No doubt you have heard the rhetoric about China being the future global economic engine. You may have read about the Chinese government’s huge cash position and its willingness to stimulate growth. This is a growth story as China’s GDP is expected to bounce between 8 – 9% for 2011 and 2012.

On the other hand we have the downside risk of reduced exports if the U.S. drops into another recession. China has inflation over 6% which detracts from the growth. A large list of accounting fraud accusations as well as the questionable practice of performing reverse mergers with shell companies just to get a listing on the US exchange has made foreign investors hesitant.

No doubt investors are weighing these issues as the Shanghai Stock Exchange has an average price-to-earnings ratio of only 15 while the U.S. S&P 500 index has an average price-to-earnings ratio of just under 14. China has a similar valuation but having much higher growth expectations, so a good buying opportunity may be present. Based on lofty future growth expectations, there are a few stocks you may want to consider buying over the next few months.

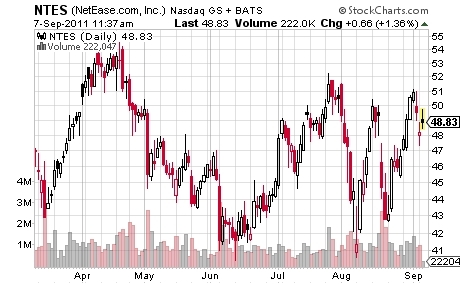

NTES – NetEase.com

This is China’s second-biggest online game operator. With the next 5 years of growth anticipated at 17.54% annually and the price-to-earnings ratio under 14, this may be a good bargain.

Over the last 7 days earnings estimates have jumped – which is often a timely buy indicator. The past 4 quarters the company has reported positive earnings surprises ranging from 6 – 21%. Current earnings growth of 20% is inline with the 3 and 5 year averages. I like the improving sales growth which sits at 46.6% over the past year.

The stock price appears rangebound between $41 and $54. If the stock bounced down to $44 or broke out past $54 on big volume, I would recommend buying. With a $6.29 billion market cap, you can mitigate some of the risk associated with smaller stocks.

CYOU – Changyou.com Limited

A trailing price-to-earnings ratio of less than 10 despite projected annualized earnings growth of over 18% for the next 5 years makes this stock worthy of further inspection. The past 90 days of earnings revisions has boosted next year’s forecast – an 11% total earnings jump. Sizeable single digit earnings surprises have also been reported for the past 4 quarters. As CYOU bounces off $36 support, this just might be the entry you were waiting for.

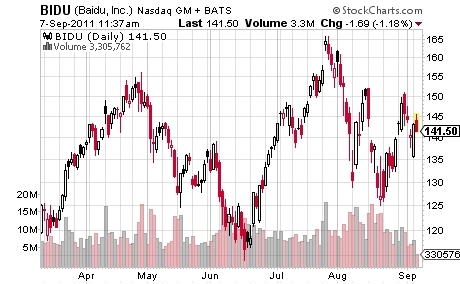

BIDU – Baidu

This internet giant with a 49.73 billion market cap is still a good buy in my books. Once again, we see positive earnings surprises and constant upwards revisions in earnings estimates – both of which are associated with prices drifting higher.

Price-to-earnings ratios are quite high at 64.74, but the forward P/E of 32.44 seems less daunting when compared to next year’s earnings growth forecast at 50.9%, and a annualized 5 year average of 46.25%.

Prices have met with some resistance at $152. If we see another pullback between $130 - $140, this could make a fine time to start a position.

How does BIDU stack up against its competitors SINA and SOHU?

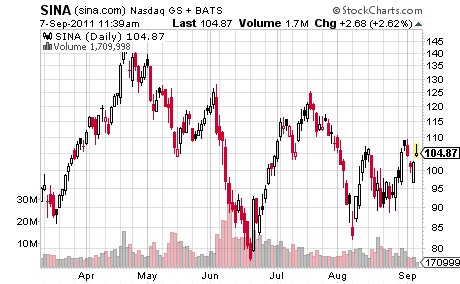

SINA (Sina Corp.)

Sina is suffering from sliding earnings forecasts, combined with a fall in trailing earnings and profit margins. The forward P/E of 66 seems quite high when compared to the 5 year annualized forecast of 21% earnings growth. I would not buy despite the recent upwards price movement.

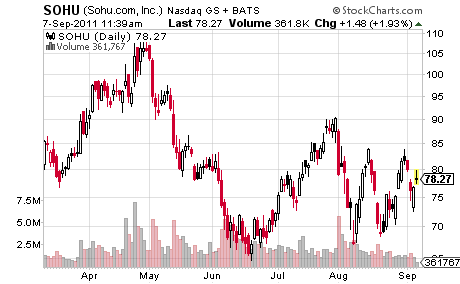

SOHU (SOHU.com )

This company has better valuations with a trailing 18.6 P/E ratio coupled with an expected 16.94% annualized earnings growth rate over the next 5 years. Positive earnings surprises and upward revised forecasts make this a ‘value-based-growth pick', as opposed to BIDU which has very aggressive future growth factored into the high price.

If prices retest around $70, or breakout past $90, this could be another China stock to have in your higher-risk portfolio holdings.

So what is my take on Chinese stocks overall? While China has been soundly punished of late - much of it was well deserved. As we stare down another potential recession in the U.S., China has a lot to lose in exports.

On another note, I also think that the witch-hunt for shady business practices in Chinese stocks will ebb as the silence between the whistle-blowing staccatos lengthen. Soon, American investors re-examine the low valuations to see if they truly reflect the current sentiment or if the fear was a bit over-dramatized.

On a final note, if American markets can keep their heads above water, the broad base of Chinese stocks could really shine, with some of the above picks potentially leading the pack.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Source:seekingalpha