Global and China Advanced Driver Assistance System (ADAS) Industry Report, 2015-2019

-

July 2015

- Hard Copy

- USD

$2,600

-

- Pages:155

- Single User License

(PDF Unprintable)

- USD

$2,450

-

- Code:

HJ005

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,800

-

Global and China Advanced Driver Assistance System (ADAS) Industry Report, 2015-2019 focuses on the following:

Overview of automotive ADAS, including classification of ADAS, laws, regulations and rating requirements in major countries, consumer cognition, functions and technical schemes of main ADASs.

Overview of automotive ADAS, including classification of ADAS, laws, regulations and rating requirements in major countries, consumer cognition, functions and technical schemes of main ADASs.

Analysis on global ADAS industry chain, covering market size, technical features, companies of sensor, chip, system integration, etc.;

Analysis on global ADAS industry chain, covering market size, technical features, companies of sensor, chip, system integration, etc.;

Analysis on global and China’s ADAS application and competition pattern, involving installation ratio, market size, as well as market share of major system integrators in the world;

Analysis on global and China’s ADAS application and competition pattern, involving installation ratio, market size, as well as market share of major system integrators in the world;

Analysis on major ADAS chip/solution suppliers and system integrators worldwide, including operation and financial conditions, ADAS technologies and relevant business.

Analysis on major ADAS chip/solution suppliers and system integrators worldwide, including operation and financial conditions, ADAS technologies and relevant business.

ADAS, short for Advanced Driver Assistance System, is not only the basis of intelligent driving and automatic driving, but the concrete application of active safety technology. ADAS can be generally divided into two categories: safety assistance and convenience and comfort assistance, with some systems integrating the pair of them.

The application of ADAS can significantly reduce the number of traffic accidents and the severity of injuries. At present, the greatest motivation to develop and use ADAS comes from more stringent requirements on safe driving from governments. Europe, the United States, Japan, and other developed countries have made provisions on ADAS configuration in new vehicles with respect to legislation and rating standard (NCAP), generally requiring ADAS to have functions of forward collision avoidance (FCA) and lane departure warning (LDW). The forerunner EU also put forward requirementson automatic emergency braking (AEB), lane keeping assistance (LKA) and even pedestrian detection system (PDS).

ADAS has been one of the fastest-growing sectors in automotive field and is expected to register a CAGR of 32% during 2014-2019. Currently, developed countries in Europe and America have had nearly 8% of new vehicles equipped with ADAS, in contrast to about 2% in emerging markets. It is predicted that over 25% of new vehicles will carry ADAS by 2019 globally.

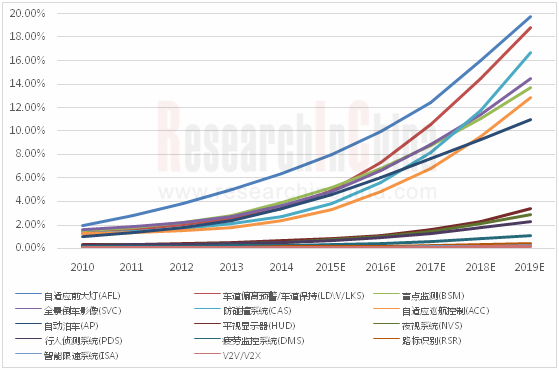

Global Penetration Rate of Main ADASs, 2010-2019E

ADAS consists mainly of sensors, chips (with signal processing and data computing chips as its core), algorithm software, etc. Sensors are usually developed and supplied by system integrators; chips and algorithm software are generally co-developed by semiconductor companies and system integrators, as well as complete vehicle makers when it comes to application in specific models. System integrators not only have the most direct and close relationship with complete vehicle makers, but also are the suppliers of integrated ADAS solutions.

