China Automotive Seal Industry Report, 2015-2018

-

Sep.2015

- Hard Copy

- USD

$2,500

-

- Pages:100

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

ZJF078

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,700

-

Tightness is an important indicator to measure the quality of the vehicle, and sealing system is also one of the most widely used parts in automobile. The sealing system primarily plays a role in filling the gap, absorbing and reducing vibration, deadening the noise, providing a route for mobile parts, and making up the errors in metal plate fabrication and assembly.

The excellent durability and longer service life of automotive weatherstrip makes a relatively small after-sales maintenance market, and the demand is mainly concentrated in complete vehicle supporting field. In 2014, China produced 23.72 million vehicles. Calculated on the basis of around 45-meter weatherstrip for a car, about 1.067 billion meters of automotive weatherstrip would be needed. China’s demand for automotive weatherstrip in 2015 is negatively affected by slower growth in new car sales and expected to go up 2%-3% year on year.

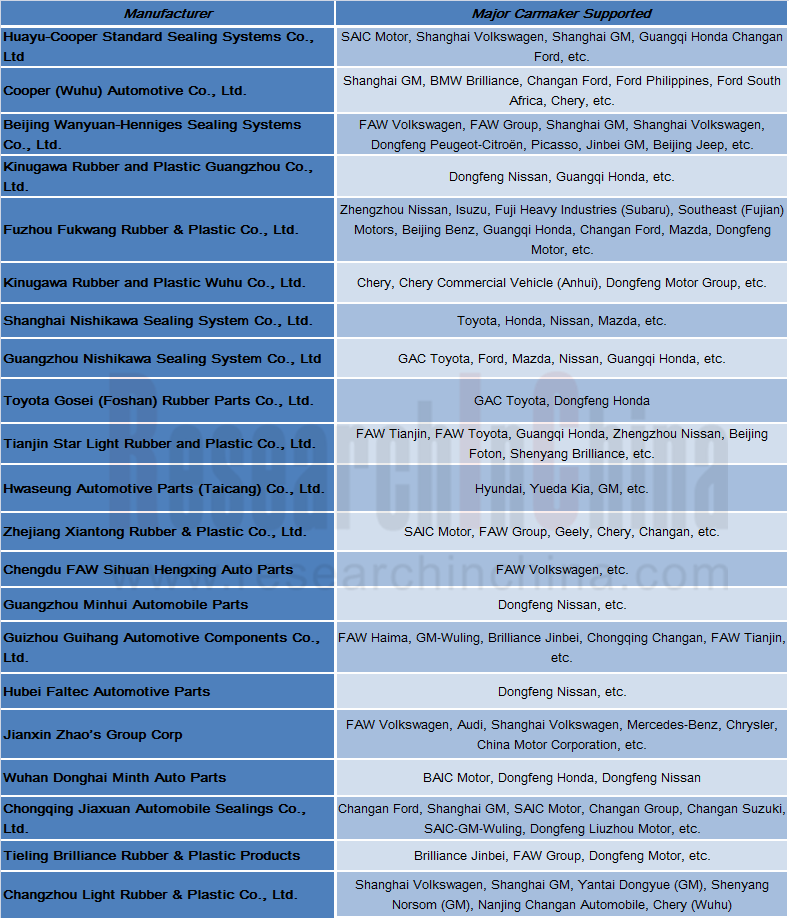

As to competitive landscape, automotive seal manufacturers are mainly joint ventures or sole-investor enterprises set up by a dozen auto groups, resulting in a relatively stable pattern of supply and demand.

Major Seal Suppliers and Supported Customers in China, 2015

Source: ResearchInChina

Local Chinese automotive weatherstrip companies support mainly homegrown brands and small-displacement models, while most joint-venture brands and high-end auto models prefer weatherstrip from large multinational auto parts companies. In 2014, domestic Chinese seal companies seized about 45% market share and joint ventures & foreign companies the remaining 55%. It is noteworthy that some local seal players are gradually entering the supply chain of JV and high-end automakers via overseas M&As and technological improvement, such as Anhui Zhongding Sealing Parts, Guizhou Guihang Automotive Components, and Minth Group, with the first having become a supplier of high-end seals (including the ones for EV and new energy vehicles) through active overseas M&As.

