China Electronic Fuel Injection (EFI) System Report, 2015-2018

-

Oct.2015

- Hard Copy

- USD

$2,750

-

- Pages:130

- Single User License

(PDF Unprintable)

- USD

$2,550

-

- Code:

YSJ091

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,950

-

In 2002, China’s gasoline engines saw an end of the application of carburetor and ushered in an era of electronic fuel injection. Starting from July 1, 2008, the implementation of National III emission standards prompted diesel engines to use electronic control. Thus, the vehicles in China have fully achieved electronic fuel injection control. On January 1, 2015, China began to comprehensively implement National IV emission standard, which has once again upgraded engine fuel electronic control.

In the field of gasoline electronic injection, the market focuses on gasoline direct injection (GDi) and hybrid injection.

At present, quite a few models of Beijing Benz, Shanghai Volkswagen, Shanghai GM, and FAW-Volkswagen are equipped with GDi, with the market size for 2015 of an estimated 4.03 million sets, up 19.23% from a year earlier. It is estimated that in 2018 the demand will reach 6.81 million sets.

Hybrid injection can make up for the weakness of GDi and was first applied in Highlander, Camry, and Audi Q5 in China. But hybrid injection needs two injection systems equipped simultaneously. In addition, fuel injection conversion need to change control system strategy, hence the need for high costs. In future, hybrid injection is expected to be widely used in high-grade vehicles with low sensitivity to price.

In the field of diesel electronic injection, the market is mainly targeted at high pressure common rail and passenger vehicle dieselization in 2015.

With the implementation of the national IV emission standard, as the most suitable technology roadmap, common rail system for diesel engines witnessed rapid development. In May and June 2014, the mainstream Chinese heavy and light-duty truck manufacturers signed letters of commitment, vowing not to sell models that fail to meet emission standards, which, to a great extent, helped improve assembly rate of high pressure common rail system.

With excellent performance in energy conservation and emission reduction, diesel-powered models have been widely recognized in the global automobile market. Made in China 2025, released by China in May 2015, said that the Government will press ahead with the application of diesel engines in passenger vehicles. At present, some automakers have kicked off diesel vehicle project. In the future, with the development of diesel-powered passenger vehicles, the proportion of high pressure common rail system equipped in passenger vehicles is expected to rise.

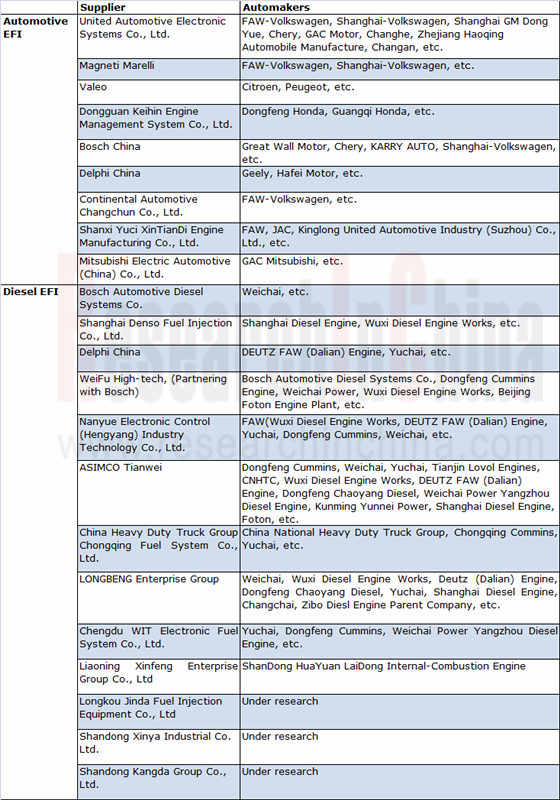

In terms of competitive landscape, whether gasoline electronic injection or diesel electronic injection is dominated by foreign players. Gasoline electronic injection suppliers include United Automotive Electronic Systems Co., Magneti Marelli, Valeo, and Donguan Keihin, etc. Diesel electronic injection market is monopolized by Bosch, Denso, and Delphi. And other local companies are only in the process of small-batch production or R&D stages