In passenger vehicle field, ADAS integrators are large in number, mostly being large auto parts companies. At present, the leading companies are technologically developing toward combination and integration of active safety with passive safety and integration of multiple ADASs. These integrations, while improving intelligentization and safety, can reduce space used and costs. By region, Continental AG, Delphi and Denso Corporation are system integrators holding the highest market share in Europe, America and Asia, respectively. Globally, Continental AG boasts the largest market share, as well as No. 1 as concerns researchers and capital investment in ADAS and automated driving technology. The world’s top 5 system integrators make up more than 65% of market share, with the remaining occupied by Valeo, TRW, Magna, Hella, Panasonic, Gentex, etc.

Compared with passenger vehicles, the system integrators that are supplying ADAS for commercial vehicles are highly concentrated, with WABCO, Continental AG and Bosch eyeing 60% global market share.

China’s ADAS industry is also in rapid development over the years. Some companies backed by colleges, universities and other research institutions have the research and development ability of core algorithm and have received market recognition. At the same time, some traditional auto parts manufacturers represented by INVO Automotive Electronics, Jinzhou Jinheng Automotive Safety System and HiRain Technologiesare flooding into the ADAS market and have realizedOEM installation by virtue of resources from the original vehicle manufacturers. In addition, the booming ADAS industry is also favored by capital market, some established or emerging companies such as INVO Automotive Electronics and Forward Innovation Corporation sold partial stake to listed companies. However, the technological gap is still obvious, with a majority of ADAS integration companies deficient of core algorithm or lagged far behind foreign rivals. With most products supplied to independent vehicle factories, it’s rather difficult for them to enter the supply chain of joint venture factories at this stage.

1. Overview of ADAS

1.1 Classification

1.2 Development Prospect

1.2.1 Promotion of Relevant Rating Requirements

1.2.2 Requirements from Development of Automated Driving

1.3 Main ADASs

1.3.1 ConsumerCognition

1.3.2 Functions and Technical Schemes

2. Global ADAS Industry Chain

2.1 Overview

2.2 Sensor

2.2.1 Radar

2.2.2 Lidar

2.2.3 Camera

2.2.4 Ultrasonic Sensor

2.2.5 Comprehensive Application and Global Market Demand of Vehicle Sensor

2.3 System Solutions/Processing Chip/SOC

2.4 System Integration

3. Global and China ADAS Application and Competition Pattern

3.1 Global ADAS Market

3.1.1 Market Size

3.1.2 Market Segments

3.1.3 Competition Pattern

3.2 China ADAS Market

3.2.1 Market Size

3.2.2 Market Segments

4. Major Global ADAS Chip/Solutions Companies

4.1 Mobileye

4.1.1 Profile

4.1.2 Operation

4.1.3 Revenue Structure

4.1.4 Advanced Technologies for ADAS

4.1.5 Customers and Suppliers

4.2 TI

4.2.1 Profile

4.2.2 Operation

4.2.3 Revenue Structure

4.2.4 ADAS Business

4.2.5 Newly-released ADAS Applications

4.3 Renesas

4.3.1 Profile

4.3.2 Operation

4.3.3 Revenue Structure

4.3.4 ADAS Business

4.4 Freescale

4.4.1 Profile

4.4.2 Operation

4.4.3 Revenue Structure

4.4.4 ADAS Business

4.4.5 Technological Cooperation on ADAS

5. Major Global ADAS Integrators

5.1 WABCO

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Major Customers

5.1.5 ADAS Business

5.2 Autoliv

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Costs and Customer Structure

5.2.5 ADAS Business

5.2.6 Technological Development of ADAS

5.3 Continental AG

5.3.1 Profile

5.3.2 Operation

5.3.3 ADAS Business

5.3.4 Integration and New Technologies for ADAS

5.4 Robert Bosch

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 ADAS Business

5.5 Delphi

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 ADAS Business

5.5.5 Integration and New Technologies of ADAS

5.6 Denso

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 ADAS Business

5.6.5 ADAS Business Planning

5.7 Other Players

5.7.1 Magna

5.7.2 Valeo

5.7.3 TRW

6 Major Chinese ADAS Integrators

6.1 INVO Automotive Electronics

6.1.1 Profile

6.1.2 ADAS Business

6.2 Jinzhou Jinheng Automotive Safety System

6.2.1 Profile

6.2.2 ADAS Business

6.3 HiRain Technologies

6.3.1 Profile

6.3.2 ADAS Business

6.4 ZongMu Technology

6.4.1 Profile

6.4.2 ADAS Business

6.5 HuiChuang Electronic Technology

6.5.1 Profile

6.5.2 ADAS Business

6.6 Forward Innovation Corporation

6.6.1 Profile

6.6.2 ADAS Business

Weight Coefficients of Euro NCAP in Various Fields

Relevant Requirements on ADAS Configuration by NCAP Organizations in Various Countries

