expensive than Tablet PCs and clamshell laptops, so the 2in1 laptop market will shrink.

For Out-Cell touch screen vendors, In-Cell and On-Cell threaten their market, the downstream market halted, and the Out-Cell touch screen capacity is excess dramatically. In 2014, the Out-Cell touch screen market witnessed a fierce price war, the market size shrunk by 16.2%, especially South Korean and Taiwanese vendors suffered the hugest losses and some of them lost the revenue by 50%, let alone bankrupt small vendors.

Wintek (annual revenue: more than USD2 billion) and Digitech Systems (annual revenue: over USD200 million) were also listed in the considerable collapsed Out-Cell touch screen vendors in 2014. In 2015, the Out-Cell touch screen market will still see significant oversupply, particularly the field of touch screens used for Tablet PCs and laptops; meanwhile, the market will decline by 10.3%.

In-Cell and On-Cell vendors will triumph. Their price disadvantage will gradually vanish with more mature technology and high output. 50% of touch screens will adopt In-Cell or On-Cell in 2016, much higher than 31% in 2014.

1. Overview of Touch Screen

1.1 Touch Screen Structure

1.2 Glass-to-glass (G/G)

1.3 Glass-to-film-to-film (G/F/F)

1.4 G1F

1.5 TOC

1.6 ON-CELL

1.7 IN-CELL

1.8 Development Trends of Medium-sized Touch Screen

1.9 Development Trends of Laptop Touch Screen

1.10 AIO PC Touch Screen

1.11 Advantages of Metal Mesh

1.12 Metal Mesh Supply Chain

1.13 Silver Nanofiber Wire

2 Touch Screen Market and Industry

2.1 Global Mobile Phone Market

2.2 Global Smartphone Market

2.3 Chinese Mobile Phone Market

2.4 Tablet PC Market

2.5 Development Trends of Global Mobile Phone Display

2.6 Development Trends of Chinese Mobile Phone Display

2.7 Global Mobile Phone Display Industry

2.8 Supply Relationship between Mobile Phone Display Vendors and Mobile Phone Brand Vendors

3 Touch Screen Industry

3.1 Touch Screen Market Size

3.2 ITO Film Market Size

3.3 ITO Film Supply Chain

3.4 ITO Film Industry

3.5 Ranking of Touch Screen Vendors

3.6 Supply Relationship between Touch Screen Vendors and Clients

4. Major Touch Screen Vendors

4.1 Innolux

4.2 Truly

4.3 LG Display

4.4 Samsung Display

4.5 Sharp

4.6 Wintek

4.7 Young Fast

4.8 JTOUCH

4.9 SMAC

4.10 ILJIN Display

4.11 Melfas

4.12 ELK

4.13 Digitech Systems

4.14 Sintek Photronic

4.15 Cando

4.16 TPK

4.17 Mutto Optronics

4.18 Laibao Hi-tech

4.19 Shenzhen O-Film Tech

4.20 GIS

4.21 Success Electronics

4.22 NISSHA Printing

5 Touch Screen Glass Vendors

5.1 Aimcore

5.2 Token

5.3 G-tech Optoelectronics

5.4 Shenzhen Lens

5.5 Boerni

Glass-to-glass (G/G) Projected Capacitive Touch Screen (P-cap Touch)

Glass-to-film-to-film (G/F/F) Projected Capacitive Touch Screen

G1F Touch

TOC Touch Screen

Sheet-based TOC

Piece-based TOC

Medium-sized Touch Screen by Technology, 2011-2015E

Laptop Touch Screen Shipment by Technology, 2012-2016E

AIO PC Touch Screen Shipment by Technology, 2012-2016E

Silver Nanofiber Wire Supply Chain

Global Mobile Phone Shipment, 2007-2015E

Global 3G/4G Mobile Phone Shipment by Region, 2011-2014

Worldwide Mobile Phone Sales to End Users by Vendor in 2013 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Vendor in 2013 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Operating System in 2013 (Thousands of Units)

