Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more important

L2.5 and L2.9 have achieved mass production for vehicles running on the road, and mass production of L3 and L4 in limited scenarios has become a goal for OEMs in the next stage. In March 2022, the U.S. National Highway Traffic Safety Administration (NHTSA) issued final rules eliminating the need for automated vehicle manufacturers to equip fully autonomous vehicles with manual driving controls to meet crash standards. The United States is expected to introduce more important policies for autonomous driving in the future to guide L3/L4 autonomous driving on the road.

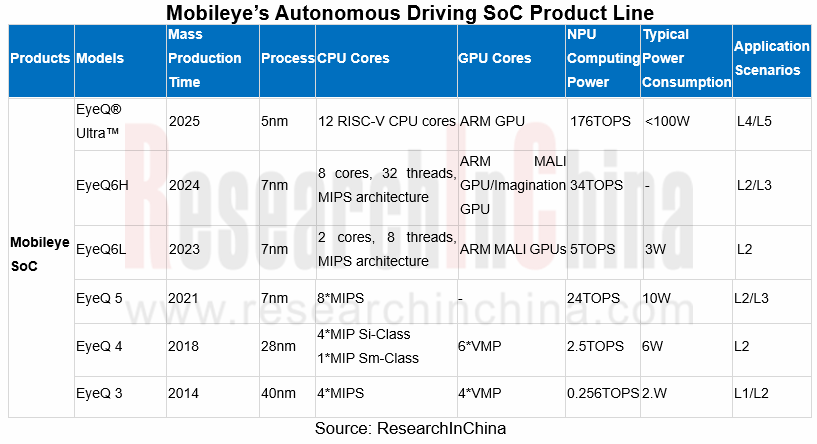

In this context, ADAS/autonomous driving chips have seen a wave of upgrades, and many chip makers have launched or planned to unveil high computing power chips. In January 2022, Mobileye introduced the EyeQ? Ultra?, the company’s most advanced, highest performing system-on-chip (SoC) purpose-built for autonomous driving. As unveiled during CES 2022, EyeQ Ultra maximizes both effectiveness and efficiency at only 176 TOPS, with 5 nanometer process technology. Although it looks less potent than chips from rivals Qualcomm and NVIDIA, the cost-effective and high-energy-efficiency EyeQ? Ultra? may still be favored by OEMs.

In addition to computing power, self-developed core IP is the focus of competition for major SoC vendors

SoC chips, which are mostly involved with heterogeneous design, include different computing units such as GPU, CPU, acceleration core, NPU, DPU, ISP, etc. Generally speaking, computing power cannot be simply evaluated from the chip alone. Chip bandwidth, peripherals, memory, as well as energy efficiency ratio and cost should be also taken into account. At the same time, the development tool chain of SoC chips is very important. Only by forming a developer ecosystem can a company build long-term sustainable competitiveness.

In chip design, the configuration of heterogeneous IP is crucial, and autonomous driving SoC chip vendors are constantly strengthening the research and development of core IP to maintain their decisive competitive edges. For example, NVIDIA upgraded its existing GPU-based product line to a three-chip (GPU+CPU+DPU) strategy:

? GPU: NVIDIA enjoys superiority in GPU and image processing derived from GPU;

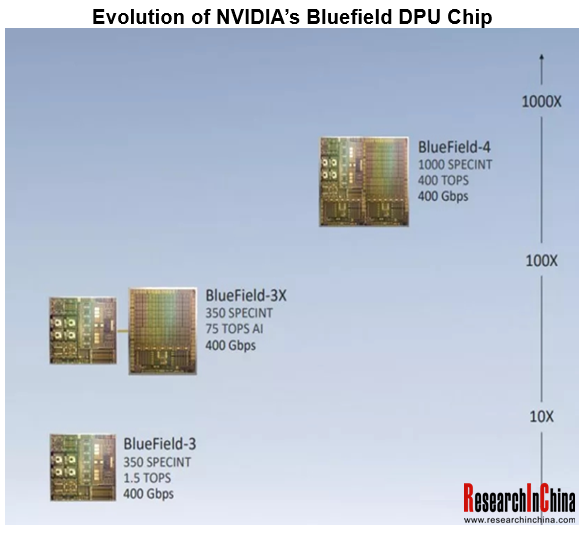

? DPU: NVIDIA announced the completion of its acquisition of Mellanox Technologies, Ltd., an Israeli chip company, for a transaction value of $7 billion and launched the BlueField?-3 data processing unit (DPU). DPU is a programmable electronic component with the versatility and programmability of a central processing unit (CPU), dedicated to efficiently handling network data packets, storage requests or analysis requests;

? In terms of CPU, NVIDIA intended to acquire the semiconductor IP semiconductor ARM as an extension of its three-chip strategy, but it failed in the end. However, NVIDIA launched the Grace? CPU, an Arm-based processor that will deliver 10x the performance of today’s fastest servers on the most complex AI and high-performance computing workloads. NVIDIA's next-generation SOC, Atlan, is based on the ARM-based Grace CPU and Ampere Next GPU.

