Global and China Automotive Lighting Industry Report, 2014-2015

-

Sep.2015

- Hard Copy

- USD

$2,700

-

- Pages:147

- Single User License

(PDF Unprintable)

- USD

$2,500

-

- Code:

ZYW216

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,800

-

- Hard Copy + Single User License

- USD

$2,900

-

Global and China Automotive Lighting Industry Report, 2014-2015 focuses on the followings:

1. Global automobile market and industry;

2. China automobile market and industry;

3. LED industry and market;

4. Automotive lighting industry and market;

5. 18 typical automotive lighting companies.

Global automotive lighting market size was USD25.3 billion in 2014, and is expected to grow by 10.8% to USD28 billion in 2015, the highest growth rate since 2010, and reach USD30.1 billion in 2016, a year-on-year rise of 7.5%.

There are two reasons for significant expansion of automotive lighting market. One is substantial improvement in the penetration of LED. As the price of LED chip continues to drop, more and more companies adopt LED to make headlamps. Despite the price of LED chip declines, LED headlamps are still more expensive than halogen lamps. About 4% of headlamps were made of LED in 2014. The figure rose to 7% in 2015 and is expected to hit 15% in 2017 and 21% in 2020, as a growing number of companies employ LED in the pursuit of emotional or aesthetic appearance. The other reason is the use of ADB/AFS. The penetration of AFS will arrive at 15% in 2015, and that of ADB 3% in the year and is predicted to stand at 10% in 2020 and 25% in 2025. The adoption of ADB makes headlamps more complicated and raises the cost. In addition, laser headlamps and OLED tail-lamps have come into being. The penetration of laser headlamps, which are extremely expensive, is expected to reach 15% in 2025.

Global economic downturn, especially the economic slowdown in China, will prolong the downward trend in the Chinese automobile market over the next couple years, thus slowing expansion of the automotive lighting market. Moreover, the deflation has been severe.

From the perspective of industry, big companies hold an increasingly dominant position, finding a higher rate than small ones in terms of revenue growth. Valeo is expected to be the one performing best in 2015 with a growth rate of up to 19%. Valeo won nearly 90% of headlamp orders of Volkswagen’s Passat B6 platform and 1/3 of Audi’s headlamp orders. The competitor- Hella is suffering market share contraction.