Shipment of Global Top 13 Smartphone Vendors, 2013-2015E

China’s Mobile Phone Monthly Shipment, Jan-Oct 2014

Share of Major Vendors in Chinese Smartphone Market, 2014

Share of Major Vendors in Chinese 4G Mobile Phone Market, 2014

Global Tablet PC Shipment, 2011-2016E

Market Share of Main Tablet PC Brands, 2013

Output of Global Tablet PC Vendors, 2012-2013

Development Trends of Global Smartphone Display Size, 2013-2017E

Development Trends of Global Smartphone Touch Technology, 2013-2017E

Development Trends of Global Smartphone Display Technology, 2013-2017E

Development Trends of Global Smartphone Display Resolution, 2013-2017E

Chinese Mobile Phone Market by Size, 2014

Development Trends of China's Smartphone Display Size, 2013-2017E

Chinese Smartphone Market by Resolution, 2014

Development Trends of China's Smartphone Display Resolution, 2013-2017E

Chinese Mobile Phone Market by PPI, 2014

Development Trends of China's Smartphone Display Technology, 2013-2017E

Shipment of Major Global Small and Medium-Sized Display Vendors, 2013-2014

Market Share of Major Mobile Phone Display Vendors in China, 2014

Share of Major Suppliers of Samsung's Mobile Phone Display, 2014

Share of Major Suppliers of APPLE's Mobile Phone Display, 2014

Share of Major Suppliers of HUAWEI's Mobile Phone Display, 2014

Share of Major Suppliers of LENOVO's Mobile Phone Display, 2014

Share of Major Suppliers of ZTE's Mobile Phone Display, 2014

Share of Major Suppliers of COOLPAD's Mobile Phone Display, 2014

Share of Major Suppliers of OPPO's Mobile Phone Display, 2014

Share of Major Suppliers of XIAOMI's Mobile Phone Display, 2014

Share of Major Suppliers of Vivo's Mobile Phone Display, 2014

Touch Screen Industry Chain

Global Touch Screen Market Size, 2010-2016E

Global Touch Screen Market Size (Shipment), 2010-2016E

Touch Screen Material Market Size, 2012-2017E

Shipment of ITO FILM Market, 2011-2016E

ITO FILM Market Size, 2011-2016E

ITO Film Structure

ITO Film Supply Chain

Comparison between Major ITO Film Vendors in Performance

Market Share of Major Global ITO Film Vendors, 2013

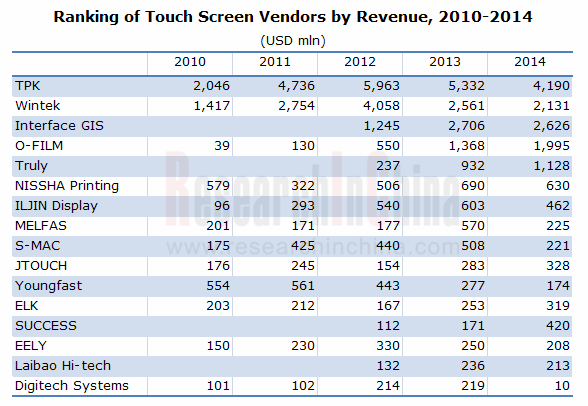

Ranking of Touch Screen Vendors by Revenue, 2010-2014

Operating Profit Margin of Touch Screen Vendors, 2012-2013

Market Share of Samsung's Mobile Phone Touch Screen Suppliers, 2012-2013

Market Share of Samsung's Tablet PC Touch Screen Suppliers, 2012-2013

Share of Nokia's Major Touch Screen Suppliers, 2014

Share of LG's Major Touch Screen Suppliers, 2012

Share of HTC's Major Touch Screen Suppliers, 2012

INNOLUX's Organizational Structure

INNOLUX's Revenue and Operating Margin, 2010-2014

INNOLUX's Revenue, Gross Margin and EBITDA Margin, Q4 2012-Q3 2014

INNOLUX's Total Debt and Debt Ratio, Q4 2012-Q3 2014

INNOLUX's Inventory, Q4 2012-Q3 2014

INNOLUX's Area Shipment and TFT- LCD ASP Trends, Q4 2012-Q3 2014

INNOLUX's Small & Medium Size Unit Shipment and Sales, Q4 2012-Q3 2014

INNOLUX's Sales Breakdown by Application, Q4 2012-Q3 2014

INNOLUX's Sales Breakdown by Size, Q4 2012-Q3 2014

Profile of INNOLUX's TFT-LCD Fabs

Profile of Touch Sensor Fabs

Truly's Revenue and Operating Margin, 2005-2014

Truly's Quarterly Revenue and Gross Margin, Q1 2013-Q4 2014

Truly's LCD Revenue by Technology, 2006-2011

Truly's Semiconductor Revenue by Business, 2012-2015E

Truly's Semiconductor Shipment by Product, 2012-2015E

Truly's Semiconductor ASP by Product, 2012-2015E

Truly's Mobile Phone LCD Major Customers

Major Customers of Truly's Automotive Displays

Truly's Touch Screen Capacity