China Automotive Seal Industry Report, 2015-2018 highlights the followings:

Overview of automotive seal industry in China, including definition & classification of product, characteristics of product and process, main policies, etc.;

Overview of automotive seal industry in China, including definition & classification of product, characteristics of product and process, main policies, etc.;

Overview of automobile and parts industry in China, covering output & sales of different categories of automobiles, competitive landscape, market size of main parts, etc.;

Overview of automobile and parts industry in China, covering output & sales of different categories of automobiles, competitive landscape, market size of main parts, etc.;

Overview of automotive seal industry in China, including market size, competitive landscape, supporting relationship, industry forecast, etc.;

Overview of automotive seal industry in China, including market size, competitive landscape, supporting relationship, industry forecast, etc.;

Analysis of 6 multinational companies (Cooper-Standard, Henniges Automotive, Toyoda Gosei, Kinugawa, Nishikawa Rubber, Hwaseung R&A) and 12 domestic counterparts including Anhui Zhongding Sealing Parts, Guizhou Guihang Automotive Components, Minth Group, Jiangyin Haida Rubber and Plastic, Jianxin Zhao’s Group Corp, Guizhou Jingzhong Rubber & Plastic Industry, and Chongqing Jiaxuan Automobile Sealings, containing profile, financial position, main products, R&D, production bases, technical features, etc.

Analysis of 6 multinational companies (Cooper-Standard, Henniges Automotive, Toyoda Gosei, Kinugawa, Nishikawa Rubber, Hwaseung R&A) and 12 domestic counterparts including Anhui Zhongding Sealing Parts, Guizhou Guihang Automotive Components, Minth Group, Jiangyin Haida Rubber and Plastic, Jianxin Zhao’s Group Corp, Guizhou Jingzhong Rubber & Plastic Industry, and Chongqing Jiaxuan Automobile Sealings, containing profile, financial position, main products, R&D, production bases, technical features, etc.