1. Global and Chinese Automotive Market

1.1 Global Automotive Market

1.2 Overview of Chinese Automotive Market

1.3 Recent Development of Chinese Automotive Market

2 Automotive Lighting Technology

2.1 Profile of HID Xenon Lamps

2.2 Typical Automotive Headlight Design

2.3 Headlight Design Trends

2.4 Laser Automotive Lighting

2.5 OLED Automotive Light

2.6 ADB/AFS

3 LED Industry

3.1 LED Automotive Lighting Market

3.2 Automotive Interior LED Lighting

3.3 Automotive Exterior LED Lighting

3.4 LED Industry Chain

3.5 Geographical Distribution of LED Industry

3.6 Ranking of Global Top 30 LED Companies by Revenue, 2012-2014

3.7 Taiwan LED Industry

3.8 Summary of LED Industry in Mainland China, 2014

4. Automotive Lighting Industry and Market

4.1 Automotive Lighting Market Overview

4.2 Automotive Lighting Market Size

4.3 Global Automotive Lighting Industry

4.4 Global Automotive Lighting OEM System

4.5 China Automotive Lighting Industry

4.6 China's Automotive Lighting OEM System

5. Automotive Lighting Companies

5.1 Hella

5.1.1 Changchun Hella

5.2 Koito

5.2.1 Shanghai Koito

5.2.2 Guangzhou Koito

5.3 Ichikoh

5.4 Stanley

5.4.1 Guangzhou Stanley

5.4.2 Tianjin Stanley Electric Co., Ltd.

5.5 Valeo

5.6 VARROC

5.6.1 Changzhou Damao Visteon

5.7 Automotive Lighting (Magneti Marelli)

5.8 TYC

5.9 DEPO

5.10 Ta Yih Industrial

5.11 Changzhou Xingyu

5.12 Jiangsu Tongming

5.13 ZKW

5.14 Liaowang Automotive Lamp

5.15 SL

5.16 Zhejiang Tianchong

5.17 Laster Tech

5.18 FIEM

6. Automotive Lighting LED Companies

6.1 Nichia Chemical

6.2 Toyoda Gosei

6.3 OSRAM

Sales Volume of Major Global Automobile Brands, 2010-2015

Production of Light Vehicles by Region , 2013-2015

Sales Volume of Automobile in China, 2005-2015

China's Automobile Output YoY Growth Rate by Type, 2008-2015

Audi A6 3.5 FSI Headlamp

BMW 730Li Headlamp

Mercedes-Benz S320L Headlamp

Honda 9-generation Accord Headlamp

Peugeot 508 Headlamp

Global Sedan Headlamp Light Source Distribution, 2009-2016E

China’s Sedan Headlamp Light Source Distribution, 2009-2016E

Audi Sport Quattro Laserlight Concept

Audi OLED Swarm System

ADB/AFS Penetration Rates, 2010-2025E

AFS System Architecture of the Reference Design

Global LED Automotive Lighting Market Size, 2010-2016E

Geographical Distribution of Global LED Output Value, 2013-2014

Rankin of Top 30 LED Companies Worldwide by Revenue, 2012-2014

Operating Margin of Taiwan LED Companies, 2012-2014

Gross Output Value of China LED Industry, 2013-2014

Ownership of MOCD in China LED Industry, 2010-2014

Output Value of LED Epitaxial Chip in China, 2010-2014

Output Value of LED Packaging in China, 2010-2014

LED Output Value by Application in China, 2010-2014

LED Application Structure by Output Value, 2013-2014

LED Output Value by Application in China, 2014

Automotive Lighting Market by type, 2015

LED Penetration, 2007-2015

Automotive Headlamp Source by technology, 2013-2015

Automotive Taillamp Source by technology, 2013-2015

Global Automotive Lighting Market Size, 2010-2018E

Global Automotive Lighting Market Size by End Market, 2010-2016E

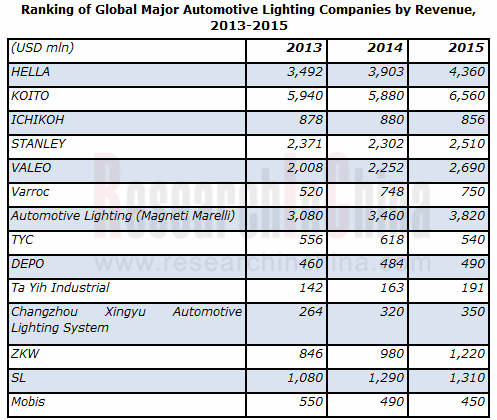

Ranking of Global Major Automotive Lighting Companies by Revenue, 2013-2015

Automotive Lighting System Supply Structure of Toyota, 2014

Automotive Lighting System Supply Structure of Honda, 2014

Automotive Lighting System Supply Structure of Nissan Renault, 2014

Automotive Lighting System Supply Structure of GM, 2014

Automotive Lighting System Supply Structure of Ford, 2014

Automotive Lighting System Supply Structure of VW, 2014

Automotive Lighting System Supply Structure of Hyundai, 2014

Market Share of Major Sedan Lighting Companies in China, 2014

Top 20 Automotive Light Companies in China by Sales, 2013

Koito’s Client Distribution, 2014

Major clients of Chinese Automotive Light Companies

Hella’s Milestone, 1899-2014

Hella’s Revenue and EBIT, FY2007-FY2015

Hella Quarterly Comparison, FY2015

Hella Gross Profit Margin Bridge, FY2014-FY2015

Hella’s Organizational Structure

Hella’s Revenue by Division, FY2010-FY2015

Hella’s Revenue by Region, FY2007- FY 2012

Hella’s Revenue by Region, FY2013- FY 2015

Favorable Customer Mix and Regional Exposure of Hella, FY2014

Global Distribution of Hella's Staff

Global Layout of Hella, 2007-2013

Hella Automotive Lighting Revenue Segment by Product, FY2015