Truly's Major CCM Customers

Revenue and Operating Margin of LG Display, 2009-2015E

Quarterly Revenue and Gross Margin of LG Display, Q1 2013-Q3 2014

Statements of Financial Position of LG DISPLAY IFRS, 2012-2014

Shipment of LG Display by Application, 2009-2013

Revenue of LG Display by Application, 2009-2013

Revenue of LG Display by Region, 2011-2013

Quarterly Shipment and ASP of LG Display, Q3 2013-Q3 2014

Quarterly Revenue of LG Display by Application, Q3 2013-Q3 2014

Quarterly Producible of LG Display by Area, Q3 2013-Q3 2014

Capacity of LG Display's Fabs

Capacity of LG Display's Fabs, 2011-2013

Footprint of LG Display

Manufacturing Base Footprint of LG Display

Revenue and Operating Margin of Samsung's DP Division, 2010-2015E

Revenue of Samsung's DP Division by Product, 2012-2015E

Revenue and Operating Profit of Samsung's DP Division, 2012-2015E

Samsung's Production Lines

Sharp's Revenue and Operating Margin, FY2008-FY2015

Sharp's Revenue by Business, FY2013-FY2015

Sharp's Operating Margin by Business, FY2013-FY2015

Sharp's Mobile Phone Panel Resolution, 2013-2014

Sharp’s Production Lines

Wintek's Revenue and Gross Margin, 2003-2013

Wintek's Revenue and Operating Margin, 2003-2013

Wintek's Monthly Revenue, Nov 2012-Nov 2014

Wintek's Global Distribution

Wintek's Revenue by Technology, 2006-2011

Wintek's Revenue by Customer, 2009-2012

Wintek's Sales Volume, Revenue and ASP, 2010-2011

Wintek's Capacity, Output and Sales Volume, 2012-2013

Wintek's Capacitive Touch Screen Capacity

Wintek's Touch Screen Cover Glass Capacity

Wintek's ATT Structure

Wintek's ATT Process

Comparison between Wintek's ATT and Traditional Capacitive G / G Touch Screen

Revenue and Operating Margin of Young Fast, 2005-2014

Monthly Revenue and Growth Rate of Young Fast, Nov 2011- Nov 2014

Revenue of Young Fast by Customer, 2010-2013

Capacity \ Output \ Sales Volume of Young Fast, 2008-2013

JTOUCH's Revenue and Operating Margin, 2006-2014

JTOUCH's Monthly Revenue and Growth Rate, Nov 2012-Nov 2014

JTOUCH's Capacity \ Output \ Sales Volume, 2008-2013

JTOUCH's Revenue by Region, 2008-2011

S-MAC's Revenue and Operating Margin, 2005-2014

S-MAC's Production Process

S-MAC's Quarterly Revenue and Operating Margin, Q1 2013-Q4 2014

S-MAC's Quarterly Revenue by Business, Q1 2013-2014

Organizational Structure of ILJIN Display

Revenue and Operating Margin of ILJIN Display, 2008-2014

Quarterly Revenue and Operating Margin of ILJIN Display, Q1 2012-Q4 2014

Revenue of ILJIN Display by Business, Q1 2011-Q4 2013

7-inch TSP Output of ILJIN Display, Q1 2010-Q4 2013

Revenue and Operating Margin of Melfas, 2007-2014

Revenue of Melfas by Product, 2007-2014

Quarterly Revenue and Operating Margin of Melfas, Q1 2013-Q4 2014

ELK's Revenue and Operating Margin, 2006-2014

ELK's Revenue by Application, 2012-2013

ELK's Revenue Customer Distribution, 2012-2013

Revenue and Operating Margin of Digitech Systems, 2007-2013

Revenue of Digitech Systems by Product, 2009-2012

Organizational Structure of Sintek Photronic

Revenue and Operating Margin of Sintek Photronic, 2004-2014

Monthly Revenue and Growth Rate of Sintek Photronic, Nov 2012-Nov 2014

Cando's Revenue and Operating Margin, 2004-2014

Cando's Monthly Revenue and Growth Rate, Nov 2012-Nov 2014

TPK's Organizational Chart

TPK's Revenue, Gross Margin and Operating Margin, 2007-2014

TPK's Quarterly Revenue and Operating Margin, Q1 2012-Q3 2014

TPK's Quarterly Revenue and Gross Margin, Q1 2011-Q3 2014

TPK's Quarterly Revenue by Size, Q1 2013-Q3 2014

