Global and Chinese OEMs’ Modular and Common Technology Platform Research Report, 2025

Modular platforms and common technology platforms of OEMs are at the core of current technological innovation in automotive industry, aiming to enhance R&D efficiency, reduce costs, and accelerate technological innovation. Modular platforms serve as the cornerstone for the expansion of OEMs' product matrices, while common technology platforms drive industry-wide technological collaboration and ecosystem integration.

In the future, the integration of these two will accelerate the transformation of the automotive industry towards electrification and intelligence, forming a new competitive landscape characterized by "standardized hardware + personalized software."

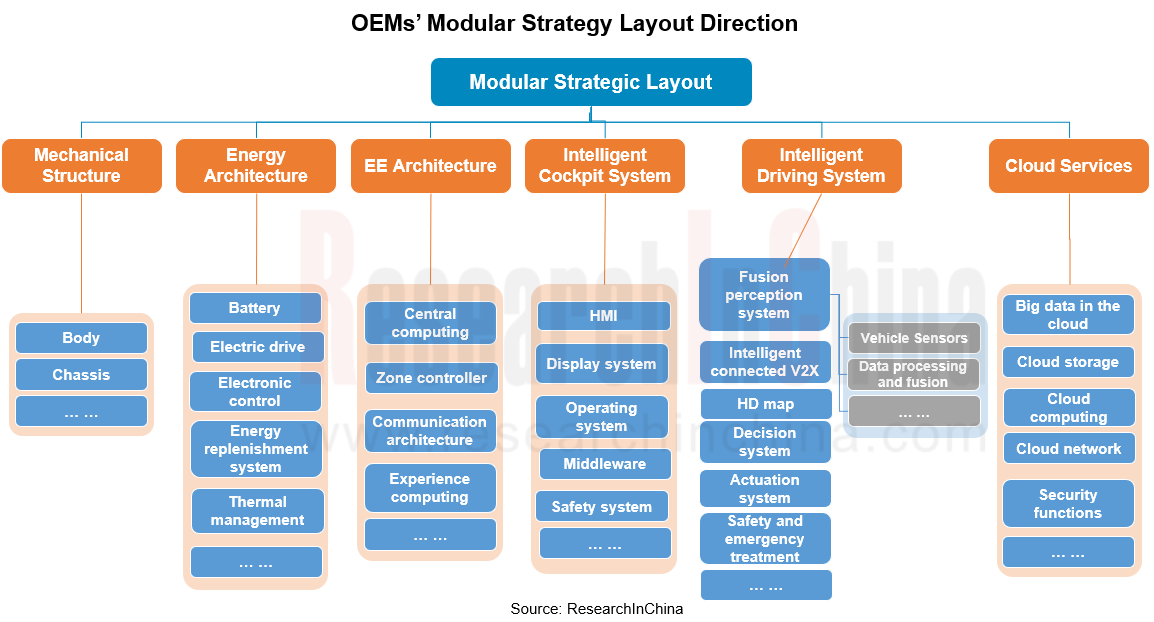

The essence of automotive modular platforms lies in increasing the flexibility of vehicle development and improving the sharing rate of components through modular standards, while providing hardware support for the new generation of EE architectures in the context of new "EISC (Electrification, Intelligentization, Shareability, Connectivity)."

Currently, major global OEMs have launched their own modular platforms, such as Volkswagen's MQB platform, the Renault-Nissan Alliance's CMF platform, Toyota's TNGA architecture, and Volvo's SPA platform, covering a wide range of vehicle models from Class A to Class D, Class E, as well as SUVs and MPVs.

Building upon modular vehicle manufacturing platforms, OEMs have further established systematic common technology platforms, with the domestic emerging car brand XPeng Motors being a standout example in this regard.

XPeng's vehicle manufacturing platforms mainly include the D platform, E platform, F platform, and H platform:

The D platform, also known as the David platform, is XPeng's production platform for Class A and below vehicles. Current models on this platform include the XPeng P5 and XPeng MONA M03 (a collaboration between XPeng and DiDi).

The E platform, or Edward platform, is XPeng's platform for Class B and Class C vehicles, launched after the David platform.

