China Automotive Ultrasonic Radar and OEM Parking Roadmap Research Report, 2022

In 2021, ultrasonic radar shipments hit 100 million units, and intelligent parking became a crucial engine.

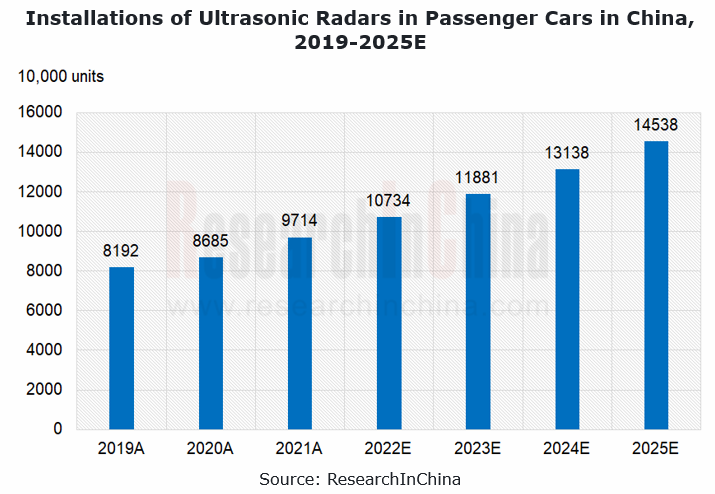

1. In 2025, China’s ultrasonic radar installations will exceed 140 million units.

According to ResearchInChina, in 2021 China’s ultrasonic radar installations in passenger cars jumped by 11.8% on the previous year to 97.138 million units, a figure projected to be more than 100 million units in 2022 and exceed 140 million units in 2025.

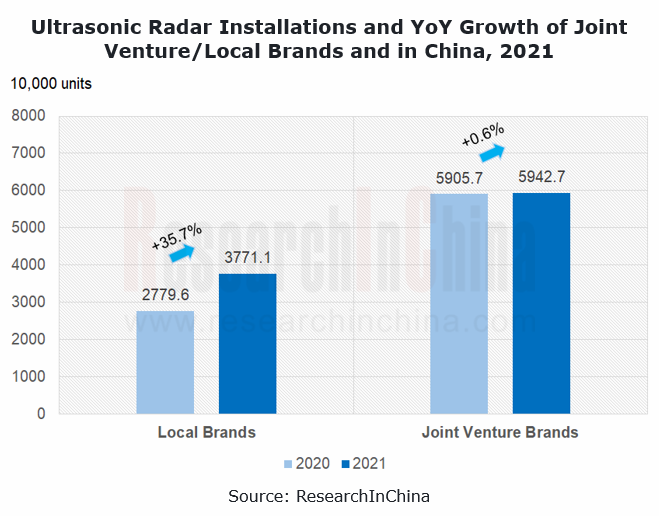

By auto brand in China, the installations of joint venture brands were higher than local brands, but from growth momentum, homegrown brands gained the upper hand.

In 2021, joint venture brands in China installed 59.427 million ultrasonic radars in their passenger cars, 1.6 times more than local brands (37.711 million units). In growth rate’s terms, the installations of local brands surged by 35.7% from a year earlier, compared with joint venture brands (a tiny 0.6%).