WeiFu High-tech, the most important fuel injection system supplier in China, mainly produces fuel injection systems for diesel engines, including injection pumps, injection nozzles, delivery valves, plunger & barrel assy, and common rails. In the first half of 2015, affected by the downturn in heavy-duty trucks and the conversion of national IV standards, WeiFu High-tech experienced a 24.46% fall in fuel injection business. Meanwhile, as the demand for high-pressure common rail increased, the rough machining business of common rail pumps and fuel injectors supplied to Bosch Automotive Diesel Systems Co. grew significantly. In 2015, WeiFu High-tech began to construct workshops of Weifu Industrial Park Phase II. When the first and second phases of the project are completed, the company will achieve a capacity of 810,000 sets/a high pressure common rail pumps and 100,000 sets/a diesel engine WAP2 system.

Major Chinese Automotive EFI Suppliers and Supported Customers

Source: China Electronic Fuel Injection (EFI) System Report, 2015-2018 by ResearchInChina

China Electronic Fuel Injection (EFI) System Report, 2015-2018 by ResearchInChina mainly focuses on the following:

Chinese policies about automotive EFI system, status quo and forecast of market demand, and import & export;

Chinese policies about automotive EFI system, status quo and forecast of market demand, and import & export;

Status quo and forecast of China gasoline EFI system market size and structure, and supply relationship of key enterprises;

Status quo and forecast of China gasoline EFI system market size and structure, and supply relationship of key enterprises;

China diesel EFI system market size and structure, technology roadmap, and the development of major enterprises;

China diesel EFI system market size and structure, technology roadmap, and the development of major enterprises;

Main EFI products, operation, development, etc of foreign companies;

Main EFI products, operation, development, etc of foreign companies;

Main EFI products, operation, development, etc of Chinese companies.

Main EFI products, operation, development, etc of Chinese companies.

