| |

|

|

China with rich coal resources ranks the first in the world in terms of coal reserves. In 2007, China's coal output and sales grew about 9% to 10%, and the profit growth rate of China's coal companies hit around 35% against the previous year. The industry prosperity was further enhanced.

In recent years, China's fixed asset investment in coal industry has increased rapidly. During the period of 2001 to 2005, the investment grew at a rate of above 40%. In the next few years, China's investment in coal industry will reduce, because of regulation and control of national policy. With fast expansion in production capacity stimulated by a great deal of investment, China has an annual increase in coal production capacity by over 400 million tons

In 2007 and 2008 respectively, making its production capacity reach 2.93 million tons in 2008.

Thanks to coal price surges in 2008, China's coal industry has also made big gains. Generally speaking, China has a relatively tight supply of coal, so coal prices have made record highs repeatedly. Furnace coal prices rise faster than those of steam coal and anthracite. By the end of May 2008, the price of Qinhuangdao gifted mixed steam coal has jumped more than 60% against the same period last year. The prices of coking coal have even more than doubled in some areas, including Taiyuan, capital of Shanxi Province, and Tangshan, a city in Hebei province. According to the statistics from Jan. to Feb., 2008, the main business revenue and profit of China coal industry saw a fast increase, rising 40.8% and 66.8% respectively. China's coal industry is bound to have big gains in 2008. Good performance of coal industry in the first half year of 2008 shows that demand in downstream industries is still robust and transportation bottleneck continues to restrict the effective expansion of production capacity.

Mergers and acquisitions among coal producers and integration of assets in coal industry will be the bright spot in investment in the future. The report makes a comprehensive analysis of all investment projects financed by 27 listed companies from 2000 to 2008, and makes a summary of investment trend of China coal industry and investment features and investment trend of the listed companies.

We have a collection of more than 35,000 pieces of information, released by 1,500 Chinese listed companied, on investment projects financed by fund raising and non fund raising since 2000. After the information is processed by software and studied by analysts, the investment direction report concerning various industries is completed, which is classified by time, region (province, autonomous region and municipality), by purpose and by sector.

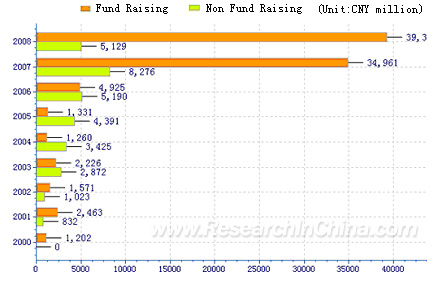

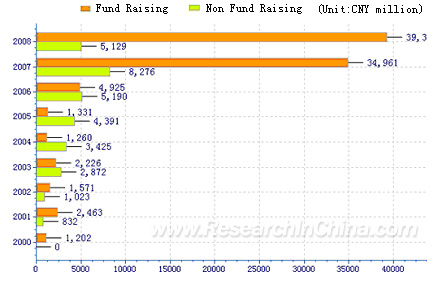

Annual Investment of China Listed Coal Companies, 2000-2008

Source: ResearchInChina

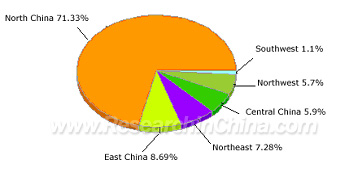

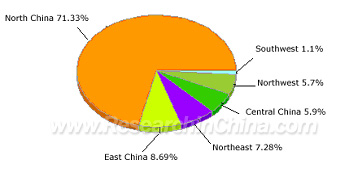

Investment Distribution of China Listed Coal Companies (by Region), 2000-2008H1

Source: ResearchInChina

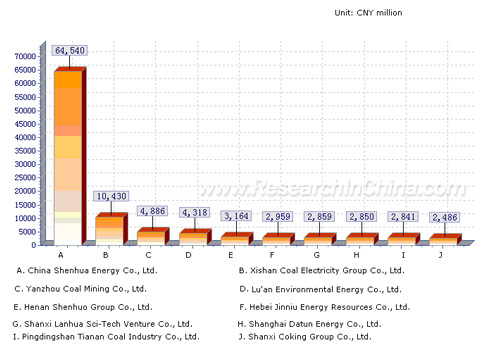

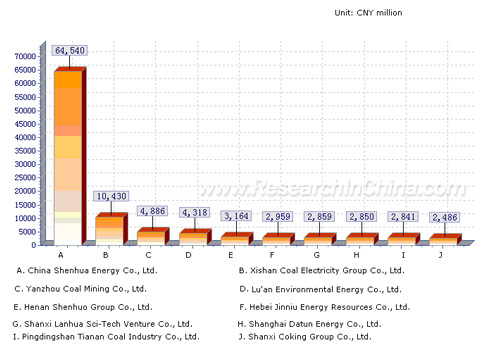

Top 10 Companies in Terms of Investment, 2000-1H2008

Source: ResearchInChina

This report analyzes all investment projects financed by 27 coal listed companies, for example, Henan Shenhuo Group Co., Ltd.

