Emerging carmaker strategy research: NIO is deploying battery swap and sub-brands for the knockout match in 2023.

In 2022, the sales surged by 32.3% year on year, being concentrated in first-tier cities.

In 2022, NIO sold 120,134 cars, up by 32.3% on an annual basis, specifically:

ES6, ET7 and EC6 were the top three models by sales, of which 42,319 ES6 cars were sold, accounting for 35.2% of the total sales. As ES7, ET7 and ET5 (“775”) were delivered, they saw a rising share of sales. Among them, the sales proportion of ET7 grew fastest, up to 19.1%.

By province, Zhejiang (26,747 units), Jiangsu (18,105 units) and Guangdong (15,626 units) ranked top three by sales.

NIO's cars are largely sold in first-tier cities. In 2022, the first three cities by sales were Shanghai (15,467 units), Hangzhou (10,890 units) and Beijing (6,776 units); users in first-tier cities swept 69.9%, down 5.9 percentage points on the previous year.

Strategy 1: lay out the construction of Power Swap stations

To boost sales in third-and fourth-tier cities, NIO has doubled down on the layout of battery swap infrastructure, and has planned to add 1,000 swap stations in 2023 instead of the originally planned 400, of which: about 400 stations will be built at highway service areas or intersections; another 600 stations will be deployed in urban areas, especially in third- and fourth-tier cities and counties where there is a certain user base but without battery swap stations. NIO intends to offer more convenient Power Swap services, alleviate the anxiety about energy replenishment, and encourage potential car owners in third- and fourth-tier cities to enjoy NIO’s services, so as to push up its car sales.

NIO’s Power Swap stations having iterated to the third generation (launched in December 2022) so far not only support the Summon & Swap feature for cars but also allow for Navigate on Pilot + Summon & Swap. In March 2023, the first third-generation Power Swap stations will land in Nanxiang Town in Jiading District, Shanghai.

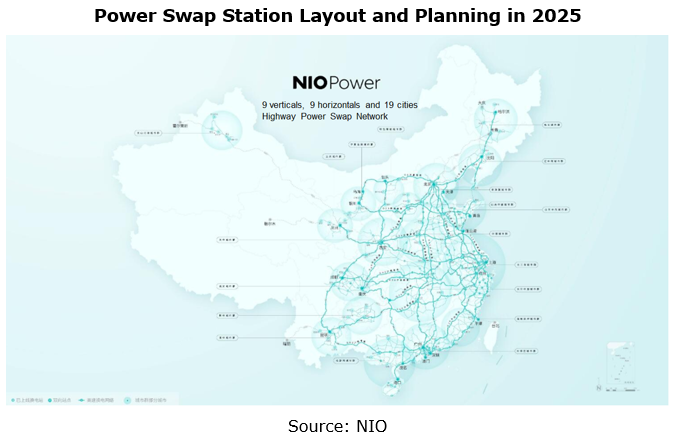

According to its plan, NIO will lay out more than 2,300 Power Swap stations (including 700+ highway Power Swap stations) in 2023; in 2025, NIO will build a 9-vertical, 9-horizontal highway battery swap network with about 3,000 Power Swap stations.

Strategy 2: establish sub-brands to explore the lower end of the market, and enable cockpit and driving integration in the models under the third brand.

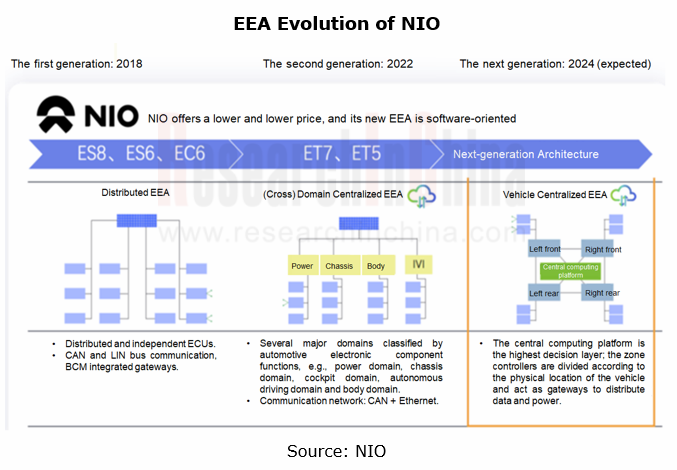

In 2022, NIO delivered ET7, ES7 and ET5, three models based on the NT2 platform, and switched from NT1 (the perception system includes cameras, ultrasonic radar, etc.) to NT2 (the perception system adds LiDAR, and upgrades cameras to the high-definition for L4 autonomous driving).

In the first half of 2023, NIO plans to deliver five new NT2-based models and a total of 200,000 cars, and develop the NT3 platform (supporting battery swap and 800V fast charging technology, and carrying batteries made by NIO).

At present, all the cars delivered by NIO are positioned as high-end models priced at higher than RMB300,000. NIO plans to cover the mid-to-high-end and low-to-mid-end markets on the basis of the original high-end brand. In the market of mid-to-high-end cars worth RMB200,000-300,000, NIO will launch "ALPS", a NT3.0-based brand. In the market of low-to-mid-end cars valued at RMB100,000-200,000, NIO will unveil “Firefly", a small-sized car brand to debut in Europe, supporting battery swap and L2+ driving assistance.