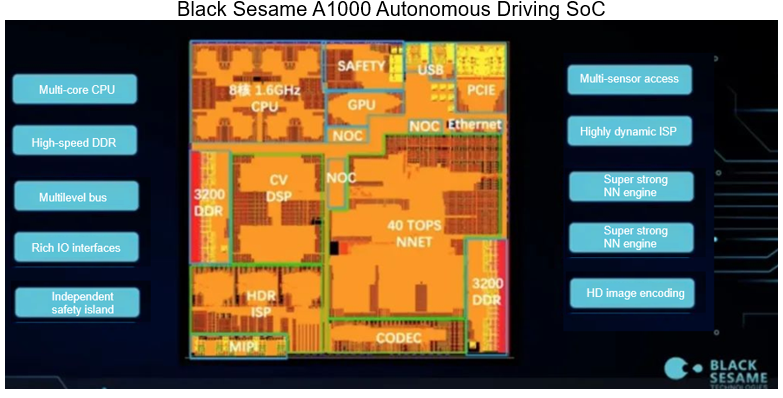

In terms of domestic vendors, Black Sesame Technologies has launched self-developed NeuralIQ ISP and DynamAI NN engine which is a deep neural network algorithm platform.

Cross-domain fusion and central computing platform chips will lead the evolution of the automotive EEA

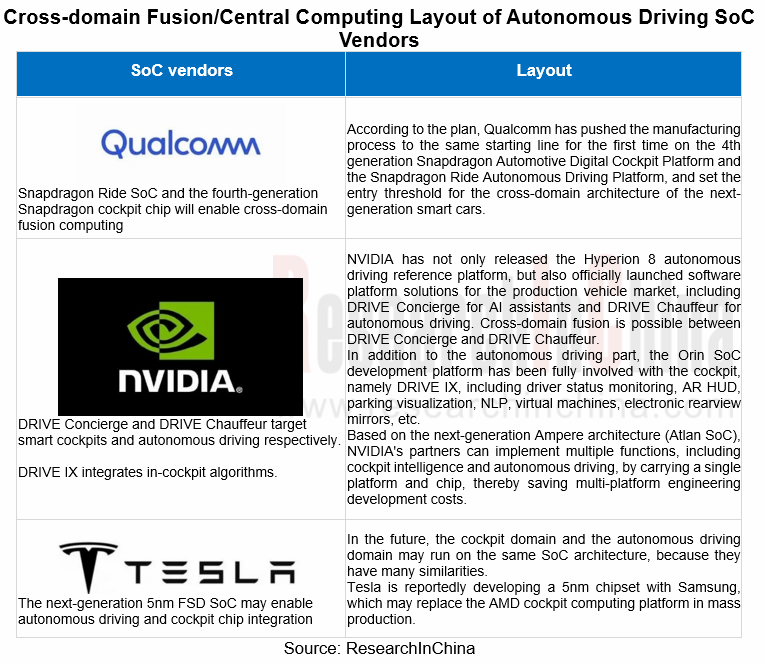

Amid the evolution trend of the automotive EEA: "distributed architecture - domain centralized architecture - cross-domain fusion architecture - central computing platform", Tesla's latest version of Model X has achieved a certain degree of central cross-domain fusion computing. Model X's automotive central computing platform includes two FSD chips, an AMD Ryzen CPU chip and an AMD RDNA2 GPU. The FSD chip and AMD CPU/GPU chip communicate through the PCIe interface and are isolated from each other.

Integrating multiple chips such as CPU, GPU, and FSD into one SoC chip through Chiplet technology will further reduce the chip communication delay. Tesla has reportedly partnered with Samsung on a new 5nm chip for autonomous driving and cockpit SoC chip integration.

The industry’s giants like NVIDIA and Qualcomm have all begun to implement cross-domain integration of autonomous driving and cockpits. For example, NVIDIA has launched DRIVE Concierge and DRIVE Chauffeur for smart cockpits and autonomous driving respectively. DRIVE IX can realize the fusion of algorithms in the cockpit. Based on the powerful software stack tools, NVIDIA's next-generation Ampere architecture (Atlan SoC) will conduct the simultaneous control over autonomous driving and intelligent cockpit with a single chip.