Investment Features of Henan Shenhuo Group Co., Ltd

The company's main business is the production, process and sales of coal and aluminum products. Diversification direction: it is also engaged in the operation of special lines of railway and import & export business regarding their own products as well as related technology.

The company's investment surged in 2005 and 2006, but began slowing down in 2007.

In Sep. 2007, the company controlled Shenhua Aluminum Industry Co., Ltd. through capital increase. Through the integration of aluminum and power industry, the company has achieved its development strategy integrating coal, power and aluminum business. Its coal business will be in a period of rapid expansion of production capacity in 2008-2010, and meanwhile, skyrocketing oil prices will also push up prices of coal. Its electrolytic aluminum business with secured supply of coal and power will have increase in revenue, following the decline in aluminum prices. The two main engines of coal and electrolytic aluminum have laid a solid foundation for its rapid development.

Before 2004, the company's investment was mainly financed by fund raising, but after 2004, its investment projects were financed chiefly by non fund raising.

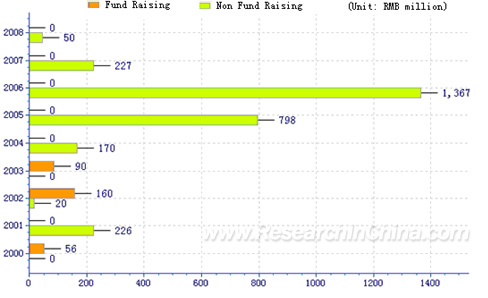

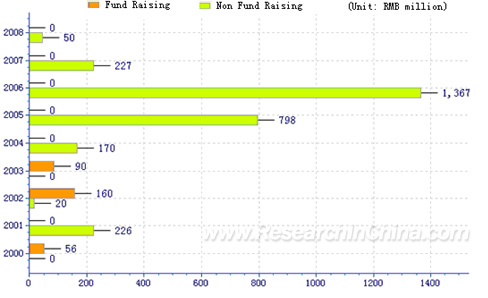

Annual Investment of Henan Shenhuo Group Co., Ltd., 2000-2008

Source: ResearchInChina

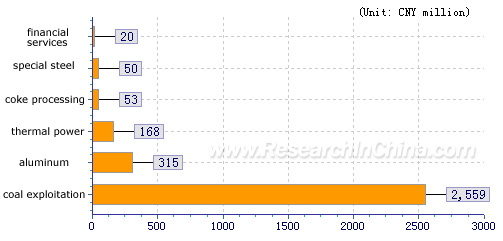

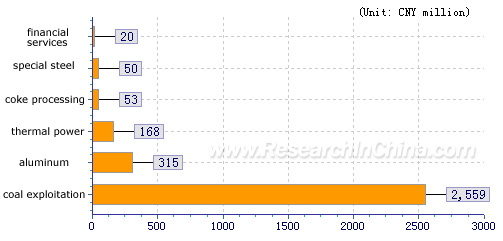

Investment Distribution of Henan Shenhuo (by Segments), 2000-2008

Source: ResearchInChina

Note: We can update the data in the report to the most recent quarter, when the report is purchased.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2008 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

China with rich coal resources ranks the first in the world in terms of coal reserves. In 2007, China's coal output and sales grew about 9% to 10%, and the profit growth rate of China's coal companies hit around 35% against the previous year. The industry prosperity was further enhanced.

In recent years, China's fixed asset investment in coal industry has increased rapidly. During the period of 2001 to 2005, the investment grew at a rate of above 40%. In the next few years, China's investment in coal industry will reduce, because of regulation and control of national policy. With fast expansion in production capacity stimulated by a great deal of investment, China has an annual increase in coal production capacity by over 400 million tons

In 2007 and 2008 respectively, making its production capacity reach 2.93 million tons in 2008.