Number of Models Carrying LDW/FCW in USA, 2011-2013

Relevant Laws and Regulations on Trucks and Buses in Various Countries (Safety and Energy Efficiency)

Survey on Global Consumers’ Intension to Use Automated Driving

Percentage of Drivers with Traffic Accidents in China, Japan, Germany and USA

Survey on Vehicle Owners: Increased Traffic Volume Adds Pressure to Driving

Survey on Vehicle Owners: Acceptability of ADAS

Functions of Main ADASs

Technical Schemes of Main ADASs

Key Sensors of ADAS

Major ADAS Sensor Types and Typical Vehicle Positions

Detection Range of Various Radars and Application Types of ADAS

Sensors and Detection Ranges of Audi A8

Significant Milestones in Camera-based Applications

Comparison between Stereoscopic Camera and Mono-camera Solutions

Ultrasonic Sensor’s Detection of Barriers

ADAS Applications for Ultrasonic Sensors

Global ADAS Sensor Demand, 2010-2019E

Global ADAS Semiconductor Device Market Size, 2010-2019E

Example of ADAS Vision Processing

Solutions/Chip Companies Layout

Composition and Working Procedures of ADAS

Two Types of Output of Decision System

Global ADAS Market Size, 2011-2019E

Global Penetration Rate of Main ADASs, 2010-2019E

Global Shipments of Vehicles with ADAS, 2010-2019E

Proportion of Global Vehicles with ADAS in Overall Shipments of Passenger Vehicles, 2010-2019E

Share of Global Automotive ADAS Market Segments, 2014 VS 2019

Global Shipments of Adaptive Cruise Control (ACC), 2010-2019E

Global Shipments of Adaptive Forward Lighting (AFL), 2010-2019E

Global Shipments of Blind Spot Monitoring (BSM), 2010-2019E

Global Shipments of Driver Monitoring System (DMS), 2010-2019E

Global Shipments of Collision Avoidance System (CAS), 2010-2019E

Global Shipments of Head-up Display (HUD)

Global Shipments of Intelligent Speed Adaptation (ISA), 2010-2019E

Global Shipments of Lane Departure Warning / Lane Keeping System (LDW/LKS), 2010-2019E