The F platform, known as the "Fuyao Platform," is a mid-sized vehicle platform. Its features include front and rear integrated die-casting, 800V architecture, and advanced EE architecture.

The H platform is XPeng's most high-end platform, targeting mid-to-large-sized vehicles.

The core of XPeng's modular vehicle manufacturing is the SEPA 2.0 Fuyao Architecture. This architecture covers a wide range of vehicle models from Class A to Class D (including sedans, SUVs, and MPVs) and supports a wheelbase range of 1800-3200mm. Through modular design, SEPA 2.0 achieves a parts commonality rate of up to 80%, reduces the R&D cycle by 20%, and integrates technologies such as CIB (Cell Integrated Body) technology and integrated die-casting processes, significantly lowering manufacturing costs and reducing vehicle weight.

With continuous technological iteration and evolution, XPeng has unveiled the new technology topology for its next-generation models, which includes:

5C Ultra-Fast Charging AI Battery: Paired with the S5 liquid-cooled ultra-fast charging station, it can charge over 1 km of range per second, reaching 80% charge in just 12 minutes.

Hybrid Silicon Carbide Coaxial E-Drive: The e-drive system achieves a comprehensive efficiency of 93.5% (CLTC), with a 30% reduction in size compared to traditional motors, freeing up more space for the rear seats.

Silent Range Extender (operating noise of only 1dB): Equipped with XPeng's Kunpeng Super Electric System.

Deep Integration of AI Technologies, including:

AI Battery Doctor: Manages the battery through a dedicated chip, extending battery life by 30%.

AI Powertrain: Intelligently adjusts energy consumption and power output to adapt to different road conditions.

AI Chassis: Combines visual perception to predict road conditions and dynamically adjusts the suspension system.

Next-Generation CIB+ Mid-Floor Integrated Die-Casting Technology: A 16,000T die-casting machine (island) will be expanded to support the production of larger die-cast components. Currently, research is underway on CIB+ mid-floor integrated die-casting technology, which is expected to increase vehicle range by 5% and reduce manufacturing costs by 10-30%.

XPeng Turing AI Autonomous Driving:

Hawkeye Vision Deployment: The AI Hawkeye Vision solution will enter mass production in 2025H1, first installed in the P7+ model and gradually extended to other models.

L3 Autonomous Driving Deployment: L3 autonomous driving will be operational by 2025H2.

End-to-End Foundation Model Deployment: The One-Model end-to-end will deliver a superior autonomous driving experience, achieving less than one intervention per 100 kilometers.

The new modular and common technology platforms have become XPeng's key to success. XPeng has completed the transition from old to new product platforms:

MONA M03: A compact sedan starting at RMB 119,800, selling hot due to its high cost-performance ratio and design advantages.

P7+: Starting at RMB 186,800, it emphasizes the concept of "AI-Defined Vehicle."

2025 XPeng G6: Positioned as an all-electric SUV in the RMB 150,000-200,000 range, starting at RMB 176,800, it focuses on AI, featuring the "Turing AI Autonomous Driving" and "5C Ultra-Fast Charging AI Battery" as standard across all models, making it the next potential bestseller.

2025 XPeng G9: Positioned as an all-electric SUV in the RMB 250,000-300,000 range, starting at RMB 248,800, it shares the same common technology platform as the new G6.

G7: Positioned as an all-electric SUV in the RMB 200,000-250,000 range, slightly above the G6, competing with the Xiaomi YU7 and the refreshed Tesla Model Y.

G01 (First Vehicle of the Kunpeng Super Electric System): Positioned as a C+-Class 6-seat SUV, it introduces plug-in hybrid range-extending technology, based on an 800V high-voltage silicon carbide platform, equipped with the 5C Ultra-Fast Charging AI Battery, hybrid silicon carbide coaxial e-drive, silent range extender (operating noise of only 1dB), AI Battery Doctor, and AI Powertrain. The range-extended version is expected to use the Dong'an engine, offering a battery electric range of 430 km and a comprehensive range of over 1,400 km. The first range-extended model is expected to enter mass production in 2025H2.

In 2024, XPeng's total sales reached 190,000 units, a year-on-year increase of 34.2%. Supported by a series of new product launches and new technology platforms, XPeng aims to achieve sales of 350,000 units in 2025.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...