NIO’s EEA has evolved from the distributed architecture NT1 to the domain centralized (5*DCU) architecture NT2. In the future, the cockpit and driving integration will be available to the models under the third brand "Firefly". In February, 2023, NIO partnered with KEBODA, a provider of automotive intelligent and energy-efficient components, systems and solutions. KEBODA will provide cockpit and driving integrated domain controller solutions for Firefly, covering autonomous driving domain control, cockpit domain control and gateway functions.

Strategy 3: phase in Navigate on Pilot (NOP) and Power Swap Assist features.

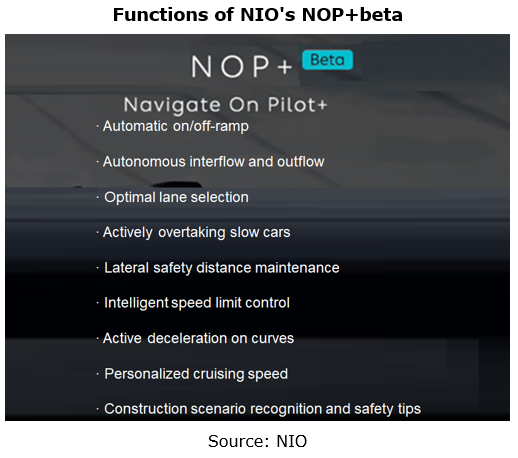

In terms of the evolution of driving assistance functions, NT1-based models feature NOP (pushed with the NIO OS 2.7.0 in October 2020), and NT2-based models support NOP+ (NOP+beta was pushed in December 2022). In the first half of 2023, NT2-based models will gradually introduce the NOP and Power Swap features via OTA updates, specifically: allowing cars to complete the route planning for battery swap on highways; intelligently navigating cars to a Power Swap station in a highway service area; supporting cars to automatically drive away from the service area after automatic battery swapping, and re-enter highways.

Compared with NOP, NOP+ offers improvements in both software and hardware. In terms of software, NOP+ has a global unified architecture and a brand-new algorithm framework. The fusion of data from vehicle cameras, LiDAR and HD maps assists the system in decision and planning. For hardware, the front view camera is replaced by a 360° fisheye camera-based sensing system, 1,550nm LiDAR is added, and radar and ultrasonic sensor (USS) constitute a two-layer sensor. As for computing platform, four Orin SoCs are installed on the 1,016 TOPS ADAM supercomputing platform.

In terms of perception architecture, NIO will update the NOP+ perception architecture to a BEV model architecture in the first half of 2023; meanwhile, the planning and control logics of NOP+ and NIO Pilot (NP) will be integrated, that is, NOP+ will shift the current map-heavy route to the perception-heavy route.

As concerns charging mode, NOP+beta is currently free of charge in a bid to cultivate users' habits. The later official version may charge fees.

Strategy 4: highlight immersive cockpit experience and build smartphone and IVI integration.

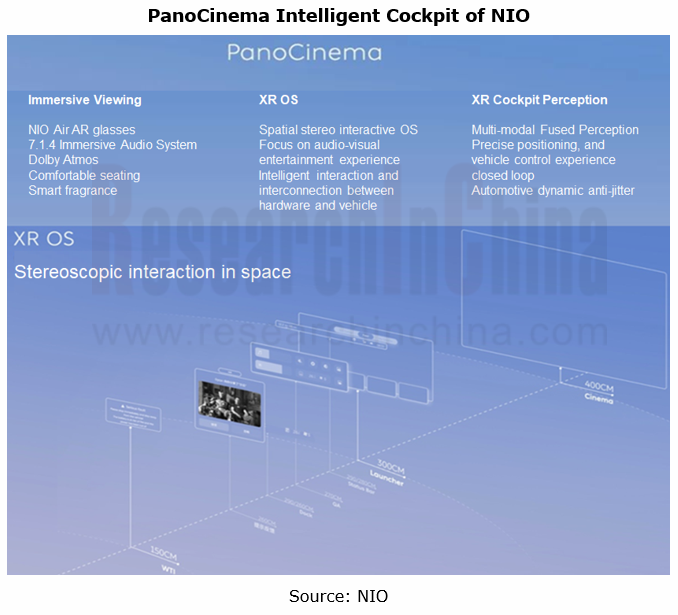

In terms of cockpit experience, NIO’s PanoCinema Intelligent Cockpit comes with the standard configuration of 23 speaker units, which are laid out according to the 7.1.4 channel scheme with 20-channel 1000W power amplifier outputs. Active tuning algorithms and Dolby Atmos bring immersive listening experience.

Based on XR OS, NIO's self-developed exclusive automotive AR operation interface, users can control AR and cockpit functions via NOMI voice assistant, NIO Air Ring and the dedicated smartphone App, when wearing AR glasses. In the future, AR glasses are expected to be combined with HUD or AR HUD. According to the latest patent of AR glasses from NIO in January 2023, its next-generation AR glasses can realize display of vehicle information.