Thanks to coal price surges in 2008, China's coal industry has also made big gains. Generally speaking, China has a relatively tight supply of coal, so coal prices have made record highs repeatedly. Furnace coal prices rise faster than those of steam coal and anthracite. By the end of May 2008, the price of Qinhuangdao gifted mixed steam coal has jumped more than 60% against the same period last year. The prices of coking coal have even more than doubled in some areas, including Taiyuan, capital of Shanxi Province, and Tangshan, a city in Hebei province. According to the statistics from Jan. to Feb., 2008, the main business revenue and profit of China coal industry saw a fast increase, rising 40.8% and 66.8% respectively. China's coal industry is bound to have big gains in 2008. Good performance of coal industry in the first half year of 2008 shows that demand in downstream industries is still robust and transportation bottleneck continues to restrict the effective expansion of production capacity.

Mergers and acquisitions among coal producers and integration of assets in coal industry will be the bright spot in investment in the future. The report makes a comprehensive analysis of all investment projects financed by 27 listed companies from 2000 to 2008, and makes a summary of investment trend of China coal industry and investment features and investment trend of the listed companies.

We have a collection of more than 35,000 pieces of information, released by 1,500 Chinese listed companied, on investment projects financed by fund raising and non fund raising since 2000. After the information is processed by software and studied by analysts, the investment direction report concerning various industries is completed, which is classified by time, region (province, autonomous region and municipality), by purpose and by sector.

Annual Investment of China Listed Coal Companies, 2000-2008

Source: ResearchInChina

Investment Distribution of China Listed Coal Companies (by Region), 2000-2008H1

Source: ResearchInChina

Top 10 Companies in Terms of Investment, 2000-1H2008

Source: ResearchInChina

This report analyzes all investment projects financed by 27 coal listed companies, for example, Henan Shenhuo Group Co., Ltd.

Investment Features of Henan Shenhuo Group Co., Ltd

The company's main business is the production, process and sales of coal and aluminum products. Diversification direction: it is also engaged in the operation of special lines of railway and import & export business regarding their own products as well as related technology.

The company's investment surged in 2005 and 2006, but began slowing down in 2007.

In Sep. 2007, the company controlled Shenhua Aluminum Industry Co., Ltd. through capital increase. Through the integration of aluminum and power industry, the company has achieved its development strategy integrating coal, power and aluminum business. Its coal business will be in a period of rapid expansion of production capacity in 2008-2010, and meanwhile, skyrocketing oil prices will also push up prices of coal. Its electrolytic aluminum business with secured supply of coal and power will have increase in revenue, following the decline in aluminum prices. The two main engines of coal and electrolytic aluminum have laid a solid foundation for its rapid development.

Before 2004, the company's investment was mainly financed by fund raising, but after 2004, its investment projects were financed chiefly by non fund raising.

Annual Investment of Henan Shenhuo Group Co., Ltd., 2000-2008

Source: ResearchInChina

Investment Distribution of Henan Shenhuo (by Segments), 2000-2008

Source: ResearchInChina

Note: We can update the data in the report to the most recent quarter, when the report is purchased. |

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. Investment Direction of China Coal Industry