TPK's Monthly Revenue and Growth Rate, Nov 2012-Nov 2014

Touch Screen Capacity, Output and Sales Volume of TPK Holding, 2008-2013

TPK's Revenue by Application, 2011-2013

Relationship between TPK Holding and Affiliated Companies

Revenue and Growth Rate of Mutto Optronics, May 2010-May 2012

Revenue and Operating Margin of Mutto Optronics, 2008-2013

Revenue of Mutto Optronics by Customer, 2012

Revenue and Net Income of Laibao Hi-tech, 2005-2014

Revenue by Business of Laibao Hi-tech, 2012-H1 2014

Revenue and Operating Margin of Shenzhen O-Film Tech, 2007-2015E

Revenue of Shenzhen O-Film Tech by Product, 2009-2015E

Quarterly Revenue of Shenzhen O-Film Tech, Q1 2009-Q3 2014

Quarterly Gross Margin of Shenzhen O-Film Tech, Q1 2009-Q3 2014

Customer Structure of Shenzhen O-Film Tech, 2012-2014

Structure of GIS

Revenue and Operating Margin of GIS, 2011-2016E

Revenue and Gross Margin of GIS, 2011-2016E

Capacity, Output and Capacity Utilization Rate of GIS, 2013

Sales Volume of GIS, 2012-2013

% of Mobile Phone Touch in Total Revenue of GIS and Gross Margin, 2012-2014

% of Tablet PC Touch in Total Revenue of GIS and Gross Margin, 2012-2014

Number of Employees of GIS, Sep 30, 2014

Employees of GIS by Educational Background, Sep 30, 2014

Employees of GIS by Region, Sep 30, 2014

R & D Organizational Structure of GIS

Production Organizational Structure of GIS

Mobile Phone Touch Cost Structure, 2012-2014

Tablet PC Touch Cost Structure, 2012-2014

Financial Summary of Subsidiaries of GIS, 2013-2014

Revenue and Operating Profit of Success Electronics, 2008-2014

Revenue of Success Electronics by Product, 2012-2014

NISSHA's Revenue and Operating Margin, FY2005-2015

NISSHA's Revenue by Business, FY2009-FY2015

NISSHA's Touch Panel Revenue by Application, FY2009-FY2015

Quarterly Revenue and Operating Margin of NISSHA, Q4 2012-Q3 2014

Quarterly Revenue and Operating Margin of NISSHA’s Touch Panel Business, Q1 2012-Q3 2014

Aimcore's Organizational Structure

Profile of Aimcore's Departments

Aimcore's Revenue and Gross Margin, 2006-2014

Aimcore's Revenue and Growth Rate, Nov 2012-Nov 2014

Token's Organizational Structure

Token's Revenue and Operating Margin, 2007-2014

Revenue and Operating Margin of G-tech Optoelectronics, 2007-2014

Monthly Revenue and Growth Rate of G-tech Optoelectronics, Nov 2012-Nov 2014

Revenue of G-tech Optoelectronics by Product, 2010-2013

Global Distribution of G-tech Optoelectronics

Business Models of G-tech Optoelectronics

Main Products of G-tech Optoelectronics

Major Customers of G-tech Optoelectronics

Customer Distribution of Shenzhen Lens, 2013

Revenue, Operating Profit and Net Income of Shenzhen Lens, 2011-2014

Assets and Liabilities of Shenzhen Lens, 2011-2013

Cash Flow of Shenzhen Lens, 2011-2013

Key Financial Indicators of Shenzhen Lens, 2011-2013

Shareholder Structure of Shenzhen Lens

Organizational Structure of Shenzhen Lens

Revenue and Net Income of Major Subsidiaries of Shenzhen Lens, 2013

Supply Structure of Major Suppliers of Shenzhen Lens, 2013

Global and China CMOS Camera Module (CCM) Industry Report, 2020-2026

The global CCM market has been ballooning thanks to expeditious penetration of multi-camera phones and advances in automotive ADAS, being worth $22.723 billion with a year-on-year spike of 16.6% in 20...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2020-2025

Electronic components like MLCC enjoy a rosy prospect alongside the burgeoning electronic manufacturing, the thriving internet and the prevalence of smart hardware.

