Passenger car T-BOX research: T-Box OEM installation rate will reach 83.5% in China in 2025

ResearchInChina has published Global and China Passenger Car T-Box Market Report 2022 to summarize and analyze the T-Box installations and installation rates to passenger cars in China and the world, T-Box suppliers, T-Box development trends, and the App remote control function configuration of new models launched by OEMs.

Passenger car T-Box is developing towards:

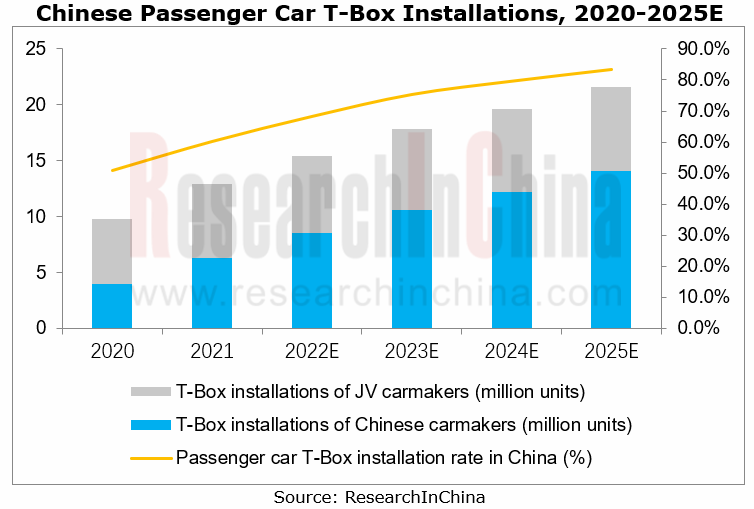

1. T-Box OEM installation rate will reach 83.5% in China in 2025;

2. 5G C-V2X T-Box seizes more and more market shares;

3. Automotive Ethernet is expected to replace CAN bus and FlexRay to become the main connection way of T-Box;

4. The remote vehicle control by mobile Apps becomes ever smarter (AVP, etc.).

T-Box OEM installation rate will register 83.5% in China in 2025

T-Box is mainly used for the communication between vehicle and Internet of Vehicles (IoV) service platform and acts as the core hardware of OEM telematics.

In 2021, 12.94 million passenger cars were installed with T-Box by OEMs in China, a year-on-year increase of 31%; the installation rate hit 60%, up about 10 percentage points from last year. By 2025, over 20 million passenger cars will be equipped with T-Box, and the installation rate will climb to 83.5%, and. T-Box and telematics are growing indispensable to passenger cars.

In 2021, 6.301 million passenger cars of Chinese automakers carried T-Box, a year-on-year spike of 59.9%; 6.634 million passenger cars of joint venture carmakers did so, up 12.9% on a yearly basis. Chinese OEMs make much faster progress in Internet of Vehicles than JV brands.

T-Box installations to passenger cars will keep an uptrend, so will the installation rate, and passenger car Internet of Vehicles will be further popularized, which are contributed by the consumers’ robust demand for intelligent connected vehicles (ICVs), the surge in new energy vehicle (NEV) sales, OEMs’ needs for FOTA as well as regulatory requirements and other factors.