Global Shipments of Night Vision System (NVS), 2010-2019E

Global Shipments of Automatic Parking (AP), 2010-2019E

Global Shipments of Pedestrian Detection System (PDS), 2010-2019E

Global Shipments of Road Sign Recognition (RSR), 2010-2019E

Global Shipments of SVC, 2010-2019E

Global Shipments of V2V/V2X, 2010-2019E

Major Global Sensor-based ADAS Integrators

Top 3 ADAS Integrators and Their Market Shares in Europe

Top 3 ADAS Integrators and Their Market Shares in North America

Top 3 ADAS Integrators and Their Market Shares in Asia Pacific

Global Top 5 ADAS Integrators and Their Market Shares

Market Size of Chinese ADAS Market, 2011-2019E

Main ADAS Configurations for Cars Sold in China, Jan-Apr 2015

Penetration Rate of Main ADASs in the Chinese Market, Jan-Apr 2015

BSM Configuration for Passenger Cars Sold in China, Apr 2015

BSM Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

BSM Configuration for New Cars in China, Apr 2015

LDW Configuration for Passenger Cars Sold in China, Apr 2015

LDW Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

LDW Configuration for New Cars in China, Apr 2015

LKS Configuration for Passenger Cars Sold in China, Apr 2015

LKS Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

LKS Configuration for New Cars in China, Apr 2015

SVC Configuration for Passenger Cars Sold in China, Apr 2015

SVC Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

SVC Configuration for New Cars in China, Apr 2015

AP Configuration for Passenger Cars Sold in China, Apr 2015

AP Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

AP Configuration for New Cars in China, Apr 2015

ACC Configuration for Passenger Cars Sold in China, Apr 2015

ACC Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

ACC Configuration for New Cars in China, Apr 2015

AEB Configuration for Passenger Cars Sold in China, Apr 2015

AEB Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

AEB Configuration for New Cars in China, Apr 2015

FCW Configuration for Passenger Cars Sold in China, Apr 2015

FCW Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

Number of Models Carrying Mobileye’s ADAS, 2007-2016E

Revenue and Net Income of Mobileye, 2011-2015Q1

Gross Margin of Mobileye, 2011-2015Q1

ADAS Products Provided by Mobileye

Revenue Breakdown of Mobileye by Division, 2011-2015Q1

Operating Profit Breakdown of Mobileye by Division, 2011-2015Q1

Composition of Mobileye EyeQ?

Cooperative Companies of Mobileye in OEM Market and Procedures

Customers Accounting for More Than 10% of Mobileye’s OEM Revenue, 2012-2014

Revenue and Net Income of TI, 2010-2015Q1

Gross Margin of TI, 2010-2015Q1

Revenue Structure of TI by Division, 2010-2014H1

Operating Profit Breakdown of TI by Division, 2010-2014

Revenue Structure of TI by Region, 2010-2014

Application of TI’s Products in Automotive Sector

Application of TI’s Analog and Embedded Processors in ADAS

TI AFE5401

Block Diagram for TDA2x SoC

TDA2x Evaluation Module

Three Categories of Products and Their Application Fields of Renesas

Revenue and Operating Profit of Renesas, FY2011-FY2015

Net Income of Renesas, FY2011-FY2015

Products and Organization Evolution of Renesas

Proportion of Semiconductor Revenue to Total Revenue of Renesas, FY2011-FY2015

Semiconductor Revenue Structure of Renesas by Product, FY2012-FY2014

MCU Revenue Breakdown of Renesas by Application Field, FY2012-FY2014

Analog and Power Devices Revenue Breakdown of Renesas by Application Field, FY2012-FY2014

SoC Revenue Breakdown of Renesas by Application Field, FY2012-FY2014

Statistics Changes in Sales Data of Renesas, FY2015

Auto Sales (Semiconductor Part) of Renesas, FY2014-FY2015

General-Purpose Sales (Semiconductor Part) of Renesas, FY2014-FY2015

General-Purpose Revenue Structure of Renesas by Application, FY2014-FY2015

Semiconductor Revenue Structure of Renesas by Application Field, FY2015

Automotive Revenue Structure of Renesas by Application, FY2015Q1

General-Purpose Revenue Structure of Renesas by Application, FY2015Q1

R-Car V2H SoC of Renesas

Block Diagram for Renesas Sensor Fusion

Recommended Products of Renesas ADAS Solutions

Roadmap for Renesas ADAS Products

Revenue and Net Income of Freescale, 2010-2015Q1

Gross Margin of Freescale, 2010-2015Q1

Revenue Structure of Freescale by Product, 2011-2015Q1

Revenue Structure of Freescale by Region, 2014

Applications of Freescale’s ADAS

Four Generation Products of Freescale ADAS MCU

77GHz Radar System of Freescale

Radar System Solutions and Target Application of Freescale

Power Architecture?-based Qorivva 32-bit MCUs of Freescale

Vision System Solutions of Freescale

Two Goals of WABCO’s Products

Revenue and Operating Profit of WABCO, 2010-2015Q1

Gross Margin of WABCO, 2010-2015Q1

Global Factories of WABCO

Revenue Structure of WABCO by Product Segments, 2011

Revenue Structure of WABCO by End Market, 2011-2014

Revenue Structure of WABCO by Region,2011-2014

Major Customers of WABCO in Various Markets

WABCO’s ADAS Products

Roadmap for WABCO’s ADAS Products

WABCO’s OptiPace?