2. Advanced automated parking solutions will be the main application scenario of ultrasonic radars.

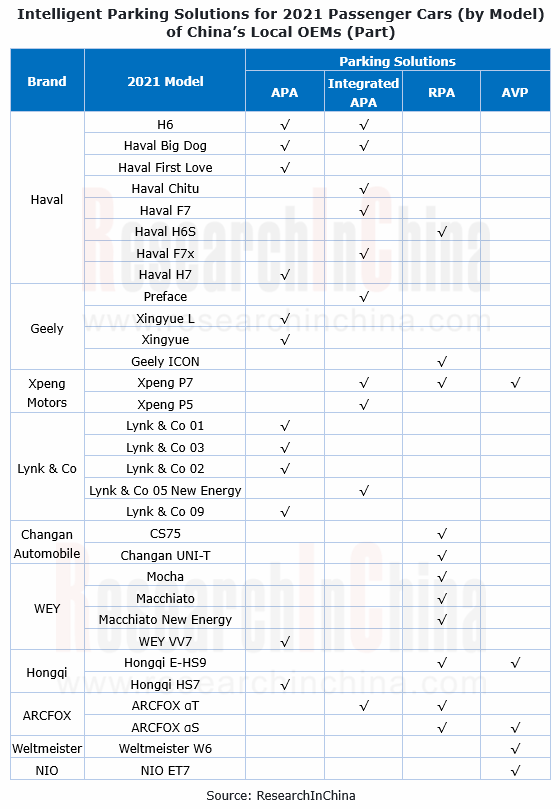

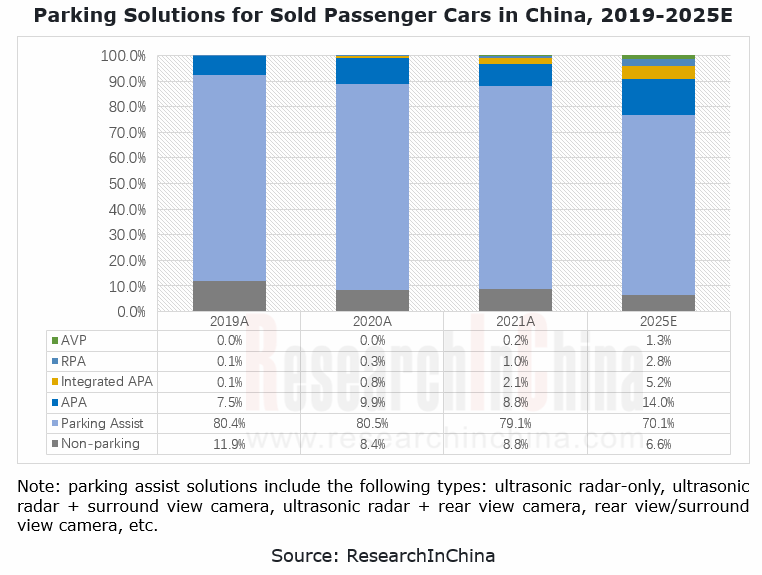

As L2+ automated driving develops, parking solutions including parking assist (e.g., ultrasonic radar-only, ultrasonic radar + surround view camera, ultrasonic radar + rear view camera, rear view/surround view camera, etc.), automated parking assist (APA), remote parking assist (RPA), and automated valet parking (AVP) are being mounted on new vehicles in China.

In 2021, in China the brands that equipped their new vehicle models with APA (including integrated APA) contained Haval, Geely and Lynk & Co; the RPA-enabled brands incorporated Changan Automobile, ARCFOX and WEY. In addition, Xpeng Motors, Hongqi, Weltmeister, and NIO were the first ones to deploy AVP solutions.

Our statistics show that in 2021, there were 1.787 million passenger cars equipped with the APA function in China, or 8.8% of the total; 432,000 passenger cars packed the integrated APA capability, accounting for 2.1%; 206,000 passenger cars, or 0.1% of the total, carried the RPA function.

3. Suppliers: Valeo and Bosch are leaders, and local players rise swiftly to prominence

Tier 1 suppliers such as Valeo and Bosch are monopolies in the Chinese ultrasonic radar market, of which Bosch already has 6 generations of ultrasonic radar products used in such scenarios as parking assist, side distance warning, side assistance, and emergency braking at low speeds.

In the parking field, Bosch has mass-produced APA, RPA and AVP solutions among others. Wherein, the RPA solution has been applied to production models such as Aion V and ARCFOX αT; AVP has been first available to New Mercedes-Benz S-Class, a production sedan.