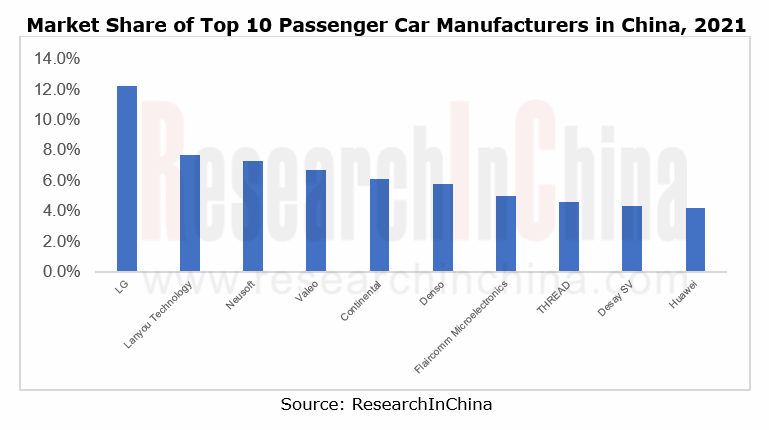

Top 10 OEMs command 64% market shares

Viewed from the market structure, the top 10 T-Box suppliers in China held 64% market shares together in 2021, with LG, Lanyou Technology and Neusoft at the top. Among them, Lanyou Technology, established in 2002 with DFS Industrial Group holding its 80% stake, mainly supplies T-Box products to Nissan and Dongfeng Motor. Lanyou’s T-Box was installed to one million cars in 2021. Also in 2021, Neusoft served 940,000 vehicles, mainly from Geely and Great Wall Motor. Thanks to Great Wall's high sales, Neusoft witnessed fast-growing T-Box installations in 2021.

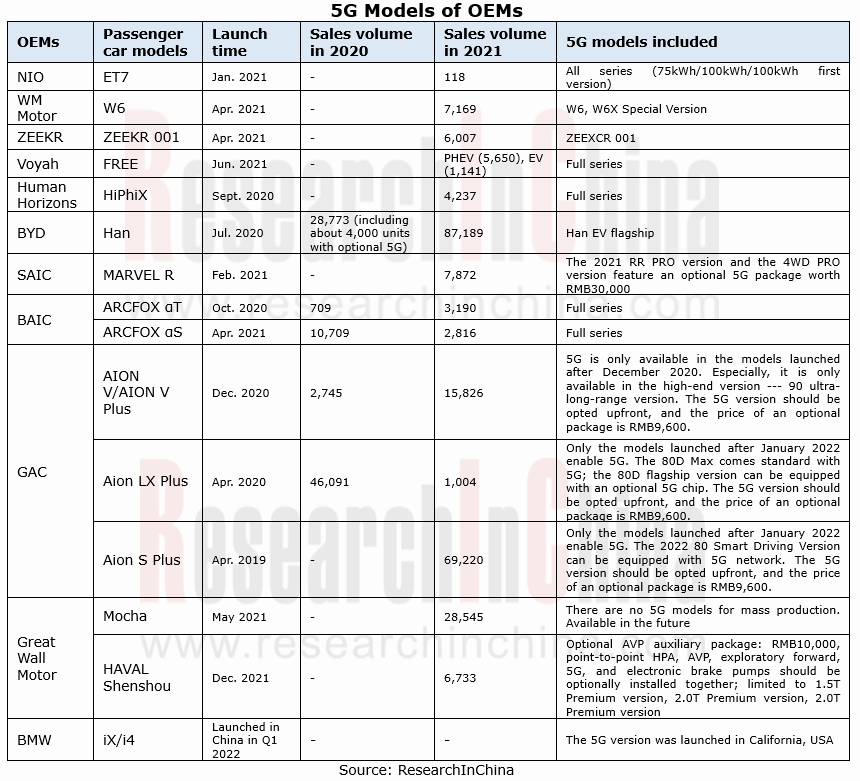

5G C-V2X T-Box will see the rising market shares

In 2020, the Ministry of Industry and Information Technology of China (MIIT) granted two 5G T-Box models Network Access License. In 2021, 19 5G T-Box models secured Network Access License, making for 9.3% which jumped 8 percentage points year-on-year. From January to March of 2022, seven 5G T-Box models obtained Network Access License. The number is expected to rise throughout 2022. At present, 4G T-Box still prevails, but it will be gradually replaced by 5G T-Box in the long run.

T-Box vendors are vigorously developing T-Box products that integrate 5G, C-V2X, high-precision positioning and other functional modules to create differentiated advantages. As of March 2022, a total of 25 5G T-Box models had gained Network Access License, including one from Samsung Harman, one from Lear, six from Neusoft, three from Datang Gohigh, two from DIAS, two from Huawei, two from JOYNEXT, two from China Mobile IoT, one from HiRain Technologies, one from Lanyou Technology, one from YF Tech, one from China TSP, one from TAGE, and one from Chelutong Technology (Chengdu) Co., Ltd.