In addition to AR glasses, NIO has also developed the mobile phone business. It aims to offer smartphone and IVI integrated experience, build a people-vehicle-smartphone closed loop, share data and make mobile phones a part of NIO’s automotive ecosystem. Its selling point may be software, offering differentiated smartphone and IVI integrated experience. In February 2023, NIO applied for the trademark "NIO PHONE". It will start close beta test in Q2 2023, and begin official release in Q3 2023.

According to its recent 2022 financial report, NIO was still in the red, with the full-year net loss of RMB14.4371 billion, up by 259.4% year on year. To achieve CEO Li Bin's goal of "break even in Q4 2023 and make profit in 2024", NIO, which persists in long-termism, has to face a last-ditch battle in 2023.

Analysis on Geely's Layout in Electrification, Connectivity, Intelligence and Sharing

Geely, one of the leading automotive groups in China, makes comprehensive layout in electrification, connectivity, intelligence and sharing.

Geely boasts more than ten brands. In 2023, it sold a tota...

48V Low-voltage Power Distribution Network (PDN) Architecture Industry Report, 2024

Automotive low-voltage PDN architecture evolves from 12V to 48V system.

Since 1950, the automotive industry has introduced the 12V system to power lighting, entertainment, electronic control units an...

Automotive Ultrasonic Radar and OEMs’ Parking Route Research Report, 2024

1. Over 220 million ultrasonic radars will be installed in 2028.

In recent years, the installations of ultrasonic radars in passenger cars in China surged, up to 121.955 million units in 2023, jumpin...

Automotive AI Foundation Model Technology and Application Trends Report, 2023-2024

Since 2023 ever more vehicle models have begun to be connected with foundation models, and an increasing number of Tier1s have launched automotive foundation model solutions. Especially Tesla’s big pr...

Qualcomm 8295 Based Cockpit Domain Controller Dismantling Analysis Report

ResearchInChina dismantled 8295-based cockpit domain controller of an electric sedan launched in December 2023, and produced the report SA8295P Series Based Cockpit Domain Controller Analysis and Dism...

Global and China Automotive Comfort System (Seating system, Air Conditioning System) Research Report, 2024

Automotive comfort systems include seating system, air conditioning system, soundproof system and chassis suspension to improve comfort of drivers and passengers. This report highlights seating system...

Automotive Memory Chip and Storage Industry Report, 2024

The global automotive memory chip market was worth USD4.76 billion in 2023, and it is expected to reach USD10.25 billion in 2028 boosted by high-level autonomous driving. The automotive storage market...

Automotive AUTOSAR Platform Research Report, 2024

AUTOSAR Platform research: the pace of spawning the domestic basic software + full-stack chip solutions quickens.

In the trend towards software-defined vehicles, AUTOSAR is evolving towards a more o...

China Passenger Car Electronic Control Suspension Industry Research Report, 2024

Research on Electronic Control Suspension: The assembly volume of Air Suspension increased by 113% year-on-year in 2023, and the magic carpet suspension of independent brands achieved a breakthrough

...

Global and China Hybrid Electric Vehicle (HEV) Research Report, 2023-2024

1. In 2025, the share of plug-in/extended-range hybrid electric passenger cars by sales in China is expected to rise to 40%.

In 2023, China sold 2.754 million plug-in/extended-range hybrid electric p...

L3/L4 Autonomous Driving and Startups Research Report, 2024

The favorable policies for the autonomous driving industry will speed up the commercialization of L3/L4.

In the second half of 2023, China introduced a range of policies concerning autonomous drivin...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024

At present, EEA is developing from the distributed type to domain centralization and cross-domain fusion. The trend for internal and external integration of domain controllers, especially the integrat...

Global and China Automotive Operating System (OS) Industry Report, 2023-2024

Chinese operating systems start to work hard In 2023, Chinese providers such as Huawei, Banma Zhixing, Xiaomi, and NIO made efforts in operating system market, launched different versions with competi...

Automotive RISC-V Chip Industry Research Report, 2024

Automotive RISC-V Research: Customized chips may become the future trend, and RISC-V will challenge ARM

What is RISC-V?Reduced Instruction Set Computing - Five (RISC-V) is an open standard instructio...

Passenger Car CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to Body) Integrated Battery Industry Report, 2024

Passenger Car CTP, CTC and CTB Integrated Battery Industry Report, 2024 released by ResearchInChina summarizes and studies the status quo of CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to ...

Software-defined Vehicle Research Report, 2023-2024 - Industry Panorama and Strategy

1. How to build intelligent driving software-defined vehicle (SDV) architecture?

The autonomous driving intelligent platform can be roughly divided into four parts from the bottom up: hardware platf...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2023-2024

In-cabin Monitoring study: installation rate increases by 81.3% in first ten months of 2023, what are the driving factors?

ResearchInChina released "Automotive DMS/OMS (Driver/Occupant Monitoring Sys...

Automotive Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2024

As intelligent connected vehicles boom, the change in automotive EEA has been accelerated, and the risks caused by electronic and electrical failures have become ever higher. As a result, functional s...