In February 2022, Chinese SoC company Horizon Robotics announced that it will cooperate with UAES to preinstall and mass-produce cross-domain integrated automotive computing platforms.

SoC vendors accelerate the layout of autonomous driving AI data training

Autonomous driving datasets are critical for training deep learning models and improving algorithm reliability. SoC vendors have launched self-developed AI training chips and supercomputing platforms. Tesla has launched the AI training chip D1 and the "Dojo" supercomputing platform, which will be used for the training of Tesla's autonomous driving neural network.

Besides, training algorithm models are becoming more and more important, including 2D annotation, 3D point cloud annotation, 2D/3D fusion annotation, semantic segmentation, target tracking, etc., such as the NVIDIA Drive Sim autonomous driving simulation platform, the Horizon Robotics "Eddie" data closed loop training platform, etc.

Foreign chip vendors:

? Tesla has launched Dojo supercomputing training platform, using Tesla's self-developed 7nm AI training chip D1 and relying on a huge customer base to collect autonomous driving data, so as to achieve model training for deep learning systems. At present, Tesla Autopilot mainly uses 2D images + annotations for training and algorithm iteration. Through the Dojo supercomputing platform, Autopilot can fulfill training through 3D images + time stamps (4D Autopilot system). The 4D Autopilot system will be predictable, and mark the 3D movement trajectory of road objects to enhance the reliability of autonomous driving functions.

? NVIDIA has announced NVIDIA Omniverse Replicator, an engine for generating synthetic data with ground truth for training AI networks. NVIDIA also has the most powerful training processor - the NVIDIA A100.

? The map data of Mobileye's REM has covered the world. In China, Mobileye has solved the compliance problem of map data collection in China through a joint venture with Tsinghua Unigroup. Intel acquired Moovit to enhance the strength and data differentiation of REM, extend the traditional HD map data from the roadside to the user side, start from the perception redundancy of assisted autonomous driving and improve the efficiency of path planning. Intel launched its self-developed flagship AI chip - Ponte Vecchio, which will spread to Mobileye's EyeQ6 (planned for mass production in 2023). In the field of AI and servers, Intel will challenge Nvidia with CO-EMIB technology.

Domestic chip vendors:

? In order to solve the long-tail problem of autonomous driving, Horizon Robotics has built a complete data closed-loop platform to iterate algorithms and improve system capabilities. Horizon Robotics has launched the "Eddie" data closed loop training platform.

? Huawei has introduced "Octopus" autonomous driving open platform, focusing on the four most critical elements of autonomous driving development - hardware, data, algorithms and HD maps to build a data-centric open platform which prompts closed-loop iterations of autonomous driving. Huawei's Ascend 910 competes with the NVIDIA A100 as the world's top AI training chip. Huawei has also launched the AI training cluster Atlas 900.

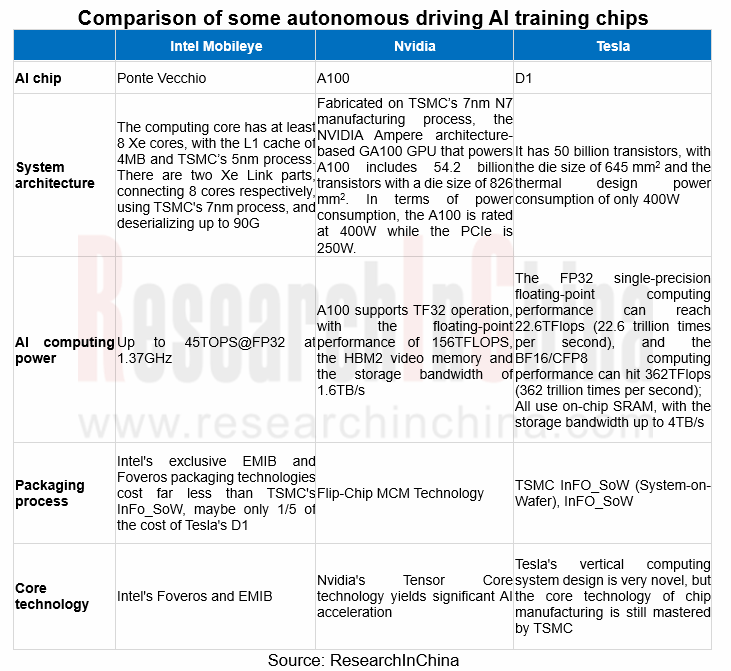

The world's leading autonomous driving AI training chips include: Intel Ponte Vecchio, NVIDIA A100, Tesla D1, Huawei Ascend 910, Google TPU (v1, v2, v3), Cerebras Wafer-Scale Engine, Graphcore IPU, etc.

