OBD (on-board diagnostic system) is an electronics self diagnostic system, typically used in automotive applications. It can monitor whether the automobile exhaust exceeds the standard or the system is normal at any time from the running state of the engine, and according to the fault code, maintenance personnel can quickly and accurately determine the nature and location of a fault. The information is stored in the ECU in the form of fault code, and ECU ensures the fault information access and processing through standard data interface.

OBD telematics is mainly composed of three parts: OBD terminal (hardware and plug-in OBD interface), software (mobile phone APP) and cloud platform.

Along with the development of intelligent automobile hardware and mobile internet, the car becomes the next fast-growing mobile terminal and telematics market also ushers in rapid development. At present, the enterprises are aggressively engaged in telematics market layout and seizing the entrance to telematics, then OBD-based telematic solutions become an important entrance.

Part of the fleet management and vehicle tracking solution providers (such as Geotab, Xirgo, Scope Technologies and ATrack), automotive electronic enterprises (Danlaw, TECHTOM, etc.) and insurance companies (Progressive, State Farm, Allstate, Insurethebox) launched their OBD telematics products during 2006-2012. In 2013-2014, the OBD intelligentt hardware market attracted the attention of capital market; and automotive electronic enterprises, start-up companies, insurance companies, mobile operators, etc. were getting involved in it successively. Among them, the startup Automatic Labs recorded more than one million units in OBD terminal shipments each year.

Prior to 2012, some Chinese enterprises developed OBD terminal, but failed in marketization due to technology and other reasons. Some companies formed the “OBD terminal + APP + Cloud Platform” business model at the outset of 2012. From the end of 2013 to early 2014, influenced by the foreign OBD intelligent hardware investment boom, this OBD telematics mode gained market attention, and all enterprises started OBD telematics market layout.

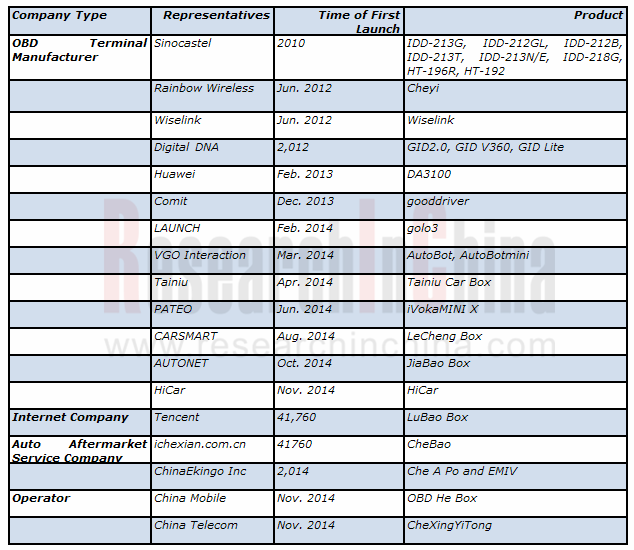

Currently, enterprises involved in OBD telematics (including independent brand OBD terminal) fall into four types: traditional OBD terminal manufacturers (part of the vehicle manufacturers, telematics companies, start-ups, etc.), internet companies, operators, and auto aftermarket service companies.

China’s OBD Telematics Market Participants and Their Products, 2010-2014

Source: ResearchInChina

In addition to a large number of enterprises’ inburst, the global and Chinese OBD telematics market characterized the followings in 2014:

(1) The service function of OBD telematics was further promoted besides application in UBI, fleet management, etc. In January 2015, Automatic worked with the smart thermostats company -- Nest to make its OBD products turn into the smart home controller. In the same month, Zubie also reached data exchange cooperation with PEQ, a provider of all software and services for SmartHome Ventures.

(2) The cloud platform of OBD telematics will be further opened, with API available for software developers which can use the data collected by the platform as well as OBD terminal equipment access interface for other competitors to increase the use of big data through data sharing, e.g. Carvoyant opened platform interface to Velio (an OBD device manufacturer) in January 2015.

(3) The voice recognition technology will be applied to OBD telematics. So far, some OBD telematics companies have added the function of voice broadcast in APP, such as Comit’s gooddriver, Baidu map version golo, etc., but the application of speech recognition is almost blank in OBD telematics.

(4) Currently, OBD is focused on the analysis of data; in the future, OBD terminal is expected to further integrate other function modules (air purification module, voice recognition module) and become multi-functional and intelligent.

Global and China OBD Telematics Industry Report, 2014-2015 mainly covers contents below:

Overview of OBD (including definition, composition, development history, interface and related products);

Overview of OBD (including definition, composition, development history, interface and related products);

Global telematics market (embracing definition, development situation, industry chain, business model, profit model, market size, penetration, etc.);

Global telematics market (embracing definition, development situation, industry chain, business model, profit model, market size, penetration, etc.);

Global OBD telematics market (covering market status, business model, profit model, major applications, etc.);

Global OBD telematics market (covering market status, business model, profit model, major applications, etc.);

China OBD telematics market (including car sales, ownership, industry chain, development history, market status, etc.);

China OBD telematics market (including car sales, ownership, industry chain, development history, market status, etc.);

12 global and 11 Chinese OBD telematics companies (including profile, operating performance, revenue structure, OBD telematics business, latest news, etc.)

12 global and 11 Chinese OBD telematics companies (including profile, operating performance, revenue structure, OBD telematics business, latest news, etc.)

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...