1. Industry Overview

1.1 Definition and Classification

1.1.1 Definition

1.1.2 Classification

1.2 Policy Environment

2. Overview of the Chinese EFI Market

2.1 Market Demand

2.2 Import and Export

2.2.1 Import

2.2.2 Export

2.3 Major Enterprises

3. Gasoline EFI

3.1 Market Size

3.2 Market Structure

3.3 Supporting

4. Diesel High Pressure Common Rail Market

4.1 Brief Introduction

4.1.1 Emission Standard

4.1.2 Development History

4.2 Technology Roadmap

4.2.1 National IV Mainstream Technology Roadmap

4.2.2 Technology Roadmaps of Leading Enterprises

4.3 Market Status

4.3.1 Assembly Rate

4.3.2 Product Price

4.3.3 Market Size

4.3.4 Market Structure

4.4 Competitive Landscape

4.4.1 Layout of Three Large Multinational Corporations in China

4.4.2 Development of Chinese Enterprises

4.5 Major Component Suppliers

5. Foreign Companies

5.1 Bosch

5.1.1 Profile

5.1.2 Operation

5.1.3 Fuel Injection System

5.1.4 Supporting of Fuel Injection System

5.1.5 Development in China

5.1.6 Bosch Automotive Diesel Systems Co., Ltd.

5.1.7 United Automotive Electronic Systems Co., Ltd.

5.2 Delphi

5.2.1 Profile

5.2.2 Operation

5.2.3 Fuel Injection System

5.2.4 Development in China

5.2.5 Fuel Injection System Production Base

5.3 Denso

5.3.1 Profile

5.3.2 Operation

5.3.3 Fuel Injection System

5.3.4 Development in China

5.3.5 Shanghai Denso Fuel Injection Co., Ltd.

5.4 Valeo

5.4.1 Profile

5.4.2 Operation

5.4.3 Fuel Injection System

5.5 Continental

5.5.1 Profile

5.5.2 Operation

5.5.3 Fuel Injection System

5.5.4 Development in China

5.5.5 Continental Automotive Changchun Co., Ltd.

5.6 Keihin

5.6.1 Profile

5.6.2 Operation

5.6.3 Fuel Injection System

5.6.4 Development in China

5.6.5 Dongguan Keihin Engine Management System Co., Ltd.

5.7 Magneti Marelli

5.7.1 Profile

5.7.2 Fuel Injection System

5.7.3 Development in China

5.8 Hirschvogel

5.8.1 Profile

5.8.2 Fuel Injection System

5.8.3 Development in China

5.9 Doowon Precision Industry Co., Ltd.

5.9.1 Profile

5.9.2 Fuel Injection System

5.10 Aisan Industry

5.10.1 Profile

5.10.2 Operation

5.10.3 Fuel Injection System

5.10.4 Business in China

6 Chinese Enterprises

6.1 Weifu High-technology Group Co., Ltd.

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 R&D and Investment

6.1.6 Fuel Injection Business

6.1.7 Subsidiaries

6.1.8 Performance Forecast

6.2 Shanxi Yuci XinTianDi Engine Manufacturing Co., Ltd.

6.3 Nanyue Electronic Control (Hengyang) Industry Technology Co., Ltd.

6.4 ASIMCO Tianwei

6.5 Liaoning Xinfeng Enterprise Group Co., Ltd

6.6 Longkou Jinda Fuel Injection Equipment Co., Ltd

6.7 China Heavy Duty Truck Group Chongqing Fuel System Co., Ltd.

6.8 LONGBENG Enterprise Group

6.9 Shandong Xinya Industrial Co. Ltd.

6.10 Shandong Kangda Group Co., Ltd.

6.11 Chengdu WIT Electronic Fuel System Co., Ltd.

7 Summary and Forecast

7.1 Market Conclusion

7.2 Competitive Landscape

7.3 Development Tends

Composition of Electronic Fuel Injection System

China’s Demand for Vehicle-use Electronic Injection System, 2011-2018E

Import Volume and Value of EFI Devices in China, 2010-2015

Key Import Origins of EFI Devices in China, 2014-2015

Export Volume and Value of China-made EFI Devices, 2010-2015

Key Export Destinations of China-made EFI Devices, 2014-2015

Leading Suppliers of Automotive EFI System in China and Their Customers

China Gasoline Electronic Injection OEM Market Size, 2009-2018E

China Gasoline Injection Market Structure, 2012-2018E

China’s GDi OEM Market Size, 2012-2018E

Supply Relationship of Major Chinese Gasoline Electronic Injection Companies

Development Course of Emission Standards for Vehicles in EU and China

Emission Limit of National III Emission

Emission Limit of National IV Emission

Emission Limit of National V Emission

Development Course of Diesel Engine Emission Upgrading Technologies

Technology Roadmaps of European and American Medium- and Heavy-duty Diesel Engine Meeting EU IV/V Emission and EPA2007-2010 Emission

Measures for China-made Engines Reaching International Standards

Chinese Manufacturers’ Selection of Medium- and Heavy-duty Engine Fuel Injection System Types during the Period of National IV Emission Standards

Assembly Rate of High-pressure Common Rail in China by Vehicle Type, 2012-2018E

Average Unit Price of Diesel High-pressure Common Rail System in China by Type, 2012-2018E

China Diesel High-pressure Common-rail Market Size, 2012-2018E

Structure (%) of Medium- and Heavy-duty and Light Diesel Electronic High-pressure Common-rail Markets, 2012-2018E

Diesel Electronic Injection Market Shares of Major Enterprises in China

Supply Relationship of Fuel Injection System of Major Enterprises in China

Supply Relationship between ECU Producers and Auto Makers in China

Supply Relationship between Sensor Manufacturers and Auto Makers in China

Revenue of Bosch, 2010-2014

Revenue Structure of Bosch, 2014

Bosch’s Main Fuel Injection System Products

Bosch’s Production Bases in Japan

Bosch’s Main Fuel Injection System-supported Models in China and ASEAN

Bosch’s Main Fuel Injection System-supported Models in Europe and America

Bosch’s Main Fuel Injection System-supported Models in Japan

Bosch’s Revenue in China, 2012-2014

Bosch’s Economical Common Rail System CRS1-16

Equity Structure of Bosch Automotive Diesel Systems Co.

Assets, Revenue and Net Income of Bosch Automotive Diesel Systems Co., 2013-2014

Main Supported Models of Bosch Automotive Diesel Systems Co.