1. Overview of Automobile Seals

1.1 Definition & Classification

1.2 Production Technologies and Future Development Trends

1.2.1 Production Technologies

1.2.2 Major Materials for Auto Seals

1.2.3 Future Development Trends

1.3 Industrial Policy

1.3.1 Authorities and Regulatory System

1.3.2 Industrial Policy

2. Overview of Automobile Seal-Related Industries

2.1 Status Quo of Automobile Industry

2.1.1 Total Automobile Market

2.1.2 Passenger Car Market

2.1.3 Commercial Vehicle Market

3. Auto Parts Industry

3. 1 Status quo

3.2 Development Trend

3.3 Market Size

4. Automobile Seal Market

4.1 Market Size

4.2 Competitive Landscape

4.3 Main Supported Models

4.4 Industry Forecast

5. Foreign Companies

5.1 Cooper-Standard Holdings INC.

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Major Customers

5.1.5 Production Base

5.1.6 Main Supporting Models

5.1.7 Business in China

5.1.8 Huayu-Cooper Standard Sealing Systems Co., Ltd

5.1.9 Cooper (Wuhu) Automotive Co., Ltd.

5.2 Henniges Automotive

5.2.1 Profile

5.2.2 Main Products

5.2.3 Beijing Wanyuan-Henniges Sealing Systems Co., Ltd.

5.3 Kinugawa Rubber Industrial Co., Ltd.

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 R&D Expenditure

5.3.5 Main Supporting Models

5.3.6 Business in China

5.3.7 Kinugawa Rubber and Plastic Guangzhou Co., Ltd.

5.3.8 Fuzhou Fukwang Rubber & Plastic Co., Ltd.

5.3.9 Kinugawa Rubber and Plastic Wuhu Co., Ltd.

5.3.10 Development Planning

5.4 Nishikawa Rubber Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 R&D Expenditure

5.4.5 Production Base

5.4.6 Major Customers and Main Supporting Models

5.4.7 Business in China

5.4.8 Shanghai Nishikawa Sealing System Co., Ltd.

5.5.9 Guangzhou Nishikawa Sealing System Co., Ltd

5.4.10 Development Planning

5.5 TOYOTA GOSEI

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 R & D

5.5.5 Major Customers and Main Supported Models

5.5.6 Business in China

5.5.7 Toyota Gosei (Foshan) Rubber Parts Co., Ltd.

5.5.8 Tianjin Star Light Rubber and Plastic Co., Ltd.

5.6 Hwaseung R&A Co., Ltd.

5.6.1 Profile

5.6.2 Operation

5.6.3 Production Base

5.6.4 Major Customers

5.6.5 Main Supporting Models

5.6.6 Business in China

5.6.7 Hwaseung Automotive Parts (Taicang) Co., Ltd.

5.6.8 Beijing Hwaseung R&A Automotive Parts Co., Ltd.

6. Domestic Companies

6.1 Anhui Zhongding Sealing Parts Co., Ltd.

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 R&D Expenditure

6.1.6 Production Bases

6.1.7 Overseas Acquisition

6.1.8 Development Strategy

6.2 Guizhou Guihang Automotive Components Co., Ltd.

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 R&D Expenditure

6.2.6 Seals Business

6.2.7 Production Base

6.2.8 Main Supporting Models

6.3 Jiangyin Haida Rubber and Plastic Co., Ltd.

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Gross Margin

6.3.5 R&D Expenditure

6.3.6 Seals Business

6.3.7 Production Base

6.3.8 Main Supporting Models

6.4 Minth Group

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 Gross Margin

6.4.5 R&D

6.4.6 Major Customers

6.4.7 Production Base

6.5 Zhejiang Xiantong Rubber & Plastic Co., Ltd.

6.5.1 Profile

6.5.2 Main Supporting Models

6.5.3 Major Projects

6.5.4 Development Strategy

6.6 Guizhou Jingzhong Rubber & Plastic Industry Co., Ltd.

6.6.1 Profile

6.6.2 Main Products and Customers

6.7 Jianxin Zhao’s Group Corp

6.7.1 Profile

6.7.2 Main Products and Customers

6.7.3 Production Base

6.8 Hebei Xinhua Ouya Group

6.8.1 Profile

6.8.2 Main Supporting Models

6.9 Shanghai Minfeng Automobile Seal Co., Ltd.

6.9.1 Profile

6.9.2 Main Supporting Models and Output & Sales Volume

6.10 Yongsheng Automotive Parts Manufacturing Co., Ltd.

6.10.1 Profile

6.10.2 Main Supporting Models

6.11 Changzhou Light Rubber & Plastic Co., Ltd.

6.11.1 Profile

6.11.2 Main Supporting Models and Output & Sales Volume

6.12 Chongqing Jiaxuan Automobile Sealings Co., Ltd.

6.12.1 Profile

6.12.2 Main Supporting Models

Position of Automobile Seals in Automobile Industry

Classification of Automobile Seals

Policies Concerning China Automobile Seals Industry

China's Automobile Output and Sales Volume, 2009-2018E

China's Sedan Output and Sales Volume, 2009-2018E

Output and Sales Volume of Top10 Sedan Makers in China, 2013-2015

China's SUV Output and Sales Volume, 2009-2018E

Output and Sales Volume of Top10 SUV Makers in China, 2013-2015

China's MPV Output and Sales Volume, 2009-2018E

Output and Sales Volume of Top10 MPV Makers in China, 2013-2015

China's Cross Passenger Vehicle Output and Sales Volume, 2009-2018E

Output and Sales Volume of Top10 Cross Passenger Vehicle Makers in China, 2013-2015

China's Bus Output, 2009-2018E

China's Bus Sales Volume, 2009-2018E

Output and Sales Volume of Top10 Bus Makers in China, 2013-2015

China's Truck Output, 2009-2018E

China's Truck Sales Volume, 2009-2018E

Output and Sales Volume of Top10 Truck Makers in China, 2013-2015

Classification of Auto Parts Companies in China

Number of Auto Parts Companies in China, 2003-2015

Operating Revenue of China Auto Parts Industry, 2003-2015

Total Profit of China Auto Parts Industry, 2003-2015

Gross Margin of China Auto Parts Industry, 2009-2015

China’s Automobile Weatherstrip Market Demand, 2009-2015

Ranking of Major Seals Manufacturers in China by Revenue, 2013-2014

Major Seals Suppliers and Supported Customers in China, 2015

Major Supported Models of Automobile Seals in China, 2009-2015

Automobile Sales Volume Plans of China’s Major Automobile Groups for 2015

Demand of Automobile Seals in China, 2014-2018E

Revenue and Net Income of Cooper-Standard, 2011-2015

Revenue Breakdown of Cooper-Standard by Product, 2012-2014

Revenue Breakdown of Cooper-Standard by Region, 2012-2015

Sales Ratio to Major Customer of Cooper-Standard, 2012-2014

Main Global Production Bases of Cooper-Standard, 2014

Supporting Relationship of Cooper-Standard

Production Bases of Cooper-Standard in China, 2015

Major Production Bases of Huayu-Cooper Standard Sealing Systems Co., Ltd

Major Seals Products of Henniges Automotive

Global Production Bases of Henniges Automotive

Major Products of Beijing Wanyuan-Henniges Sealing Systems Co., Ltd.

Revenue and Net Income of Kinugawa, FY2011-FY2015

Revenue Structure of Kinugawaby Product, FY2012-FY2015

Revenue Structure of Kinugawa by Region, FY2012-FY2015

R&D Expenditure of Kinugawa, FY2012-FY2015

Major Supportings of Kinugawa Seals, 2014

Kinugawa’s Layout in China

Revenue and Net Income of Nishikawa Rubber, FY2011-FY2015

Revenue of Nishikawa Rubber’s Major Products, FY2014-FY2015

Revenue from Major Regions of Nishikawa Rubber, FY2014-FY2015

R&D Expenditure of Nishikawa Rubber, FY2012-FY2015

Major Production Bases of Nishikawa Rubber (Excluding China)