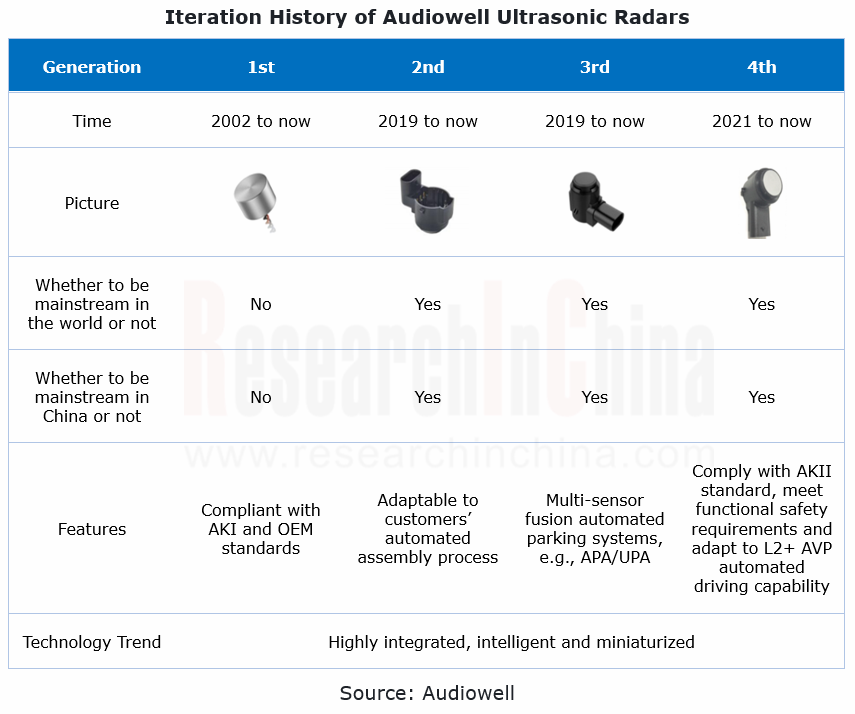

Among local companies in China, Audiowell, Shenzhen Longhorn Automotive Electronic Equipment, Coligen, TungThih Electronic and Zongmu Technology are at the leading edge. Thereof, Audiowell’s vehicle ultrasonic radars have undergone 4 iterations, and its fourth-generation AK2 ultrasonic radar core was unveiled in 2021, the up-to-date technology that enables L2+ AVP automated driving capability following UPA and APA. Audiowell also got the investment from Desay SV in 2021 and successfully went public on June 14, 2022.

As well as Audiowell, SOFTEC, Coligen, and Forvision (ThunderSoft acquired 51.48% of its shares in 2021) have also launched AK2 series ultrasonic radars, some of which have been produced in quantities.

As intelligent parking solutions like Home-AVP and AVP come out, independent controllers can no longer meet the existing needs, and the parking domain begins to integrate into the autonomous driving domain. On this basis, the driving and parking integrated solutions come into being.

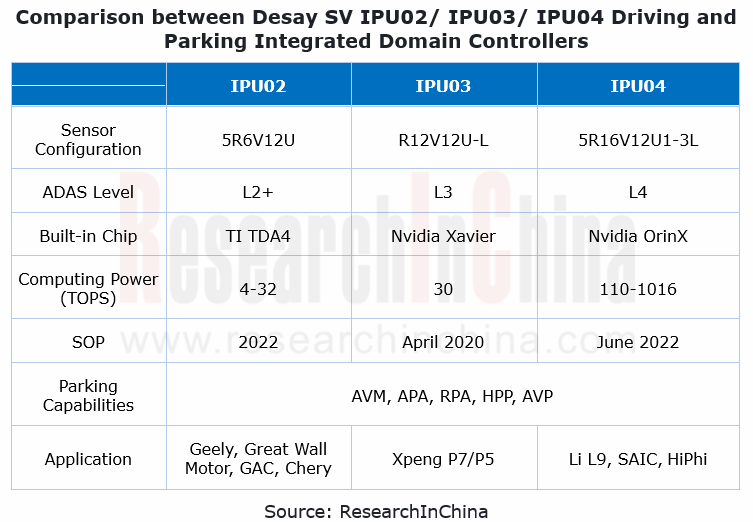

So far, quite a few companies in China including Neusoft Reach, Desay SV, Freetech and iMotion have rolled out their driving and parking integrated solutions, and have secured designated OEM orders for production vehicle models.

Desay SV IPU03 domain controller having been used in Xpeng P7, enables driving and parking integration, and supports on/off-ramp and automatic lane change in highway scenarios, automatic follow in urban traffic jams, and automated parking and valet parking in low-speed scenarios.