Lanyou Technology mass-produced its 5G C-V2X T-Box in August 2021. Based on 5G, it provides high bandwidth, integrates 5G, C-V2X and centimeter-level positioning, supports 5G only and 5G+V2X dual mode, and enables at least 25 C-V2X application scenarios. Lanyou in harness with Huawei, Qualcomm, MTK, UNISOC and other platforms now boasts 5G T-Box customers such as Dongfeng Voyah, Aeolus, Nissan, and Venucia.

Neusoft’s 5G C-V2X T-Box bolsters 16 application scenarios based on three mainstream platforms and V2X national standards, as well as supports 5G NSA/SA communication, L1+L5 GNSS global positioning, Gigabit Ethernet technology, C-V2X communication, CANFD communication, LIN communication, Bluetooth 5.0+ communication, WiFi 6 communication, RKE, TPMS communication and ETC, etc. In 2021, Neusoft's 5G (V2X) BOX were massively available onto New Great Wall Haval H6, ZEEKR 001 and other models.

HiRain Technologies leverages the AP+NAD+MCU architecture for its 5G T-Box, provides multi-platform support (like Qualcomm, MTK), and presents various forms such as stand-alone type, smart antenna type, and multiple communication module integration. Functional interfaces cover 5G SA/NSA, C-V2X, CAN/CANFD, Gigabit Ethernet, dual-band GNSS, WiFi6, Bluetooth 5.2, USB, etc., and can also integrate TPMS, ETC, swap control, Bluetooth key (scalable UWB) and the like. For intelligent driving, centimeter-level positioning, parking lot/vehicle AVP, 10 Gigabit Ethernet high-speed channels and other services are available. Mass production for Dongfeng Voyah and other models has been achieved.

Some companies are also developing T-Box products that support 5G C-V2X. For example, the 5G T-Box being developed by Flaircomm Microelectronics will be compatible with mainstream 5G SOC solutions at home and abroad, and support SA/NSA networking technology, 5G V2X technology, centimeter-level positioning, Gigabit Automotive Ethernet and CAN FD bus technology.

Meanwhile, OEMs have begun to mount 5G C-V2X technology on more and more new models. For instance, SAIC Marvel R is equipped with 5G V2X i-BOX, a fusion of 5G, V2X and high-precision positioning; GAC Aion V, outfitted with Huawei MH5000 5G Module, features a 100M transmission channel and enables intelligent driving with C-V2X.

Automotive Ethernet is expected to replace CAN bus and FlexRay to become the main connection method of T-Box

New automotive functions (such as automated parking system, lane departure detection system, blind spot detection and advanced infotainment system) pose higher requirements on new data bus transmission.

With the release of the new Ethernet protocol in 2021, automotive Ethernet is expected to substitute for CAN bus and FlexRay and be the main connection method of T-Box by virtue of its low cost, low power consumption, low electromagnetic radiation, and strong scalability, thus speeding up updates and calibrations of firmware and software remarkably while reducing downtime caused by vehicle system updates. BMW and GM have confirmed that they will replace the CAN bus with 10BASE-T1S in their next-generation cars.

To date, the T-Box products of leading Chinese players (Lanyou Technology, Neusoft, Flaircomm Microelectronics, HiRain Technologies, etc.) have integrated Gigabit Ethernet to efficiently handle a universe of data from intelligent connected vehicle in the future.

The remote vehicle control by mobile Apps grows ever smarter (like AVP)

Automotive T-BOX is mainly used to communicate with background systems and mobile Apps so as to display and control vehicle information on the mobile Apps.

With the addition of technologies such as cloud computing and HD maps, the remote vehicle control functions on mobile Apps are constantly evolving. For example, AVP allows the driver to remotely control parking via mobile Apps in above-ground or basement public parking lots at a certain distance from their cars. WM W6 and GAC Aion V Plus have offered such a feature.

Automotive Intelligent Cockpit Platform Research Report, 2023

Intelligent cockpit platform research: the boundaries between vehicles and PCs are blurring, and there are several feasible paths for cockpit platforms.

Automotive Intelligent Cockpit Platform Resea...

