①In terms of the amount of installed data, installations of side-view cameras maintain a growth rate of over 90%

From January to May 2025, ADAS cameras (statistical scope: front-view, side-view, surround view) installations for new passenger cars in China reached 33.160 million, a year-on-year increase of 38.6%; In 2024, the data was 76.424 million, a year-on-year increase of 44.4%.

Among them, side-view cameras grew the fastest. From January to May 2025, installations of side-view cameras were 7.077 million, a year-on-year increase of 96.6%. Specifically, in terms of brands and models, from January to May 2025, a total of 42 brands and 133 models adopted the 5-side-view camera solution, with a total of 1.18 million installed models, a year-on-year increase of 129.5%.

In terms of price ranges for 5-side-view camera solution, the 200,000-250,000 yuan range has the highest proportion at 24.2%. In this price range, there are many models with a 100% installation rate of 5 side-view cameras, including Xiaomi SU7, Li Auto L6, ONVO L60, Zeekr 7X, etc.

In terms of quantity, surround view cameras have the largest installation volume among all ADAS cameras. From January to May 2025, the installation volume of surround view cameras was 18.595 million, a year-on-year increase of 27.1%. Specifically, for models, a total of 302 models have a 100% installation rate of surround view cameras. In terms of brands, BYD ranks first in installations, accounting for 17.1%, which is 11.7 percentage points higher than Geely Automobile, which ranks second in installations.

From January to May 2025, a total of 31 brands have a 100% installation rate of surround view cameras, including Zeekr, Voyah, Li Auto, NIO, IM Motors, ORA, Xiaomi, Hyptec, Deepal, etc.

② In terms of ADAS solutions, the 12V solution has the fastest growth, followed by the 11V solution

From January to May 2025, by ADAS solutions equipped in models, the 12V solution grew the fastest, followed by the 11V solution. Among them, installations of the 12V solution reached 366,000 vehicles, a year-on-year increase of 1241.8%. Installations of the 11V solution was 707,000 vehicles, a year-on-year increase of 80.0%.

12V Solution

The mainstream 12V solution consists of 3 front-view cameras (3 monocular / 1 monocular + 1 binocular / 1 trinocular), 4 side-view cameras, 1 rear-view camera and 4 surround view cameras.

Take the BYD God's Eye (DiPilot) released in February 2025 as an example. Vision-only solution God's Eye C uses 12 cameras, including 1 trinocular front-view camera, 5 side-view cameras and 4 surround view cameras. Among them, both sides of the trinocular front-view camera are isomorphic 8MP wide-angle cameras (FOV 120°), and the middle one is an 8MP telephoto camera (FOV 30°). The 12V solution, together with 5R12U, can realize intelligent driving functions such as memory NOA, highway and expressway NOA, ICC, valet parking, and remote parking.

From January to May 2025, there are 11 brands including BYD, Fangchengbao, Zeekr, Hyptec, EXEED, Denza, etc., with a total of 41 models adopting the 12V solution.

11V Solution

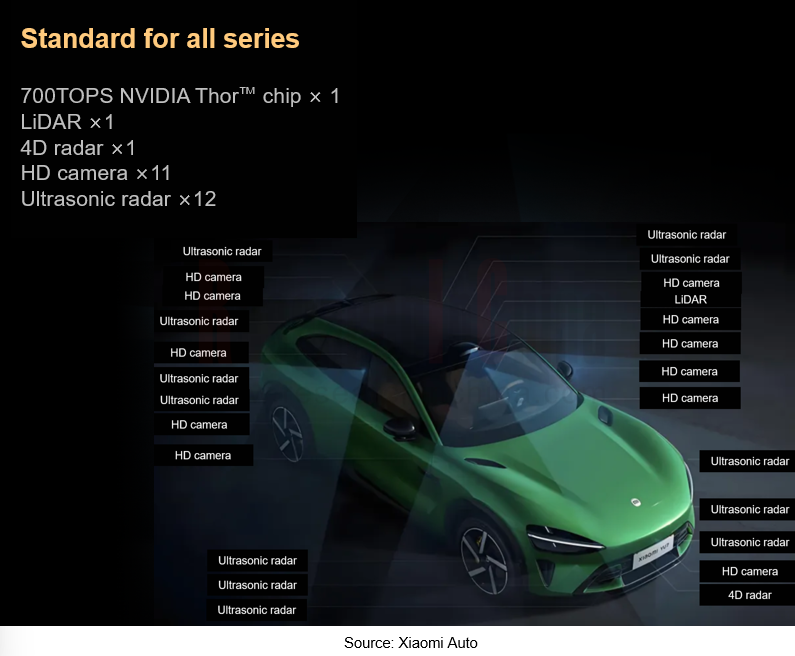

The Xiaomi YU7 released in June 2025 adopts the 11V solution, including 2 front-view cameras, 4 surround view cameras, 4 side-view cameras and 1 rear-view camera. It is reported that all the above cameras are provided by Sunny Automotive Optech. Together with LiDAR, 4D radars and ultrasonic radars, the Xiaomi YU7 can realize a full set of high-end functions including urban NOA, highway NOA, intelligent parking, and memory parking.

From January to May 2025, there are 32 brands including Xiaomi, XPeng, Yangwang, IM Motors, Voyah, Li Auto, etc., with a total of 83 models adopting the 11V solution.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...