Chinese Emerging Carmakers’ Telematics System and Entertainment Ecosystem Research Report, 2022-2023

Telematics service research (III): emerging carmakers work on UI design, interaction, and entertainment ecosystem to improve user cockpit experience.

ResearchInChina released Chinese Emerging Carmake...

China Passenger Car Cockpit-Parking Industry Report, 2023

Cockpit-parking integration research: cockpit-parking vs. driving-parking, which one is the optimal solution for cockpit-driving integration?Cockpit-parking vs. driving-parking, which one is the optim...

Automotive Sensor Chip Industry Report, 2023

Sensor chip industry research: driven by the "more weight on perception" route, sensor chips are entering a new stage of rapid iterative evolution.

At the Auto Shanghai 2023, "more weight on percepti...

Automotive Electronics OEM/ODM/EMS Industry Report, 2023

Automotive electronics OEM/ODM/EMS research: amid the disruption in the division of labor mode in the supply chain, which auto parts will be covered by OEM/ODM/EMS mode? Consumer electronic manu...

China Automotive Smart Glass Research Report, 2023

Smart glass research: the automotive smart dimming canopy market valued at RMB127 million in 2022 has a promising future.Smart dimming glass is a new type of special optoelectronic glass formed by com...

Automotive Ultrasonic Radar and OEM Parking Roadmap Development Research Report, 2023

Automotive Ultrasonic Radar Research: as a single vehicle is expected to carry 7 units in 2025, ultrasonic radars will evolve to the second generation.

As a single vehicle is expec...

Autonomous Driving SoC Research Report, 2023

Research on autonomous driving SoC: driving-parking integration boosts the industry, and computing in memory (CIM) and chiplet bring technological disruption.

“Autonomous Driving SoC Research ...

China ADAS Redundant System Strategy Research Report, 2023

Redundant System Research: The Last Line of Safety for Intelligent VehiclesRedundant design refers to a technology adding more than one set of functional channels, components or parts that enable the ...

Intelligent Steering Key Components Report, 2023

Research on intelligent steering key components: four development trends of intelligent steering

The automotive chassis consists of four major systems: transmission system, steering system, driving ...

Automotive Digital Instrument Cluster Operating System Report, 2023

Digital Instrument Cluster Operating System Report: QNX commanded 71% of the Chinese intelligent vehicle cluster operating system market.

Amid the trend for the integration of digital cluster and cen...

800V High Voltage Platform Research Report, 2023

How to realize the commercialization of 800V will play a crucial part in the strategy of OEMs.

As new energy vehicles and battery technology boom, charging and battery swapping in the new energy vehi...

Automotive Intelligent Cockpit Platform Research Report, 2023

Intelligent cockpit platform research: the boundaries between vehicles and PCs are blurring, and there are several feasible paths for cockpit platforms.

Automotive Intelligent Cockpit Platform Resea...

Global and China Automotive Wireless Communication Module Industry Report,2023

Vehicle communication module research: 5G R16+C-V2X module, smart SiP module and other new products spring up.

In 2022, 4G modules swept 84.3% of the vehicle communication module market....

Intelligent Vehicle Cockpit-Driving Integration Research Report, 2023

Cockpit-Driving Integration Research: many companies are making layout and may implement it during 2024-2025.

1. What is the real cockpit-driving integration?

At present, automotive electroni...

Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosystem Research Report, 2022

Telematics System Research 2: Baidu Family Bucket, Huawei and Tencent Become the Mainstream Ecosystems

ResearchInChina released Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosyst...

China Automotive Digital Key Research Report, 2023

Automotive Digital Key Research: the pace of mobile phones replacing physical keys quickens amid the booming market

"China Automotive Digital Key Research Report, 2023" released by ResearchInChina co...

Automotive Camera Tier2 Suppliers Research Report, 2022-2023

1. The automotive camera market maintains a pattern of "one superpower and several great powers".

Automotive cameras are used to focus the light reflected from the target onto the CIS after refractio...

Emerging Carmaker Strategy Research Report, 2023 - NIO

Emerging carmaker strategy research: NIO is deploying battery swap and sub-brands for the knockout match in 2023.In 2022, the sales surged by 32.3% year on year, being concentrated in first-tier citie...