Autoliv in Numbers

Autoliv Milestone

Autoliv’s Automotive Safety System Products

Revenue and Operating Profit of Autoliv, 2010-2015Q1

Gross Margin of Autoliv, 2010-2014

Global Factories of Autoliv

Revenue Structure of Autoliv by Product, 2011-2015Q1

Output of Autoliv’s Products, 2013Q1-2015Q1

Output of Autoliv’s Products, 2009-2014

Revenue Structure of Autoliv by Region, 2009-2014

Autoliv’s Cost Structure and Changes

Customers Contributing More Than 10% of Autoliv’s Revenue, 2011-2014

Autoliv’s Major Customers and % of Revenue, 2014

Autoliv’s Active Safety Development Path and Strategy

Shipments of and Number of Models Carrying Autoliv’s Active Safety Products, 2009-2013

Major Customers of Autoliv’s Active Safety

Autoliv’s Revenue from Active Safety Products, 2009-2013

Functions of Autoliv’s Active Safety System

Autoliv’s Active Safety System Products and Their Applications

Dynamic Spot Light Function of Autoliv’s Night Vision System

Revenue and EBIT of Continental, 2009-2015Q1

Revenue Structure of Continental by Division, 2011-2015Q1

Revenue Structure of Continental by Region, 2011-2014

Continental’s Revenue from Chassis & Safety Division, 2011-2015Q1

Revenue CAGR in Sector Segments of Continental, 2013-2018E

ADAS Products Sales Volume and Growth Rate of Continental, 2011-2014

Global ADAS Production Bases and R&D Centers of Continental

Roadmap for Automated Driving of Continental

ContiGuard Integrating Active and Passive Safety Systems

Continental’s Integrated Safety Algorithm (ISA)

Sales & EBIT of Bosch Mobile Solutions, 2012-2014

Business Scope of Bosch’s Automotive Chassis Control System Division

Revenue Structure of Bosch by Division, 2012-2014

Revenue Structure of Bosch by Region, 2012-2014

Products of Bosch’s Automotive Chassis Control System Division

Bosch’s Emergency Braking Systems (Two Types)

Bosch’s Driver Drowsiness Detection System

Bosch’s ACC Systems (Two Types)

Applications of Bosch’s Sensor System and ADAS

Revenue and Operating Profit of Delphi, 2010-2015Q1

Main Growth Areas of Delphi’s Divisions, 2013-2016

Major Customers and Regional Distribution of Delphi

Revenue Structure of Delphi by Customer, 2014

Revenue Structure of Delphi by Division, 2012-2015Q1

Revenue Breakdown of Delphi by Region, 2011-2014

Growth of Delphi’s Active Safety Business, 2014-2017E

Customers of Delphi’s Active Safety Products as of 2013

Applications of Delphi’s Sensor System and ADAS

Delphi’s Integrated Safety and Networking Technology Solutions

Delphi’s Roadmap for Intelligent Driving

Revenue of Denso, FY2011-FY2015

Operating Profit and Net Income of Denso, FY2011-FY2015

Revenue Structure of Denso by Division, FY2011-FY2015

Auto Sales of Denso by Division, FY2011-FY2015

Revenue Structure of Denso by Region, FY2011-FY2015

Revenue Breakdown of Denso by Customer, FY2010-FY2014

Denso’s Technology Roadmap for Safe Driving

Denso’s Driver Status Monitor System

Denso’s Lane Keeping Assist System

Denso’s Pre-Crash Safety System

Applications of Delphi’s Sensor System and ADAS

Safety Functions and Products Supplied by Denso under Various Driving Situations

Three Levels (Entry, Standard, Advanced) of ADAS Products Suites of Denso

Major Partners of INVO Automotive Electronics

Global Distribution of HiRain Technologies

AFS of HiRain Technologies

SVC System Architecture of ZongMu Technology

Main Functions of ZongMu Technology

ADAS Products of HuiChuang Electronic Technology

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...