Production Bases and R&D Center of United Automotive Electronic Systems Co.

Assets, Revenue, and Net Income of United Automotive Electronic Systems Co., 2013-2014

Main Supported Models of United Automotive Electronic Systems Co.

Recalled Models affected by Hidden Danger of United Automotive Electronic Systems ’s Fuel Pumps

Delphi’s Order Value, 2010-2015

Revenue and Profit of Delphi, 2012-2015

Revenue Breakdown of Delphi by Region, 2010-2014

Revenue Breakdown of Delphi by Segment, 2010-2014

Delphi’s Top 10 Customers, 2014

Delphi’s Main Fuel Injection System-supported Models in China and ASEAN

Delphi’s Main Fuel Injection System-supported Models in Europe and America

Delphi’s Revenue in China, 2011-2014

Delphi’s Fuel Injection System Production Bases in China

Sales and Profits of Denso, FY2011-FY2015

Revenue Breakdown of Denso by Region, FY2011-FY2015

Customer Structure of Denso, FY2014-FY2015

Bosch’s Main Fuel Injection System-supported Models in ASEAN

Bosch’s Main Fuel Injection System-supported Models in Europe and America

Bosch’s Main Fuel Injection System-supported Models in Japan

Denso’s Major Production Bases in Japan

Distribution of Denso’s Enterprises in China

Valeo’s Order Value and Sales, 2013-2015

Valeo’s Revenue Structure, 2013-2015

Valeo’s Main Fuel Injection System-supported Models

Revenue and Net Income of Continental, 2010-2015H1

Revenue Structure of Continental by Segment, 2010-2015H1

Revenue Structure of Continental by Region, 2010-2014

Gross Margin of Continental, 2010-2015H1

Key Fuel Injection System Products of Continental

Continental’s Main Fuel Injection System-supported Models in ASEAN

Continental’s Main Fuel Injection System-supported Models in Europe and America

Distribution of Continental’s Business in China

Revenue and Profits of Keihin, FY2011-FY2014

Keihin’s Main Fuel Injection System-supported Models in China and ASEAN

Keihin’s Main Fuel Injection System-supported Models in Europe and America

Keihin’s Main Fuel Injection System-supported Models in Japan

Distribution of Keihin’s Enterprises in China

Dongguan Keihin’s Main Supported Models

Magneti Marelli’s Main Fuel Injection System-supported Models in China and ASEAN

Magneti Marelli’s Main Fuel Injection System-supported Models in Europe and America

Distribution of Magneti Marelli’s Enterprises in China

Hirschvogel’s Main Fuel Injection System-supported Models in Europe and America

Revenue of Doowon Precision Industry Co., 2012-2014

Business Indicators of Aisan Industry, FY2010-FY2015

Revenue of Aisan Industry by Region, FY2014-FY2015

Revenue of Aisan Industry by Segment, FY2014-FY2015

Major Customers of Aisan Industry, FY2013-FY2015

Aisan Industry’s Production Bases in Japan

Aisan Industry’s Production Bases in China

Revenue and YoY Growth of WeiFu High-tech, 2010-2015

Net Income and YoY Growth of WeiFu High-tech, 2010-2015

Revenue Structure of WeiFu High-tech by Business, 2009-2015

Revenue Structure of WeiFu High-tech by Region, 2009-2015

Gross Margin of WeiFu High-tech, 2011-2015

R&D Costs and % of Total Revenue of WeiFu High-tech, 2012-2014

Production and Sales of WeiFu High-tech by Product, 2012-2014

Fuel Injection System Revenue and Gross Margin of WeiFu High-tech, 2010-2015

Major Shareholding Subsidiaries of WeiFu High-tech

Affiliates of WeiFu High-tech

Revenue and Net Income of WeiFu High-tech’s Major Subsidiaries, 2013-2014

Revenue and Net Income of WeiFu High-tech, 2015-2018E

Major Products of Xinfeng Enterprise

Growth Rate of China’s Demand for Vehicle-use Electronic Injection System, 2013-2018E

Growth Rate of China GDi OEM Market Size, 2013-2018E

Growth Rate of China Diesel Common-rail System Market Size, 2013-2018E

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...