Global and China Automotive Wireless Communication Module Industry Report,2023

Vehicle communication module research: 5G R16+C-V2X module, smart SiP module and other new products spring up.

In 2022, 4G modules swept 84.3% of the vehicle communication module market....

Intelligent Vehicle Cockpit-Driving Integration Research Report, 2023

Cockpit-Driving Integration Research: many companies are making layout and may implement it during 2024-2025.

1. What is the real cockpit-driving integration?

At present, automotive electroni...

Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosystem Research Report, 2022

Telematics System Research 2: Baidu Family Bucket, Huawei and Tencent Become the Mainstream Ecosystems

ResearchInChina released Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosyst...

China Automotive Digital Key Research Report, 2023

Automotive Digital Key Research: the pace of mobile phones replacing physical keys quickens amid the booming market

"China Automotive Digital Key Research Report, 2023" released by ResearchInChina co...

Automotive Camera Tier2 Suppliers Research Report, 2022-2023

1. The automotive camera market maintains a pattern of "one superpower and several great powers".

Automotive cameras are used to focus the light reflected from the target onto the CIS after refractio...

Emerging Carmaker Strategy Research Report, 2023 - NIO

Emerging carmaker strategy research: NIO is deploying battery swap and sub-brands for the knockout match in 2023.In 2022, the sales surged by 32.3% year on year, being concentrated in first-tier citie...

Nissan CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022-2023

Nissan CASE research: two leverages for Dongfeng Nissan to turn the tables. Introduction: since 2020, the declining sales of Dongfeng Nissan have exposed its problems in brand influence and product co...

China Automotive Gesture Interaction Development Research Report,2022-2023

Vehicle gesture interaction research: in 2022, the installations rocketed by 315.6% year on year.China Automotive Gesture Interaction Development Research Report, 2022-2023 released by ResearchInChina...

Automotive Power Management Integrated Circuits (PMIC) Industry Report, 2023

Automotive PMIC research: the process of domestic automotive PMICs replacing foreign ones in China in the “crisis of chip shortage”.

Automotive power management integrated circuits (PMIC) find broad ...

Automotive Cockpit SoC Research Report, 2023

Cockpit SoC research in 2023: Can X86 solutions returning to cockpit SoC challenge the “ARM+Google” mobile solution?

This report highlights the research on the products and plans of 9 overseas and 8 ...

AI Foundation Model and Autonomous Driving Intelligent Computing Center Research Report, 2023

New infrastructures for autonomous driving: AI foundation models and intelligent computing centers are emerging.

In recent years, the boom of artificial intelligence has actuated autonomous driving, ...

Automotive Microcontroller Unit (MCU) Industry Report, 2023

MCU Industry Research: Automotive high-end MCU will be still in short supply, and how OEMs can break the situation.

ResearchInChina has released "Automotive Microcontroller Unit (MCU) Industry Repor...

Global and China Fuel Cell Market and Trend Research Report, 2023

Fuel Cell Industry Research: Hydrogen energy has been put on the national agenda with scenario application being rolled out.The hydrogen energy industry has been included into the national energy stra...

Global and China Automotive Smart Antenna Research Report, 2022-2023

Smart antenna research: the integration of automotive antennas and intelligent connected terminals tends to accelerate.

The development trend of automotive antennas: tend to be intelligent, diversif...

Chinese Independent OEMs’ Telematics System and Entertainment Ecosystem Research Report, 2022

Vehicle telematics system research 1: the control scope is expected to expand to the entire vehicle.From January to December 2022, Chinese independent OEMs installed telematics systems in 6.42 million...

China Autonomous Shuttle Market Report, 2022-2023

Autonomous Shuttle Research: application scenarios further extend amidst policy promotion and continuous exploration

Autonomous shuttles are roughly categorized into minibuses and robobuses. Minibuse...

Intelligent Cockpit Domain Control Unit (DCU) and Head Unit Dismantling Report, 2023 (1)

Dismantling of Head Unit and Cockpit Domain Control Unit (DCU) of NIO, Toyota and Great Wall Motor The report highlights the dismantling of Toyota’s MT2712-based head unit, Fisker’s Intel A2960-based ...