Major Customers of Nishikawa Rubber

Seals Supporting of Nishikawa Rubber, 2015

Major Production Bases of Nishikawa Rubber in China

Main Business of TOYOTA GOSEI

Revenue and Net Income of TOYOTA GOSEI, FY2010-FY2015

Net Profit Margin of TOYOTA GOSEI, FY2010-FY2015

Revenue Structure of TOYOTA GOSEI by Product, FY2014-FY2015

Revenue Structure of TOYOTA GOSEI by Region, FY2014-FY2015

R&D Expenditure and % in total Revenue of TOYOTA GOSEI, FY2010-FY2015

Major Partners of of TOYOTA GOSEI

Customers Structure of TOYOTA GOSEI, FY2012-FY2015

Seals Supporting of TOYOTA GOSEI, 2015

Major Production Bases of TOYOTA GOSEI in China

Revenue, Operating Profit and Net Income of Hwaseung R&A, 2012-2015

Major Production Bases of Hwaseung R&A Worldwide (Excluding China)

Major Customers of Hwaseung R&A Worldwide (Excluding China)

Seals Supporting of Hwaseung R&A

Major Production Bases of Hwaseung R&A in China

Capacity and Output of Hwaseung Automotive Parts (Taicang) Co., Ltd, 2012-2014

Capacity and Output of Beijing Hwaseung R&A Automotive Parts Co., Ltd, 2012-2014

Operating Revenue and Net Income of Anhui Zhongding Sealing Parts, 2012-2015

Operating Revenue and Net Income of Anhui Zhongding Sealing Parts, 2014-2018E

Operating Revenue of Anhui Zhongding Sealing Parts’ Major Products, 2013-2015

Revenue of Anhui Zhongding Sealing Parts in Major Regions, 2013-2015

Gross Margin of Anhui Zhongding Sealing Parts’ Major Products, 2013-2015

R&D Expenditure of Anhui Zhongding Sealing Parts, 2011-2015

Major Production Bases of Automobile Seals of Anhui Zhongding Sealing Parts

Overseas Acquisition Course of Anhui Zhongding Sealing Parts, 2009-2015

Revenue and Net Income of Guizhou Guihang Automotive Components, 2010-2015

Revenue and Net Income of Guizhou Guihang Automotive Components, 2014-2018E

Revenue of Guizhou Guihang Automotive Components by Product, 2010-2015

Revenue of Guizhou Guihang Automotive Components by Region, 2010-2015

Gross Margin of Guizhou Guihang Automotive Components by Product, 2010-2015

R&D Expenditure of Guizhou Guihang Automotive Components, 2012-2013

Output and Sales Volume of Guizhou Guihang Automotive Components, 2012-2015

Major Production Bases of Guizhou Guihang Automotive Components

Revenue and Net Income of Jiangyin Haida Rubber and Plastic, 2010-2015

Revenue and Net Income of Jiangyin Haida Rubber and Plastic, 2014-2018E

Revenue of Jiangyin Haida Rubber and Plastic by Product, 2010-2015

Revenue of Jiangyin Haida Rubber and Plastic by Region, 2012-2014

Gross Margin of Jiangyin Haida Rubber and Plastic by Product, 2010-2015

R&D Expenditure of Jiangyin Haida Rubber and Plastic, 2010-2015

Development Course of Jiangyin Haida Rubber and Plastic

Key Seals Orders of Jiangyin Haida Rubber and Plastic, 2015H1

Major Production Plants of Jiangyin Haida Rubber and Plastic

Major Customers and Supporting Relationship of Jiangyin Haida Rubber and Plastic

Operating Revenue and Net Income of Minth Group, 2010-2015

Operating Revenue and Net Income of Minth Group, 2014-2018E

Revenue of Minth Group by Region, 2012-2015

Gross Profit and Gross Margin of Minth Group, 2010-2015

R&D Expenditure and % in Total Revenue of Minth Group, 2010-2015

Major Customers and Supporting Relationship of Minth Group

Major Production Bases Distribution of Minth Group in China

Major Production Bases Distribution of Minth Group in Overseas Countries

Fund-raised Projects of Zhejiang Xiantong Rubber & Plastic under Planning

Major Seals Products of Guizhou Jingzhong Rubber & Plastic Industry

Organization Chart of Jianxin Zhao’s Group Corp

Major Cooperative Brands of Jianxin Zhao’s Group Corp

Major Supportings and Marketing Network of Hebei Xinhua Ouya Group

Output and Sales Volume of Shanghai Minfeng Automobile Seal Co., Ltd., 2010-2014

Major Seals Products of Yongsheng Automotive Parts Manufacturing

Output and Sales Volume of Seals of Changzhou Light Rubber & Plastic, 2010-2014

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...