MLCC was much sought after and it...

Global and China Voice Coil Motor (VCM) Industry Report, 2019-2025

VCM (voice circle motor or voice coil actuator), a part for smartphone camera, shares around 6% of smartphone camera industry chain value.

Globally, popularity of smartphones such as those with mult...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2019-2025

Chinese aluminum electrolytic capacitor market has been expanding amid a transfer of its downstream industries to China like home appliance illumination, cellphones and computers as well as automatic ...

Global and China Flexible Printed Circuit (FPC) Industry Report, 2019-2025

Flexible printed circuit (FPC) products make their way into consumer electronics like smartphone and tablet PC, in the form of modules for display, touch control, fingerprint recognition, etc. The vol...

Global and China GaAs Industry Report, 2019-2025

Gallium arsenide (GaAs), one of the most mature compound semiconductors, is an integral part of smartphone power amplifier (PA). In 2018, GaAs-based radio frequency (RF) seized over half of the GaAs w...

Global and China Advanced Packaging Industry Report, 2019-2025

The global semiconductor packaging and testing market is enlarging with the prevalence of consumer electronics, automotive semiconductors and the Internet of Things (IoT), with its size edging up 2.5%...

Global and China MLCC Electronic Ceramics Industry Report, 2019-2025

MLCC is mainly used in audio and video equipment, mobile phones, computers and automobiles. The prospective boom of MLCC formula powder hinges on demand: 1) The accelerated renewal of consumer electro...

Global and China OLED Industry Report, 2019-2025

OLED, a new-generation display technology, features simple display structure, green consumables and flexibility and can be rolled up, which makes it easier to transport and install without considering...

Global and China Camera Module Industry Report, 2019-2025

Affected by factors like the maturity of mobile phone markets worldwide and the prolonged replacement of mobile phone by users, the mobile phone market has undergone a slowdown in growth rate. From Q4...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2018-2023

MLCC finds most application in consumer electronics, automobile and industrial fields and gets beefed up remarkably with the approaching 5G era of cellphones and tablet PCs, the advances in automotive...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2018-2023

Aluminum electrolytic capacitor, a core electronic component, is widely used in consumer electronics, computers and peripherals, industry, electric power, lighting and automobiles.

Global aluminum e...

Global and China CMOS Camera System Industry Report, 2017-2021

Global CCM (CMOS Camera Module) market was worth USD16.611 billion in 2015, a year-on-year rise of 3.8% from 2014, the slowest rate since 2010. Global market fell modestly in 2016 due to a drop in shi...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2017-2021

Global OLED market size approximated USD15.7 billion in 2016, a 20.8% rise from a year earlier. Stimulated by reports that Apple will adopt OLED screen for multiple iPhone models in 2017-2018, OLED sc...

Global and China CMOS Camera System Industry Report, 2016-2020

Global and China CMOS Camera System Industry Report, 2016-2020 covers the following:1. Analysis of CMOS Image Sensor (CIS) Industry and Market, with 7 vendors involved.2. Analysis of CMOS Camera Lens ...

Global and China Multi-layer Ceramic Capacitor (MLCC) Industry Report, 2017-2020

The rapid development of consumer electronics and industrial intelligentization has greatly promoted the booming of passive components including multi-layer ceramic capacitor (MLCC). In 2015, China’s ...

Global PCB Industry Report, 2015-2020

Global PCB Industry Report, 2015-2020 highlights the followings:1. Global PCB Market and Status Quo of the Industry2. Global Downstream Markets of PCB3. Mobile Phone PCB Trends4. Tablet PC/Laptop Comp...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2016-2020

The OLED market has been developing rapidly worldwide over the recent years, and its market size reached USD13 billion in 2015. With technology and capacity construction, OLED (from small-sized panels...