1.1 Overview of China Coal Industry

1.2 Investment Features of China Coal Industry2. Investment Direction of Listed Coking Companies

2.1 Analysis of Investment Projects of Shanxi Coking Co., Ltd.

2.1.1 Investment Direction

2.1.2 Investment Features

2.2 Analysis of Investment Projects of Shanxi Antai Group Co., Ltd.

2.2.1 Investment Direction

2.2.2 Investment Features

2.3 Analysis of Investment Projects of Shanxi Jinmei Energy Co., Ltd.

2.3.1 Investment Direction

2.3.2 Investment Features

2.4 Analysis of Investment Projects of Sichuan Shengda Group Co., Ltd.

2.4.1 Investment Direction

2.4.2 Investment Features 3. Investment Direction of Listed Coal Companies

3.1 Analysis of Investment Projects of Henan Shenhuo Group Co., Ltd.

3.1.1 Investment Direction

3.1.2 Investment Features

3.2 Analysis of Investment Projects of Hebei Jinniu Energy Resources Co., Ltd.

3.2.1 Investment Direction

3.2.2 Investment Features

3.3 Analysis of Investment Projects of Xishan Coal Electricity Group Co., Ltd.

3.3.1 Investment Direction

3.3.2 Investment Features

3.4 Analysis of Investment Projects of Zhengzhou Coal & Electric Co., Ltd.

3.4.1 Investment Direction

3.4.2 Investment Features

3.5 Analysis of Investment Projects of Gansu Jingyuan Coal Electricity Co., Ltd.

3.5.1 Investment Direction

3.5.2 Investment Features

3.6 Analysis of Investment Projects of Yanzhou Coal Mining Co., Ltd.

3.6.1 Investment Direction

3.6.2 Investment Features

3.7 Analysis of Investment Projects of Shanxi Guoyang New Energy Co., Ltd.

3.7.1 Investment Direction

3.7.2 Investment Features

3.8 Analysis of Investment Projects of Taiyuan Coal Gasification Co., Ltd.

3.8.1 Investment Direction

3.8.2 Investment Features

3.9 Analysis of Investment Projects of Shanghai Datun Energy Co., Ltd.

3.9.1 Investment Direction

3.9.2 Investment Features

3.10 Analysis of Investment Projects of Hengyuan Coal & Electricity Co., Ltd.

3.10.1 Investment Direction

3.10.2 Investment Features

3.11 Analysis of Investment Projects of Shanxi Lanhua Sci-Tech Venture Co., Ltd.

3.11.1 Investment Direction

3.11.2 Investment Features

3.12 Analysis of Investment Projects of Datong Coal Mine Group Co., Ltd.

3.12.1 Investment Direction

3.12.2 Investment Features

3.13 Analysis of Investment Projects of Pingdingshan Tianan Coal Industry Co., Ltd.

3.13.1 Investment Direction

3.13.2 Investment Features

3.14 Analysis of Investment Projects of Guizhou Panjiang Clean Coal Co., Ltd.

3.14.1 Investment Direction

3.14.2 Investment Features

3.15 Analysis of Investment Projects of ST Pingneng Co., Ltd.

3.15.1 Investment Direction

3.15.2 Investment Features

3.16 Analysis of Investment Projects of Anyuan Co., Ltd.

3.16.1 Investment Direction

3.16.2 Investment Features

3.17 Analysis of Investment Projects of Kaiyuan Clean Coal Co., Ltd.

3.17.1 Investment Direction

3.17.2 Investment Features

3.18 Analysis of Investment Projects of Lutian Coal Co., Ltd.

3.18.1 Investment Direction

3.18.2 Investment Features

3.19 Analysis of Investment Projects of China Shenhua Energy Co., Ltd.

3.19.1 Investment Direction

3.19.2 Investment Features

3.20 Analysis of Investment Projects of Lu'an Environmental Energy Co., Ltd.

3.20.1 Investment Direction

3.20.2 Investment Features

3.21 Analysis of Investment Projects of Guotou Xinji Energy Co., Ltd.

3.21.1 Investment Direction

3.21.2 Investment Features

3.22 Analysis of Investment Projects of China National Coal Corp.

3.22.1 Investment Direction

3.22.2 Investment Features

3.23 Analysis of Investment Projects of Xinjiang International Industry Co., Ltd.

3.23.1 Investment Direction

3.23.2 Investment Features

|

|

|

|

|

2005-2008 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Annual Investment of China Listed Coal Companies, 2000-2008

Investment of China Listed Coal Companies by Region, 2000-2008

Investment Distribution of China Listed Coal Companies by Region, 2000-2008

Top 10 Regions in Terms of Investment in Coal Industry, 2000-2008

Investment Distribution of China Listed Coal Firms by Province/Municipality, 2000-2008

Top 10 Companies in Terms of Investment (by Investment Purpose), 2000-2008

Top 10 Companies in Terms of Investment Distribution (by Investment Purpose), 2000-2008

Investment of Listed Firms in China Coal Industry (by Segmented Industry), 2000-2008

Investment Distribution of Listed Coal Companies (by Segmented Industry), 2000-2008

Top 10 Companies in Terms of Investment in China Coal Industry, 2000-2008

Investment of Listed Coal Companies by Non Fund Raising, 2006 Q1-2008 Q2

Investment of Listed Coal Companies by Non Fund Raising by Region, 2006 Q1-2008 Q2

Top 5 Regions in Terms of Non-fundraising Investment by Listed Coal Firms, 2006 Q1-2008 Q2

Top 5 Firms in Terms of Non-fundraising Investment by Listed Coal Firms, 2006 Q1-2008 Q2

Top 5 Firms in Terms of Non-fundraising Investment (by Segmented Industry), 2006 Q1-2008 Q2

