Automotive Display, Center Console and Cluster Industry Report, 2025

In addition to cockpit interaction, automotive display is another important carrier of the intelligent cockpit. In recent years, the intelligence level of cockpits has continued to improve, and automotive displays are gradually breaking through the original layout, moving towards smarter and more advanced layout in solutions and display panel technologies.

1. Judging from the installation data, in 2024, more brands follow suit and adopt the cluster-free cockpit solution, the installation volume of rear entertainment screens doubled, and the installation volume of combined display (including dual-display and triple-display) continue to increase.

(1) Cluster-free is being deepened, and Chinese independent brands mostly use a combination of HUD and center console screen

The "cluster-free" craze led by Tesla continued to increase in 2024. In 2024, the sales of cluster-free models exceeded 1.5 million, a year-on-year increase of 50.0%. Among them, Li Auto's five models contributed a total of 32.4% of the market share. Deepal's three models contributed 7.9% of the market share.

Different from Tesla's single center console screen solution, Chinese independent brands mostly use a combination of HUD and center console screen to replace the cluster. Representative brands include Li Auto and Deepal. Li Auto's full range of models use a solution of HUD + safe driving interactive screen + center console screen to replace the cluster; Deepal S07, Deepal S05, and Deepal L07 use an AR-HUD + center console screen solution to replace the cluster.

(2) The installations of rear entertainment screens have doubled, with second-row roof being the main installation location

According to the data in 2024, the sales volume of new cars equipped with rear entertainment screens was close to 900,000 units, a year-on-year increase of 121.8%. in terms of vehicle types installed, mid-to-large-sized sedans accounted for 48.1% of these sales, serving as the primary driving force, followed by midsize SUVs at 17.0% and MPVs at 13.1%.

From the installation location point of view, the second-row entertainment screens are mainly installed on second-row roof and behind the front-row center armrest. in terms of screen control, the second-row entertainment screens have developed a variety of control methods such as touch, voice, gesture, remote control, functional control screen, etc.

(3) The installation volume of combined displays (including dual-display and triple-display) continues to rise, with dual-display solutions accounting for more than 90%

In 2024, a total of 3.378 million new cars equipped with combined display solutions were sold, of which nearly 250,000 were equipped with triple-display, a year-on-year increase of more than 200%. Specifically, the AITO M9 model alone contributed more than 60% of triple-display market share, while Voyah series accounted for nearly 20%.

From the installation solution point of view, since the electronic exterior rearview mirror (CMS) was approved for road use, the first model adopting five-display solution, Lingxi L, was launched in September 2024. It adopts a five-display layout with three 12.3-inch displays + two 7-inch CMS displays.

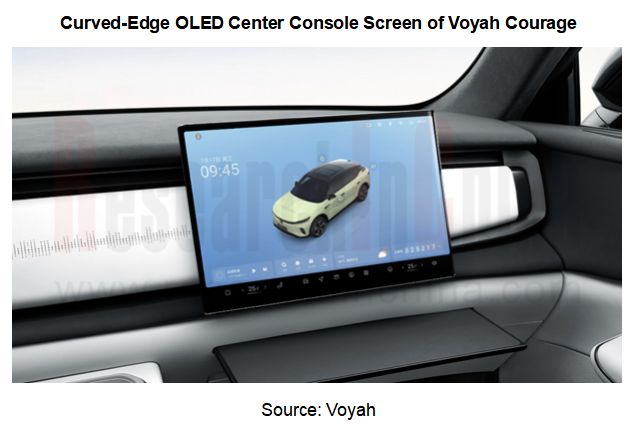

2. For display technology, the number of OLED models is increasing, and curved screens and curved-edge screens are being used in cars

Automotive display panels are gradually transitioning from LCD to OLED. in the field of OLED, curved OLED and curved-edge OLED have been installed in cars. Foldable OLED and rollable OLED have mature technical solutions.

In October 2024, Voyah Courage was launched. This model uses the industry's first curved-edge OLED display screen. Its’ left can adjust the brightness, and the right supports volume adjustment. It is reported that this product comes from BOE Varitronix. Moreover, its center console screen supports left and right sliding.

In March 2025, Yangwang U7 was launched. This model uses a display combination of 23.6-inch LCD cluster + 12.8-inch OLED curved center console screen + 23.6-inch OLED co-pilot screen. This curved OLED center console screen was first used on Yangwang U8 in 2023, with a curvature of R800.

From the supplier's perspective, there are mature technical solutions for foldable OLED and rollable OLED. Foldable and rollable displays were first used in the mobile phone field and quickly became popular. In recent years, many display suppliers have also launched their own rollable /foldable display products. Those displays benefit from the variability of their display form. They can be adjusted in the cockpit according to driving conditions and usage purposes, and can significantly improve interior design of the vehicle by minimizing the volume and installation space.

BOE's 15.05-inch electric foldable screen

Developed based on BOE's f-OLED technology, this product has a bending radius of R3 and can be flexibly unfolded and hidden according to different usage scenarios.

LG Display’s foldable OLED display

It can be installed behind the front seat and used as a display, or it can be taken down and used as a portable tablet for work, thus creating a "mobile office" scenario.

The 17-inch foldable OLED product can not only watch large-size video images, but also adjust the folding angle of the screen to allow the product to be used as a 12.3-inch tablet computer.

Passenger Car Digital Chassis Research Report, 2026

Research on Digital Chassis: Leading OEMs Have Completed Configuration of Version 2.0 1. Leading OEMs Have Completed Configuration of Digital Chassis 2.0

By the degree of wired control of each c...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2026

Multiple Mandatory Standards for Intelligent Vehicles in China Upgrade Functional Safety Requirements from Recommended to Mandatory Access Criteria In 2026, China has intensively issued and promo...

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...