T-Box Research: T-Box will achieve functional upgrades given the demand from CVIS and end-to-end autonomous driving

ResearchInChina released the "Global and China Passenger Car T-Box Market Report 2025", highlighting:

Global and Chinese T-Box market size forecast;

The demand and impact of automotive V2X, 5G, satellite communications and other functions on T-Box;

T-Box derivative functions required under the new EEA, ;

The market structure of key components such as main control modules, communication modules, and storage modules;

T-Box product strategies of OEMs and domestic and foreign suppliers.

The combined share of top 10 suppliers exceeds 74%

In 2024, the Chinese passenger car T-Box market continued to grow, with an installation rate of 93.3%.

According to the estimated installations, top ten T-Box suppliers in the Chinese passenger car market in 2024 include LGE, Neusoft, Huawei, Jingwei Hirain, Gosuncn, Flaircomm Microelectronics, Valeo, Continental, Lan-You Technology and Denso, with a combined market share of more than 74%.

Amid growing 5G demand, T-Box suppliers enter the 5G era

In 2024, the growth in Chinese 5G market accelerated, and the number of vehicles equipped with 5G communications climbed to 3.59 million, a year-on-year spike of 119.5%. Driven by market demand, T-Box suppliers enter the 5G era. Currently, the suppliers that have mass-produced 5G T-Box mainly include Neusoft, LGE, Huawei, Valeo, JoyNext, etc. Top 5 suppliers occupy a combined share of 70.3%, marking a high level of market concentration.

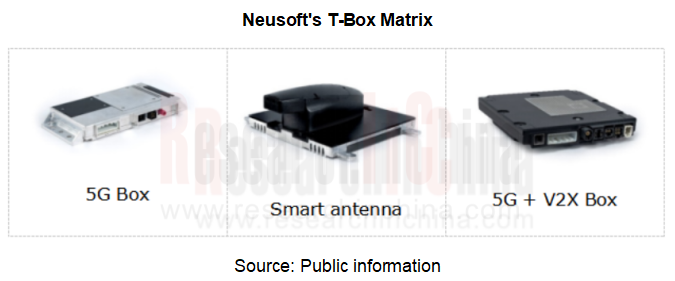

Neusoft Group has formed a product matrix covering 4G/V2X Box, smart antennas, 5G/V2X Box, and achieved mass production. In 2024, Neusoft T-Box was designated by many OEMs such as Geely, Hongqi, and Great Wall Motor, and undertook overseas OEM projects such as BMW T-Box.

With the advantages in 5G modules, Huawei has achieved breakthroughs in OEMs such as GAC and Changan. Huawei's 5G T-Box module supports functions such as Huawei HiCar and HiLink to connect and control data between mobile phones, cars, and smart homes.

In its 2024 IPO, Flaircomm Microelectronics raised RMB210 million for 5G T-BOX R&D and industrialization projects, focusing on the R&D of 5GNR T-BOX. The 5GNR T-BOX will rely on the company's technology accumulation in the communication field and integrate new technologies such as CAN-FD, Ethernet, and smart antennas.

The construction of CVIS accelerates, promoting the integration of V2X modules and T-Box.

In 2024, China tried to apply "vehicle-road-cloud integration", and C-NCAP included V2X in active safety testing. These two major measures will accelerate the introduction of V2X modules into vehicles. According to statistics, 500,000 passenger cars were equipped with V2X in China in 2024, and brands such as NIO, Ford, Volkswagen, Lincoln, Mercedes-Benz, Audi, Rising Auto, Tank, Hongqi, BMW and Aion have taken the lead in achieving V2X mass production.

At this stage, some OEMs have integrated C-V2X modules into T-Box to realize CVIS functions based on a unified communication protocol under 5G technology. The most typical case is GM T-Box (i.e. The 12th-generation On-Star) that integrates C-V2X modules. In addition, domestic OEMs such as Tank 500 and Aion LX PLUS also adopt this solution.

In the following diagram showing the GM T-Box connection port, X1 is a 20-pin main connector, X2 is an audio and 100BASE-T1 automotive Ethernet connector, X6 is a single-ended C-V2X antenna, and X3 is a 4-antenna connector (cellular communication, DRX, GNSS and C-V2X). X7 is an automotive-grade Gigabit Ethernet connector.

The integration of 5G+V2X modules has become the T-Box focus of various suppliers:

Huawei has launched its C-V2X T-BOX that is compatible with both 4.5G and 5G;

PATEO CONNECT+ has unveiled its 4.5G C-V2X T-Box;

Harman’s modular TCU (Telematics Control Unit) accommodates a cellular NAD (Network Access Device) side-by-side Autotalks’ second-generation chipset providing C-V2X capabilities.

Neusoft has released the V2X protocol stack (VeTalk) that integrates 5G and independent research and development, launched the 5G/V2X Box, and conducted mass production.

Neusoft's 5G/V2X Box based on a mainstream platform (Qualcomm, MTK, and domestic platforms) can provide customized development of V2X DAY1 and DAY2 scenarios and development of new 5G scenario applications. It also supports overseas ECALL and communication certification, and bolsters overseas Internet of Vehicles functions.

The rise of end-to-end autonomous driving has triggered new demand for T-Box

In 2025, end-to-end autonomous driving emerged. The system directly implements full-process decision-making from sensor input to control output through deep learning models, breaking through the limitations of traditional modular architectures. This technical path puts forward higher requirements for T-Box, the core of the automotive communication and computing.

1. Low-latency, high-bandwidth data transmission capabilities

End-to-end models that process massive sensor data, such as video streams, require 5G-V2X communications to enable low-latency, highly reliable data transmission. T-Box should integrate 5G modules and C-V2X functions to ensure real-time interaction between the vehicle and the cloud, and between the vehicle and infrastructure, and to support the rapid response of autonomous driving algorithms.

At the same time, T-Box needs to communicate efficiently with automotive sensors and domain controllers through high-speed networks such as automotive Ethernet to reduce data transmission delays.

In areas without cellular network coverage (such as remote mountainous areas), T-Box should integrate low-orbit satellite communication modules (such as Starlink technology) to ensure the continuity of the end-to-end system.

2. Multi-sensor fusion and data processing support

End-to-end autonomous driving requires T-Box to integrate multi-source sensor data(such as cameras, radars, IMUs, etc.) to provide comprehensive input information for AI models.

T-Box should have edge computing capabilities to pre-process sensor data, reduce the burden on the cloud and central processor, and ensure real-time performance.

3. Edge computing and heterogeneous computing power upgrade

The next-generation T-Box supports lightweight model reasoning by integrating the NPU (neural processing unit). For example, Lan-You Technology's YDU 2.0 enables driving-parking integration through edge computing.?Local storage and cache optimization

End-to-end models frequently call HD maps and historical trajectory data. T-Box connects SSD via a PCIe interface to attain TB-level local cache.

In summary, under the demand for high-level Internet of Vehicles in the future, T-Box will continue to evolve:

In terms of communication, 5G RedCap is expected to replace Cat.4 to meet L2 and below connectivity, and 5G A and 6G will support real-time decision-making for higher-level autonomous vehicles;

In terms of architecture, T-Box is integrated with the smart cockpit domain, smart driving domain, or central computing platform; with gradually virtualized functions, it has become a software module on the central OS;

By function, it integrates with V2G, AR/VR and other in-vehicle and out-of-vehicle facility data, becoming the nerve center for full-dimensional interconnection between the vehicle and the outside.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...