Hella Automotive Electronics Revenue Segment by Product, FY2015

Hella Aftermarket Revenue Segment by Business, FY2015

Koito’s Revenue and Operating Margin, FY2006- FY 2016

Assets and Equity of Koito, 2011-2015

Koito’s Revenue by Region, FY2008- FY2013

Koito’s Revenue by Region, FY2013- FY2015

Koito’s Plants in China

ADB of Koito

Koito LED Roadmap, 2007-2015

Major Vehicle Models Supported by Koito

LED light Sales of Shanghai Koito, 2005-2009

Shanghai Koito’s Revenue and Operating Margin, 2004-2013

Ichikoh’s Revenue and Operating Margin, FY2006- FY 2016

Ichikoh’s Revenue by Region, FY2007- FY2014

Ichikoh's Distribution in the World

Ichikoh's Distribution in Japan

Major Vehicle Models Supported by Ichikoh

Stanley’s Main Products

Stanley’s Revenue and Operating Margin, FY2006- FY 2016

Stanley’s Assets and Liabilities, FY2010- FY 2014

Stanley’s Automotive Lighting Revenue and Operating Margin, FY2006- FY 2015

Stanley’s Revenue by Region, FY2008- FY 2014

Guangzhou Stanley’s Revenue and Operating Margin, 2004-2013

Valeo’s Revenue and Gross Margin, 2005-2014

Valeo’s Revenue by Division, 2009-H1 2015

Valeo’s EBITDA by Division, 2012-2014

Valeo’s Clients by Region, 2007-2014

Valeo’s Automotive Lighting Main Customer

Varroc’s Revenue by Product, FY2013

Varroc’s Revenue by Segment, 2014

Global Distribution of Technical Centers of Visteon’s Automotive Lighting Division

Global Distribution of Production Bases of Visteon’s Automotive Lighting Division

Major Vehicle Models Supported by Visteon’s Automotive Lighting Division

Global Distribution of Magneti Marelli

Revenue of Magneti Marelli by Product, 2013

Revenue and EBIT Margin of Magneti Marelli, 2006-2015

Auotomotive Lighting Revenue of Magneti Marelli, 2007-2015

Automobiles Equipped with Automotive Lighting

Lights Used by Mercedes-Benz S

Lights Used by BMW 4 Series

TYC’s Revenue and Operating Margin, 2005-2015

TYC’s Monthly Revenue and Growth Rate, July 2013-July 2015

Financial Status of TYC's Subsidiary in Mainland China, 2010

Financial Status of TYC's Subsidiary in Mainland China, 2011

Financial Status of TYC's Subsidiary in Mainland China, 2012

Financial Status of TYC's Subsidiary in Mainland China, 2013

Financial Status of TYC's Subsidiary in Mainland China, 2014

DEPO’s Revenue and Operating Margin, 2006-2015

DEPO’s Monthly Revenue, July 2013-July 2015

DEPO’s Revenue by Region, 2009-2012

DEPO Global Distribution Network

Financial Data of DEPO’s Subsidiary in Mainland China, 2012

Revenue and Operating Margin of Ta Yih Industrial, 2004-2015

Monthly Revenue and Growth Rate of Ta Yih Industrial, July 2013-July 2015

Distribution of Ta Yih Industrial

Industrial Products of Ta Yih Industrial

Clients of Ta Yih Industrial

Equity Structure of Changzhou Xingyu

Output of Changzhou Xingyu, 2013-2014

Revenue and Operating Margin of Changzhou Xingyu, 2007-2015

Client Structure of Changzhou Xingyu, 2007-2014

Distribution of Staff Positions of Changzhou Xingyu, 2014

Major Clients of Jiangsu Tongming

ZKW's Organizational Structure

Geographical Distribution of ZKW's Staff, 2014-2015

SL’s Revenue and Operating Margin, 2008-2014

SL’s Revenue by Product, 2010-2014

Structure of Laster Tech

Revenue and Gross Margin of Laster Tech, 2008-2015

Monthly Revenue of Laster Tech, July 2013-July 2015

Revenue of Laster Tech by Business, 2011-2013

Products of Laster Tech

Fiem’s Revenue and Profit, FY2011-FY2014

Revenue Structure of Fiem by Product, FY2014

Fiem’s Manufacturing Unit

Fiem’s Major Clients

Revenue and Operating Margin of Nichia Chemical, 2003-2014

Revenue and Operating Margin of Nichia Chemical LED Division, 2004-2014

Revenue and Operating Margin of Toyoda Gosei, FY2006-FY2015

Revenue of Toyoda Gosei by Product, FY2006-FY2015

Revenue of Toyoda Gosei by Region, FY2006-FY2015

Revenue and Operating Margin of Toyoda Gosei in Asia-Pacific, FY2006-FY2015

Revenue and Operating Margin of Toyoda Gosei LED Business, FY2008-FY2015

OSRAM’S Quarterly Revenue and EBITA Margin, Q1 2012-Q1 2015

Osram’s Revenue by Division, 20012-2014

Osram’s Revenue by Division, 20014-2015

Osram’s EBITA by Division, 20012-2014

Osram’s SP Revenue and EBIT, Q3 2013-Q1 2015

Osram’s OS Revenue and EBIT, Q3 2013-Q1 2015

Osram’s Revenue by Region, 20012-2014

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...