Intelligent Cockpit Domain Control Unit (DCU) and Head Unit Dismantling Report, 2023 (1)

Dismantling of Head Unit and Cockpit Domain Control Unit (DCU) of NIO, Toyota and Great Wall Motor The report highlights the dismantling of Toyota’s MT2712-based head unit, Fisker’s Intel A2960-based ...

Automotive Vision Algorithm Industry Research Report, 2023

Research on automotive vision algorithms: focusing on urban scenarios, BEV evolves into three technology routes.1. What is BEV?

BEV (Bird's Eye View), also known as God's Eye View, is an end-to-end t...

ADAS Domain Controller Key Component Trends Report, 2022

ResearchInChina researched and summarized China’s current mainstream high computing power ADAS domain controller products such as Huawei MDC and DJI ADAS domain controller prototype, and technical inf...

Automotive High-precision Positioning Research Report, 2023

High Precision Positioning Research: four forms of mass-produced integrated high-precision positioning products

With the continuous development of autonomous driving, the demand for high-precis...

Automotive AUTOSAR Platform Research Report, 2023

AUTOSAR research: CP + AP integration, ecosystem construction, and localization will be the key directions.

AUTOSAR standard technology keeps upgrading, and the willingness to build open cooperation ...

China Autonomous Driving Algorithm Research Report, 2023

Autonomous Driving Algorithm Research: BEV Drives Algorithm Revolution, AI Large Model Promotes Algorithm Iteration

The core of the autonomous driving algorithm technical framework is divided into th...

Dismantling Report: DJI Front View Binocular Camera and Innovusion LIDAR

Dismantling Report: DJI Front View Binocular Camera and Innovusion LIDAR

Recently, ResearchInChina selected two key components essential to current intelligent driving assistance systems - front view...

Automotive CMOS Image Sensor (CIS) Chip Industry Research Report, 2022

Automotive CIS research: three major segmentation scenarios create huge market space

It is known that the biggest application market of image sensor is smartphone field. As the smartphone market beco...

Global and China Automotive Cluster and Center Console Industry Report, 2022

Automotive Display Research: Penetration Rate of OLED, Mini LED and Other Innovative Display Technology Increased Rapidly

With the penetration of new energy and intelligent driving vehicles, the tren...

Autonomous Driving Simulation Industry Chain Report (Chinese Companies), 2022

Simulation Research (Part II): digital twin, cloud computing, and data closed-loop improve simulation test efficiency.

Simulation tests can not only be conducted in extreme working conditions and mor...

Automotive Memory Chip Industry Research Report, 2022

Automotive Memory Chip Research: Localization is imperative amid intense competition

The global smart phone storage market size hit US$46 billion in 2021 when the global automotive storage market siz...

Autonomous Driving Simulation Industry Chain Report (Foreign Companies), 2022

Simulation test research: foreign autonomous driving simulation companies forge ahead steadily with localization services.

As the functions of ADAS and autonomous driving systems are developed and th...

China Automotive Multimodal Interaction Development Research Report, 2022

Multimodal interaction research: more hardware entered the interaction, immersive cockpit experience is continuously enhanced

ResearchInChina's “China Automotive Multimodal Interaction Development Re...

Global and China Automotive Operating System (OS) Industry Report,2022

Operating system research: the automotive operating system for software and hardware cooperation enters the fast lane.

Basic operating system: foreign providers refine and burnish functions; Chinese ...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2022

Automotive radar research: installations surged by 49.5% year on year in 2021, and by 35.4% in the first nine months of 2022.

1. The installations of automotive radars sustain growth, and are expect...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2022

In-cabin Monitoring Research: In the first nine months of 2022, the installations of DMS+OMS swelled by 130% yr-on-yr with visual DMS/OMS as the mainstream solution

Local manufacturers are keen to de...

NIO ET5/ET7 Intelligent Function Deconstructive Analysis Report, 2022

NIO ET5/ET7 Intelligent Function Deconstruction: R&D will change the market pattern in 2025Chinese automakers have triumphed remarkably in the field of high-end intelligent electric vehicles. Afte...

Automotive Smart Cockpit Design Trend Report, 2022

Research on design trends of intelligent cockpits: explore 3D, integrated interaction. ...