Annual Investment of Shanxi Coking Co., Ltd., 2000-2008

Shanxi Coking Investment Distribution by Region, 2000-2008

Shanxi Coking Investment Distribution by Investment Purpose, 2000-2008

Shanxi Coking Investment by Main Investment Purpose, 2000-2008

Shanxi Coking Investment Distribution by Segmented Industry, 2000-2008

Shanxi Coking Investment by Main Segmented Industry, 2000-2008

Shanxi Coking Key Investment Projects, 2000-2008

Shanxi Coking Latest Investment Projects, 2000-2008

Shanxi Coking Main A&M Projects, 2000-2008

Annual Investment of Shanxi Antai Group Co., Ltd., 2000-2008

Antai Group Investment Distribution by Region, 2000-2008

Antai Group Investment Distribution by Investment Purpose, 2000-2008

Antai Group Investment by Main Investment Purpose, 2000-2008

Antai Group Investment Distribution by Segmented Industry, 2000-2008

Antai Group Investment by Main Segmented Industry, 2000-2008

Antai Group Main Investment Projects, 2000-2008

Antai Group Latest Investment Projects, 2000-2008

Annual Investment of Shanxi Meijin Energy Group Co., Ltd., 2000-2008

Meijin Energy Investment Distribution by Region, 2000-2008

Meijin Energy Investment Distribution by Investment Purpose, 2000-2008

Meijin Energy Investment by Main Investment Purpose, 2000-2008

Meijin Energy Investment Distribution by Segmented Industry, 2000-2008

Meijin Energy Investment by Main Segmented Industry, 2000-2008

Meijin Energy Main Investment Projects, 2000-2008

Meijin Energy Latest Investment Projects, 2000-2008

Annual Investment Trend of Sichuan Shengda Group Co., Ltd., 2000-2008

Sichuan Shengda Investment Distribution by Region, 2000-2008

Sichuan Shengda Investment Distribution by Investment Purpose, 2000-2008

Sichuan Shengda Investment by Main Investment Purpose, 2000-2008

Sichuan Shengda Investment Distribution by Segmented Industry, 2000-2008

Sichuan Shengda Investment by Main Segmented Industry, 2000-2008

Sichuan Shengda Main Investment Projects, 2000-2008

Sichuan Shengda Latest Investment Projects, 2000-2008

Sichuan Shengda Main M&A Projects, 2000-2008

Investment of Heihua Group Co., Ltd. by Main Investment Purpose, 2000-2008

Heihua Group Investment by Main Segmented Industry, 2000-2008

Annual Investment Trend of Henan Shenhuo Group Co., Ltd., 2000-2008

Shenhuo Group Investment Distribution by Region, 2000-2008

Shenhuo Group Investment Distribution by Investment Purpose, 2000-2008

Shenhuo Group Investment by Main Investment Purpose, 2000-2008

Shenhuo Group Investment Distribution by Segmented Industry, 2000-2008

Shenhuo Group Investment by Main Segmented Industry, 2000-2008

Shenhuo Group Main Investment Projects, 2000-2008

Shenhuo Group Latest Investment Projects, 2000-2008

Shenhuo Group Main M&A Projects, 2000-2008

Annual Investment of Heibei Jinniu Energy Resources Co., Ltd., 2000-2008

Jinniu Energy Investment Distribution by Region, 2000-2008

Jinniu Energy Investment Distribution by Investment Purpose, 2000-2008

Jinniu Energy Investment by Main Investment Purpose, 2000-2008

Jinniu Energy Investment Distribution by Segmented Industry, 2000-2008

Jinniu Energy Investment by Main Segmented Industry, 2000-2008

Jinniu Energy Main Investment Projects, 2000-2008

Jinniu Energy Latest Investment Projects, 2000-2008

Jinniu Energy Main M&A Projects, 2000-2008

Annual Investment Trend of Xishan Coal Electricity Group Co., Ltd., 2000-2008

Xishan Coal Investment Distribution by Region, 2000-2008

Xishan Coal Investment Distribution by Investment Purpose, 2000-2008

Xishan Coal Investment by Main Investment Purpose, 2000-2008

Xishan Coal Investment Distribution by Segmented Industry, 2000-2008

Xishan Coal Latest Investment Projects, 2000-2008

Xishan Coal Main M&A Projects, 2000-2008

Annual Investment Trend of Gansu Jingyuan Coal Electricity Co., Ltd., 2000-2008

Gansu Jingyuan Investment Distribution by Region, 2000-2008

Gansu Jingyuan Investment Distribution by Investment Purpose, 2000-2008

Gansu Jingyuan Investment by Main Investment Purpose, 2000-2008

|

2005-2008 www.researchinchina.com All Rights Reserved

|